When Do You Buy Oil? - Real Time Insight

15 Junio 2012 - 8:01AM

Zacks

Thanks to a strong dollar and sluggish demand, prices in the

energy commodity world have been quite weak this year. In fact,

crude oil in WTI terms has slumped by about 21% so far in 2012

while Brent crude—the European benchmark for the commodity—has lost

about 12.2% in the same time frame.

These kinds of performances would have been unfathomable just a

few months ago when the U.S. economy was on the mend and political

risk from Iran and other Middle East nations was leading many to

think that supplies would not be able to keep up with demand.

However, in just the past six weeks, oil prices have taken these

solid gains and turned them into heavy losses, pushing crude oil

down double digits in just the past month alone.

Given the ongoing—and apparently spreading—troubles in Europe,

as well as the increasingly strong dollar, many are forecasting

that oil prices could have further to fall this year. Credit

Suisse, for example, looks for oil to drop to $50/bbl. if a severe

credit crunch hits the market, while the EIA has recently reduced

its price target (although not as drastically) for crude prices in

the second half of the year as well.

Yet despite this bearish outlook, there could be a few reasons

to be optimistic about oil prices in the second half of the year. A

step in the right direction for the euro crisis could be bullish

for demand across the board while a return to turmoil in the Middle

East—possibly with a Syrian civil war as a catalyst—could boost

prices as well (also read Three ETFs For An Iranian Crisis).

Furthermore, an expansion of QE programs in some of the Western

world’s key central banks could also be a positive for oil as it

may once again stoke fears of inflation and reignite demand for

commodities and other real assets once more (read Follow Goldman

into Commodities with These Three ETFs).

Clearly, oil could go either way as we head into Q3 and either

continue its recent slump or rise back towards the triple digit

level. What do you think will be the case?

Also given the uncertainty, is it better to play oil via the

commodity (such as with USO or

BNO), oil producers with stocks/ETFs like

CVX or XLE, or the relatively

safe and high payout space of MLPs with options like

AMJ or EPD?

Let us know what you think in the comments below!

JPM-ALERN MLP (AMJ): ETF Research Reports

US BRENT OIL FD (BNO): ETF Research Reports

CHEVRON CORP (CVX): Free Stock Analysis Report

ENTERPRISE PROD (EPD): Free Stock Analysis Report

US-OIL FUND LP (USO): ETF Research Reports

SPDR-EGY SELS (XLE): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

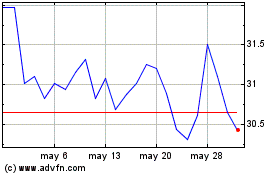

United States Brent Oil (AMEX:BNO)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

United States Brent Oil (AMEX:BNO)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024