Company Delivers Top-Line Revenue Growth and

Improvements in Profitability and Key Operating Metrics

Announces Strategic Agreement with Bridge Media

Networks to Greatly Expand Video, OTT, and CTV Initiatives, plus a

Capital Infusion and Advertising Partnership

The Arena Group Holdings, Inc. (NYSE American: AREN) (“we,”

“us,” “our,” the “Company” or “The Arena Group”), a technology

platform and media company home to more than 265 brands, including

Sports Illustrated, TheStreet, Parade Media (“Parade”), Men’s

Journal, and HubPages, today announced financial results for the

three and six months ended June 30, 2023 (“Q2 2023”). The Company

once again generated year-over-year top- and bottom-line

improvements in Q2 2023, growing revenues by 9% while reducing

total operating expenses by 2%, leading to a 34% improvement in

gross profit, a $2.7 million improvement in net loss, and a $4.1

million improvement in adjusted EBITDA compared to the three months

ended June 30, 2022 (“Q2 2022”).

Additionally, today after the market close, The Arena Group

announced a strategic partnership to dramatically expand its

position in the video industry through a transaction with Bridge

Media Networks. The Company has signed a binding letter of intent

with Bridge Media Networks’ parent company, Simplify Inventions,

LLC (“Simplify”), which, if consummated, is expected to vastly

expand its video capabilities in digital streaming, OTT, OTA, CTV,

and Free Ad Support Television (“FAST”) channels, subject to

negotiation of final terms, completion of due diligence,

stockholder approval, the receipt of any required regulatory

approvals and certain other closing conditions. As part of the

proposed transaction, Simplify will invest $50 million in cash in

the combined entity, of which $25 million will be in the form of

common stock and $25 million will be in the form of non-convertible

preferred stock, and will contribute substantial video content,

production, and distribution assets and direct a significant

advertising spend towards the combined entity. The Company also

announced that it has extended its debt facility with B. Riley

Financial for three years at a fixed rate of 10%, and will reduce

the overall amount of its debt by $20 million from current levels.

The Company expects that the proposed strategic transaction will

include the following key components:

- The Arena Group will acquire and operate Bridge Media Networks’

network business, which includes two 24-hour networks, NEWSnet and

Sports News Highlights, which have 35 OTT distribution

relationships and are distributed on more than 100 owned and

affiliated linear television channels across 46 states through OTA,

MVPD, and cable outlets. Additionally, Bridge Media Networks will

contribute its automotive and travel brands, Driven and TravelHost,

which will anchor new vertical arenas on The Arena Group’s

technology platform.

- The combined entity will operate within The Arena Group and is

expected to expand its consumer reach, product offering for

advertisers, and further diversify its revenue across one of the

fastest-growing segments in the media industry: OTT, CTV, and FAST

channel programming.

- As part of the transaction, The Arena Group will receive a $50

million cash investment, a five-year guaranteed advertising

commitment of approximately $60 million from a group of consumer

brands also owned by Simplify, including 5-hour ENERGY®, and the

Bridge Media Networks operations. As consideration, Simplify will

receive $25 million of preferred stock at a 10% non-cash

payment-in-kind (“PIK”) coupon with a term of five years from the

closing date, and common equity which will represent approximately

65% ownership of the combined company on a fully diluted basis

based on $5 per share.

- The transaction is expected to close in the fourth quarter of

2023, subject to the negotiation of definitive agreements, the

completion of due diligence, the approval of The Arena Group’s

shareholders, the receipt of any required regulatory approvals and

certain other closing conditions. Additional details regarding the

proposed strategic transaction are available in a Current Report on

Form 8-K filed with the Securities and Exchange Commission (the

“SEC”) and a press release issued today, August 14, 2023.

Second Quarter 2023 Financial and Operational

Highlights

- Revenue increased 9% to $58.8 million compared to $53.8 million

in the prior year period.

- Digital advertising revenue increased by 19% to $29.3 million

from $24.7 million in the prior year period. This was aided by our

programmatic CPMs outperforming industry benchmarks by 41%,

according to STAQ Benchmarking, a market-norm reporting service

provided by Operative.

