UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-41225

VIZSLA SILVER CORP.

(Translation of registrant's name into English)

Suite 1723, 595 Burrard Street

Vancouver, British Columbia V7X 1J1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ x ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VIZSLA SILVER CORP. |

| |

(Registrant) |

| |

|

|

| Date: September 12, 2024 |

By: |

/s/ Michael Konnert |

| |

|

|

| |

|

Michael Konnert |

| |

Title: |

Chief Executive Officer |

Condensed Consolidated Interim Financial Statements

(Expressed in Canadian dollars - unaudited)

For the three-month periods ended July 31, 2024, and 2023.

VIZSLA SILVER CORP.

Condensed Consolidated Interim Statements of Financial Position

Expressed in Canadian dollars - unaudited

| As at |

Note |

|

July 31, 2024 |

|

|

April 30, 2024

(audited) |

|

| |

|

|

|

$ |

|

|

$ |

|

| ASSETS |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

3 |

|

39,572,921 |

|

|

37,548,304 |

|

| |

Taxes receivable |

4 |

|

14,689,935 |

|

|

15,463,595 |

|

| |

Other receivables |

|

|

674,441 |

|

|

527,432 |

|

| |

Prepaid expenses |

|

|

1,462,256 |

|

|

2,218,609 |

|

| Total current assets |

|

|

56,399,553 |

|

|

55,757,940 |

|

| |

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

| |

Long-term prepaid expenses |

|

|

20,630 |

|

|

22,729 |

|

| |

Long-term taxes receivable |

4 |

|

5,381,607 |

|

|

5,846,416 |

|

| |

Property, plant, and equipment |

5 |

|

614,766 |

|

|

588,444 |

|

| |

Investment |

6 |

|

930,017 |

|

|

605,394 |

|

| |

Investment in associate |

7 |

|

6,911,174 |

|

|

- |

|

| |

Exploration and evaluation assets |

8a |

|

198,092,991 |

|

|

208,706,494 |

|

| |

Deferred payment |

8b |

|

2,488,262 |

|

|

1,255,515 |

|

| Total non-current assets |

|

|

214,439,447 |

|

|

217,024,992 |

|

| Total assets |

|

|

270,839,000 |

|

|

272,782,932 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

| |

Accounts payable and accrued liabilities |

|

|

1,427,557 |

|

|

2,527,373 |

|

| |

Due to related party |

9 |

|

22,446 |

|

|

1,148,600 |

|

| Total liabilities |

|

|

1,450,003 |

|

|

3,675,973 |

|

| |

|

|

|

|

|

|

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

| |

Share capital |

10 |

|

286,039,727 |

|

|

270,775,104 |

|

| |

Shares to be issued |

8a |

|

- |

|

|

882,830 |

|

| |

Reserves |

|

|

39,844,018 |

|

|

36,572,860 |

|

| |

Accumulated other comprehensive gain |

|

|

3,301,377 |

|

|

21,927,333 |

|

| |

Deficit |

|

|

(59,796,125 |

) |

|

(61,051,168 |

) |

| Total shareholders' equity |

|

|

269,388,997 |

|

|

269,106,959 |

|

| Total liabilities and shareholders' equity |

|

|

270,839,000 |

|

|

272,782,932 |

|

Note 1 - Nature and Continuance of Operations

Note 14 - Subsequent Events

They are signed on the Company's behalf by:

|

"Michael Konnert"

|

"Craig Parry"

|

|

Director, CEO

|

Director, Chairman

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements

VIZSLA SILVER CORP.

Condensed Consolidated Interim Statements of Income (Loss) and Comprehensive Income (Loss)

Expressed in Canadian dollars - unaudited

| |

|

|

For the three-month periods ended |

|

| |

Note |

|

July 31, 2024 |

|

|

July 31, 2023 |

|

| |

|

|

$ |

|

|

$ |

|

| General and administrative expenses |

|

|

|

|

|

|

|

| Amortization |

|

|

65,485 |

|

|

67,258 |

|

| Consulting fees |

|

|

288,950 |

|

|

282,493 |

|

| Directors fees |

9 |

|

87,500 |

|

|

77,924 |

|

| Foreign exchange (gain) / loss |

7 |

|

52,470 |

|

|

(174,628 |

) |

| Insurance |

|

|

157,805 |

|

|

187,085 |

|

| Management fees |

9 |

|

100,000 |

|

|

87,500 |

|

| Marketing |

|

|

997,400 |

|

|

698,860 |

|

| Office and miscellaneous |

7, 9 |

|

370,335 |

|

|

268,444 |

|

| Professional fees |

7 |

|

572,174 |

|

|

91,033 |

|

| Share-based compensation |

7, 9, 10e, f |

|

3,689,313 |

|

|

2,738,283 |

|

| Transaction costs |

|

|

112,997 |

|

|

- |

|

| Transfer agent and filing |

7 |

|

112,045 |

|

|

93,695 |

|

| Travel and promotion |

|

|

19,475 |

|

|

16,627 |

|

| |

|

|

|

|

|

|

|

| |

|

|

(6,625,949 |

) |

|

(4,434,574 |

) |

| Other income / (loss) |

|

|

|

|

|

|

|

| Interest income |

|

|

341,170 |

|

|

114,844 |

|

| Revaluation gain/(loss) on investment in equity instruments |

6 |

|

137,623 |

|

|

(82,878 |

) |

| Gain on debt settlement |

7 |

|

321,862 |

|

|

- |

|

| Gain on spin out of royalty interest |

7 |

|

13,749,421 |

|

|

- |

|

| Net income / (loss) |

|

|

7,924,127 |

|

|

(4,402,608 |

) |

| |

|

|

|

|

|

|

|

| Other comprehensive gain/(loss) |

|

|

|

|

|

|

|

| Items that will be reclassified subsequently |

|

|

|

|

|

|

|

| Translation gain/(loss) on foreign operations |

|

|

(18,625,956 |

) |

|

7,828,945 |

|

| Comprehensive income/(loss) |

|

|

(10,701,829 |

) |

|

3,426,337 |

|

| Basic and diluted income/(loss) per share |

|

|

0.03 |

|

|

(0.02 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of common shares |

|

|

|

|

|

|

|

| Basic and diluted |

|

|

238,246,923 |

|

|

207,940,239 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements

VIZSLA SILVER CORP.

