Perspective Therapeutics, Inc. (“Perspective” or the “Company”)

(NYSE AMERICAN: CATX), a radiopharmaceutical company that is

pioneering advanced treatment applications for cancers throughout

the body, today announced the pricing of an underwritten offering

of 51,515,880 shares of its common stock at an offering price of

$1.51 per share and, to certain investors in lieu of common stock,

pre-funded warrants to purchase 1,464,252 shares of its common

stock at a price of $1.509 per pre-funded warrant. The aggregate

gross proceeds from this offering are expected to be approximately

$80 million, before deducting underwriting discounts and

commissions and other offering expenses payable by Perspective in

connection with the offering. The purchase price per share of each

pre-funded warrant represents the per share offering price for the

common stock, minus the $0.001 per share exercise price of such

pre-funded warrant. The offering is expected to close on or about

May 29, 2024, subject to the satisfaction of customary closing

conditions. All of the shares of common stock and pre-funded

warrants to be sold in the offering are being sold by Perspective.

BofA Securities, Inc., Oppenheimer & Co.

Inc. and RBC Capital Markets, LLC are acting as joint book-running

managers for the offering and B. Riley Securities, Inc. is acting

as a co-manager for the offering.

Perspective intends to use the net proceeds that

it will receive from the offering for: (i) the continued clinical

development of VMT-α-NET, VMT-01/02 and PSV359; (ii) the continued

development of PSV40X and additional preclinical product candidates

as well as broader development platform; and (iii) the build out,

operation and expansion of manufacturing facilities, as well as for

working capital and other general corporate purposes. A portion of

the net proceeds may also be used to acquire, license or invest in

complementary products, technologies, intellectual property or

businesses, although Perspective has no present commitments or

agreements to do so.

The securities described above are being offered

by Perspective pursuant to an automatic shelf registration

statement on Form S-3 that went effective upon the Company’s filing

with the Securities and Exchange Commission (the “SEC”) on May 24,

2024. A final prospectus supplement will be filed with the SEC.

These documents can be accessed on the SEC’s website at

www.sec.gov.

Copies of the final prospectus supplement, when

available, and accompanying prospectus relating to the offering may

be obtained from BofA Securities, Inc., Attention: Prospectus

Department, NC1-022-02-25, 201 North Tryon Street, Charlotte, North

Carolina 28255-0001, via email at dg.prospectus_requests@bofa.com,

from Oppenheimer & Co. Inc., Attention: Syndicate Prospectus

Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by

telephone at (212) 667-8055, or by email at

EquityProspectus@opco.com, or from RBC Capital Markets, LLC,

Attention: Equity Capital Markets, 200 Vesey Street, 8th Floor, New

York, NY 10281, by telephone at (877) 822-4089, or by email at

equityprospectus@rbccm.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Perspective Therapeutics,

Inc.

Perspective Therapeutics, Inc., is a

radiopharmaceutical development company that is pioneering advanced

treatment applications for cancers throughout the body. The Company

has proprietary technology that utilizes the alpha emitting isotope

212Pb to deliver powerful radiation specifically to cancer cells

via specialized targeting peptides. The Company is also developing

complementary imaging diagnostics that incorporate the same

targeting peptides, which provide the opportunity to personalize

treatment and optimize patient outcomes. This "theranostic"

approach enables the ability to see the specific tumor and then

treat it to potentially improve efficacy and minimize toxicity.

The Company's melanoma (VMT01) and

neuroendocrine tumor (VMT-α-NET) programs have entered Phase 1/2a

imaging and therapy trials for the treatment of metastatic melanoma

and neuroendocrine tumors at several leading academic institutions.

The Company has also developed a proprietary 212Pb generator to

secure key isotopes for clinical trial and commercial

operations.

SAFE HARBOR STATEMENTS UNDER THE PRIVATE

SECURITIES LITIGATION ACT OF 1995: To the extent any statements

made in this press release deal with information that is not

historical, these are forward-looking statements under the Private

Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements regarding the timing of the

closing of the offering, as well as the anticipated use of proceeds

for the offering and other statements identified by words such as

“will,” “potential,” “could,” “can,” “believe,” “intends,”

“continue,” “plans,” “expects,” “anticipates,” “estimates,” “may,”

other words of similar meaning or the use of future dates.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. Uncertainties and risks may

cause Perspective’s actual results to be materially different than

those expressed in or implied by Perspective’s forward-looking

statements. For Perspective, this includes satisfaction of the

customary closing conditions of the offering, delays in obtaining

required stock exchange or other regulatory approvals, stock price

volatility and uncertainties relating to the financial markets, the

medical community and the global economy, and the impact of

instability in general business and economic conditions, including

changes in inflation, interest rates and the labor market. More

detailed information on these and additional factors that could

affect Perspective’s actual results are described in Perspective’s

filings with the SEC, including its Annual Report on Form 10-K

for the year ended December 31, 2023, as revised or supplemented by

its Quarterly Reports on Form 10-Q and other documents filed with

the SEC. All forward-looking statements in this news release speak

only as of the date of this news release. Perspective undertakes no

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or

otherwise.

Perspective Therapeutics IR:

Annie Cheng

ir@perspectivetherapeutics.com

Russo Partners, LLC

Nic Johnson / Adanna G. Alexander, Ph.D.

PerspectiveIR@russopr.com

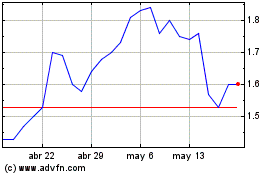

Perspective Therapeutics (AMEX:CATX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Perspective Therapeutics (AMEX:CATX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024