- Total print revenue increased 9% to $20.4 million compared to

$18.7 million in the prior year period.

- Gross margin improved to 37% compared to 30% in the prior year

period.

- Operating expenses decreased by $0.8 million or 2%, to $36.0

million from $36.8 million in the prior year period.

- Net loss narrowed by $2.7 million, or 12%, to $19.5 million

from $22.2 million in the prior year period.

- Q2 2023 included approximately $14.7 million in non-cash

charges, including stock-based compensation, amortization of

platform development and intangible assets, and other non-cash

charges.

- Adjusted EBITDA* improved significantly from a negative $4.2

million in Q2 2022 to a loss of $76 thousand in Q2 2023.

*Adjusted EBITDA is a non-GAAP measure. For additional

information regarding non-GAAP financial measures, see “Use of

Non-GAAP Financial Measures” and “Net Loss to Adjusted EBITDA

Reconciliation” below.

Management Commentary

Chairman and Chief Executive Officer of The Arena Group, Ross

Levinsohn, said, “This is a watershed moment for The Arena Group.

Our agreement with Bridge Media Networks combines our brands with

vast video opportunities across all digital and terrestrial

platforms. Upon completion of the agreements, we will have

fortified our balance sheet, reduced and extended our debt, and

secured a significant advertising partnership. We also have added a

dynamic and successful investor and entrepreneur to our Company.

The innovative business combination with Bridge Media Networks,

contemplated in today’s announcement, promises the next exciting

phase of our evolution. We believe the result, once the proposed

transaction is complete, will be a well-capitalized company, poised

to grow rapidly with leading digital and video offerings that will

resonate with advertisers and consumers.”

“The hard work of our incredible employees to transform The

Arena Group over the past three years has enabled this moment to

expand our Company. Our continued progress in growing our scale and

driving efficiency was a key factor in our ability to achieve this

milestone transaction,” continued Mr. Levinsohn. “While many in our

industry have seen their businesses shrinking in the second

quarter, we grew revenue 9% year-over-year, overcoming

industry-wide challenges in the digital advertising ecosystem.”

Mr. Levinsohn continued, “We have continued to diversify our

revenue streams, growing eCommerce from a nascent business into a

growth engine, and we expect further expansion through the balance

of the year. We focused on operational efficiency and reduced our

total operating expenses by 2% from the prior year period even as

we grew revenue by 9% year-over-year, driving a $6.3 million

improvement in our loss from operations. Combined with a

significant improvement in our gross margins, we are making steady

progress towards achieving sustainable profitability.”

Highlights across the Company’s verticals include:

- The Sports vertical, anchored by Sports Illustrated, saw the

expansion of several key properties including SI Golf and

FanNation. The Company launched an F1 Formula Racing site which is

now the second largest F1-focused site after just eight months,

according to data from Comscore and MRI-Simmons.

- Sports Illustrated Swimsuit’s 2023 launch more than doubled

traffic as compared to the prior year. The announcement of the four

covers – Martha Stewart, Megan Fox, Brooks Nader, and Kim Petras –

and subsequent launch events in New York and Florida garnered over

108 billion media impressions and over 13,500 articles written

about the release, according to data from Comscore and SimilarWeb.

The group also saw record online digital advertising revenue,

nearly tripling last year’s numbers.

- The Finance vertical, anchored by TheStreet, had a record

quarter with 38 million monthly average pageviews according to

Google Analytics, an increase of 31% as compared to the prior year

quarter. TheStreet launched partnerships with Tom Lee’s FundStrat

Global Advisors and Tornado to expand its content base and reach a

broader audience.

- The Lifestyle vertical, anchored by Parade and Men’s Journal,

saw an expansion of publishing partners covering new content

channels such as entertainment, astrology, sneakers, wine, and

streaming TV. Parade continued to drive year-over-year traffic

growth, with a 33% increase in monthly average pageviews as

compared to the prior year quarter, according to Google Analytics.

