UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): March 5, 2024

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-38519 |

|

82-1436829 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1101

Marina Village Parkway

Suite

201

Alameda,

California 94501

(Address

of principal executive offices)

(510)

671-8370

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

AGE |

|

NYSE

American |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On

March 5, 2024, AgeX Therapeutics, Inc., a Delaware corporation (“AgeX”), drew $500,000 of its credit available under the

Amended and Restated Secured Convertible Promissory Note, as amended ( the “Secured Note”), with Juvenescence Limited.

The

Repayment Date on which the outstanding principal balance of the Secured Note will become due and payable shall be May 9, 2024. The other

material terms of the Secured Note are summarized in AgeX’s Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange

Commission (the “SEC”) on November 14, 2023.

Item

8.01 – Other Events.

As

previously announced, on August 29, 2023, AgeX entered into an Agreement

and Plan of Merger and Reorganization (the “Merger Agreement”) with Serina Therapeutics Inc., an Alabama corporation (“Serina”),

and Canaria Transaction Corporation, an Alabama corporation and wholly owned subsidiary of AgeX (“Merger Sub”), pursuant

to which, among other matters and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Merger Sub

will merge with and into Serina, with Serina surviving as a wholly owned subsidiary of AgeX (the “Merger”), as more fully

described in AgeX’s definitive proxy statement/prospectus/information statement filed with the SEC on February 14, 2024 (the “Proxy Statement/Prospectus/Information Statement”), a copy of which was

first mailed to AgeX stockholders on or about February 20, 2024.

On

March 7, 2024, the Board of Directors of AgeX (the “AgeX Board”) declared a warrant dividend (the “Warrant Dividend”)

in connection with the Merger that is expected to be issued on or about March 19, 2024 to all stockholders of record as of the close

of business on March 18, 2024 (the “Warrant Dividend Record Date”), subject to, among other things, obtaining stockholder

approval of the Warrant Dividend and a proposed reverse stock split (the “Reverse Stock Split”) at the Special Meeting (as

defined below) and the Reverse Stock Split being effected prior the Warrant Dividend Record Date, as more fully described in the Proxy

Statement/Prospectus/Information Statement. Assuming, among other things, that AgeX receives stockholder approval for the Reverse Stock

Split, it is anticipated the Reverse Stock Split will be effected on March 14, 2024 with shares of AgeX common stock to commence trading

on a post-Reverse Stock Split basis effective with the open of business on March 15, 2024.

The

Warrant Dividend will consist of three warrants (each, a “Post-Merger Warrant”) for each five shares of AgeX common stock

issued and outstanding held by the stockholder of record as of the Warrant Dividend Record Date. Each Post-Merger Warrant will be exercisable

at an exercise price equal to $13.20 per warrant (such exercise price reflecting the Reverse Stock Split) for (i) one share of AgeX common

stock and (ii) one warrant (each, an “Incentive Warrant”) and will expire on July 31, 2025. Each Incentive Warrant will be

exercisable at an exercise price equal to $18.00 per warrant (such exercise price reflecting the Reverse Stock Split) for one share of

AgeX common stock and will expire on the four-year anniversary of closing of the Merger. Each Post-Merger Warrant and Incentive Warrant

will be issued pursuant to the terms of a warrant agreement to be entered into by AgeX and a warrant agent in connection with the closing

of the Merger. No fractional warrants will be issued. The number of Post-Merger Warrants to be issued to a stockholder of record will

be rounded down to the nearest whole number if such holder would be entitled to receive a fractional warrant. For additional information

regarding the Warrant Dividend and the terms of the Post-Merger Warrant and Incentive Warrant, please refer to the Proxy Statement/Prospectus/Information

Statement.

AgeX

will hold a special meeting of stockholders (the “Special Meeting”) on March 14, 2024, unless postponed or adjourned to a

later date, for the purpose of voting on the proposals contained in the Proxy Statement/Prospectus/Information Statement, including the

proposals pertaining to the Warrant Dividend and the Reverse Stock Split. The distribution of the Warrant Dividend is contingent on,

among other things, obtaining approval of AgeX’s stockholders at the Special Meeting and the Reverse Stock Split being effected

prior to the Warrant Dividend Record. The Reverse Stock Split is contingent on, among other things, obtaining approval of AgeX’s

stockholders at the Special Meeting. To the extent that the effectiveness of the Reverse Stock Split and the commencement of shares of

AgeX common stock trading on a post-Reverse Stock Split basis is delayed or postponed, the Warrant Dividend Record Date and the Warrant

Dividend will be correspondingly delayed or postponed.

