TIDMPPC

RNS Number : 4126J

President Energy PLC

22 December 2020

22 December 2020

PRESIDENT ENERGY PLC

("President" or the "Company")

Developments in Rio Negro, Argentina

Paraguay update

President Energy (AIM: PPC), the energy company with a diverse

portfolio of production and exploration assets focused primarily in

Argentina announces an update on developments in Rio Negro.

Highlights

-- New treatment plant to be built in Rio Negro with a projected

completion of August 2021

-- Will eliminate third party treatment costs with total savings

estimated at US$2.5 million per year

-- $5 million aggregate cost of project funded by favourable new

Peso based medium term loan provided by Banco Hipotecario

-- Of the US$3.7 million bank loan outstanding at the half year,

US$2.2 million has already been repaid

-- Paraguay farm out negotiations materially advanced

New treatment plant

Currently President's battery in its Puesto Flores/Estancia

Vieja Concession, Rio Negro, transports the Company's oil through

President's pipeline to a third party treatment plant which then

processes the oil to sales quality and dispatches it onwards via

pipeline to the main regional hub. In order to transport the oil

through the pipeline, some water has to be sent to the third party

which is ultimately disposed of following processing. President

pays the third party for that treatment, transportation of oil and

the disposal of residual water.

President has now sanctioned a project to eliminate such third

party costs by engineering a new plant with the capacity to treat

all the Company's oil to sales specification. The solution also

will provide President with the capacity to transport its oil

either through pipelines or by truck.

The plant has been designed by President's in-house engineering

team who will also supervise its construction.

The aggregate savings of opex including shrinkage, quality

discount and transport fees are estimated to be approximately

US$2.5 million per year with the total cost of the project

estimated to be US$5 million. The feasibility study has been

completed with work commencing in January and projected completion

of end August 2021.

Funding of plant

The project is being funded by a new US$5 million secured loan

from Banco Hipotecario. The Argentine pesos denominated loan is

repayable in 36 months with an initial 12 months payment holiday.

The interest rate in pesos is fixed at 30% with the projected rate

of peso depreciation in Argentina for 2021 currently estimated to

be in the range of 28-40%.

This type of loan has been propounded by the Argentine

Government to stimulate growth and investment. Taking into account

those projected depreciation rates and the fact that President is

paid in pesos at the dollar equivalent at the time of payment (not

invoice) for its oil and gas, it is considered that the loan is

likely, in the absence of unforeseen circumstances, to have an

effective zero or negative rate of interest.

As the Company has in H2 2020 repaid US$2.2 million of the

US$3.7 million bank debt reported at the half year ended 30 June

2020, the total current bank debt is now US$6.5 million which by

end June 2021 will have reduced by a further US$1.5 million leaving

US$5 million, being the amount required to fund the plant.

Paraguay update

Negotiations with a substantial and reputable National Oil

Company in relation to a farm out of the Pirity Concession,

Paraguay have materially advanced recently with the next step to

negotiate and agree legal documentation which follow the form of

the AIPN international precedent documentation for operating and

farm out agreements. Drafts of these agreements are already in

circulation.

President's principal focus has been on a contribution to well

costs and finding a partner with sympathetic aims and ambitions.

Inter alia under the terms of the deal under discussion, President

will remain operator and retain a 50% interest in the relevant

Concession.

As stated in previous announcements, although there can be no

guarantee of a successful conclusion of negotiations, with every

tick in the box the prospects of a positive outcome come ever

closer. With that caveat, there has been material progress recently

leading to the view that on current evidence there is a better than

a 50% chance of a mutually satisfactory conclusion to the

discussions. It is hoped to conclude matters before the end of Q1

2021 with a view to drilling an exploration well targeting a

location in the Delray complex within approximately 12 months.

By way of reminder the Delray complex is estimated by President

to have a mid case of 230 Million barrels of unrisked oil resources

in place. The complex is unrelated to the two structures targeted

in the previous exploration campaign and has as its analogue proven

producing oil fields on the same trend located over the border in

Argentina. A concise geological presentation on the Delray complex

has been published by President and can be found on the Company's

web site at www.presidentenergyplc.com.

Peter Levine, Chairman, commented

"The new plant will materially reduce opex and produce improved

cash flow and bottom line profits

"The benefits are enhanced by the funding terms which are

projected to have a zero or even negative interest rate thanks to

the Government's initiative for which President is appreciative.

President is likewise grateful to the Province of Rio Negro and its

partner EDHIPSA for their continued support and encouragement

"The funding underlines the debt capacity and good credit

standing of President and the project demonstrates the commitment

of the Company to constantly find ways to improve its margins and

profits

"As to Paraguay, in relation to the farm out, it is still very

much a matter of step by step with each step bringing one closer to

a positive outcome. In this regard although patience is required

and whilst there can be no guarantees, we are encouraged by the

progress to date and are cautiously optimistic as to a successful

conclusion."

Glossary:

Boepd barrels of oil equivalent (oil and gas) per day

MMscft/d million standard cubic feet of gas per day

Oil in place means the total oil content of a reservoir

Contact:

President Energy PLC

Rob Shepherd, Group FD +44 (0) 207 016 7950

Nikita Levine, Investor Relations info@presidentpc.com

finnCap (Nominated Advisor)

Christopher Raggett, Charlie Beeson +44 (0) 207 220 0500

Shore Capital (Corporate Broker)

Jerry Keen, Antonio Bossi +44 (0) 207 408 4090

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets.

The Company has operated interests in the Puesto Flores,

Estancia Vieja, Puesto Prado and Las Bases Concessions, and

Angostura exploration contract, all of which are situated in the

Rio Negro Province in the Neuquén Basin of Argentina and in the

Puesto Guardian Concession, in the Noroeste Basin in NW Argentina.

Alongside this, President Energy has cash generative production

assets in Louisiana, USA and further significant exploration and

development opportunities through its acreage in Paraguay and

Argentina.

The Group is also actively pursuing value accretive acquisitions

of high-quality production and development assets capable of

delivering positive cash flows and shareholder returns. With a

strong strategic and institutional base of support, including the

international commodity trader and logistics company Trafigura, an

in-country management team as well as the Chairman whose interests

as the largest shareholder are aligned to those of its

shareholders, President Energy gives UK investors access to an

energy growth story combined with world class standards of

corporate governance, environmental and social responsibility.

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPPGGWPUPUGCG

(END) Dow Jones Newswires

December 22, 2020 02:00 ET (07:00 GMT)

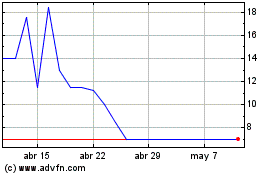

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024