Through an exclusive licensing deal, the popular weekly podcast

Club Random with Bill Maher is now featured by Men’s Journal.

- The Company announced that it has signed an agreement with

acTVe Action Sports, LLC to launch five new FAST channels featuring

its Adventure Network brands including Surfer, Powder, and BikeMag,

with potential to expand to additional brands.

Financial Results for the Three Months Ended June 30, 2023

Compared to the Three Months Ended June 30, 2022

Revenue

Revenue was $58.8 million in Q2 2023, representing an increase

of 9% compared to $53.8 million in Q2 2022.

Digital Revenue

Revenue from digital operations grew 10% year-over-year to $38.4

million in Q2 2023, as a $4.6 million, or 19%, year-over-year

increase in digital advertising and a $0.9 million, or 218%,

year-over-year increase in other digital revenue more than offset a

$2.1 million decrease in revenue from digital subscriptions and a

slight decrease in licensing and syndication revenue. The strong

growth in digital advertising was driven by a 35% increase in

revenue per page view, more than offsetting a 12% decrease in

monthly average pageviews.

Print Revenue

Total print revenue saw significant growth, as it increased by

9% to $20.4 million in Q2 2023 from $18.7 million in Q2 2022, which

reflects growth in the results of Sports Illustrated and

improvements in the Athlon Outdoor properties, which were acquired

as part of the Parade Media acquisition in April 2022.

Gross Profit

Gross profit for Q2 2023 increased $5.5 million or 34% to $21.7

million, from $16.1 million in the prior year period, This

represented an improvement of 7 percentage points in gross margin

from 30% to 37%. Contributing to this improvement was a

year-over-year decrease in content and editorial expense of $1.4

million or 9% and a $4.6 million or 19% increase in digital

advertising revenue, reflecting our continued efforts to manage

costs and drive efficiencies.

Operating Expenses

Total operating expenses declined $0.8 million or 2% to $36.0

million in Q2 2023 from $36.8 million in the prior year period. The

company continues to maintain expense discipline while optimizing

operations and integrating acquired properties.

Net Loss

Net loss was $19.5 million in Q2 2023 as compared to $22.2

million in the prior year period, a $2.7 million of 12%

improvement, primarily as a result of a $6.3 million narrowing in

loss from operations that was partially offset by a $2.5 million

increase in interest expense related to increased debt outstanding.

Q2 2023 included non-cash charges of $14.7 million, consistent with

the charges in the prior year period.

Adjusted EBITDA

Adjusted EBITDA was a loss of $76 thousand for Q2 2023, a $4.1

million improvement as compared to an Adjusted EBITDA loss of $4.2

million in the prior year period. Adjusted EBITDA is a non-GAAP

financial measure. A disclaimer and reconciliation are provided

below.

Balance Sheet and Liquidity as of June 30, 2023

Cash and cash equivalents were $5.5 million as of June 30, 2023,

compared to $13.9 million as of December 31, 2022.

In the first half of 2023, net cash used in operating activities

was $16.4 million, as compared to $7.5 million used in operating

activities in the first half of 2022.

Fiscal 2023 Outlook

Management suspended its 2023 full-year guidance, citing the

complexity of the proposed strategic transaction with Bridge Media

Networks, and expects to be able to issue revised guidance in four

to six months, after the integration of the respective

businesses.

Conference Call

Ross Levinsohn, The Arena Group’s Chief Executive Officer, Doug

Smith, Chief Financial Officer, and Andrew Kraft, Chief Operating

Officer, will host a conference call and live webcast to review the

quarterly results and provide a corporate update at 4:30 p.m. ET

today. To access the call, please dial 800-285-6670 (toll free) or

713-481-1320. The conference call will also be webcast live on the

Investor Relations section of The Arena Group’s website at

https://investors.thearenagroup.net/news-and-events/events.