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements contained in this communication regarding matters that are not historical facts are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, known as the PSLRA. These include statements

regarding the anticipated completion and effects of the proposed Merger and related timing, including the anticipated completion and

timing of the Warrant Dividend, Warrant Dividend Record Date and the Reverse Stock Split, pro forma descriptions of the combined company,

Serina’s and the combined company’s planned preclinical and clinical programs, including planned clinical trials, the potential

of Serina’s product candidates, the anticipated cash expected from warrant exercises and the ability for proceeds to fund the operations

of the combined company for as long as anticipated, the expected trading of the combined company’s stock on the NYSE American under

the ticker symbol “SER”, management of the combined company and other statements regarding management’s intentions,

plans, beliefs, expectations or forecasts for the future. All forward-looking statements are based on assumptions or judgments about

future events and economic conditions that may or may not be correct or necessarily take place and that are by their nature subject to

significant risks, uncertainties and contingencies. You are cautioned not to place undue reliance on these forward-looking statements.

No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Statements that contain

words such as “anticipates,” “believes,” “plans,” “expects,” “projects,”

“future,” “intends,” “may,” “will,” “should,” “could,” “estimates,”

“predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify

these forward-looking statements that are intended to be covered by the safe-harbor provisions of the PSLRA.

There

are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included

in this communication. With respect to the Merger, these risks and uncertainties include: the possibility that stockholders of AgeX may

not approve the Merger; one or more conditions to consummating the Merger may not be satisfied; one or more material agreements that

may be entered into in connection with the Merger may be terminated by a party to the agreement; AgeX or the combined company may be

unable to obtain approval to list on the NYSE American the shares of AgeX common stock expected to be issued pursuant to the Merger;

and the closing of the Merger might be delayed or not occur at all. In addition, the Merger could cause AgeX to face additional risks,

including risks associated with conducting and financing Serina’s current or future research and product development programs,

including risks that those research and development programs will not result in the development of products or technologies with the

desired clinical utility, benefits, or market acceptance; risks associated with conducting clinical trials of Serina product candidates

and obtaining Food and Drug Administration or other regulatory approvals to market product candidates, including risks with respect to

the timing of initiation of Serina’s planned clinical trials, the timing of the availability of data or other results from clinical

trials, and the timing of any planned investigational new drug application or new drug application; risks associated with the combined

company’s ability to identify additional products or product candidates with significant commercial potential; risks associated

with AgeX’s, Serina’s or the combined company’s ability to protect its intellectual property position; product liability

risks; the risk that the cash balance of the combined company following the closing of the Merger will be lower than expected or reduced;

the risk that the combined company’s anticipated sources and related timing of financing following the closing of the Merger will

not provide proceeds necessary to fund the operations of the combined company for as long as anticipated; the risk that the transactions

contemplated by the Side Letter entered into by AgeX, Serina and Juvenescence on August 29, 2023 are not completed in a timely manner

or at all; risks associated with AgeX’s or Serina’s estimates regarding future revenue, expenses, capital requirements, and

need for additional financing following the Merger; risks associated with the ability of AgeX and the combined company to remain listed

on the NYSE American; the risk that products may not be successfully commercialized or that the combined company might not otherwise

be able to generate sufficient revenues to operate at a profit; potential adverse changes to business or employee relationships, including

those resulting from the announcement or completion of the Merger; the risk that changes in AgeX’s capital structure, management,

business, and governance following the Merger could have adverse effects on the market value of its common stock; the ability of AgeX

and Serina to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers; risks

associated with Serina’s or the combined company’s ability to successfully collaborate with Serina’s existing collaborators

or enter into new collaborations, or to fulfill its obligations under any such collaboration agreements; risks associated with the combined

company’s commercialization, marketing and manufacturing capabilities and strategy; the risk that pursuing and completing the Merger

and related transactions could distract AgeX and Serina management from their respective ongoing business operations or cause AgeX and

Serina to incur substantial costs; risks associated with competition and developments in the industry in which the combined company will

operate; the impact of world health events and any related economic downturn; the risk of changes in governmental regulations or enforcement

practices; AgeX’s and Serina’s ability to meet guidance, market expectations, and internal projections; the impact of AgeX

stockholders having their percentage ownership interests in AgeX reduced by the issuance of AgeX common stock to Serina stockholders

in the Merger and by the issuance of shares of AgeX common stock upon the exercise of Post-Merger Warrants by Juvenescence, and other

important factors that could cause actual results to differ materially from those projected or expected by AgeX management or stockholders.

