Powerhouse Enrgy Grp Placing and issue of equity

14 Enero 2021 - 1:01AM

UK Regulatory

TIDMPHE

Powerhouse Energy Group plc

Strategic Placing to raise £10 million

Powerhouse Energy Group plc (AIM: PHE) ("Powerhouse" or the "Company"), the

sustainable hydrogen company pioneering hydrogen production from waste plastic,

is pleased to announce it has raised ��10 million, before

expenses, by way of a Placing at 5.5p per share ("Issue Price") (the "Placing"

or "Fundraising"). The Placing was arranged by Turner Pope Investments Ltd

(TPI) and was oversubscribed.

The Directors have undertaken the Fundraising to provide funds that they

believe will expedite signifcantly financial close of the funding of the first

commercial scale DMG installation utilising the Company's technology, which is

targetted to be reached during the first quarter of 2021. The Directors' view

is that completion of this first reference site will be extremely commercially

and strategically important to the Company, not least as a springboard for

overseas sales and marketing.

A total of 181,818,182 new Ordinary Shares of 0.5p in the capital of the

Company ("Ordinary Shares") have been placed at the Issue Price ("Placing

Shares") with an institutional investor and a small number of Turner Pope's

private clients, as well as the White Family (the Company's largest

shareholder), raising £10 million, before expenses.

Related Party Transaction

The White Family is a long-term supporter of the Company and is investing

approximately £2.6 million in the Fundraising. The participation by the White

Family is considered a related party transaction under the AIM rules as the

White Family (constituting Howard White, Ben White, Josh White and Serena Eden

Reyes-White) currently holds 26.05% percent of the share capital. Following the

Fundraising, the White Family will hold 1,015,045,935 Ordinary Shares

representing 26.05% held by the individual White Family members as follows:

Josh White - 377,746,610 Ordinary Shares

Ben White - 247,775,210 Ordinary Shares

Serena White-Reyes - 211,459,086 Ordinary Shares

Howard White - 178,065,029 Ordinary Shares

The Directors of the Company, having consulted with WH Ireland, the Company's

Nominated Adviser, consider the terms of this transaction to be fair and

reasonable insofar as shareholders are concerned.

Use of funds

The Company will use the net funds from the Fundraising to advance the project

procurement and delivery of long lead items before the formal financial close

of the first commercial scale DMG installation , thereby protecting the

targeted timeline for the Company, and advancing the completion of the

Company's DMG technology. This will allow the Company to complete negotiations

rapidly for the Special Project Vehicle ("SPV") to be established to deliver

the Protos plant. Powerhouse will apply the net funds from the Fundraising to

invest alongside Peel NRE Environmental Limited. By providing investment for

this SPV, the Company believes that financial close will be significantly

expedited.

This investment in the Protos SPV will give the Company access to extra revenue

via participation at project level on the first commercial deployment, rather

than simply as licensor of the DMG technology, and will allow Powerhouse to

significantly advance its overall business plan. Importantly, commissioning the

first commercial unit will provide a reference site for potential overseas

customers and partners. It will also provide the Company with greater

beneficial technical exposure in the project delivery phase.

The Directors consider that these steps are beneficial for the Company's future

and are likely to bring forward the date on which licence fee income, which is

expected to constitute the principal portion of the Company's future revenue,

will start to be received.

Commenting, Tim Yeo, Executive Chairman of Powerhouse, said:

"This is a very exciting step forward and a great start to 2021. It

demonstrates how our Company is getting down to business. In addition the

Warrant granted to Peel Holdings (IoM) Limited on 9 September 2020 ("Peel

Warrant") is exercisable for a period of six months from the date when

financial close is reached on Protos.

"The exercise of the Peel Warrant would bring a further £10.2 million of cash

into Powerhouse. Together with the proceeds of this Fundraising, the exercise

of the Peel Warrant would place our Company on a very secure financial footing

and facilitate the deployment of our technology internationally, helping to

accelerate a clean energy transition and provide a solution to non-recylable

plastic."

David Ryan, CEO of Powerhouse, said:

"My overriding priority is to bring Powerhouse's first project to operation

soonest. The completed plant would enable future customers worldwide to see the

DMG technology delivering the reality of waste plastic regenerated to hydrogen,

realising the predicted technology environmental and commercial benefits. This

investment will allow Powerhouse and Peel to deliver this reality sooner and I

consider it as an obvious step for the Company to make in these challenging

times."

Admission to trading on AIM

Further to the Fundraising, the Company is issuing 181,818,182 Ordinary

Shares. Application will be made for the admission of 181,818,182 Ordinary

Shares to trading on AIM ("Admission") and it is expected that this will occur

on or around 21 January 2021. These shares will rank pari passu in all respects

with the Company's existing issued Ordinary Shares.

Subsequent to the issue of Ordinary Shares, the Company will have 3,896,918,875

Ordinary Shares in issue with voting rights. Powerhouse has no shares in

Treasury, therefore this figure may be used by shareholders, from Admission, as

the denominator for the calculations by which they will determine if they are

required to notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure and Transparency Rules.

Broker Warrants

TPI has been issued with 9,090,910 warrants to subscribe for new Ordinary

Shares at the Issue Price, exercisable for a period of three years from

Admission.

ENDS

For more information, contact:

Powerhouse Energy Group plc Tel: +44 (0) 203 368 6399

Tim Yeo, Executive Chairman

WH Ireland Limited (Nominated Tel: +44 (0) 207 220 1666

Adviser)

James Joyce/ Lydia Zychowska

Turner Pope Investments Ltd (Joint Tel: +44 (0) 203 657 0050

Broker)

Andrew Thacker

SisterSmith PR (media enquiries) Mob: +44 (0) 7766522305

Becca Smith

Notes for editors:

About Powerhouse Energy Group plc

Powerhouse, the sustainable hydrogen company, has developed a proprietary

process technology - Distributed Modular Generation (DMG®) - which can utilise

waste plastic, end-of-life-tyres, and other waste streams to efficiently and

economically convert them into syngas from which valuable products such as

chemical precursors, hydrogen, electricity and other industrial products may be

derived. Powerhouse's technology is one of the world's first proven,

distributed, modular, hydrogen from waste (HfW) process.

The Powerhouse DMG® process can generate up to 2 tonnes of road-fuel quality

hydrogen and more than 58MWh of exportable electricity per day.

Powerhouse's process produces low levels of safe residues and requires a small

operating footprint, making it suitable for deployment at enterprise and

community level. As announced on 11th February 2020 under its Supplemental

Agreement with Peel Environmental, Powerhouse will receive an annual license

fee of GBP500,000 in respect of each project which is commissioned.

Powerhouse is quoted on the London Stock Exchange's AIM Market under the

ticker: PHE and is incorporated in the United Kingdom.

For more information see www.powerhouseenergy.net

END

(END) Dow Jones Newswires

January 14, 2021 02:01 ET (07:01 GMT)

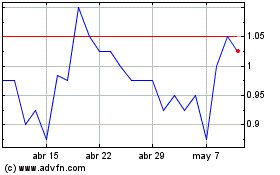

Powerhouse Energy (LSE:PHE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Powerhouse Energy (LSE:PHE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024