Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

14 Agosto 2024 - 11:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: August 2024

Commission File No. 001-34184

SILVERCORP

METALS INC.

(Translation of registrant's name into English)

Suite 1750 – 1066 W. Hastings Street

Vancouver BC, Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form 40-F [ X ]

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Note: Regulation S-T Rule 101(b)(1) only

permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is "submitting"

the Form 6-K in paper as permitted by Regulation S-T "Rule" 101(b)(7) [ ]

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are

traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: August 14, 2024 |

SILVERCORP METALS INC. |

| |

|

| |

/s/ Jonathan Hoyles |

| |

Jonathan Hoyles |

| |

General Counsel and Corporate Secretary |

EXHIBIT INDEX

3

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

|

|

| Item 1: |

Name and Address of Company |

Silvercorp Metals Inc. ("Silvercorp")

Suite 1750 – 1066 West Hastings Street

Vancouver, British Columbia

V6E 3X1

|

|

| Item 2: |

Date of Material Change |

July 31, 2024

A news release announcing the material change was disseminated via Canada Newswire on July 31, 2024 and a copy was filed on Silvercorp's profile at www.sedarplus.ca.

|

|

| Item 4: |

Summary of Material Change |

On July 31, 2024, Silvercorp completed its acquisition of all of the issued and outstanding common shares (each, an “Adventus Share”) in the capital of Adventus Mining Corporation (“Adventus”) not already owned by Silvercorp.

|

|

| Item 5: |

5.1 - Full Description of Material Change |

Silvercorp completed its acquisition of all of the Adventus Shares not already owned by Silvercorp effective as of 12:01 a.m. (the “Effective Time”) on July 31, 2024, by way of a statutory plan of arrangement under the provisions of the Canada Business Corporations Act (the “Arrangement”).

Under the terms of the Arrangement, each former shareholder of Adventus, other than Silvercorp, is entitled to receive 0.1015 of one common share in the capital of Silvercorp (each, a “Silvercorp Share”) for each Adventus Share (the “Exchange Ratio”). All outstanding stock options and common share purchase warrants of Adventus are now exercisable for Silvercorp Shares, with the number of Silvercorp Shares issuable on exercise and the exercise price adjusted in accordance with the Exchange Ratio. All outstanding Adventus restricted share units vested as of the Effective Time and have been settled in cash, funded by Silvercorp through Adventus.

Adventus intends to cause the Adventus Shares to be delisted from the TSX Venture Exchange as soon as practicable. In connection therewith, Adventus intends to submit an application to the applicable securities regulators to cease to be a reporting issuer and to terminate its public reporting obligations. Christian Kargl-Simard, Adventus' former President and Chief Executive Officer, and Frances Kwong, Adventus’ former Chief Financial Officer and Corporate

Secretary, have agreed to continue to provide services to Adventus in consultancy roles for a transition period following the completion of the Arrangement.

5.2 - Disclosure for Restructuring Transactions

Not applicable.

|

|

| Item 6: |

Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

|

|

| Item 7: |

Omitted Information |

Not applicable.

|

|

| Item 8: |

Executive Officer |

Lon Shaver, President (Tel: +1-604-669-9397)

August 9, 2024

Forward-Looking Statements

This material change report includes certain information that may constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable securities legislation. Forward-looking information includes, but is not limited to, information with respect to the completion of the Arrangement, including statements regarding Silvercorp's intention to cause Adventus to cease to be a reporting issuer under applicable Canadian securities laws and the agreement of Christian Kargl-Simard and Frances Kwong to continue to provide services to Adventus in consultancy roles for a transition period following the completion of the Arrangement. Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information, including the ability to achieve the benefits of the Arrangement; subsequent developments in the litigation concerning the Curipamba-El Domo project; the continuation of operations in Adventus’ and Silvercorp’s properties without interruption; current and future market conditions; the execution of each of Adventus' and Silvercorp's business strategies; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated, intended or implied. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this material change report is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Silvercorp disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

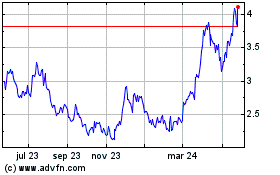

Silvercorp Metals (AMEX:SVM)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

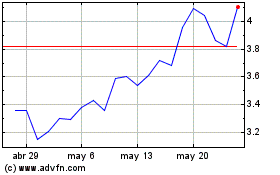

Silvercorp Metals (AMEX:SVM)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024