Velocys PLC Publication of Circular (1437R)

26 Junio 2020 - 1:00AM

UK Regulatory

TIDMVLS

RNS Number : 1437R

Velocys PLC

26 June 2020

Velocys plc

("Velocys" or the "Company")

26 June 2020

Publication of Circular

Velocys plc (VLS.L), the sustainable fuels technology company, announces that, further to

its announcements on 24 and 25 June 2020, the Company will today publish the circular in connection

with its fundraise (the "Circular").

The Circular will be posted to shareholders today. The full text of the Circular can also

be found at www.velocys.com/investors .

Open Offer

As previously announced, the Company is providing eligible shareholders with the opportunity

to subscribe for new ordinary shares (the "Open Offer Shares") in the Company by way of an

open offer (the "Open Offer") at the offer price for the fundraise of 5p, pro rata to their

holdings of existing ordinary shares ("Existing Ordinary Shares"). Eligible shareholders may

also make applications in excess of their pro rata initial entitlement up to an amount equal

to the total number of Open Offer Shares available under the Open Offer less an amount equal

to such eligible shareholder's Open Offer entitlement.

The Company is providing all eligible shareholders with the opportunity to subscribe for an

aggregate of up to 19,999,957 shares to raise gross proceeds of up to c.GBP1 million on the

basis of:

3.10676 Open Offer Shares for every 100 Existing Ordinary Shares

Further details of the Open Offer, including the terms and conditions, are available to shareholders

in the Circular.

For further information, please contact: Velocys

Henrik Wareborn, CEO

Andrew Morris, CFO

Lak Siriwardene, Head of Communications &

Sustainability +44 1865 800821

Numis Securities (Nomad and joint broker)

Stuart Skinner

Emily Morris

Alamgir Ahmed +44 20 7260 1000

Canaccord Genuity (Joint broker)

Henry Fitzgerald-O'Connor

James Asensio +44 20 7523 8000

Radnor Capital (Investor relations)

Joshua Cryer

Iain Daly +44 20 3897 1830

Field Consulting (PR)

Robert Jeffery +44 20 7096 7730

Notes to Editors

Velocys is an international UK-based sustainable fuels technology company. Velocys designed,

developed and now licenses proprietary Fischer-Tropsch technology for the generation of clean,

low carbon, synthetic drop-in aviation and road transport fuel from municipal solid waste

and residual woody biomass plants currently in construction and development.

Velocys is currently developing two reference projects: one in Natchez, Mississippi, USA (incorporating

Carbon Capture, Utilisation and Storage) and one in Immingham, UK, to produce fuels that significantly

reduce both greenhouse gas emissions and key exhaust pollutants for aviation and road transport.

Originally a spin-out from Oxford University, in 2008 the company acquired a US company based

on complementary technology developed at the Pacific Northwest National Laboratory. Velocys

is headquartered in Oxford in the United Kingdom.

www.velocys.com

Important Notices

This announcement does not constitute an offer to buy, acquire or subscribe for, or the solicitation

of an offer to buy, acquire or subscribe for, Placing Shares (as defined in the announcement

of the Company made on 24 June 2020), Open Offer Shares or Retail Shares (as defined in the

announcement of the Company made on 24 June 2020) or an invitation to buy, acquire or subscribe

for the Placing Shares, Open Offer Shares or Retail Shares in any jurisdiction. This announcement

has not been filed with, examined or approved by the Financial Conduct Authority or the London

Stock Exchange or any other regulatory authority.

Numis Securities Limited ("Numis"), which is authorised and regulated in the United Kingdom

by the Financial Conduct Authority and is a member of the London Stock Exchange, is acting

as nominated adviser and joint broker to the Company for the purposes of the AIM Rules. Canaccord

Genuity Limited ("Canaccord"), which is authorised and regulated in the United Kingdom by

the Financial Conduct Authority and is a member of the London Stock Exchange, is acting as

joint broker to the Company for the purposes of the AIM Rules. Numis and Canaccord are each

acting exclusively for the Company in connection with the Placing, and will not be responsible

to anyone other than the Company for providing the protections afforded to their respective

clients or for providing advice in relation to the proposals in this announcement or any other

matter referred to in this announcement. Neither Numis nor Canaccord have authorised the contents

of this announcement for any purpose and, without limiting the statutory rights of any person

to whom this announcement is issued, no representation or warranty, express or implied, is

made by either Numis or Canaccord as to any of the contents or completeness of this announcement.