The effects of many of such factors are difficult to predict and may be beyond AgeX’s or Serina’s control.

New

factors emerge from time to time, and it is not possible for us to predict all such factors, nor can we assess the impact of each such

factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements. Additional factors that could cause actual results to differ materially from the results

anticipated in these forward-looking statements are contained in the Proxy Statement/Prospectus/Information Statement and AgeX’s

periodic reports filed with the SEC under the heading “Risk Factors” and other filings that AgeX may make with the SEC. Forward-looking

statements included in this communication are based on information available to AgeX and Serina as of the date of this communication.

Undue reliance should not be placed on these forward-looking statements that speak only as of the date they are made, and except as required

by law, AgeX and Serina each disclaims any intent or obligation to update these forward-looking statements.

Additional

Information and Where to Find It

In

connection with the proposed business combination transaction between AgeX and Serina, AgeX filed a registration statement on Form S-4/S-1

(the “Form S-4/S-1”) with the SEC that contains the Proxy Statement/Prospectus/Information Statement and other relevant documents

concerning the proposed transaction. AGEX URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS AND ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN AND WILL

CONTAIN IMPORTANT INFORMATION ABOUT AGEX, SERINA AND THE PROPOSED TRANSACTION AND RELATED MATTERS. The Proxy Statement/Prospectus/Information

Statement was first mailed to AgeX stockholders on or about February 20, 2024. Investors and stockholders will be able to obtain free

copies of the Form S-4/S-1 and other documents filed by AgeX with the SEC (when they become available) through the website maintained

by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the Form S-4/S-1 and other documents

filed by AgeX with the SEC by contacting Andrea Park by email at apark@agexinc.com. Investors and stockholders are urged to read the

Form S-4/S-1, including the Proxy Statement/Prospectus/Information Statement contained therein, and the other relevant materials when

they become available before making any voting or investment decision with respect to the proposed transaction.

Participants

in the Solicitation

AgeX

and Serina, and each of their respective directors and executive officers and certain of their other members of management and employees,

may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about AgeX’s

directors and executive officers is included in AgeX’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with

the SEC on March 31, 2023, in the proxy statement for AgeX’s 2023 annual meeting of stockholders, filed with the SEC on November

7, 2023, as supplemented by the supplement to the proxy statement for AgeX’s 2023 annual meeting of stockholders, filed with the

SEC on November 14, 2023, and in AgeX’s Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2023, filed

with the SEC on November 14, 2023. Additional information regarding these persons and their interests in the transaction are included

in the Proxy Statement/Prospectus/Information Statement. These documents can be obtained free of charge from the sources indicated above.

No

Offer or Solicitation

This

communication relates to a proposed business combination transaction between AgeX and Serina. This communication is for informational

purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote or approval, in any jurisdiction, pursuant to the proposed business combination transaction or otherwise, nor shall there be any

sale, issuance, exchange or transfer of the securities referred to in this communication in any jurisdiction in contravention of applicable

law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AGEX

THERAPEUTICS, INC. |

| |

|

|

| Date:

March 7, 2024 |

By: |

/s/

Andrea E. Park |

| |

|

Chief

Financial Officer |

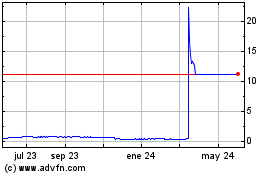

AgeX Therapeutics (AMEX:AGE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

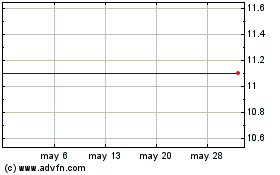

AgeX Therapeutics (AMEX:AGE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024