Following the conclusion of the live call, a replay of the

webcast will be available on the Investor Relations section of the

Company’s website for at least 90 days. A telephonic replay of the

conference call will also be available from 7 p.m. ET on August 14,

2023 until 11:59 p.m. ET on August 28, 2023 by dialing 877-481-4010

(United States) or 919-882-2331 (international) and using the

passcode 48775.

About The Arena Group

The Arena Group (NYSE American: AREN) is an innovative

technology platform and media company with a proven cutting-edge

playbook that transforms media brands. Our unified technology

platform empowers creators and publishers with tools to publish and

monetize their content, while also leveraging quality journalism of

anchor brands like Sports Illustrated, TheStreet, Parade, Men’s

Journal, and HubPages to build their businesses. The company

aggregates content across a diverse portfolio of over 265 brands,

reaching over 100 million users monthly. Visit us at

thearenagroup.net and discover how we are revolutionizing the world

of digital media.

About Bridge Media Networks

Bridge Media Networks is a dynamic and innovative media group

that offers a wide range of platforms for delivering the latest

news, sports, automotive, and travel content. Bridge Media

Networks’ portfolio includes over-the-air television stations, two

national television networks, cutting-edge streaming platforms, and

dynamic websites designed to keep viewers informed and entertained.

Bridge Media Networks’ unwavering commitment is to provide viewers

with the most comprehensive and impartial content possible through

its flagship brands: NEWSnet, Sports News Highlights, Driven, and

TravelHost.

Use of Non-GAAP Financial Measures

We report our financial results in accordance with generally

accepted accounting principles in the United States of America

(“GAAP”); however, management believes that certain non-GAAP

financial measures provide users of our financial information with

useful supplemental information that enables a better comparison of

our performance across periods. This press release includes

references to Adjusted EBITDA, which is a non-GAAP financial

measure. We believe Adjusted EBITDA provides visibility to our

underlying continuing operating performance by excluding the impact

of certain items that are noncash in nature or not related to our

core business operations. We calculate Adjusted EBITDA as net loss,

as adjusted for loss from discontinued operations, with additional

adjustments for (i) interest expense (net), (ii) provision for or

benefit from income taxes, (iii) depreciation and amortization,

(iv) stock-based compensation, (v) change in fair value of

contingent consideration, (vi) liquidated damages, (vii) loss on

impairment of assets, (viii) employee retention credit, and (ix)

employee restructuring payments.

Our Adjusted EBITDA measure may not be comparable to a similarly

titled measure used by other companies, has limitations as an

analytical tool, and should not be considered in isolation, or as a

substitute for analysis of our operating results as reported under

GAAP. Additionally, we do not consider our Adjusted EBITDA as

superior to, or a substitute for, the equivalent measures

calculated and presented in accordance with GAAP. A reconciliation

of Adjusted EBITDA to net loss has been provided in the financial

statement tables included in this press release, and investors are

encouraged to review the reconciliation.

Forward-Looking Statements

This press release includes statements that constitute

forward-looking statements. Forward-looking statements may be

identified by the use of words such as “forecast,” “guidance,”

“plan,” “estimate,” “will,” “would,” “project,” “maintain,”

“intend,” “expect,” “anticipate,” “prospect,” “strategy,” “future,”

“likely,” “may,” “should,” “believe,” “continue,” “opportunity,”

“potential,” and other similar expressions that predict or indicate

future events or trends or that are not statements of historical

matters, and include, for example, statements related to the

proposed strategic transaction with Simplify Inventions, including

the Company’s ability to complete the transaction and the potential

benefits thereof, the Company’s anticipated restructuring of its

indebtedness, the Company’s anticipated future expenses and

investments, business strategy and plans, expectations relating to

its industry, market conditions and market trends and growth,

market position and potential market opportunities, and objectives

for future operations. These forward-looking statements are based

on information available at the time the statements are made and/or

management’s good faith belief as of that time with respect to

future events and are subject to risks and uncertainties that could

cause actual results to differ materially from those expressed in

or suggested by the forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, the ability of the Company to expand its verticals; the