This announcement contains (or may contain) certain forward-looking statements with respect

to certain of the Company's current expectations and projections about future events. These

statements, which sometimes use words such as "anticipate", "believe", "intend", "estimate",

"expect" and words of similar meaning, reflect the directors' beliefs and expectations and

involve a number of risks, uncertainties and assumptions that could cause actual results and

performance to differ materially from any expected future results or performance expressed

or implied by the forward-looking statement. Statements contained in this announcement regarding

past trends or activities should not be taken as a representation that such trends or activities

will continue in the future. The Information contained in this announcement Is subject to

change without notice and neither Numis, Canaccord nor, except as required by applicable law,

the Company assumes any responsibility or obligation to update publicly or review any of the

forward-looking statements contained herein. You should not place undue reliance on forward-looking

statements, which speak only as of the date of this announcement.

The distribution of this announcement outside the United Kingdom may be restricted by law

and therefore any persons outside the United Kingdom into whose possession this announcement

comes should inform themselves about and observe any such restrictions as to the Placing,

the Open Offer, the Retail Offer, the Placing Shares, the Open Offer Shares, the Retail Shares

and the distribution of this announcement. Any failure to comply with such restrictions may

constitute a violation of the securities laws of any jurisdiction outside of the United Kingdom.

This announcement does not constitute an offer to sell or an invitation to subscribe for,

or the solicitation of an offer to buy or to subscribe for, shares in any jurisdiction in

which such an offer or solicitation is unlawful. In particular, this announcement is not for

release, publication or distribution, directly, or indirectly, in whole or in part, in, into

or from the United States, Australia, New Zealand, Canada, the Republic of South Africa, Japan

or to any US Person, or any national, resident or citizen of Australia, New Zealand, Canada,

the Republic of South Africa or Japan. No offering of Placing Shares, or any other securities

of the Company, is being made in the United States and this announcement, and the information

contained herein, does not constitute an offer to sell or a solicitation of an offer to buy

any Placing Shares, Open Offer Shares, Retail Shares or any other securities of the Company

in the United States.

No person has been authorised to give any information or to make any representation other

than those contained in this announcement (or the circular to be sent to Shareholders today)

in connection with the Placing, the Retail Offer, the Open Offer and Admission (all as defined

in the announcement of the Company made on 24 June 2020) and, if given or made, such information

or representation must not be relied upon as having been authorised by or on behalf of the

Company, Numis or Canaccord or any of their respective directors, employees or officers.

Information to Distributors

Solely for the purposes of the product governance requirements of Directive 2014/65/EU on

markets in financial instruments, as amended ("MiFID II") and local implementing measures,

and disclaiming all and any liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance Requirements) may otherwise

have with respect thereto, the Placing Shares, the Open Offer Shares and the Retail Shares

have been subject to a product approval process, which has determined that such Placing Shares,

Open Offer Shares and/or Retail Shares are: (i) compatible with an end target market of retail

investors and investors who meet the criteria of professional clients and eligible counterparties,

each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels

as are permitted by MiFID II (the "Target Market Assessment"). Notwithstanding the Target

Market Assessment, Distributors should note that: the price of Placing Shares, Open Offer

Shares and Retail Shares may decline and investors could lose all or part of their investment;

Placing Shares, Open Offer Shares and/or Retail Shares (as applicable) offer no guaranteed

income and no capital protection; and an investment in Placing Shares, Open Offer Shares and/or

Retail Shares (as applicable) is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction with an appropriate financial

or other adviser) are capable of evaluating the merits and risks of such an investment and

who have sufficient resources to be able to bear any losses that may result therefrom. The

Target Market Assessment is without prejudice to any contractual, legal or regulatory selling

restrictions in relation to the Placing, Open Offer and Retail Offer. For the avoidance of

doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability

or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or

group of investors to invest in, or purchase, or take any other action whatsoever with respect

to the Placing Shares, Open Offer Shares or Retail Shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

CIRQELFLBQLEBBV

(END) Dow Jones Newswires

June 26, 2020 02:00 ET (06:00 GMT)

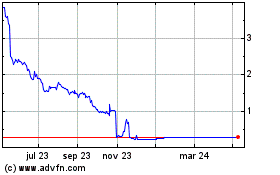

Velocys (LSE:VLS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Velocys (LSE:VLS)

Gráfica de Acción Histórica

De May 2023 a May 2024