Condensed Consolidated Interim Statements of Cash Flows

Expressed in Canadian dollars - unaudited

| For the three-month periods ended |

|

July 31, 2024 |

|

|

July 31, 2023 |

|

| |

|

$ |

|

|

$ |

|

| Operating activities |

|

|

|

|

|

|

| Net income/(loss) for the period |

|

7,924,127 |

|

|

(4,402,608 |

) |

| Items not affecting cash: |

|

|

|

|

|

|

| Amortization |

|

65,485 |

|

|

67,258 |

|

| Share-based compensation |

|

3,452,456 |

|

|

2,738,283 |

|

| Revaluation loss on investment in equity instruments |

|

(137,623 |

) |

|

82,878 |

|

| Gain on debt settlement |

|

(321,862 |

) |

|

- |

|

| Gain on spin out of royalty interest |

|

(13,258,396 |

) |

|

- |

|

| |

|

|

|

|

|

|

| Changes in non-cash working capital items: |

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

(1,099,816 |

) |

|

(644,338 |

) |

| Due to related parties |

|

(1,126,154 |

) |

|

(208,755 |

) |

| Taxes receivable |

|

1,238,469 |

|

|

(1,776,781 |

) |

| Other receivable |

|

(147,009 |

) |

|

(74,274 |

) |

| Prepaid expenses |

|

758,452 |

|

|

386,499 |

|

| Net cash flows used in operating activities |

|

(2,651,871 |

) |

|

(3,831,838 |

) |

| |

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

| Deferred payment of exploration and evaluation assets |

|

(1,232,747 |

) |

|

- |

|

| Exploration and evaluation expenditures |

|

(5,967,514 |

) |

|

(8,063,516 |

) |

| Accounts payable related to exploration and evaluation assets |

|

(86,630 |

) |

|

(173,924 |

) |

| Purchase of equipment |

|

(125,023 |

) |

|

(136,220 |

) |

| Strategic investment expenditures |

|

(187,000 |

) |

|

- |

|

| Net cash flows used in investing activities |

|

(7,598,914 |

) |

|

(8,373,660 |

) |

| |

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

| Issuance of common shares - warrants exercise |

|

11,830,708 |

|

|

7,961 |

|

| Issuance of common shares - option exercise |

|

2,481,760 |

|

|

- |

|

| Share issuance costs |

|

(111,973 |

) |

|

- |

|

| Net cash flows provided by financing activities |

|

14,200,495 |

|

|

7,961 |

|

| |

|

|

|

|

|

|

| Effects of foreign exchange |

|

(1,925,093 |

) |

|

400,483 |

|

| Increase (Decrease) in cash and cash equivalents |

|

2,024,617 |

|

|

(11,797,054 |

) |

| Cash and cash equivalents, beginning of period |

|

37,548,304 |

|

|

12,608,704 |

|

| Cash and cash equivalents, end of period |

|

39,572,921 |

|

|

811,650 |

|

| |

|

|

|

|

|

|

| Supplemental cash flow |

|

|

|

|

|

|

| Shares issued for RSUs |

|

181,298 |

|

|

- |

|

| Shares issued for E&E acquisition |

|

882,830 |

|

|

- |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements

VIZSLA SILVER CORP.

Condensed Consolidated Interim Statements of Changes in Equity

Expressed in Canadian dollars - unaudited, except for number of shares

| |

|

|

Common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Note |

|

Number |

|

|

Amount |

|

|

Reserves |

|

|

Share to

be issued |

|

|

Other

comprehensive

income (loss) |

|

|

Deficit |

|

|

Total |

|

| |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, April 30, 2023 |

|

|

207,938,329 |

|

|

237,460,259 |

|

|

30,324,553 |

|

|

- |

|

|

9,465,293 |

|

|

(45,102,779 |

) |

|

232,147,326 |

|

| Shares issued pursuant to exercise of warrants and options |

10b |

|

5,490 |

|

|

7,961 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

7,961 |

|

| Stock-based compensation - options |

10e |

|

- |

|

|

- |

|

|

2,455,724 |

|

|

- |

|

|

- |

|

|

- |

|

|

2,455,724 |

|

| Stock-based compensation - RSUs |

10f |

|

- |

|

|

- |

|

|

282,559 |

|

|

- |

|

|

- |

|

|

- |

|

|

282,559 |

|

| Net loss and other comprehensive gain for the period |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

7,828,945 |

|

|

(4,402,608 |

) |

|

3,426,337 |

|

| Balance, July 31, 2023 |

|

|

207,943,819 |

|

|

237,468,220 |

|

|

33,062,836 |

|

|

- |

|

|

17,294,238 |

|

|

(49,505,387 |

) |

|

238,319,907 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, April 30, 2024 |

|

|

232,642,035 |

|

|

270,775,104 |

|

|

36,572,860 |

|

|

882,830 |

|

|

21,927,333 |

|

|

(61,051,168 |

) |

|

269,106,959 |

|

| Shares issued pursuant to property acquisition |

10b |

|

448,137 |

|

|

882,830 |

|

|

- |

|

|

(882,830 |

) |

|

- |

|

|

- |

|

|

- |

|

| Shares issued pursuant to exercise of warrants, options, and RSUs |

10b |

|

9,150,098 |

|

|

14,493,766 |

|

|

(181,298 |

) |

|

- |

|

|

- |

|

|

- |

|

|

14,312,468 |

|

| Share issuance costs - cash |

10b |

|

- |

|

|

(111,973 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(111,973 |

) |

| Stock-based compensation - options |

10e |

|

- |

|

|

- |

|

|

3,121,766 |

|

|

- |

|

|

- |

|

|

- |

|

|

3,121,766 |

|

| Stock-based compensation - RSUs |

10f |

|

- |

|

|

- |

|

|

330,690 |

|

|

- |

|

|

- |

|

|

- |

|

|

330,690 |

|

| Distribution to shareholders |

7 |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(6,669,084 |

) |

|

(6,669,084 |

) |

| Net income and other comprehensive loss for the period |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(18,625,956 |

) |

|

7,924,127 |

|

|

(10,701,829 |

) |

| Balance, July 31, 2024 |

|

|

242,240,270 |

|

|

286,039,727 |

|

|

39,844,018 |

|

|

- |

|

|

3,301,377 |

|

|

(59,796,125 |

) |

|

269,388,997 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements

1. Nature and Continuance of Operations

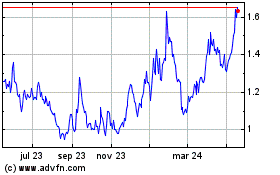

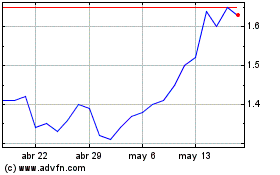

The Company was incorporated on September 26, 2017, under the Business Corporations Act (British Columbia) under the name Vizsla Capital Corp. On March 8, 2018, the Company changed its name to Vizsla Resources Corp. On February 5, 2021, the Company changed its name to Vizsla Silver Corp. (the "Company", "Vizsla Silver"). It is trading on the venture exchange under the symbol VZLA. The Company's principal business activity is the exploration of mineral properties. The Company currently conducts substantially all its operations in Canada and Mexico in one business segment.

On January 21, 2022, Vizsla Silver Corp was listed on the NYSE American and commenced trading under the symbol "VZLA".

The head office and principal address of the Company is located at 595 Burrard Street, Suite 1723

Vancouver, BC V7X 1J1.

The Company has not yet determined whether its properties contain ore reserves. The recoverability of the amounts shown for mineral properties and exploration costs is dependent upon the existence of ore reserves, the ability of the Company to obtain the necessary financing to complete the exploration and development of its properties, and future profitable production or proceeds from the disposal of properties.

These condensed consolidated interim financial statements have been prepared using accounting principles applicable to a going concern which assumes the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of business rather than through a process of forced liquidation.

The Company continues to experience risks associated with global inflation and volatility in foreign exchange rates. The Company continues to monitor each of these risks and will execute timely and appropriate measures as necessary. Further, near-term metal prices, exchange rates, discount rates, and other key assumptions used in the Company's accounting estimates are subject to greater uncertainty given the current economic environment. Changes in these assumptions could significantly impact the Company's accounting estimates.

2. Material Accounting Policies and Basis of Presentation

These condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard ("IAS") 34, Interim Financial Reporting, as issued by the International Accounting Standards Board ("IASB"). Accordingly, certain information and footnote disclosure normally included in annual financial statements prepared in accordance with International Financial Reporting Standards ("IFRS") have been omitted or condensed, and therefore these condensed consolidated interim financial statements should be read in conjunction with the Company's April 30, 2024, audited annual consolidated financial statements and the notes to such financial statements.