Company’s ability to grow its subscribers; the Company’s ability to

grow its advertising revenue; general economic uncertainty in key

global markets and a worsening of global economic conditions or low

levels of economic growth; the effects of steps that the Company

could take to reduce operating costs; the remaining effects of the

COVID-19 pandemic and impact on the demand for the Company

products; the inability of the Company to sustain profitable sales

growth; circumstances or developments that may make the Company

unable to implement or realize the anticipated benefits, or that

may increase the costs, of its current and planned business

initiatives; and those factors detailed by the Company in its

public filings with the SEC, including its Annual Reports on Form

10-K and Quarterly Reports on Form 10-Q. Should one or more of

these risks, uncertainties, or facts materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated or anticipated by the

forward-looking statements contained herein. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. Except as required under the federal

securities laws and the rules and regulations of the SEC, we do not

have any intention or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval with respect to the proposed transaction with

Bridge Media Networks (the “Proposed Transaction”) or

otherwise.

Additional Information and Where to Find It

In connection with the Proposed Transaction, the Company intends

to file relevant materials with the SEC, including a preliminary

and definitive proxy statement to be filed by the Company. The

definitive proxy statement and proxy card will be delivered to the

stockholders of the Company in advance of the special meeting

relating to the Proposed Transaction. THE COMPANY’S STOCKHOLDERS

ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY

WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY THE

COMPANY WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR

INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE

PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders

will be able to obtain a free copy of the proxy statement and such

other documents containing important information about the Company,

once such documents are filed with the SEC, through the website

maintained by the SEC at www.sec.gov. The Company makes available

free of charge at the Company’s website copies of materials it

files with, or furnishes to, the SEC. The contents of the websites

referenced above are not deemed to be incorporated by reference

into the proxy statement.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an

offer to purchase or a solicitation of an offer to sell any

securities. The Company and its directors, executive officers and

certain employees may be deemed to be participants in the

solicitation of proxies from the stockholders of the Company in

connection with the Proposed Transaction. Information regarding the

special interests of these directors and executive officers in the

Proposed Transaction will be included in the definitive proxy

statement referred to above. Security holders may obtain

information regarding the names, affiliations and interests of the

Company’s directors and executive officers in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and

its definitive proxy statement for the 2023 annual meeting of

stockholders. Additional information regarding the interests of

such individuals in the Proposed Transaction will be included in

the definitive proxy statement relating to the Proposed Transaction

when it is filed with the SEC. These documents (when available) may

be obtained free of charge from the SEC’s website at www.sec.gov

and the Company’s website. The contents of the websites referenced

above are not deemed to be incorporated by reference into the proxy

statement.

THE ARENA GROUP HOLDINGS, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

June 30, 2023

(unaudited)

December 31,

2022

($ in thousands, except share

data)

Assets

Current assets:

Cash and cash equivalents

$

5,489

$

13,871

Restricted cash

502

502

Accounts receivable, net

31,632

33,950

Subscription acquisition costs, current

portion

34,983

25,931

Prepayments and other current assets

11,768

4,441

Total current assets

84,374

78,695

Property and equipment, net

483

735

Operating lease right-of-use assets

279

372

Platform development, net

9,788

10,330

Subscription acquisition costs, net of

current portion

12,354

14,133

Acquired and other intangible assets,

net

49,454

58,970

Other long-term assets

1,025

1,140

Goodwill

41,329

39,344

Total assets

$

199,086

$

203,719

Liabilities, mezzanine equity and

stockholders’ deficiency

Current liabilities:

Accounts payable

$

13,794

$

12,863

Accrued expenses and other

23,143

23,102

Line of credit

14,907

14,092

Unearned revenue

66,799

58,703

Subscription refund liability

890

845

Operating lease liability

456

427

Contingent consideration

970

-

Liquidated damages payable

6,142

5,843

Bridge notes

35,844

34,805

Term debt

66,183

65,684

Total current liabilities

229,128

216,364

Unearned revenue, net of current

portion

17,080

19,701

Operating lease liability, net of current

portion

122

358

Liquidated damages payable, net of current

portion

-

494

Other long-term liabilities

4,733

5,307

Deferred tax liabilities

538

465

Total liabilities

251,601

242,689

Commitments and contingencies

Mezzanine equity:

