Velocys PLC Results of General Meeting and Open Offer (9732S)

14 Julio 2020 - 7:17AM

UK Regulatory

TIDMVLS

RNS Number : 9732S

Velocys PLC

14 July 2020

Velocys plc

("Velocys" or the "Company")

14 July 2020

Results of General Meeting and Open Offer

Velocys plc (VLS.L), the sustainable fuels technology company, announced on 24 June 2020 and

25 June 2020 that it proposed to raise up to approximately GBP21 million through a Placing,

Retail Offer and Open Offer, conditional (amongst other things) upon the passing of certain

resolutions by shareholders. The Company is pleased to announce that the resolutions set out

in the circular published on 26 June 2020 and put to shareholders at the General Meeting held

earlier today were duly passed by means of a poll. A summary of the voting results is set

out below:

Resolution FOR AGAINST TOTAL WITHHELD*

No. of votes % No. of % No. of votes No.

cast votes cast cast

------------- ------- ------------ ------ ------------- ----------

Resolution

1

To grant

the directors

authority

to allot

shares in

the Company

in the

amounts

set out in

the notice

of general

meeting 317,413,903 99.99% 38,614 0.01% 317,452,517 121,877

------------- ------- ------------ ------ ------------- ----------

Resolution

2

Conditionally

on Resolution

1, to empower

the directors

to disapply

pre-emption

rights on

the issue

of shares

in the

Company

in the

amounts

set out in

the notice

of general

meeting 315,900,540 99.55% 1,423,381 0.45% 317,323,921 250,473

------------- ------- ------------ ------ ------------- ----------

*A vote withheld is not a vote in law and counts neither "For" nor "Against" the relevant

resolution.

Furthermore, the Company is pleased to announce that the Open Offer, which closed for acceptances

at 11.00 a.m. on 13 July 2020, was significantly oversubscribed, with final valid applications

including Excess Entitlements from Eligible Shareholders in respect of 104,608,452 Open Offer

Shares representing a take-up of approximately 523% of the maximum number of Open Offer Shares

available. Eligible Shareholders who have validly applied for their Basic Entitlement of Open

Offer Shares will receive their Basic Entitlement in full, while applications for additional

Open Offer Shares through the Excess Entitlements have been scaled back on a pro rata basis,

such that the maximum number of Open Offer Shares of 19,999,957 have been issued by the Company.

Accordingly, the Company will raise total gross proceeds of approximately GBP21 million through

the Placing, Retail Offer and Open Offer. Application has been made for 419,999,957 New Ordinary

Shares to be admitted to trading on AIM ("Admission"). It is expected that Admission of the

VCT Shares (22,950,000 New Ordinary Shares) will occur on 15 July 2020 and Admission of the

General Placing Shares, Retail Shares and Open Offer Shares (397,049,957 New Ordinary Shares)

will occur on 16 July 2020. Following Admission, the Company will have 1,063,756,057 Ordinary

Shares in issue.

The Company does not currently hold any shares in treasury. Accordingly, the above figure

of 1,063,756,057 Ordinary Shares may be used by shareholders of the Company as the denominator

for the calculations by which they will determine if they are required to notify their interest

in, or a change in their interest in, the share capital of the Company under the FCA's Disclosure

Guidance and Transparency Rules.

Unless otherwise defined herein, capitalised terms used in this announcement shall have the

same meanings as defined in the circular sent to shareholders of the Company on 26 June 2020.

---- Ends ----

For further information, please contact: Velocys

Henrik Wareborn, CEO

Andrew Morris, CFO

Lak Siriwardene, Head of Communications &

Sustainability +44 1865 800821

Numis Securities (Nomad and joint broker)

Stuart Skinner

Emily Morris

Alamgir Ahmed +44 20 7260 1000

Canaccord Genuity (Joint broker)

Henry Fitzgerald-O'Connor

James Asensio +44 20 7523 8000

Radnor Capital (Investor relations)

Joshua Cryer

Iain Daly +44 20 3897 1830

Field Consulting (PR)

Robert Jeffery +44 20 7096 7730

Certain information contained in this announcement would have constituted inside information

(as defined by Article 7 of Regulation (EU) No 596/2014) prior to its release as part of this

Announcement. The person responsible for arranging the release of this Announcement on behalf

of the Company is Andrew Morris, CFO of the Company.

Notes to Editors

Velocys is an international UK-based sustainable fuels technology company. Velocys designed,

developed and now licenses proprietary Fischer-Tropsch technology for the generation of clean,

low carbon, synthetic drop-in aviation and road transport fuel from municipal solid waste

and residual woody biomass plants currently in construction and development.

Velocys is currently developing two reference projects: one in Natchez, Mississippi, USA (incorporating

Carbon Capture, Utilisation and Storage) and one in Immingham, UK, to produce fuels that significantly

reduce both greenhouse gas emissions and key exhaust pollutants for aviation and road transport.

Originally a spin-out from Oxford University, in 2008 the company acquired a US company based

on complementary technology developed at the Pacific Northwest National Laboratory. Velocys

is headquartered in Oxford in the United Kingdom.

www.velocys.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMKKQBDBBKDQOD

(END) Dow Jones Newswires

July 14, 2020 08:17 ET (12:17 GMT)

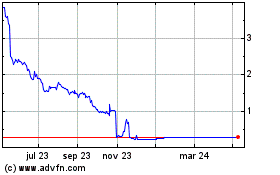

Velocys (LSE:VLS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Velocys (LSE:VLS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024