0001046995

false

0001046995

2023-10-16

2023-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 16, 2023

eMagin Corporation

(Exact name of Registrant as specified in its

charter)

| Delaware |

001-15751 |

56-1764501 |

(State or other jurisdiction

of incorporation) |

(Commission

File No.) |

(IRS Employer

Identification No.) |

|

700

South Drive, Suite 201,

Hopewell Junction, NY |

|

12533 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number: (845)

838-7900

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 Par Value Per Share |

|

EMAN |

|

NYSE American |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging Growth Company

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

As of October 16, 2023, eMagin Corporation (“eMagin” or

the “Company”) has received all regulatory approvals required in connection with the previously announced Agreement and Plan

of Merger, dated as of May 17, 2023 (the “Merger Agreement”), by and among the Company, Samsung Display Co., Ltd., a Korean

corporation (“Parent” or “Samsung Display”), Emerald Intermediate, Inc., a Delaware corporation and wholly owned

subsidiary of Parent (“Silk USA”), and Emerald Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Silk

USA (“Merger Sub”), pursuant to which Merger Sub will merge with and into the Company (the “Merger”), with the

Company surviving the Merger as a wholly owned subsidiary of Silk USA. As a result, the closing conditions under the Merger Agreement

in respect of (i) the expiration or termination of any applicable waiting periods under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976, as amended, and (ii) receipt of any other required governmental approvals or waivers thereof, including

clearance from the Committee on Foreign Investment in the United States have been satisfied.

As of the date of this report, eMagin expects the Merger to close on

October 18, 2023, or as soon as possible thereafter, subject to completion or waiver of the remaining customary closing conditions.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements”

within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Exchange Act. These forward-looking statements are based on eMagin’s current expectations, estimates and projections about the

expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s

beliefs and certain assumptions made by eMagin and Parent, all of which are subject to change. In this context, forward-looking statements

often address expected future business and financial performance and financial condition, and often contain words such as “expect,”

“anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “see,”

“will,” “may,” “would,” “might,” “potentially,” “estimate,” “continue,”

“target,” similar expressions or the negatives of these words or other comparable terminology that convey uncertainty of future

events or outcomes. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which

are beyond our control, and are not guarantees of future results, such as statements about the consummation of the proposed transaction

and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate the proposed transaction

or to make or take any filing or other action required to consummate the transaction on a timely matter or at all, are not guarantees

of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those

expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ

materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution

must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not

limited to: (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining anticipated tax treatment,

unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial

condition, losses, future prospects, business and management strategies for the management, expansion and growth of eMagin’s business

and other conditions to the completion of the transaction; (ii) the impact of the COVID-19 pandemic and the current conflict between the

Russian Federation and Ukraine on eMagin’s business and general economic conditions; (iii) eMagin’s ability to implement its

business strategy; (iv) significant transaction costs associated with the proposed transaction; (v) potential litigation relating to the

proposed transaction; (vi) the risk that disruptions from the proposed transaction will harm eMagin’s business, including current

plans and operations; (vii) the ability of eMagin to retain and hire key personnel; (viii) potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the proposed transaction; (ix) legislative, regulatory and economic developments

affecting eMagin’s business; (x) general economic and market developments and conditions; (xi) the evolving legal, regulatory and

tax regimes under which eMagin operates; (xii) potential business uncertainty, including changes to existing business relationships, during

the pendency of the merger that could affect eMagin’s financial performance; (xiii) restrictions during the pendency of the proposed

transaction that may impact eMagin’s ability to pursue certain business opportunities or strategic transactions; and (xiv) unpredictability

and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as eMagin’s

response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, are more

fully discussed in the Definitive Proxy Statement filed with the Securities and Exchange Commission in connection with the proposed transaction.

While the list of factors presented here is, and the list of factors presented in the Definitive Proxy Statement are, considered representative,

no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with

those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial

loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on eMagin’s financial

condition, results of operations, or liquidity. The forward-looking statements included herein are made only as of the date hereof. eMagin

does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new

information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable

laws.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 17, 2023 |

EMAGIN CORPORATION |

| |

|

|

| |

By: |

/s/ Mark A. Koch |

| |

Name: |

Mark A. Koch |

| |

Title: |

Chief Financial Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

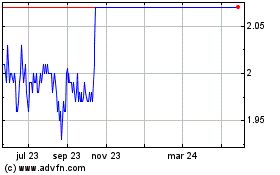

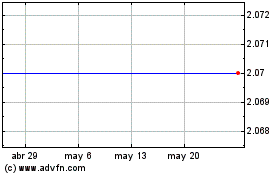

eMagin (AMEX:EMAN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

eMagin (AMEX:EMAN)

Gráfica de Acción Histórica

De May 2023 a May 2024