Series G redeemable and convertible

preferred stock, $0.01 par value, $1,000 per share liquidation

value and 1,800 shares designated; aggregate liquidation value:

$168; Series G shares issued and outstanding: 168; common shares

issuable upon conversion: 8,582 at June 30, 2023 and December 31,

2022

168

168

Series H convertible preferred stock,

$0.01 par value, $1,000 per share liquidation value and 23,000

shares designated; aggregate liquidation value: $12,856 and

$14,356; Series H shares issued and outstanding: 12,856 and 14,356;

common shares issuable upon conversion: 1,774,128 and 1,981,128 at

June 30, 2023 and December 31, 2022, respectively

11,508

13,008

Total mezzanine equity

11,676

13,176

Stockholders’ deficiency:

Common stock, $0.01 par value, authorized

1,000,000,000 shares; issued and outstanding: 22,014,927 and

18,303,193 shares at June 30, 2023 and December 31, 2022,

respectively

219

182

Common stock to be issued

-

-

Additional paid-in capital

297,522

270,743

Accumulated deficit

(361,932

)

(323,071

)

Total stockholders’ deficiency

(64,191

)

(52,146

)

Total liabilities, mezzanine equity and

stockholders’ deficiency

$

199,086

$

203,719

THE ARENA GROUP HOLDINGS, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

($ in thousands, except share

data)

Revenue

$

58,806

$

53,752

$

110,186

$

101,995

Cost of revenue (includes amortization of

platform development and developed technology for three months

ended 2023 and 2022 of $2,323 and $2,375, respectively and for the

six months ended 2023 and 2022 of $4,692 and $4,686,

respectively)

37,142

37,622

67,177

66,119

Gross profit

21,664

16,130

43,009

35,876

Operating expenses

Selling and marketing

19,503

17,483

37,472

34,699

General and administrative

11,722

14,834

24,775

28,348

Depreciation and amortization

4,735

4,444

9,501

8,646

Loss on impairment of assets

-

-

119

257

Total operating expenses

35,960

36,761

71,867

71,950

Loss from operations

(14,296

)

(20,631

)

(28,858

)

(36,074

)

Other (expense) income

Change in fair value of contingent

consideration

90

-

(409

)

-

Interest expense

(5,001

)

(2,506

)

(9,183

)

(5,326

)

Liquidated damages

(177

)

(128

)

(304

)

(300

)

Total other expenses

(5,088

)

(2,634

)

(9,896

)

(5,626

)

Loss before income taxes

(19,384

)

(23,265

)

(38,754

)

(41,700

)

Income tax (provision) benefit

(100

)

1,741

(107

)

1,727

Loss from continuing operations

(19,484

)

(21,524

)

(38,861

)

(39,973

)

Loss from discontinued operations, net of

tax

-

(683

)

-

(683

)

Net loss

$

(19,484

)

$

(22,207

)

$

(38,861

)

$

(40,656

)

Basic and diluted net loss per common

share:

Continuing operations

$

(0.88

)

$

(1.18

)

$

(1.89

)

$

(2.37

)

Discontinued operations

-

(0.04

)

-

(0.04

)

Basic and diluted net loss per common

share

$

(0.88

)

$

(1.22

)

$

(1.89

)

$

(2.41

)

Weighted average number of common shares

outstanding – basic and diluted

22,074,500

18,258,890

20,509,676

16,847,920

THE ARENA GROUP HOLDINGS, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited)

Six Months Ended June

30,

2023

2022

($ in thousands)

Cash flows from operating

activities

Net loss

$

(38,861

)

$

(40,656

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation of property and equipment

197

245

Amortization of platform development and

intangible assets

13,996

13,087

Amortization of debt discounts

1,645

934

Noncash and accrued interest

602

69

Loss on impairment of assets

119

257

Change in fair value of contingent

consideration

409

-

Liquidated damages

304

300

Stock-based compensation

12,616

16,466

Deferred income taxes

73

(1,782

)