These condensed consolidated interim financial statements are based on the IFRS issued and effective as of July 31, 2024. These condensed consolidated interim financial statements were authorized for issuance by the Company's Board of Directors on September 12, 2024, and follow the same accounting policies and methods of computation as the most recent annual consolidated financial statements.

a) Basis of Consolidation

The principal subsidiaries of the Company, which are accounted for under the consolidation method, are as follows:

| Entity |

Principal activities |

Country of

incorporation

and operation |

Ownership

interest as

at July 31,

2024 |

Ownership

interest as

at April 30,

2024 |

| Canam Alpine Ventures Ltd. |

Holding Co |

Canada |

100% |

100% |

| |

|

|

|

|

| Minera Canam S.A. DE C.V. |

Exploring evaluating mineral properties |

Mexico |

100% |

100% |

| |

|

|

|

|

Operaciones Canam Alpine

S.A. DE C.V. |

Exploring evaluating mineral properties |

Mexico |

100% |

100% |

| |

|

|

|

|

Panuco Royalty Corp. (formerly Vizsla Royalty Corp.,

Vizsla Copper Corp., and 1283303 B.C. Ltd.) * |

Royalty Company |

Canada |

41.35% |

100% |

| |

|

|

|

|

| Canam Royalties Mexico, S.A. de C.V.* |

Royalty Company |

Mexico |

41.35% |

100% |

| |

|

|

|

|

| Vizsla Royalties Corp.* |

Royalty Company |

Canada |

41.35% |

100% |

Subsidiaries are all entities (including structured entities) over which the group has control. The group controls an entity when the group is exposed to or has rights to, variable returns from its involvement with the entity and can affect those returns through its power over the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the group. They are deconsolidated from the date that control ceases. All significant intercompany transactions and balances have been eliminated.

On October 13, 2023, Vizsla Royalty Corp.'s name was changed to Panuco Royalty Corp., and Vizsla Royalties Corp. was incorporated. Vizsla Royalties Corp. became the Company's wholly owned subsidiary, and Panuco Royalty Corp. became its wholly owned subsidiary.

* On June 24, 2024, Vizsla Royalties Corp., and its subsidiaries (Panuco Royalty Corp. and Canam Royalties Mexico, S.A. de C.V.) were spun out of Vizsla Silver Corp. (Note 7). Following the Arrangement as defined in Note 7, Vizsla Royalties Corp. is no longer a wholly owned subsidiary of Vizsla Silver.

2. Material Accounting Policies and Basis of Presentation (continued)

b) Loss of control

When losing control of a subsidiary, the Company derecognizes the assets and liabilities of the subsidiary at their carrying amounts, including any non-controlling interests in the former subsidiary. Consideration received and any investment retained in the former subsidiary are recognized at its fair value. If the transaction, event or circumstances that resulted in the loss of control involves a distribution of shares of the subsidiary to owners in their capacity as owners, that distribution is recognized at its fair value in accordance with IFRIC 17 – distribution of non-cash assets to owners, as a reduction in deficit from the Company. Any gain or loss is recognized in profit or loss attributable to the Company.

c) Accounting standards issued but not yet adopted

The new standards or amendments issued but not yet effective are either not applicable or Company is evaluating the impact of the adoption of the specific standard below on the condensed consolidated interim financial statements.

Accounting pronouncements

New standards and interpretations not yet adopted in 2024:

IFRS 18: Presentation and Disclosure of Financial Statements

On April 9, 2024, the IASB issued IFRS 18, Presentation and Disclosure in Financial Statements ("IFRS 18"), to improve reporting of financial performance. IFRS 18 replaces IAS 1, Presentation of Financial Statements ("IAS 1"). IFRS 18 carries forward many of the requirements of IAS 1 but introduces significant changes to the structure of a company's statement of income (loss).

The standard is applicable for annual reporting periods beginning on or after January 1, 2027, with earlier adoption permitted. The Company is currently evaluating the impact of the adoption of the standard.

d) Significant Accounting Judgments and Estimates

Preparing the condensed consolidated interim financial statements in conformity with IFRS requires management to make judgments, estimates, and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses, and related disclosure. Estimates and assumptions are continuously evaluated and are based on management's experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

Judgment is used mainly in determining how a balance or transaction should be recognized in the financial statements. Estimates and assumptions are used mainly in determining the measurement of recognized transactions and balances. Actual results may differ from these estimates.

Information about critical judgments and estimates in applying accounting policies that have the most significant effect on the amounts recognized in the interim financial statements for the three-month period ended July 31, 2024, are consistent with those applied and disclosed in Note 2 of the annual consolidated financial statements. The Company's interim results are not necessarily indicative of its results for a full year.

Significant areas where management's judgment and estimate has been applied include:

- Fair value calculation of share-based payments

The fair value of share-based payments in relation to the warrants and options granted is calculated using a Black Scholes option pricing model. There are a number of estimates used in the calculation such as the expected option life, rate of forfeiture of options granted, risk-free interest rate used and the future price volatility of the underlying security which can vary from actual future events. The factors applied in the calculation are management's best estimates based on industry average and future forecasts.

- Fair value determination of distributed assets and retained interest on spin-out transaction

Management assessed the fair value of the distributed assets and retained interest at the transaction day. The shares were valued using market prices, while the warrants were estimated using an option pricing model. The retained interest was also measured based on fair value of the shares. Management applied judgment in determining the appropriate timing for recognizing these values in the financial statements.

- Multiple arrangements accounted for as a single transaction

Significant judgement involved in determining whether multiple arrangements should be accounted for as a single transaction when the Company loses control of a subsidiary in two or more arrangements. As the spin-out arrangement and private placement of Vizsla Royalties are considered entered in contemplation of each other and form a single transaction designed to achieve an overall commercial effect, management assessed the spin-out arrangement and the loss of control in Vizsla Royalties Corp. as one single transaction.

3. Cash and Cash Equivalents

Cash and cash equivalents of $39,572,921 (April 30, 2024 - $37,548,304) included $25,000,000 in term deposits that are cashable within one to two months (April 30, 2024: $30,000,000). The term deposits earn interest at 4.94%-5.11% (April 30, 2024: 5.24%-5.33%).

At July 31, 2024, the Company had 237,233 Mexican pesos ("MXN") (April 30, 2024 - 441,705 MXN) and 1,480,832 US dollars (April 30, 2024 - 2,226,985 US dollars).

4. Taxes Receivable

Taxes receivables consist of amounts due from tax authorities and are classified into current and non-current portions based on the expected timing of recovery.

Current taxes receivables

The current portion of taxes receivable represents amounts expected to be recovered within the next twelve months.

As at July 31, 2024, the current taxes receivable are as follows:

| |

|

July 31, 2024 |

|

|

April 30, 2024 |

|

| |

|

$ |

|

|

$ |

|

| Goods and Service Tax (GST) recoverable |

|

137,259 |

|

|

108,542 |

|

| Mexican Value Added Tax (IVA) recoverable |

|

14,552,676 |

|

|

15,355,053 |

|

| Total current taxes receivable |

|

14,689,935 |

|

|

15,463,595 |

|

*Mexican IVA is net of provision of $434,840 (5,868,290 MXN) (April 30, 2024 - $472,397 (5,868,290 MXN)).

Subsequent to July 31, 2024, the Company received $1,591,402 (23,240,536 MXN) of Mexican IVA recoverable.

Non-current taxes receivables

The non-current portion of taxes receivable represents amounts expected to be recovered after more than twelve months from the reporting date.

As at July 31, 2024, the non-current taxes receivable are as follows:

| |

|

July 31, 2024 |

|

|

April 30, 2024 |

|

| |

|

$ |

|

|

$ |

|

| Mexican Value Added Tax (IVA) recoverable |

|

5,381,607 |

|

|

5,846,416 |

|

5. Property, Plant and Equipment

| |

|

|

Computer

equipment |

|

|

Computer

software |

|

|

Office

equipment |

|

|

Mining

equipment |

|

|

Office

improvements |

|

|

Total |

|

| Cost |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Balance - April 30, 2023 |

|

79,234 |

|

|

55,212 |

|

|

57,443 |

|

|

355,514 |

|

|

253,196 |

|

|

800,599 |

|

| |

Additions |

|

7,197 |

|

|

37,003 |

|

|

69,579 |

|

|

389,398 |

|

|

- |

|

|

503,177 |

|

| |

Disposal |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

Effect of change in exchange rate |

|

4,909 |

|

|

- |

|

|

4,860 |

|

|

32,128 |

|

|

17,012 |

|

|

58,909 |

|

| Balance - April 30, 2024 |

|

91,340 |

|

|

92,215 |

|

|

131,882 |

|

|

777,040 |

|

|

270,208 |

|

|

1,362,685 |

|

| |

Additions |

|

- |

|

|

- |

|

|

17,308 |

|

|

107,715 |

|

|

- |

|

|

125,023 |

|

| |

Disposal |

|

(13,400 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(13,400 |

) |

| |

Effect of change in exchange rate |

|

(3,688 |

) |

|

- |

|

|

(4,121 |

) |

|

(23,084 |

) |

|

(10,070 |

) |

|

(40,963 |

) |

| Balance - July 31, 2024 |

|

74,252 |

|

|

92,215 |

|

|

145,069 |

|

|

861,671 |

|

|

260,138 |

|

|

1,433,345 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accumulated Amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance - April 30, 2023 |

|

36,022 |

|

|

55,212 |

|

|

42,360 |

|

|

128,653 |

|

|

153,624 |

|

|

415,871 |

|

| |

Amortization |

|

20,808 |

|

|

37,003 |

|

|

82,016 |

|

|

85,565 |

|

|

103,584 |

|

|

328,976 |

|

| |

Disposal |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

Effect of change in exchange rate |

|

2,353 |

|

|

- |

|

|

4,936 |

|

|

9,145 |

|

|

12,960 |

|

|

29,394 |

|

| Balance - April 30, 2024 |

|

59,183 |

|

|

92,215 |

|

|

129,312 |

|

|

223,363 |

|

|

270,168 |

|

|

774,241 |

|

| |

Amortization |

|

5,024 |

|

|

- |

|

|

19,310 |

|

|

41,116 |

|

|

35 |

|

|

65,485 |

|

| |

Disposal |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

Effect of change in exchange rate |

|

(1,643 |

) |

|

- |

|

|

(3,933 |

) |

|

(5,506 |

) |

|

(10,065 |

) |

|

(21,147 |

) |

| Balance - July 31, 2024 |

|

62,564 |

|

|

92,215 |

|

|

144,689 |

|

|

258,973 |

|

|

260,138 |

|

|

818,579 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As at April 30, 2023 |

|

43,212 |

|

|

- |

|

|

15,083 |

|

|

226,861 |

|

|

99,572 |

|

|

384,728 |

|

| As at April 30, 2024 |

|

32,157 |

|

|

- |

|

|

2,570 |

|

|

553,677 |

|

|

40 |

|

|

588,444 |

|

| As at July 31, 2024 |

|

11,688 |

|

|

- |

|

|

380 |

|

|

602,698 |

|

|

- |

|

|

614,766 |

|

6. Strategic Investment in Prismo Metals Inc. and Intangible Asset

On December 16, 2022, the Company entered a strategic investment with Prismo Metals Inc. ("Prismo"), listed on the Canadian Securities Exchange as "PRIZ," which was finalized on January 6, 2023. The Company acquired (i) a right of first refusal ("ROFR") to purchase Prismo's Palos Verdes project, valid until January 6, 2027, and (ii) 4,000,000 Prismo units. Each unit includes one common share and half of a share purchase warrant, allowing the purchase of an additional share at $0.75 for two years.

The ROFR obligates Prismo to notify the Company of third-party offers for Palos Verdes, giving the Company a 45-day window to match the offer. The ROFR expires if the Company's ownership falls below 8%. The Prismo units were valued at $1,413,225 based on a market price of $0.48 per share, considering a discount for lack of marketability ("DLOM").

The investment included $500,000 in cash and 1,000,000 Company shares, fair valued at $1,357,155, both subject to a hold period of four months and one day, and a voluntary escrow period of 24 months with 25% of the securities released every six months.

The fair value of Vizsla shares is determined using a level 2 fair value measurement. The share price is based on the market price on the Closing Date of $1.62, after factoring in the lack of marketability. The applicable DLOM rate is provided below.

| As at Jan 6, 2023 |

|

DLOM |

|

| Date |

|

Vizsla |

|

|

Prismo |

|

| 06-Jul-23 |

|

10.6% |

|

|

21.3% |

|

| 06-Jan-24 |

|

15.9% |

|

|

28.1% |

|

| 06-Jul-24 |

|

18.0% |

|

|

30.1% |

|

| 06-Jan-25 |

|

20.4% |

|

|

31.4% |

|

As part of the strategic investment, Prismo and the Company agreed to form a technical committee to explore the Panuco silver-gold district. Before the investment, the Company held no Prismo shares. After the deal, the Company owns 4,000,000 shares and 2,000,000 warrants, representing 10.08% of Prismo's non-diluted shares and 14.4% on a partially diluted basis. As of July 31, 2024, 3 million shares have been released from the voluntary hold.

Due to the absence of common management or directors, the Company has no significant influence over Prismo and recognizes its Prismo units as an investment, measured at fair value through profit or loss. For the period ended July 31, 2024, the fair value change was a gain of $137,623 (July 31, 2023: loss of $82,878). To maintain its ROFR, the Company must ensure its ownership percentage remains above 8%. In the June 18, 2024, financing round by Prismo, the Company acquired an additional 1,100,000 Prismo shares at $0.17 per share. The Company now owns 5,100,000 shares, representing 9.56% of Prismo's non-diluted shares. These shares are subject to a four-month holding period. The investment continuity schedule is provided below:

| |

|

|

Strategic Investment |

|

| |

|

|

$ |

|

| Balance - April 30, 2023 |

|

1,297,098 |

|

| |

Gain (loss) from fair value adjustment |

|

(691,704 |

) |

| Balance - April 30, 2024 |

|

605,394 |

|

| |

Additions |

|

187,000 |

|

| |

Gain from fair value adjustment |

|

137,623 |

|

| Balance - July 31, 2024 |

|

930,017 |

|

6. Strategic Investment in Prismo Metals Inc. and Intangible Asset (continued)

Prismo shares are fair valued using the discount for lack of marketability ("DLOM") method. DLOM is based on the risk arising from the restricted holding period and voluntary escrow. The valuation of Prismo shares follows a level 2 fair value measurement. The share price is derived from the market price on the period-end date, July 31, 2024, of $0.24 (April 30, 2024: $0.145), with consideration for the lack of marketability. The DLOM rate used is provided below:

| |

July 31, 2024 |

April 30, 2024 |

| Date |

DLOM |

DLOM |

| 06-Jul-23 |

Issued |

Issued |

| 06-Jan-24 |

Issued |

Issued |

| 06-Jul-24 |

Issued |

10.87% |

| 06-Jan-25 |

19.90% |

19.90% |

The fair value of the Prismo warrants granted was calculated as of July 31, 2024, using the Black-Scholes option pricing model with the following assumptions:

| |

July 31, 2024 |

April 30, 2024 |

| Risk Free Interest Rate |

3.59% |

4.45% |

| Expected Dividend Yield |

Nil |

Nil |

| Expected Volatility |

98.08% |

113.64% |

| Expected Term in Years |

0.44 years |

0.69 years |

7. Plan of Arrangement - Spin out of Vizsla Royalties Corp.

On January 17, 2024, the Company announced an arrangement agreement (“Arrangement”) with its subsidiary Vizsla Royalties Corp. ("Spinco"), which holds a net smelter royalty (NSR) on the Panuco silver-gold project in Sinaloa, Mexico. Under the Arrangement, Vizsla Silver shareholders received one new Vizsla Silver share, one-third of a Spinco share, and one-third of a Spinco warrant for each Vizsla Silver share held. As a result, Spinco ceased being a wholly owned subsidiary of Vizsla Silver.