Bad debt expense

54

372

Other

-

185

Change in operating assets and liabilities

net of effect of business combination:

Accounts receivable, net

2,213

(83

)

Subscription acquisition costs

(7,273

)

2,143

Royalty fees

-

7,500

Prepayments and other current assets

(7,327

)

264

Other long-term assets

8

13

Accounts payable

742

335

Accrued expenses and other

(800

)

(7,131

)

Unearned revenue

5,526

945

Subscription refund liability

45

(693

)

Operating lease liabilities

(114

)

(107

)

Other long-term liabilities

(574

)

(128

)

Net cash used in operating activities

(16,400

)

(7,465

)

Cash flows from investing

activities

Purchases of property and equipment

-

(379

)

Capitalized platform development

(2,132

)

(2,784

)

Proceeds from sale of equity

investment

-

2,450

Payments for acquisition of business, net

of cash acquired

(500

)

(9,481

)

Net cash used in investing activities

(2,632

)

(10,194

)

Cash flows from financing

activities

Repayments under line of credit, net

borrowing

815

(4,180

)

Proceeds from common stock registered

direct offering

11,500

-

Payments of issuance costs from common

stock registered direct offering

(167

)

-

Proceeds from common stock public

offering, net of offering costs

-

32,058

Payments of issuance costs from common

stock public offering

-

(1,568

)

Payment of deferred cash payments

(75

)

(453

)

Payment of taxes from common stock

withheld

(1,423

)

(556

)

Payment of restricted stock

liabilities

-

(2,152

)

Net cash provided by financing

activities

10,650

23,149

Net increase (decrease) in cash, cash

equivalents, and restricted cash

(8,382

)

5,490

Cash, cash equivalents, and restricted

cash – beginning of period

14,373

9,851

Cash, cash equivalents, and restricted

cash – end of period

$

5,991

$

15,341

Cash, cash equivalents, and restricted

cash

Cash and cash equivalents

$

5,489

$

14,839

Restricted cash

502

502

Total cash, cash equivalents, and

restricted cash

$

5,991

$

15,341

Supplemental disclosure of cash flow

information

Cash paid for interest

$

7,140

$

4,323

Cash paid for income taxes

85

-

Noncash investing and financing

activities

Reclassification of stock-based

compensation to platform development

$

548

$

1,125

Issuance cost of offerings recorded in

accrued expenses and other

189

-

Issuance of common stock in connection

with settlement of liquidated damages

499

7,008

Issuance of common stock upon conversion

of series H preferred stock

1,500

511

Issuance of common stock in connection

with acquisition

2,000

-

Deferred cash payments recorded in

connection with acquisitions

246

1,889

Common stock issued in connection with

acquisition of Athlon

-

3,141

Assumptions of liabilities in connection

with acquisition of Athlon

-

12,642

Reclassification to liability upon common

stock modification

68

-

THE ARENA GROUP HOLDINGS, INC.

AND SUBSIDIARIES

NET LOSS TO ADJUSTED EBITDA

RECONCILIATION

(unaudited)

The following table presents a

reconciliation of Adjusted EBITDA to net loss, which is the most

directly comparable GAAP measure, for the periods indicated:

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

Net loss

$

(19,484

)

$

(22,207

)

$

(38,861

)

$

(40,656

)

Net loss from discontinued operations

-

683

-

683

Net loss from continued operations

(19,484

)

(21,524

)

(38,861

)

(39,973

)

Add (deduct):

Interest expense, net (1)

5,001

2,506

9,183

5,326

Income tax provision (benefit)

100

(1,741

)

107

(1,727

)

Depreciation and amortization (2)

7,058

6,819

14,193

13,332

Stock-based compensation (3)

6,189

9,099

12,616

16,466

Change in fair value of contingent

consideration (4)

(90

)

-

409

-

Liquidated damages (5)

177

128

304

300

Loss on impairment of assets (6)

-

-

119

257

Employee retention credit (7)

-

-

(6,868

)

-

Employee restructuring payments (8)

973

505

4,262

679

Adjusted EBITDA

$

(76

)

$

(4,208

)

$

(4,536

)

$

(5,340

)

(1)

Interest expense is related to our capital

structure and varies over time due to a variety of financing

transactions. Interest expense includes $715 and $274 for

amortization of debt discounts for the three months ended June 30,

2023 and 2022, respectively, as presented in our condensed

consolidated statements of cash flows, which is a noncash item.