The Arrangement was approved by shareholders on June 17, 2024, received court approval on June 19, and final TSX Venture Exchange ("TSX-V") approval on June 20, 2024. It was completed on June 24, 2024. Shareholders received one new Vizsla Silver share and 0.3333 Spinco shares for each Vizsla Silver share held as of June 21, 2024.

Following closing of the Arrangement, Vizsla Silver and Spinco intend to complete a number of steps, including the following: (a) Spinco will settle an outstanding loan from Vizsla Silver into Spinco Shares, (b) Vizsla Silver will make an additional $3,500,000 loan to Spinco if required, (c) Spinco may exercise its buyback right on an underlying royalty on the Panuco Project, after which point the royalty held by Spinco will consist of a 2% NSR on the entire Panuco Project, (d) Spinco will complete a private placement for gross proceeds of at least $3,000,000, and (e) Spinco will complete a consolidation of the Spinco Shares on the basis of one new Spinco Share for every ten old Spinco Shares.

Vizsla Silver and Spinco have entered into a royalty right agreement which provides that, if Vizsla Silver or any of its affiliates acquires mineral properties within a two-kilometer boundary around the Panuco Project, it must offer Spinco an NSR on such mineral property to Spinco on terms proposed by Vizsla Silver.

7. Plan of Arrangement - Spin out of Vizsla Royalties Corp. (continued)

Upon closing, the Company retained 83,000,000 shares of Spinco. The Company also received $470,081 in cash and 32,186,240 Spinco shares at $0.06 to offset a $2,079,393 loan, resulting in a gain on settlement of debt at $321,862, and increasing its total holdings to 115,186,240 shares (41.35% of Spinco’s holdings). Spinco completed the non-brokered private placement on July 29, 2024, raising gross proceeds of $5 million. Spinco shares began trading on the TSX-V under the symbol VROY on August 26, 2024. Spinco consolidated its common shares at a 10-to-1 ratio, as approved by the Board on July 31, 2024.

In accordance with IFRIC 17, 80,493,651 shares and 80,493,651 warrants of Spinco were treated as a distribution of capital to the Company's shareholders, with a fair value of $6,669,084 (80,493,651 shares at $0.06 per share, totaling $4,829,619, and 80,493,651 warrants valued at $1,839,465 using the Black-Scholes pricing model). The retained interest in Spinco held by Vizsla Silver was fair valued at $6,911,174, based on 115,186,240 Spinco shares at $0.06 per share. As a result, the Company recorded a gain of $13,749,421 from the spin-out in its consolidated statements of loss and comprehensive loss for the three-month period ended July 31, 2024.

The fair value of SpinCo's warrants granted in the three-month period ended July 31, 2024, was calculated as of the grant date using the Black-Scholes pricing model with the following assumptions:

|

Risk Free Interest Rate

|

3.94%

|

|

Expected Dividend Yield

|

-

|

|

Expected Volatility

|

73.71%

|

|

Expected Term in Years

|

0.47 years

|

8. Exploration and Evaluation Assets

a) Canam Alpine Ventures Ltd. - Panuco-Copala Property

On November 5, 2019, under a share exchange agreement dated September 13, 2019, the Company acquired all common shares of Canam Alpine Ventures Ltd. ("Canam"), a private British Columbia company. Canam owns two Mexican subsidiaries: Minera Canam S.A. DE C.V. and Operaciones Canam Alpine S.A. DE C.V. The Company agreed to pay $45,000 in cash and issue 6,000,000 common shares and 12,000,000 Milestone Shares, with additional shares issued upon achievement of milestones:

- Milestone 1: Issuance of 6,500,000 common shares if defined options are exercised by Canam.

- Milestone 2: Issuance of 5,500,000 common shares if a resource greater than 200,000 gold equivalent ounces is defined.

The Company also issued 250,000 common shares at closing and will issue 250,000 additional shares per milestone, totaling 750,000 shares as finders' fees. Contingent consideration of $308,595 related to the milestones and finders' fees was recorded at fair value and has been fully reversed as of April 30, 2022.

Additionally, Canam entered into option agreements with Minera Rio Panuco S.A. de C.V. ("Panuco") on August 8, 2019, and Silverstone Resources S.A. de C.V. ("Copala") on September 9, 2019. The Panuco agreement requires $2,000,000 in exploration and $23,000,000 in payments, with an extension paid on May 6, 2020. The Copala agreement requires $1,423,000 in exploration and $20,000,000 in payments, with a 3.0% NSR that can be reduced to 1.5% for 10% of the purchase price. On July 21, 2021, the Company signed a binding amending agreement with Panuco and an option exercise notice with Copala to acquire 100% of the Panuco-Copala silver-gold district.

Under the Amending Agreement, Vizsla and Panuco have accelerated the exercise of Vizsla's option on the Panuco Property. Upon closing, Vizsla will acquire 100% of the Panuco Property (43 concessions, 3,839 Ha) and the "El Coco" mill for:

- $4,250,000 in cash (paid) upon signing.

- 6,245,902 Vizsla common shares at $2.44 per share ($12,000,000) upon transfer of the property (issued).

- $6,100,000 in additional cash: $250,000 paid on August 19, 2021; $850,000 paid on February 1, 2022; $5,000,000 paid on May 6, 2022, for the mill.

The Panuco Property includes the royalty-free Napoleon vein corridor.

Under the Copala Exercise Notice, Vizsla and Copala have also accelerated the exercise of Vizsla's option on the Copala Property. According to the definitive agreement signed on July 20, 2021, Vizsla will acquire 100% of the Copala Property (64 concessions, 5,547 Ha) for:

- $9,500,000 in cash (paid) upon transfer of the property.

- 4,944,672 Vizsla common shares at $2.44 per share (issued).

8. Exploration and Evaluation Assets (continued)

a) Canam Alpine Ventures Ltd. - Panuco-Copala Property (continued)

Costs related to the properties can be summarized as follows:

| |

|

|

Balance

April 30, 2023 |

|

|

Additions |

|

|

Balance

April 30, 2024 |

|

|

Additions |

|

|

Balance

July 31, 2024 |

|

| Acquisition costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash |

$ |

26,140,301 |

|

$ |

- |

|

$ |

26,140,301 |

|

$ |

- |

|

$ |

26,140,301 |

|

| |

Effective settlement of loans receivables |

|

1,190,024 |

|

|

- |

|

|

1,190,024 |

|

|

- |

|

|

1,190,024 |

|

| |

Shares |

|

58,146,988 |

|

|

882,830* |

|

|

59,029,818 |

|

|

- |

|

|

59,029,818 |

|

| |

Subtotal |

$ |

85,477,313 |

|

$ |

882,830 |

|

$ |

86,360,143 |

|

$ |

- |

|

$ |

86,360,143 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Balance

April 30, 2023 |

|

|

Additions |

|

|

Balance

April 30, 2024 |

|

|

Additions |

|

|

Balance

July 31, 2024 |

|

| Exploration costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Analysis |

$ |

8,302,436 |

|

|

3,069,729 |

|

$ |

11,372,165 |

|

$ |

370,250 |

|

$ |

11,742,415 |

|

| |

Depreciation |

|

77,662 |

|

|

94,996 |

|

|

172,658 |

|

|

34,286 |

|

|

206,944 |

|

| |

Drilling |

|

35,608,933 |

|

|

12,867,027 |

|

|

48,475,960 |

|

|

1,336,941 |

|

|

49,812,901 |

|

| |

Ejido rights |

|

421,243 |

|

|

- |

|

|

421,243 |

|

|

- |

|

|

421,243 |

|

| |

Engineering consulting |

|

1,184,053 |

|

|

47,252 |

|

|

1,231,305 |

|

|

- |

|

|

1,231,305 |

|

| |

Equipment |

|

2,400,740 |

|

|

1,590,199 |

|

|

3,990,939 |

|

|

199,936 |

|

|

4,190,875 |

|

| |

Field cost |

|

6,053,420 |

|

|

2,754,630 |

|

|

8,808,050 |

|

|

210,517 |

|

|

9,018,567 |

|

| |

Geological consulting |

|

8,133,775 |

|

|

5,571,329 |

|

|

13,705,104 |

|

|

809,646 |

|

|

14,514,750 |

|

| |

Geophysical survey |

|

158,542 |

|

|

3,693 |

|

|

162,235 |

|

|

- |

|

|

162,235 |

|

| |

Geotech |

|

- |

|

|

182,599 |

|

|

182,599 |

|

|

5,666 |

|

|

188,265 |

|

| |

GIS management |

|

203,054 |

|

|

164,414 |

|

|

367,468 |

|

|

42,017 |

|

|

409,485 |

|

| |

Land and reclamation fees |

|

- |

|

|

20,727 |

|

|

20,727 |

|

|

- |

|

|

20,727 |

|

| |

Maintenance |

|

849,862 |

|

|

811,532 |

|

|

1,661,394 |

|

|

333,686 |

|

|

1,995,080 |

|

| |

Metallurgical testing |

|

- |

|

|

134,005 |

|

|

134,005 |

|

|

131,583 |

|

|

265,588 |

|

| |

Other consulting |

|

- |

|

|

42,760 |

|

|

42,760 |

|

|

56,540 |

|

|

99,300 |

|

| |

Project development |

|

- |

|

|

5,391,840 |

|

|

5,391,840 |

|

|

2,379,476 |

|

|

7,771,316 |

|

| |

Rent of land |

|

386,648 |

|

|

- |

|

|

386,648 |

|

|

- |

|

|

386,648 |

|

| |

Special project |

|

- |

|

|

43,408 |

|

|

43,408 |

|

|

43,408 |

|

|

86,816 |

|

| |

Travel and miscellaneous |

|

7,051,471 |

|

|

645,381 |

|

|

7,696,852 |

|

|

100,192 |

|

|

7,797,044 |

|

| |

Subtotal |

$ |

70,831,839 |

|

$ |

33,435,521 |

|

$ |

104,267,360 |

|

$ |

6,054,144 |

|

$ |

110,321,504 |

|

| |

|

$ |

156,309,152 |

|

$ |

34,318,351 |

|

$ |

190,627,503 |

|

$ |

6,054,144 |

|

$ |

196,681,647 |

|

| |

Effect of change in exchange rate |

|

6,422,573 |

|

|

11,656,418 |

|

|

18,078,991 |

|

|

(16,667,647 |

) |

|

1,411,344 |

|

| Total |

|

$ |

162,731,725 |

|

$ |

45,974,769 |

|

$ |

208,706,494 |

|

$ |

(10,613,503 |

) |

$ |

198,092,991 |

|

*Shares addition during the year ended April 30, 2024, is related to the acquisition of El Richard - San Enrique claims.

8. Exploration and Evaluation Assets (continued)

a) Canam Alpine Ventures Ltd. - Panuco-Copala Property (continued)

The Company created a 100% owned subsidiary, Canam Royalties Mexico, S.A. de C.V. ("Canam Royalties") through Vizsla Royalty Corp., which is 100% owned by the Company. On February 23, 2022, Vizsla transferred 2% NSR on certain concessions and 0.5% NSR on certain concessions to Canam Royalties. On November 16, 2022, and January 30, 2023, Vizsla transferred 2% NSR on certain concessions to Canam Royalties. On Oct 13, 2023, Vizsla Royalty Corp.'s name was changed to Panuco Royalty Corp., and Vizsla Royalties Corp. was incorporated. Vizsla Royalties Corp. became a wholly owned subsidiary of the Company, and Panuco Royalty Corp. became its wholly owned subsidiary.

On June 24, 2024, the Company completed the arrangement agreement to spin out Vizsla Royalties Corp. to shareholders under the Business Corporations Act (British Columbia) (Note 7).

Acquisition of El Richard - San Enrique claims

The Company entered into an asset purchase agreement (the "APA") dated March 5, 2024, with Inca Azteca Gold S.A.P.I. de C.V. ("Inca Azteca Gold") and the Company's wholly owned subsidiary, Minera Canam, S.A. de C.V. ("Minera Canam") pursuant to which the Company agreed to acquire, through Minera Canam, all of Inca Azteca Gold's right, title and interest in and to the mineral concessions (the "Acquisition"). The Acquisition includes two large claims comprising 10,667 hectares (the "El Richard - San Enrique claims" or "San Enrique prospect") located south and partially adjacent to the Company's Panuco project (the "Panuco Project" or "Panuco"). The San Enrique prospect is situated along the highly prospective Panuco - San Dimas corridor. All acquisition cost related to the San Enrique prospect will be summarized in Note 8a as part of the Panuco-Copala Property since the "El Richard - San Enrique claims" is now considered part of the Panuco project.

Pursuant to the APA, the Company has agreed to issue an aggregate of US$650,000 in common shares of the Company at the exchange rate and market price applicable on the effective date (April 15, 2024) (collectively, the "Consideration Shares") plus any applicable value added tax to Inca Azteca Gold (paid). For accounting purposes, the acquisition will be recorded as an exploration and evaluation asset, as defined in IFRS 6 Exploration for and Evaluation of Mineral Resources. The Acquisition was settled with equity and its fair value can be reliably providing using share price on the closing date of April 15, 2024, per IFRS 2 Share-based payment.

On May 3, 2024, the Company issued to the Inca Azteca Gold 448,137 common shares of Vizsla priced at $1.97 per share (for a total value of $882,830 (US$650,000)) upon the completion of the transfer of the El Richard - San Enrique claims (Note 10g). The Company also paid $1,103,387 (US$805,143) for surface duties owed by Inca Azteca Gold to Governmental Entities concerning the mineral concessions.

The Consideration Shares are subject to a four-month hold period pursuant to applicable Canadian securities laws and Inca Azteca Gold has agreed to voluntary resale restrictions, whereby 12.5% of the Consideration Shares will become free trading on the date that is four months and one day from the effective date and an additional 12.5% will become free trading every three months thereafter.

8. Exploration and Evaluation Assets (continued)

b) Acquisition of Goanna Resources, S.A.P.I. de C.V (La Garra claims)

The Company has entered into an agreement to acquire the past-producing La Garra-Metates district ("La Garra") situated in the heart of the silver-gold-rich Panuco - San Dimas corridor. As of July 31, 2024, the transaction was not closed.