Interest expense includes $1,645 and $934 for amortization of debt

discounts for the six months ended June 30, 2023 and 2022,

respectively. Investors should note that interest expense will

recur in future periods.

(2)

Depreciation and amortization is related

to our developed technology and Platform included within cost of

revenues of $2,323 and $2,375, for the three months ended June 30,

2023 and 2022, respectively, and depreciation and amortization

included within operating expenses of $4,735 and $4,444 for the

three months ended June 30, 2023 and 2022, respectively.

Depreciation and amortization is related to our developed

technology and Platform included within cost of revenues of $4,692

and $4,686, for the six months ended June 30, 2023 and 2022,

respectively, and depreciation and amortization included within

operating expenses of $9,501 and $8,646 for the six months ended

June 30, 2023 and 2022, respectively. We believe (i) the amount of

depreciation and amortization expense in any specific period may

not directly correlate to the underlying performance of our

business operations and (ii) such expenses can vary significantly

between periods as a result of new acquisitions and full

amortization of previously acquired tangible and intangible assets.

Investors should note that the use of tangible and intangible

assets contributed to revenue in the periods presented and will

contribute to future revenue generation and should also note that

such expense will recur in future periods.

(3)

Stock-based compensation represents

noncash costs arise from the grant of stock-based awards to

employees, consultants and directors. We believe that excluding the

effect of stock-based compensation from Adjusted EBITDA assists

management and investors in making period-to-period comparisons in

our operating performance because (i) the amount of such expenses

in any specific period may not directly correlate to the underlying

performance of our business operations, and (ii) such expenses can

vary significantly between periods as a result of the timing of

grants of new stock-based awards, including grants in connection

with acquisitions. Additionally, we believe that excluding

stock-based compensation from Adjusted EBITDA assists management

and investors in making meaningful comparisons between our

operating performance and the operating performance of other

companies that may use different forms of employee compensation or

different valuation methodologies for their stock-based

compensation. Investors should note that stock-based compensation

is a key incentive offered to employees whose efforts contributed

to the operating results in the periods presented and are expected

to contribute to operating results in future periods. Investors

should also note that such expenses will recur in the future.

(4)

Change in fair value of contingent

consideration represents the change in the put option on our common

stock in connection with the Fexy Studios acquisition.

(5)

Liquidated damages (or interest expense

related to accrued liquidated damages) represents amounts we owe to

certain of our investors in private placements offerings conducted

in fiscal years 2018 through 2020, pursuant to which we agreed to

certain covenants in the respective securities purchase agreements

and registration rights agreements, including the filing of resale

registration statements and becoming current in our reporting

obligations, which we were not able to timely meet.

(6)

Loss on impairment of assets represents

certain assets that are no longer useful.

(7)

Employee retention credit represents

payroll related tax credits under the Cares Act.

(8)

Employee restructuring payments represents

severance payments to employees under employer restructuring

arrangements and payments to our former Chief Executive Officer for

the three and six months ended June 30, 2023 and 2022,

respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814967447/en/

Investor Relations: Rob Fink FNK IR Aren@fnkir.com

646.809.4048

Media: Rachael Fink Manager, Public Relations, The Arena

Group Rachael.fink@thearenagroup.net

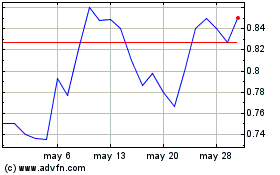

Arena (AMEX:AREN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Arena (AMEX:AREN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024