The Company entered into a share purchase agreement (the "SPA") dated March 27, 2024, with Exploradora Minera La Hacienda S.A. de C.V. and Manuel de Jesus Hernandez Tovar (collectively, the "Sellers") pursuant to which the agreed to acquire (the "Acquisition") all of the outstanding shares of Goanna Resources, S.A.P.I. de C.V. ("Goanna Resources"), a private Mexican corporation, from the Sellers. Goanna Resources is the owner of the La Garra-Metates District. Pursuant to the SPA, the Company has agreed to make cash payments in an aggregate of US$3,075,000 in cash (collectively, the "Cash Payments") and issue an aggregate of 5,555,555 common shares in the capital of the Company (collectively, the "La Garra Consideration Shares") to the Sellers. Also, the Company agreed to pay tenement taxes owed by Goanna Resources to Governmental Entities concerning the mineral concessions in the amount of US$1,606,500.

Cash Payments will be made, and the La Garra Consideration Shares will be issued over a period of 24 months from closing.

|

|

Cash

|

Shares (ii)

|

|

|

US$

|

|

|

Signing of nonbinding LOI (i)

|

100,000

|

|

|

Closing of the transaction

|

-

|

257,937

|

|

3 months from effective date

|

150,000

|

476,190

|

|

6 months from effective date

|

275,000

|

535,714

|

|

9 months from effective date

|

225,000

|

595,238

|

|

12 months from effective date

|

350,000

|

714,286

|

|

15 months from effective date

|

300,000

|

833,333

|

|

18 months from effective date

|

375,000

|

952,381

|

|

24 months from effective date

|

1,300,000

|

1,190,476

|

|

|

3,075,000

|

5,555,555

|

|

|

|

|

|

(i) Paid on January 18, 2024.

|

|

|

|

(ii) Deemed share price is determined based on the greater of the volume weighted average price of Vizsla shares on the NYSE over the period of 45 consecutive trading days ending on the date prior to the execution date (March 27, 2024) and the market price.

|

For accounting purposes, the acquisition will be recorded as an asset acquisition as Goanna Resources did not meet the definition of a business, as defined in IFRS 3 Business Combinations.

The Company made four payments up to July 31, 2024: $135,050 (US$100,000) on January 18, 2024, upon signing a non-binding letter of intent, $1,095,768 (US$810,000) on March 6, 2024, $1,092,806 (US$796,500) on May 17, 2024, and $137,550 (US$100,000) on July 23, 2024, as deferred payments to the Sellers to pay tenement taxes owed by Goanna Resources to Governmental Entities concerning the mineral concessions. Since the transaction had not closed as of July 31, 2024, these payments were classified as deferred payments on the Condensed Consolidated Interim Statements of Financial Position. Deferred payments also include $27,088 of legal fees and other transaction costs incurred in relation to the acquisition.

The acquisition is subject to closing conditions, including the approval of the TSX-V and the NYSE. The transaction has been conditionally approved by both the TSX-V and NYSE, pending final approval from both exchanges.

9. Related Party Transactions

During the three-month periods ended July 31, 2024, and 2023, the Company has the following related party transactions:

(a) The Company has incurred $365,624 (July 31, 2023: $321,874) in salary, consulting fees, and management fees to the Company's officers and companies owned by the Company's officers as compensation.

(b) The Company has incurred $87,500 (July 31, 2023: $75,000) in director fees to the Company's directors.

(c) The Company has paid $195,000 (July 31, 2023: $150,000) to a company with common directors and officers for rent expenses and administration expenses.

(d) The Company has granted 4,850,000 (July 31, 2023: 2,965,000) stock options to officers and directors of the Company (Note 10(e)).

(e) The Company has granted 360,000 (July 31, 2023: nil) RSUs to officers of the Company (Note 10(f)).

(f) As of July 31, 2024, $22,446 (April 30, 2024: $1,148,600) was payable to officers of the Company.

These transactions are in the normal course of operations and have been valued in these condensed consolidated interim financial statements at the exchange amount, which is the amount of consideration established and agreed to by the related parties.

10. Share Capital

a) Authorized

Unlimited number of common shares with no par value.

b) Issued and outstanding

As at July 31, 2024, 242,240,270 (April 30, 2024: 232,642,035) common shares with no par value were issued and outstanding.

During the three-months period ended July 31, 2024, 6,598,587 warrants were exercised at a weighted average exercises price of $1.79 for proceeds of $11,830,708, and 2,438,200 options were exercised at a weighted average exercise price of $1.02 for proceeds of $2,481,760. 113,311 RSUs were exercised and converted to common shares at the vested price of $1.60. The Company incurred $111,973 of share issuance cost related to the at-the-market equity program ("ATM") (July 31, 2023 - $nil). The ATM Program allows the Company to sell up to C$50,000,000 of Vizsla Silver Shares from treasury through Canaccord Genuity at its discretion, under the terms of the distribution agreement.

In relation to the acquisition of El Richard - San Enrique claims, the Company agreed to issue an aggregate of US$650,000 in common shares of the Company at the exchange rate and market price applicable on the effective date (April 15, 2024). On May 3, 2024, the Company issued to the Inca Azteca Gold 448,137 common shares of Vizsla priced at $1.97 per share (for a total value of $882,830 (US$650,000)). Transfer of the El Richard - San Enrique claims was completed on May 8, 2024.

During the three-months ended July 31, 2023, 5,490 warrants were exercised for proceeds of $7,691. No other shares were issued during the three months ended July 31, 2023.

c) Escrow shares

As of July 31, 2024, the Company has 250,000 shares in escrow (April 30, 2024: 500,000). The escrow shares relate to the Prismo transaction (Note 6) are subject to a voluntary escrow period of 24 months. During this period, 25% of the securities will be released every six months, starting from the closing date of January 6, 2023. As of July 31, 2024, 750,000 have been released and 250,000 shares remain in escrow.

d) Warrants

As of July 31, 2024, the Company has 8,838,576 warrants outstanding and exercisable (April 30, 2024: 15,437,163).

During the three-month period ended July 31, 2024, 6,598,587 warrants were exercised at a weighted average exercises price of $1.79 for proceeds of $ $11,830,708.

During the three-months ended July 31, 2023, 5,490 warrants were exercised for proceeds of $7,691. No other warrants were issued during the three months ended July 31, 2023.

10. Share Capital (continued)

d) Warrants (continued)

The following is a summary of warrant transactions for the three-month period ended July 31, 2024, and for the year ended April 30, 2024:

| |

|

July 31, 2024 |

|

|

April 30, 2024 |

|

| |

|

Number of warrants |

|

|

Weighted average

exercise price |

|

|

Number of warrants |

|

|

Weighted average

exercise price |

|

| |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

| Warrants outstanding, beginning of the period |

|

15,437,163 |

|

|

1.89 |

|

|

14,771,833 |

|

|

1.91 |

|

| Issued |

|

- |

|

|

- |

|

|

1,380,000 |

|

|

1.50 |

|

| Exercised |

|

(6,598,587 |

) |

|

(1.79 |

) |

|

(714,670 |

) |

|

(1.46 |

) |

| Expired |

|

- |

|

|

|

|

|

- |

|

|

|

|

| Warrants outstanding, end of the period |

|

8,838,576 |

|

|

1.95 |

|

|

15,437,163 |

|

|

1.89 |

|

The following warrants were outstanding and exercisable on July 31, 2024:

Expiry date

|

Exercise

price *

$ |

Number of warrants

outstanding and

exercisable |

| 15-Nov-24 |

1.98 |

8,196,600 |

| 15-Nov-24 |

1.43 |

71,415 |

| 09-Feb-25 |

1.63 |

212,008 |

| 28-Feb-26 |

1.48 |

358,553 |

| |

|

8,838,576 |

*According to the Arrangement with Vizsla Royalties on June 24, 2024 (Note 7), each Vizsla Silver Warrants was exchanged for one Vizsla Silver Replacement Warrant with the exercise price being adjusted accordingly.

As at July 31, 2024, the weighted average remaining contractual life for outstanding warrants is 0.35 years (April 30, 2024: 0.69 years).

The fair value of the broker warrants granted in the year ended April 30, 2024, was calculated as of the grant date using the Black-Scholes pricing model with the following assumptions:

| |

For the year ended

April 30, 2024 |

| Risk Free Interest Rate |

4.18% |

| Expected Dividend Yield |

- |

| Expected Volatility |

61.35% |

| Expected Term in Years |

2 years |

During the three-month period ended July 31, 2024, the Company recorded fair value of $nil (year ended April 30, 2024 - $742,418) against reserves.

10. Share Capital (continued)

e) Options

The Company has adopted a Stock Option Plan (the "Plan") pursuant to which options may be granted to directors, officers, and consultants of the Company. Under the terms of the Plan, the Company can issue a maximum of 10% of the issued and outstanding common shares at the time of the grant, a maximum term of 10 years, and the exercise price of each option is determined by the directors but may not be less than the closing market price of the Common Shares on the day preceding the date of granting of the option less any available discount, in accordance with TSXV Policies. No option may be granted for a term longer than ten years. Options granted under the Plan including vesting and the term, are determined by, and at the discretion of, the Board of Directors.

On June 12, 2024, the Company granted 6,050,000 stock options at an exercise price of $2.26 directors, officers, employees and consultants of the Company. These options are exercisable for a period of five years and will vest over the next two years.

During the three-month period ended July 31, 2024, 2,438,200 options were exercised with weighted average exercise price of $1.02 for proceeds of $2,481,760, and 58,000 options were canceled. No other options were issued, canceled, or expired during the three-month period ended July 31, 2024.

The continuity of stock options for the three-month periods ended July 31, 2024, and for the year ended April 30, 2024, is as follows:

| |

|

July 31, 2024 |

|

|

April 30, 2024 |

|

| |

|

Number of

options |

|

|

Weighted

average

exercise price |

|

|

Number of

options |

|

|

Weighted

average

exercise price |

|

| |

|

|

|

$ |

|

|

|

|

|

$ |

|

| Options outstanding, beginning of the period |

|

18,803,722 |

|

|

1.66 |

|

|

15,926,972 |

|

|

1.69 |

|

| Issued |

|

6,050,000 |

|

|

2.24 |

|

|

4,500,000 |

|

|

1.57 |

|

| Cancelled |

|

(58,000 |

) |

|

(2.18 |

) |

|

(841,000 |

) |

|

(1.85 |

) |

| Exercised |

|

(2,438,200 |

) |

|

(1.02 |

) |

|

(782,250 |

) |

|

(1.38 |

) |

| Options outstanding, end of the period |

|

22,357,522 |

|

|

1.88 |

|

|

18,803,722 |

|

|

1.66 |

|

| Options exercisable, end of the period |

|

15,107,322 |

|

|

1.83 |

|

|

15,469,222 |

|

|

1.68 |

|

10. Share Capital (continued)

e) Options (continued)

The following options were outstanding and exercisable as July 31, 2024:

| Expiry date |

Exercise price

$ |

Adjusted

exercise price

$ |

Adjusted

exercise price*

$ |

Number of

Options

outstanding |

Number of

Options

exercisable |

| |

|

|

|

|

|

| 27-Feb-29 |

0.15 |

0.14 |

0.14 |

480,000 |

480,000 |

| 30-Dec-24 |

0.69 |

0.66 |

0.65 |

325,000 |

325,000 |

| 07-Jan-25 |

0.72 |

0.69 |

0.68 |

60,000 |

60,000 |

| 29-Jun-25 |

0.79 |

0.76 |

0.75 |

370,000 |

370,000 |

| 06-Aug-25 |

2.15 |

2.07 |

2.05 |

1,490,000 |

1,490,000 |

| 01-Oct-25 |

1.46 |

1.40 |

1.39 |

6,800 |

6,800 |

| 01-Dec-25 |

1.46 |

1.40 |

1.39 |

100,000 |

100,000 |

| 12-Jan-26 |

1.71 |

1.64 |

1.63 |

60,000 |

60,000 |

| 17-Feb-26 |

1.50 |

1.44 |

1.43 |

1,717,722 |

1,717,722 |

| 22-Jun-26 |

2.31 |

2.22 |

2.20 |

3,350,000 |

3,350,000 |

| 12-Jul-26 |

2.44 |

2.34 |

2.32 |

220,000 |

220,000 |

| 27-Jul-26 |

2.44 |

2.34 |

2.32 |

139,000 |

139,000 |

| 24-Sep-26 |

2.25 |

2.25 |

2.25 |

1,685,000 |

1,685,000 |

| 01-Feb-27 |

2.45 |

2.45 |

2.43 |

200,000 |

200,000 |

| 02-Jun-27 |

1.74 |

1.74 |

1.72 |

457,000 |

457,000 |

| 10-Feb-28 |

1.60 |

1.60 |

1.59 |

1,710,000 |

996,000 |

| 19-May-28 |

1.60 |

1.60 |

1.59 |

3,287,000 |

1,955,800 |

| 15-Nov-28 |

1.36 |

1.36 |

1.35 |

400,000 |

160,000 |

| 18-Dec-25 |

1.53 |

1.53 |

1.52 |

250,000 |

125,000 |

| 12-Jun-29 |

2.26 |

2.26 |

2.24 |

6,050,000 |

1,210,000 |

| |

|

|

|

22,357,522 |

15,107,322 |

*According to the Arrangement with Vizsla Royalties on June 24, 2024, each Vizsla Silver Option was exchanged for one Vizsla Silver Replacement Option with the exercise price being adjusted accordingly. The change in the fair value of the options upon replacement was in the amount of $28,617.

The fair value of the options granted was calculated using the Black-Scholes option pricing model with the following assumptions for options granted in the three-month period ended July 31, 2024, and 2023:

|

|

For the three months ended

|

|

|

July 31, 2024

|

July 31, 2023

|

|

Risk Free Interest Rate

|

2.84%-4.01%

|

3.29%

|

|

Expected Dividend Yield

|

-

|

-

|

|

Expected Volatility

|

60-75%

|

96.24%

|

|

Expected Term in Years

|

3-5 years

|

5 years

|

The Company recorded a fair value of $3,251,839 as share-based compensation for the three months period ended July 31, 2024 (July 31, 2023 - $2,455,724). For the three-month period ended July 31, 2024, the Company used an estimated forfeiture rate of 4%, resulting in an impact of $130,074 (July 31,2023: $nil) which reduces the fair value of share-based compensation.

10. Share Capital (continued)

f) Restricted shares units ("RSU")

As of July 31, 2024, the Company has 1,702,744 RSUs outstanding (April 30, 2024: 1,044,073).

During the three-month period ended July 31, 2024, 113,311 RSUs were exercised and converted to common shares at the vested price of $1.60 and 3,018 RSU was cancelled. The Company granted 775,000 RSUs to officers, employees, and consultants of the Company. These RSUs will vest in three equal annual instalments commencing on the first anniversary of the grant date. The fair value of each RSU is $2.34 which is the value of a Vizsla common share on grant day.

During the three-month period ended July 31, 2023: