Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-270533

The information contained in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUPPLEMENT

To the short form base shelf prospectus dated March 31, 2023

|

New Issue

|

September 16, 2024

|

VIZSLA SILVER CORP.

C$<@>

<@> Common Shares

This prospectus supplement of Vizsla Silver Corp. (the "Corporation"), together with the accompanying base shelf prospectus, qualifies the distribution (the "Offering") of <@> Common Shares (as defined below) (the "Offered Shares") at a price of C$<@> per Common Share (the "Offering Price"). The Offering is being made pursuant to an underwriting agreement (the "Underwriting Agreement") dated September 16, 2024 among the Corporation and Canaccord Genuity Corp., as the sole bookrunner and lead underwriter (the "Lead Underwriter"), <@> and <@>. (collectively with the Lead Underwriter, the "Underwriters"). The Offered Shares will be offered in each of the provinces and territories of Canada, except Quebec, in the United States and, subject to applicable law, in certain jurisdictions outside of Canada and the United States through the Underwriters either directly or through their respective Canadian or U.S. broker-dealer affiliates or agents in accordance with the Underwriting Agreement. The Offering Price was determined by arm's length negotiations between the Corporation and the Lead Underwriter, on behalf of the Underwriters, with reference to the prevailing market price of the Common Shares. See "Plan of Distribution" and "Description of the Securities Being Distributed".

The common shares in the capital of the Corporation (the "Common Shares") are listed and posted for trading on the TSX Venture Exchange (the "TSXV") and the NYSE American LLC (the "NYSE American") under the symbol "VZLA" and on the Börse Frankfurt (Frankfurt Stock Exchange) (the "Frankfurt Exchange") under the symbol "0G3. On September 13, 2024, the last trading day before the announcement of the Offering and the date of this prospectus supplement, the closing price of the Common Shares on the TSXV was C$2.94, on the NYSE American was US$2.19 and on the Frankfurt Exchange was €1.97.

S - ii

The Corporation has applied to list the Offered Shares on the TSXV and on NYSE American. Listing is subject to the Corporation fulfilling all of the requirements of the TSXV and NYSE American.

______________________________________

Price: C$<@> per Offered Share

______________________________________

|

|

Price to the Public

|

Underwriters' Fee(1)

|

Net Proceeds to the

Corporation(2)

|

| |

|

|

|

|

Per Offered Share

|

$<@>

|

$<@>

|

$<@>

|

| |

|

|

|

|

Total(3)(4)

|

$<@>

|

$<@>

|

$<@>

|

Notes:

(1) Pursuant to the Underwriting Agreement, the Corporation has agreed to pay the Underwriters a cash fee equal to 5.0% of the gross proceeds of the Offering (the "Underwriters' Fee"), including in respect of any gross proceeds raised on the exercise of the Over-Allotment Option (as defined herein). See "Plan of Distribution".

(2) After deducting the Underwriters' Fee, but before deducting the expenses of the Offering, estimated to be C$<@>, which will be paid by the Corporation from the proceeds of the Offering.

(3) The Corporation has granted to the Underwriters an option (the "Over-Allotment Option") to purchase up to an additional <@> Common Shares (the "Over-Allotment Shares") at the Offering Price for additional gross proceeds of up to C$<@>, solely for the purpose of covering over-allotments made in connection with the Offering, if any, and for market stabilization purposes. The Over-Allotment Option may be exercised by the Underwriters in whole or in part to acquire Over-Allotment Shares at the Offering Price at any time for a period of 30 days after the Closing Date. This prospectus supplement and accompanying base shelf prospectus qualify the grant of the Over-Allotment Option. A purchaser who acquires securities forming part of the Underwriters' over-allocation position acquires those securities under this prospectus supplement and accompanying base shelf prospectus, regardless of whether the Underwriters' over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. See "Plan of Distribution".

(4) If the Over-Allotment Option is exercised in full, the total price to the public, the Underwriters' Fee and the net proceeds to the Corporation (before deducting expenses of the Offering (see note 2 above)), will be C$<@>, C$<@> and C$<@>, respectively. See "Plan of Distribution" and the table below.

|

Underwriters' Position

|

Maximum Number of

Common Shares

Available

|

Exercise Period

|

Exercise Price

|

| |

|

|

|

|

Over-Allotment Option

|

Up to <@> Over-Allotment Shares

|

Any time for a period of 30 days following the Closing Date

|

$<@> per Over-Allotment Share

|

Unless the context otherwise requires, all references to the "Offering" and the "Offered Shares" in this prospectus supplement shall include all Over-Allotment Shares issuable assuming the full exercise of the Over-Allotment Option.

Subject to applicable laws, the Underwriters may, in connection with the Offering, over-allot or effect transactions intended to stabilize or maintain the market price of the Common Shares at levels other than those which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. The Underwriters may decrease the price of which the Offered Shares are distributed from the Offering Price specified on the cover page. See "Plan of Distribution".

The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by the Corporation and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under "Plan of Distribution" and subject to approval of certain Canadian legal matters on behalf of the Corporation by Forooghian + Company Law Corporation, certain United States legal matters on behalf of the Corporation by Goodwin Procter LLP, certain Canadian legal matters on behalf of the Underwriters by Cassels Brock & Blackwell LLP, and certain United States legal matters on behalf of the Underwriters by Skadden, Arps, Slate, Meagher & Flom LLP.

S - iii

Subscriptions for the Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is expected that the completion of the sale of the Offered Shares pursuant to the Offering (the "Closing") will take place on or about September 19, 2024, or on such other date as may be agreed upon by the Corporation and the Lead Underwriter and, in any event, on or before a date not later than 42 days after the date of this prospectus supplement (the "Closing Date"). Except as may be otherwise agreed by the Corporation and the Lead Underwriter, the Offering will be conducted under the book-based system operated by CDS Clearing and Depository Services Inc. ("CDS"). No certificates evidencing the Offered Shares will be issued to purchasers of the Offered Shares. A purchaser who purchases Offered Shares will receive only a customary confirmation from the registered dealer from or through whom Offered Shares are purchased and who is a CDS participant. CDS will record the CDS participants who hold Offered Shares on behalf of owners who have purchased Offered Shares in accordance with the book-based system. See "Plan of Distribution".

The Corporation is permitted, under the multi-jurisdictional disclosure system adopted by the United States and Canada (the "MJDS"), to prepare this prospectus supplement and the accompanying base shelf prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. The Corporation has prepared its financial statements included or incorporated herein by reference in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS") and interim financial statements included or incorporated herein by reference have been prepared in accordance with IFRS as applicable to interim financial reporting, including IAS 34, Interim Financial Reporting, and thus may not be comparable to financial statements of United States companies.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of Canada, that all of our officers and all of our directors are not residents of the United States, that some of the Underwriters or experts named in this prospectus supplement and in the accompanying base shelf prospectus are not residents of the United States, and that certain of the Corporation's assets and all or a substantial portion of the assets of such persons are located outside of the United States. See "Enforceability of Certain Civil Liabilities".

NEITHER THE SEC, ANY STATE SECURITIES REGULATOR, NOR ANY CANADIAN SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THE SECURITIES OFFERED HEREBY OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING BASE SHELF PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

An investment in the Offered Shares involves significant risks that should be carefully considered by prospective investors before purchasing Offered Shares. The risks outlined in this prospectus supplement, the base shelf prospectus, and in the documents incorporated by reference herein and therein, should be carefully reviewed and considered by prospective investors in connection with any investment in Offered Shares. See the "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors" sections of the base shelf prospectus and in this prospectus supplement.

Prospective investors should be aware that the acquisition, holding or disposition of the Offered Shares may have tax consequences both in Canada and in the United States. Such consequences for investors who are resident in, or citizens of, the United States or who are resident in Canada may not be fully described herein. Prospective investors should read the tax discussion under the headings "Certain Canadian Federal Income Tax Considerations" and "Certain United States Federal Income Tax Considerations" in this prospectus supplement and consult their own tax advisors with respect to their own particular circumstances.

Eduardo Luna, a director of the Corporation, resides outside of Canada. Mr. Luna has appointed Forooghian + Company Corporate Services Inc. of Suite 401, 353 Water Street, Vancouver, British Columbia, V6B 1B8 as his agent for service of process. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

S - iv

The Corporation's head office is located at Suite 1723, 595 Burrard Street, Vancouver, British Columbia, V7X 1J1 and its registered office is located at Suite 401, 353 Water Street, Vancouver, British Columbia, V6B 1B8.

This prospectus supplement and the accompanying base shelf prospectus contain references to United States dollars and Canadian dollars. United States dollars are referred to as "United States dollars" or "US$". Canadian dollars are referred to as "Canadian dollars" or "C$". See "Currency Presentation and Exchange Rate Information".

S - v

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

BASE SHELF PROSPECTUS DATED MARCH 31, 2023

S - vi

GENERAL MATTERS

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the Offered Shares and also adds to and updates certain information contained in the base shelf prospectus and the documents incorporated by reference herein and therein. The second part, the base shelf prospectus, gives more general information, some of which may not apply to the Offered Shares. This prospectus supplement is deemed to be incorporated by reference into the base shelf prospectus solely for the purposes of the Offering constituted by this prospectus supplement.

Purchasers should rely only on the information contained in or incorporated by reference into this prospectus supplement and the base shelf prospectus. If the description of the Offered Shares or any other information varies between this prospectus supplement and the base shelf prospectus (including the documents incorporated by reference herein and therein on the date hereof), the investor should rely on the information in this prospectus supplement. Neither the Corporation nor the Underwriters have authorized any other person to provide purchasers with additional or different information. If anyone provides purchasers with different, additional or inconsistent information, such purchasers should not rely on it. Neither the Corporation nor the Underwriters are offering to sell, or seeking offers to buy, the Offered Shares in any jurisdiction where offers and sales are not permitted. Purchasers should assume that the information appearing in this prospectus supplement and the base shelf prospectus, as well as information the Corporation has previously filed with the securities regulatory authority in each of the provinces and territories of Canada that is incorporated herein and in the base shelf prospectus by reference, is accurate as of their respective dates only, regardless of the time of any sale of the Offered Shares pursuant hereto. The Corporation's business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus supplement shall not be used by anyone for any purpose other than in connection with the Offering.

The documents incorporated or deemed to be incorporated by reference herein or in the prospectus contain meaningful and material information relating to the Corporation and readers of this prospectus supplement should review all information contained in this prospectus supplement, the base shelf prospectus and the documents incorporated or deemed to be incorporated by reference herein and therein, as amended or supplemented.

References in this prospectus supplement to the "Corporation", "we", "us" or "our" refer to Vizsla Silver Corp. and its subsidiaries, unless the context indicates otherwise.

NON-IFRS MEASURES

The annual consolidated financial statements of the Corporation are prepared in accordance with IFRS. Additionally, the Corporation utilizes certain non-IFRS measures such as working capital (calculated as current assets less current liabilities). The Corporation believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Corporation. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying base shelf prospectus and the documents incorporated by reference herein and therein contain "forward-looking information" within the meaning of applicable Canadian securities legislation and or "forward-looking statements" within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as "forward-looking information" or "forward-looking statements"). Forward-looking information includes statements that use forward-looking terminology such as "may", "could", "would", "should", "will", "intend", "plan", "expect", "budget", "estimate", "anticipate", "believe", "continue", "potential" or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Technical and scientific information is based on the assumptions and parameters set out herein, in the PEA Technical Report (as defined below) and on the opinion of "qualified persons" (as defined in NI 43-101 (as defined below)). Such forward-looking information includes, without limitation, statements with respect to the Corporation's expectations, strategies and plans for the Panuco Project (as defined below), including the Corporation's current planned exploration, development and permitting activities; the future issuance of Offered Shares and the terms, conditions and amount thereof; the Corporation's use of proceeds from the sale of Offered Shares, if any; the plan of distribution with respect to the sale of Offered Shares; the requirement for additional financing in order to maintain the Corporation's operations and exploration activities; the timing, receipt and maintenance of approvals, licences and permits from any federal, national, provincial, territorial, municipal or other government, any political subdivision thereof, and any ministry, sub-ministry, agency or sub-agency, court, board, bureau, office, or department, including any government-owned entity, having jurisdiction over the Corporation or its assets; future financial or operating performance and condition of the Corporation and its business, operations and properties, and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management, in light of management's experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this prospectus supplement including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise any necessary capital on reasonable terms to advance the development of the Panuco Project and pursue planned exploration; expectations about the ability to acquire mineral resources and/or mineral reserves through acquisition and/or development; future prices of silver, gold and other metals; the timing and results of exploration and drilling programs; the accuracy of budgeted exploration and development costs and expenditures; expectations regarding inflation; future currency exchange rates and interest rates; operating conditions being favourable, including whereby the Corporation is able to operate in a safe, efficient and effective manner; political and regulatory stability; the receipt of governmental and third party approvals, licences and permits on favourable terms; obtaining required renewals for existing approvals, licences and permits and obtaining all other required approvals, licences and permits on favourable terms; sustained labour stability; stability in financial and capital goods markets; the absence of any material adverse effects arising as a result of terrorism, sabotage, natural disasters, public health concerns, equipment failures or adverse changes in government legislation or the socio-economic conditions in Mexico and the surrounding area with respect to the Panuco Project and operations; and the availability of drilling and other mining equipment, energy and supplies. While the Corporation considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. Many assumptions are based on factors and events that are not within the control of the Corporation and there is no assurance they will prove to be correct.

S - 3

Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Corporation to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. Such risks include, without limitation: general business, social, economic, political, regulatory and competitive uncertainties; differences in size, grade, continuity, geometry or location of mineralization from that predicted by geological modelling and the subjective and interpretative nature of the geological modelling process; the speculative nature of mineral exploration and development, including the risk of diminishing quantities or grades of mineralization; fluctuations in the spot and forward price of silver; inflationary pressures; a failure to achieve commercial viability, despite an acceptable silver price, or the presence of cost overruns which render the Panuco Project uneconomic; geological, hydrological and climatic events which may adversely affect infrastructure, operations and development plans, and the inability to effectively mitigate or predict with certainty the occurrence of such events; the Corporation's limited operating history; the Corporation's history of losses and expectation of future losses; credit and liquidity risks associated with the Corporation's financing activities, including constraints on the Corporation's ability to raise and expend funds; delays in the performance of the obligations of the Corporation's contractors and consultants, the receipt of governmental and third party approvals, licences and permits in a timely manner or to complete and successfully operate mining and processing components; the Corporation's failure to accurately model and budget future capital and operating costs associated with the further development and operation of the Panuco Project; adverse fluctuations in the market prices and availability of commodities and equipment affecting the Corporation's business and operations; title defects to the Corporation's mineral properties; the Corporation's management being unable to successfully apply their skills and experience to attract and retain highly skilled personnel; the cyclical nature of the mining industry and increasing prices and competition for resources and personnel during mining cycle peaks; the Corporation's failure to comply with laws and regulations or other regulatory requirements; the Corporation's failure to comply with existing approvals, licences and permits, and the Corporation's inability to renew existing approvals, licences and permits or obtain required new approvals, licences and permits on timelines required to support development plans; the risks related to equipment shortages, road and water access restrictions and inadequate infrastructure; the Corporation's failure to comply with environmental regulations, the tendency of such regulations to become more strict over time, and the costs associated with maintaining and monitoring compliance with such regulations; the adverse influence of third party stakeholders including social and environmental non-governmental organizations; risks related to natural disasters, terrorism, civil unrest, public health concerns (including health epidemics or pandemics or outbreaks of communicable diseases such as the coronavirus) and other geopolitical uncertainties; the adverse impact of competitive conditions in the mineral exploration business; the Corporation's failure to maintain satisfactory labour relations and the risk of labour disruptions or changes in legislation relating to labour; changes in national and local government legislation, taxation, controls, regulations and other political or economic developments in the jurisdictions in which the Corporation operates; limits of insurance coverage and uninsurable risk; the adverse effect of currency fluctuations on the Corporation's financial performance; difficulties associated with enforcing judgments against directors residing outside of Canada; conflicts of interest; reduction in the price of Common Shares as a result of sales of Common Shares by existing shareholders; the dilutive effect of future acquisitions or financing activities and the failure of future acquisitions to deliver the benefits anticipated; trading and volatility risks associated with equity securities and equity markets in general; the Corporation's not paying dividends in the foreseeable future or ever; failure of the Corporation's information technology systems or the security measures protecting such systems; the costs associated with legal proceedings should the Corporation become the subject of litigation or regulatory proceedings; costs associated with complying with public Corporation regulatory reporting requirements; risks related to war (including the ongoing conflicts between Russia and Ukraine and Israel and Palestine); and other risks involved in the exploration and development business generally, including, without limitation, environmental risks and hazards, cave-ins, flooding, rock bursts and other acts of God or natural disasters or unfavourable operating conditions; risk of loss of entire investment; macroeconomic risks; risks relating to inflationary pressures; risks related to negative operating cash flows; risks relating to capital resources; uncertainties regarding the use of proceeds from the Offering; discretion regarding the use of proceeds from the Offering; risks relating to at-the-market distributions generally; share price volatility; market price depression; dilution risks; risks relating to the lack of a liquid market for the Common Shares, and those risk factors discussed or referred to in this prospectus supplement, the base shelf prospectus and in the Annual Information Form (as defined below), Annual MD&A (as defined below), Interim MD&A (as defined below) and the PEA Technical Report (as defined below), all of which readers are advised to carefully review and consider. Although the Corporation has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking information, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from those anticipated, estimated or intended. See "Risk Factors" for a discussion of certain factors investors should carefully consider before deciding to purchase any Offered Shares.

The Corporation cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information.

The forward-looking information and statements contained in this prospectus supplement and the base shelf prospectus represent the Corporation's views and expectations as of the date of this prospectus supplement and the base shelf prospectus, respectively, unless otherwise indicated in such documents, and forward-looking information and statements contained in the documents incorporated by reference herein and therein represent the Corporation's views and expectations as of the date of such documents, unless otherwise indicated in such documents. The Corporation disclaims any intent or obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of assumptions or factors, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws. Investors are urged to read the Corporation's filings with Canadian securities regulatory agencies, which can be viewed online under the Corporation's profile on the Canadian System for Electronic Document Analysis and Retrieval + ("SEDAR+") at www.sedarplus.ca and the SEC's Electronic Data Gathering, Analysis and Retrieval System ("EDGAR") at www.sec.gov.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Unless otherwise indicated, all mineral reserve and mineral resource estimates included in this prospectus supplement and the documents incorporated by reference herein have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Standards on mineral resources and mineral reserves, as amended (the "CIM Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this prospectus supplement and the documents incorporated by reference herein use the terms "indicated mineral resources" and "inferred mineral resources" as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the "U.S. Rules") are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Corporation is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If the Corporation ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Corporation will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the U.S. Rules, the SEC recognizes estimates of "indicated mineral resources" and "inferred mineral resources." In addition, the definitions of "proven mineral reserves" and "probable mineral reserves" under the U.S. Rules are now "substantially similar" to the corresponding standards under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any indicated mineral resources or inferred mineral resources that the Corporation reports are or will be economically or legally mineable. Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are "substantially similar" to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Corporation may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Corporation prepared the mineral reserve or mineral resource estimates under the standards adopted under the U.S. Rules.

FINANCIAL INFORMATION

The financial statements of the Corporation incorporated by reference in this prospectus supplement have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and are reported in Canadian dollars.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

The aggregate Offering amount set forth in this prospectus supplement is in Canadian dollars. This prospectus supplement, the accompanying base shelf prospectus and the documents incorporated by reference herein and therein, contain references to United States dollars and Canadian dollars. United States dollars are referred to as "United States dollars" or "US$". Canadian dollars are referred to as "Canadian dollars" or "C$".

The high, low and closing rates for Canadian dollars in terms of the United States dollar for each of the periods indicated, as reported by the Bank of Canada, were as follows:

|

|

April 30, 2024

|

|

April 30, 2023

|

|

April 30, 2022

|

| |

|

|

|

|

|

|

High

|

C$1.3875

|

|

C$1.3856

|

|

C$1.2942

|

|

Low

|

C$1.3128

|

|

C$1.2540

|

|

C$1.2040

|

|

Closing

|

C$1.3746

|

|

C$1.3578

|

|

C$1.2792

|

DOCUMENTS INCORPORATED BY REFERENCE

This prospectus supplement is deemed to be incorporated by reference into the base shelf prospectus solely for the purposes of the distribution of the Offered Shares. Information has been incorporated by reference in this prospectus supplement from documents filed with the securities commissions or similar authorities in Canada. Other documents are also incorporated, or are deemed to be incorporated by reference, into the base shelf prospectus and reference should be made to the base shelf prospectus for full particulars thereof. Copies of the documents incorporated herein by reference may be obtained on request, without charge, from the Corporate Secretary of the Corporation at Suite 1723, 595 Burrard Street, Vancouver, British Columbia, V7X 1J1, telephone (778) 899-3050 and are also available electronically under the SEDAR+ profile of the Corporation at www.sedarplus.ca or through EDGAR at the website of the SEC at www.sec.gov. The filings of the Corporation available on SEDAR+ and EDGAR are not incorporated by reference in this prospectus supplement except as specifically set out herein.

As of the date hereof, the following documents, filed by the Corporation with the securities commissions or similar authorities in each of the provinces and territories of Canada and filed with, or furnished to, the SEC, are specifically incorporated by reference into, and form an integral part of, the prospectus, provided that such documents are not incorporated by reference to the extent that their contents are modified or superseded by a statement contained in this prospectus supplement, the base shelf prospectus or in any other subsequently filed document that is also incorporated by reference in this prospectus supplement, as further described below:

(a) the annual information form of the Corporation dated July 18, 2024 for the year ended April 30, 2024 (the "Annual Information Form"), except for the information contained under the heading "Description of Business - Material Mineral Projects", which has been superseded by the summary from the PEA Technical Report reproduced in "Appendix A - Summary Section from the PEA Technical Report" in this prospectus supplement;

(b) the audited annual consolidated financial statements of the Corporation for the years ended April 30, 2024 and 2023, together with the notes thereto and the auditors' report thereon (the "Annual Financial Statements");

(c) the management's discussion and analysis of financial condition and results of operations of the Corporation ("Annual MD&A") for the years ended April 30, 2024 and 2023;

(d) the management information circular of the Corporation dated May 17, 2024 with respect to the Corporation's special meeting of shareholders held on June 17, 2024;

(e) the condensed consolidated interim financial statements of the Corporation for the three months ended July 31, 2024, together with the notes thereto (the "Interim Financial Statements");

(f) the MD&A of the Corporation for the three months ended July 31, 2024 (the "Interim MD&A");

(g) the management information circular of the Corporation dated August 23, 2024 with respect to the Corporation's annual general meeting to be held on October 3, 2024;

(h) the material change report of the Corporation dated August 21, 2024 in respect of (a) the closing of the spin out the shares of Vizsla Royalties Corp. to shareholders of the Corporation (the "Spinout"), and (b) the results from a independent preliminary economic assessment on the Panuco Project (the "PEA");

(i) the technical report entitled "Panuco Project, NI 43-101 Technical Report and Preliminary Economic Assessment, Sinaloa State, Mexico" with an effective date of July 24, 2024 (the "PEA Technical Report");

(j) the material change report of the Corporation dated September 9, 2024, in respect of the filing of the PEA Technical Report;

(k) the material change report of the Corporation dated September 13, 2024 in respect of an update to its at-the-market equity program (the "ATM Program Update") to offer and sell up to US$100,000,000 of Common Shares to the public, from time to time; and

(l) the template version of the term sheet dated September 16, 2024 in connection with the Offering (the "Marketing Material").

Any documents of the type required to be incorporated by reference in a short form prospectus pursuant to National Instrument 44-101 - Short Form Prospectus Distributions ("NI 44-101") of the Canadian Securities Administrators, including, without limitation, any material change reports (excluding material change reports filed on a confidential basis), interim financial statements, annual financial statements and the auditor's report thereon, MD&A, information circulars, annual information forms, marketing materials and business acquisition reports filed by the Corporation with the securities commissions or similar authorities in any of the provinces and territories of Canada after the date of this prospectus supplement and prior to the termination of the Offering shall be deemed to be incorporated by reference into and form an integral part of this prospectus.

In addition, to the extent that any document or information incorporated by reference into this prospectus supplement is filed with, or furnished to, the SEC pursuant to the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") after the date of this prospectus supplement, such document or information will be deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part (in the case of a report on Form 6-K, if and to the extent expressly provided therein). In addition, if and to the extent indicated therein, the Corporation may incorporate by reference in this prospectus supplement documents that it files with or furnishes to the SEC pursuant to Section 13(a), 13(c) or 15(d) of the Exchange Act.

Any statement contained in this prospectus supplement, the base shelf prospectus or in a document incorporated or deemed to be incorporated by reference herein or therein for the purposes of the Offering shall be deemed to be modified or superseded, for purposes of this prospectus supplement and the base shelf prospectus, to the extent that a statement contained herein or therein or in any other subsequently filed document that also is incorporated or is deemed to be incorporated by reference herein or therein, modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or omission to state a material fact that was required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall be deemed, except as so modified or superseded, not to constitute a part of this prospectus supplement or the base shelf prospectus.

References to the Corporation's website in any documents that are incorporated by reference into this prospectus do not incorporate by reference the information on such website into this prospectus, and we disclaim any such incorporation by reference.

MARKETING MATERIAL

In connection with the Offering, the Underwriters may use "marketing materials" (as such term is defined in NI 44-101 Short Form Prospectus Distributions), including the Marketing Material. The marketing materials do not form part of this prospectus supplement and the accompanying base shelf prospectus to the extent that the contents of the marketing materials have been modified or superseded by a statement contained in this prospectus supplement and the accompanying base shelf prospectus. Any "template version" of any "marketing materials" (each as defined in National Instrument 41-101 - General Prospectus Requirements) that has been, or will be, filed on SEDAR+ before the termination of the distribution under the Offering (including any amendments to, or an amended version of, any template version of any marketing materials) is deemed to be incorporated by reference into this prospectus supplement and the accompanying base shelf prospectus solely for the purposes of the Offering.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be, filed with the SEC as part of a registration statement on Form F-10 (File No. 333-270533) (the "registration statement") of which this prospectus supplement forms a part: (1) the Underwriting Agreement; (2) the documents listed under "Documents Incorporated by Reference"; (3) the consent of MNP LLP with respect to their independent registered public accounting firm's report on the Annual Financial Statements; (4) powers of attorney from certain of the Corporation's directors and officers (included on the signature page to the registration statement); and (5) the consents of the "qualified persons" referred to in the prospectus under "Interests of Experts".

THE CORPORATION

The following is a summary of information about the Corporation and does not contain all the information about the Corporation that may be important. Please read the more detailed information included in this prospectus supplement, including the section entitled "Risk Factors", and the base shelf prospectus and any documents incorporated by reference herein and therein. See "Documents Incorporated by Reference".

General

The Corporation is a mineral exploration company focused on creating shareholder value through discovery. The Corporation holds a 100% interest in the mineral property known as the "Panuco Silver-Gold Project" (the "Panuco Project") located in the Panuco-Copala mining district in the municipality of Concordia in the State of Sinaloa, Mexico, which interest the Corporation holds through its wholly-owned subsidiaries, Canam Alpine Ventures Ltd. and Minera Canam S.A. de C.V. As of the date hereof, the Corporation's only material property is the Panuco Project.

Further information regarding the Panuco Project and the business and operations of the Corporation can be found in the Annual Information Form and the other materials incorporated or deemed to be incorporated by reference into this prospectus supplement. See "Documents Incorporated by Reference", and see also "Risk Factors" in this prospectus supplement, the base shelf prospectus and the Annual Information Form.

Intercorporate Relationships

The following chart sets out the various intercorporate relationships of the Corporation:

Recent Developments

On February 29, 2024, the Corporation completed a bought deal private placement (the "Bought Deal") pursuant to which the Corporation issued a total of 23,000,000 Common Shares for aggregate gross proceeds of C$34,500,000.

On April 12, 2024, the Corporation announced the appointment of Suki Gill to its board of directors.

On June 20, 2024, the Corporation announced the closing date for the Spinout.

On July 24, 2024, the Corporation announced the results of the PEA.

On August 27, 2024, the Corporation filed the PEA Technical Report on SEDAR+.

On September 13, 2024, the Corporation announced the ATM Program Update.

CONSOLIDATED CAPITALIZATION

There have been no material changes in the share and loan capital of the Corporation, on a consolidated basis, since the date of the Interim Financial Statements, which have not been disclosed in this prospectus supplement or the documents incorporated by reference herein.

The following table sets forth the consolidated capitalization of the Corporation (i) as at the date of the Interim Financial Statements, before giving effect to the Offering; (ii) as at such date, after giving effect to the Offering, assuming no exercise of the Over-Allotment Option; and (iii) as at such date, after giving effect to the Offering, assuming full exercise of the Over-Allotment Option. The table should be read in conjunction with the Interim Financial Statements, including the notes thereto and the related management's discussion and analysis.

|

|

|

As at July 31, 2024

(unaudited)

|

|

As at July 31, 2024,

after giving effect to the

Offering (2)

(unaudited)

|

|

As at July 31, 2024,

after giving effect to the

Offering and the full

exercise of the Over-

Allotment Option (2)

(unaudited)

|

| |

|

|

|

|

|

|

|

Current Liabilities

|

|

C$1,450,003

|

|

C$<@>

|

|

C$<@>

|

| |

|

|

|

|

|

|

|

Long Term Liabilities

|

|

Nil

|

|

Nil

|

|

Nil

|

| |

|

|

|

|

|

|

|

Common Shares

|

|

242,240,270

|

|

<@>

|

|

<@>

|

| |

|

|

|

|

|

|

|

Convertible Securities

|

|

8,838,576 warrants(1)

22,357,522 stock options

|

|

8,838,576 warrants(1)

22,357,522 stock options

|

|

8,838,576 warrants(1)

22,357,522 stock options

|

| |

|

|

|

|

|

|

|

Restricted Share Units

|

|

1,702,744

|

|

1,702,744

|

|

1,702,744

|

Notes:

(1) Includes warrants, compensation options, compensation warrants and broker warrants.

(2) Assuming issuance of the Offered Shares, but no exercise of any other outstanding convertible securities. See "Plan of Distribution".

USE OF PROCEEDS

After deducting the Underwriters' Fee of C$<@> (or C$<@> if the Over-Allotment Option is exercised in full) and expenses of the Offering estimated to be C$<@>, the net proceeds to the Corporation from the Offering are estimated to be C$<@> (or C$<@> if the Over-Allotment Option is exercised in full). See "Plan of Distribution".

The net proceeds from the Offering (assuming no exercise of the Over-Allotment Option) are expected to be used by the Corporation as set out in the table below. Any net proceeds realized on exercise of the Over-Allotment Option are expected to be applied to unallocated general working capital.

| Use of Proceeds |

|

Approximate Amount |

| Exploration and development of the Panuco Project(1) |

|

C$<@> |

| Potential future acquisitions(2) |

|

C$<@> |

General and administrative expenses

Unallocated working capital |

|

C$<@>

C$<@> |

| Total |

|

C$<@> |

Notes:

(1) The Corporation has the following exploration and development objectives for the Panuco Project in the next 12 months from the date of this prospectus supplement: <@>.

(2) These funds are anticipated to be allocated towards possible acquisitions of assets in Mexico. No specific transaction has been identified as of the date of this prospectus supplement. The Corporation anticipates that any potential acquisitions could occur in the next 12 months from the date of this prospectus supplement.

The Corporation currently intends to spend the net proceeds of the Offering as stated in this prospectus supplement. However, there may be circumstances where, for sound business reasons, a reallocation of funds may be deemed prudent or necessary. The actual amount that the Corporation spends in connection with each of the intended uses of proceeds may vary significantly from the amounts specified above and will depend on a number of factors, including those referred to under "Risk Factors".

The Corporation has had negative operating cash flow in recent years. The Corporation anticipates that it will continue to have negative operating cash flow until such time, if ever, that commercial production is achieved at the Panuco Project. To the extent that the Corporation has negative operating cash flows in future periods, the Corporation may need to allocate a portion of its existing working capital, including the net proceeds from the Offering, to fund such negative cash flow. There are no assurances that the Corporation will not experience negative cash flow from operations in the future. See "Risk Factors".

Jesus Velador, Ph.D. MMSA QP, Vice President of Exploration of the Corporation, is the "qualified person" who supervised the preparation of, and reviewed and approved, the above use of proceeds disclosure and is of the view that the proposed expenditure amounts and business objectives in respect of the exploration and development work proposed to be completed on the Panuco Project are reasonable.

Business Objectives

The Corporation is focused on the advancement of the Panuco Project. The net proceeds of the Offering will be used to accelerate the Corporation's development of the Panuco Project. Additionally, although the Corporation has not executed any agreements in respect to any acquisitions, the additional capital may allow the Corporation to take advantage of such any opportunity if it arises. No assurance can be given that the Corporation will be able to execute on any acquisition opportunity and accordingly, the Corporation may from time to time reallocate a portion of the net proceeds obtained from the Offering primarily for working capital and general corporate purposes having regard to the Corporation's circumstances at the relevant time. See "Risk Factors".

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

The Corporation's authorized share capital consists of an unlimited number of Common Shares without par value, of which 242,848,543 Common Shares were issued and outstanding as of September 16, 2024. For a summary of certain material attributes and characteristics of the Common Shares, see "Description of Securities - Common Shares" in the base shelf prospectus.

PLAN OF DISTRIBUTION

Pursuant to the Underwriting Agreement, the Corporation has agreed to issue and sell and the Underwriters have severally (and not jointly nor jointly and severally) agreed to purchase, as principals, subject to compliance with all necessary legal requirements and the terms and conditions contained in the Underwriting Agreement, a total of <@> Offered Shares at the Offering Price of C$<@> per Offered Share, payable in cash to the Corporation against delivery of such Offered Shares on the Closing Date. The obligations of the Underwriters under the Underwriting Agreement are conditional and may be terminated at their discretion on the basis of "material change out", "disaster and regulatory out", and "breach out" termination provisions in the Underwriting Agreement and may also be terminated upon the occurrence of certain other stated events. The Underwriters are, however, obligated to take up and pay for all of the Offered Shares offered by this prospectus supplement (not including the Over-Allotment Shares issuable upon exercise of the Over-Allotment Option) if any Offered Shares are purchased under the Underwriting Agreement, subject to certain exceptions.

Pursuant to the Underwriting Agreement, the Corporation has granted to the Underwriters the Over-Allotment Option, exercisable in whole or in part at any time up to 30 days after the Closing Date, to purchase up to an additional <@> Offered Shares at the Offering Price to cover over-allocations, if any, and for market stabilization purposes, on the same terms and conditions as apply to the purchase of Offered Shares thereunder. This prospectus supplement qualifies for distribution the Offered Shares as well as the grant of the Over-Allotment Option and the issuance of the Over-Allotment Shares pursuant to the exercise of the Over-Allotment Option. A purchaser who acquires Over-Allotment Shares forming part of the Underwriters' over-allocation position acquires those Over-Allotment Shares under this prospectus supplement, regardless of whether the over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases.

In consideration for their services in connection with the Offering, the Underwriters will be paid the Underwriters' Fee equal to 5.0% of the gross proceeds of the Offering (including in connection with any gross proceeds from the sale of the Over-Allotment Shares). The Offering Price was determined by arm's length negotiations between the Corporation and the Lead Underwriter, on behalf of the Underwriters, with reference to the prevailing market price of the Common Shares. See "Risk Factors".

The Offered Shares will be offered in each of the provinces and territories of Canada, except Quebec, in the United States and, subject to applicable law, in certain jurisdictions outside of Canada and the United States through the Underwriters either directly or through their respective Canadian or U.S broker-dealer affiliates or agents in accordance with the Underwriting Agreement.

The Corporation has applied to list the Common Shares distributed hereunder on the TSXV and NYSE American. Listing will be subject to the Corporation fulfilling all listing requirements of the TSXV and NYSE American.

Pursuant to rules and policy statements of certain securities regulators, the Underwriters may not, at any time during the period of distribution under the Offering, bid for or purchase Offered Shares for their own accounts or for accounts over which they exercise control or direction. The foregoing restriction is subject to certain exceptions, including: (i) a bid or purchase permitted under the Universal Market Integrity Rules for Canadian Marketplaces administered by the Investment Industry Regulatory Organization of Canada relating to market stabilization and passive market making activities; (ii) a bid or purchase made for or on behalf of a customer where the order was not solicited during the period of the distribution, provided that the bid or purchase was for the purpose of maintaining a fair and orderly market and not engaged in for the purpose of creating actual or apparent active trading in, or raising the price of, such securities, or (iii) a bid or purchase to cover a short position entered into prior to the commencement of the prescribed restricted period. Consistent with these requirements, and in connection with the Offering, the Underwriters may over-allot and effect transactions which are intended to stabilize or maintain the market price of the Offered Shares at levels other than those which otherwise might prevail on the open market. If these activities are commenced, they may be discontinued by the Underwriters at any time. The Underwriters may carry out these transactions on the TSXV, NYSE American, in the over-the-counter market or otherwise.

Certain of the Underwriters and their affiliates have performed investment banking, commercial banking and advisory services for the Corporation from time to time for which they have received customary fees and expenses. The Underwriters and their affiliates may, from time to time, engage in transactions with and perform services for the Corporation in the ordinary course of their business.

The Offered Shares sold by the Underwriters to the public will initially be offered at the Offering Price specified on the cover page. After the Underwriters have made a reasonable effort to sell all of the Offered Shares at the Offering Price specified on the cover page, the Underwriters may decrease the Offering Price to an amount not greater than the Offering Price set forth on the cover page, and the compensation realized by the Underwriters will be decreased by the amount that the aggregate price paid by the purchasers for the Offered Share is less than the gross proceeds paid by the Underwriters to the Corporation. The decrease in the Offering Price will not decrease the amount of net proceeds of the Offering to the Corporation.

The Corporation has agreed in the Underwriting Agreement to reimburse the Underwriters for certain legal fees and certain other expenses in connection with the Offering, including for the Underwriters' Canadian counsel and the Underwriters' U.S. counsel (plus applicable taxes and disbursements).

The Corporation has agreed, pursuant to the Underwriting Agreement, to indemnify and save harmless the Underwriters and their respective subsidiaries and affiliates, and each of their respective directors, officers, employees, partners, agents, and shareholders against certain liabilities, including civil liabilities under Canadian and United States securities legislation in certain circumstances or to contribute to payments the Underwriters may have to make because of such liabilities.

The Corporation has agreed in the Underwriting Agreement that the Corporation will not to issue any Common Shares or securities convertible into Common Shares for a period of 90 days from the Closing Date without the prior written consent of the Lead Underwriter, such consent not to be unreasonably withheld, except in conjunction with (i) the grant or exercise or vesting of stock options, restricted share units, deferred share units and other similar issuances pursuant to the equity incentive plans of the Corporation and other stock-based compensation arrangements including, for greater certainty the sale of any shares issued thereunder; (ii) the exercise or conversion of outstanding convertible securities; and (iii) any obligations in respect of existing agreements or as otherwise previously publicly announced by the Corporation, which for certainty does not include the Corporation’s previously announced at-the-market program.

The Corporation has agreed in the Underwriting Agreement to cause each of its executive officers and directors to enter into a lock-up agreement to be executed concurrently with the closing of the Offering, pursuant to which for a period of 90 days from the Closing Date, each will not, directly or indirectly, offer, sell, contract to sell, grant any option to purchase, make any short sale, or otherwise dispose of, or transfer, or announce any intention to do so, any Common Shares, whether now owned or hereinafter acquired, directly or indirectly, or under their control or direction, or with respect to which each has beneficial ownership, or enter into any transaction or arrangement that has the effect of transferring, in whole or in part, any of the economic consequences of ownership of Common Shares, whether such transaction is settled by the delivery of Common Shares, other securities, cash or otherwise other than pursuant to a take-over bid or any other similar transaction made generally to all of the shareholders of the Corporation, for tax purposes to the Corporation in connection with the vesting or exercise of stock options or other incentive plan securities, or with the consent of the Underwriters, such consent not to be unreasonably withheld.

Subscriptions for the Common Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. Except as may be otherwise agreed by the Corporation and the Lead Underwriter, the Offering will be conducted under the book-based system operated by CDS. No certificates evidencing the Offered Shares will be issued to purchasers of the Common Shares. A purchaser who purchases Offered Shares will receive only a customary confirmation from the registered dealer from or through whom Offered Shares are purchased and who is a CDS participant. CDS will record the CDS participants who hold Offered Shares on behalf of owners who have purchased Offered Shares in accordance with the book-based system.

The Corporation expects that delivery of the Offered Shares will be made against payment therefor on the Closing Date, which will be the third business day following the date of pricing of the Offered Shares. Under Rule 15c6-1 under the Exchange Act, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, investors who wish to trade Offered Shares prior to the Closing Date may be required to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Investors who wish to trade Offered Shares prior to the Closing Date should consult their own advisors.

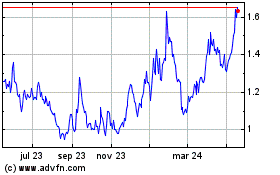

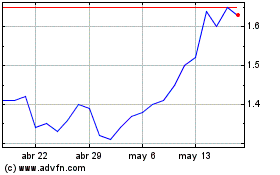

TRADING PRICE AND VOLUME

The outstanding Common Shares are listed and posted for trading on the TSXV and the NYSE American and trade under the symbol "VZLA".

The following table sets forth the high and low sale prices in Canadian dollars and trading volumes for the Common Shares on the TSXV for the previous 12 months prior to the date of this prospectus supplement:

|

Month

|

|

High

|

|

Low

|

|

Volume

|

| |

|

|

|

|

|

|

|

September 1 - 13, 2024

|

|

C$2.94

|

|

C$2.43

|

|

2,690,756

|

| |

|

|

|

|

|

|

|

August 2024

|

|

C$2.93

|

|

C$2.30

|

|

8,803,770

|

| |

|

|

|

|

|

|

|

July 2024

|

|

C$3.02

|

|

C$2.28

|

|

8,634,994

|

| |

|

|

|

|

|

|

|

June 2024

|

|

C$2.52

|

|

C$2.19

|

|

8,908,749

|

| |

|

|

|

|

|

|

|

May 2024

|

|

C$2.63

|

|

C$1.79

|

|

14,519,011

|

| |

|

|

|

|

|

|

|

April 2024

|

|

C$2.15

|

|

C$1.78

|

|

10,002,495

|

|

Month

|

|

High

|

|

Low

|

|

Volume

|

| |

|

|

|

|

|

|

|

March 2024

|

|

C$1.80

|

|

C$1.46

|

|

6,142,229

|

| |

|

|

|

|

|

|

|

February 2024

|

|

C$2.02

|

|

C$1.44

|

|

7,317,473

|

| |

|

|

|

|

|

|

|

January 2024

|

|

C$2.25

|

|

C$1.56

|

|

11,962,288

|

| |

|

|

|

|

|

|

|

December 2023

|

|

C$1.74

|

|

C$1.43

|

|

4,654,501

|

| |

|

|

|

|

|

|

|

November 2023

|

|

C$1.68

|

|

C$1.33

|

|

4,539,995

|

| |

|

|

|

|

|

|

|

October 2023

|

|

C$1.56

|

|

C$1.33

|

|

3,015,838

|

| |

|

|

|

|

|

|

|

September 2023

|

|

C$1.79

|

|

C$1.34

|

|

2,647,396

|

On September 13, 2024, the last trading day prior to the announcement of the Offering and the date of this prospectus supplement, the closing price of the Common Shares on the TSXV was C$2.94.

The following table sets forth the high and low sale prices in United States dollars and trading volumes for the Common Shares on the NYSE American for the previous 12 months prior to the date of this prospectus supplement:

|

Month

|

|

High

|

|

Low

|

|

Volume

|

| |

|

|

|

|

|

|

|

September 1 - 13, 2024

|

|

US$2.19

|

|

US$1.79

|

|

6,313,477

|

| |

|

|

|

|

|

|

|

August 2024

|

|

US$2.14

|

|

US$1.68

|

|

22,220,418

|

| |

|

|

|

|

|

|

|

July 2024

|

|

US$2.21

|

|

US$1.68

|

|

19,712,815

|

| |

|

|

|

|

|

|

|

June 2024

|

|

US$1.85

|

|

US$1.59

|

|

20,263,694

|

| |

|

|

|

|

|

|

|

May 2024

|

|

US$1.92

|

|

US$1.30

|

|

36,727,096

|

| |

|

|

|

|

|

|

|

April 2024

|

|

US$1.58

|

|

US$1.27

|

|

22,265,779

|

| |

|

|

|

|

|

|

|

March 2024

|

|

US$1.34

|

|

US$1.08

|

|

8,590,111

|

| |

|

|

|

|

|

|

|

February 2024

|

|

US$1.50

|

|

US$1.07

|

|

8,304,990

|

| |

|

|

|

|

|

|

|

January 2024

|

|

US$1.68

|

|

US$1.16

|

|

11,324,590

|

| |

|

|

|

|

|

|

|

December 2023

|

|

US$1.32

|

|

US$1.05

|

|

5,300,700

|

| |

|

|

|

|

|

|

|

November 2023

|

|

US$1.24

|

|

US$0.96

|

|

4,398,767

|

| |

|

|

|

|

|

|

|

October 2023

|

|

US$1.15

|

|

US$0.97

|

|

2,763,858

|

| |

|

|

|

|

|

|

|

September 2023

|

|

US$1.36

|

|

US$0.98

|

|

2,598,018

|

On September 12, 2024, the last trading day prior to the announcement of the Offering and the date of this prospectus supplement, the closing price of the Common Shares on the NYSE American was US$2.19.

MINERAL PROPERTY

The PEA Technical Report was filed by the Corporation on August 27, 2024.

The disclosure required by Section 9.1 of NI 44-101F1 is included in the attached Appendix A to this prospectus supplement.

PRIOR SALES

Common Shares

The following table summarizes details of the Common Shares issued by the Corporation during the 12 months prior to the date of this prospectus supplement:

|

Date

|

|

Security

|

|

Price

|

|

Number of Securities

|

|

January 9, 2024

|

|

Common Shares(1)

|

|

C$1.45

|

|

128,547

|

|

January 15, 2024

|

|

Common Shares(1)

|

|

C$1.45

|

|

17,568

|

|

January 15, 2024

|

|

Common Shares(4)

|

|

C$0.69

|

|

15,000

|

|

January 17, 2024

|

|

Common Shares(5)

|

|

C$0.76

|

|

20,000

|

|

January 31, 2024

|

|

Common Shares(1)

|

|

C$1.45

|

|

551,565

|

|

February 1, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

11,500

|

|

February 29, 2024

|

|

Common Shares(6)

|

|

C$1.50

|

|

23,000,000

|

|

March 13, 2024

|

|

Common Shares(7)

|

|

C$1.80

|

|

33,922

|

|

March 20, 2024

|

|

Common Shares(7)

|

|

C$1.80

|

|

52,116

|

|

April 5, 2024

|

|

Common Shares(8)

|

|

C$1.80

|

|

64,339

|

|

April 15, 2024

|

|

Common Shares(8)

|

|

C$1.80

|

|

48,554

|

|

April 15, 2024

|

|

Common Shares(9)

|

|

C$1.60

|

|

184,000

|

|

April 15, 2024

|

|

Common Shares(10)

|

|

C$1.60

|

|

130,000

|

|

April 15, 2024

|

|

Common Shares(11)

|

|

C$1.74

|

|

60,000

|

|

April 15, 2024

|

|

Common Shares(12)

|

|

C$1.44

|

|

140,000

|

|

April 15, 2024

|

|

Common Shares(13)

|

|

C$1.69

|

|

75,000

|

|

April 15, 2024

|

|

Common Shares(5)

|

|

C$0.76

|

|

36,250

|

|

April 17, 2024

|

|

Common Shares(7)

|

|

C$1.80

|

|

7,855

|

|

April 18, 2024

|

|

Common Shares(9)

|

|

C$1.60

|

|

32,000

|

|

April 19, 2024

|

|

Common Shares(5)

|

|

C$0.76

|

|

30,000

|

|

April 19, 2024

|

|

Common Shares(15)

|

|

C$1.40

|

|

10,000

|

|

May 2, 2024

|

|

Common Shares(5)

|

|

C$0.76

|

|

3,791

|

|

May 8, 2024

|

|

Common Shares(16)

|

|

C$1.97

|

|

448,137

|

|

May 8, 2024

|

|

Common Shares(8)

|

|

C$1.80

|

|

2,035

|

|

May 15, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

25,500

|

|

May 16, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

30,000

|

|

May 21, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

37,500

|

|

May 21, 2024

|

|

Common Shares(8)

|

|

C$1.80

|

|

4,809

|

|

May 21, 2024

|

|

Common Shares(17)

|

|

C$1.65

|

|

375,140

|

|

May 21, 2024

|

|

Common Shares(15)

|

|

C$1.40

|

|

5,000

|

|

Date

|

|

Security

|

|

Price

|

|

Number of Securities

|

|

May 21, 2024

|

|

Common Shares(18)

|

|

C$0.66

|

|

450,000

|

|

May 21, 2024

|

|

Common Shares(5)

|

|

C$0.76

|

|

450,000

|

|

May 21, 2024

|

|

Common Shares(19)

|

|

C$2.22

|

|

15,000

|

|

May 22, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

6,300

|

|

May 23, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

10,000

|

|

May 23, 2024

|

|

Common Shares(20)

|

|

C$1.50

|

|

88,500

|

|

May 23, 2024

|

|

Common Shares(17)

|

|

C$1.65

|

|

353,008

|

|

May 23, 2024

|

|

Common Shares(21)

|

|

C$0.16

|

|

100,000

|

|

May 23, 2024

|

|

Common Shares(15)

|

|

C$1.40

|

|

25,000

|

|

May 23, 2024

|

|

Common Shares(12)

|

|

C$1.44

|

|

25,000

|

|

May 27, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

132,100

|

|

May 28, 2024

|

|

Common Shares(17)

|

|

C$1.65

|

|

15,000

|

|

May 28, 2024

|

|

Common Shares(20)

|

|

C$1.50

|

|

31,123

|

|

May 28, 2024

|

|

Common Shares(10)

|

|

C$1.60

|

|

75,000

|

|

May 28, 2024

|

|

Common Shares(9)

|

|

C$1.60

|

|

25,000

|

|

May 28, 2024

|

|

Common Shares(8)

|

|

C$1.80

|

|

2,099

|

|

May 29, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

4,000

|

|

May 30, 2024

|

|

Common Shares(8)

|

|

C$1.80

|

|

13,332

|

|

May 30, 2024

|

|

Common Shares(15)

|

|

C$1.40

|

|

25,000

|

|

May 30, 2024

|

|

Common Shares(9)

|

|

C$1.60

|

|

16,000

|

|

May 30, 2024

|

|

Common Shares(12)

|

|

C$1.44

|

|

25,000

|

|

May 30, 2024

|

|

Common Shares(11)

|

|

C$1.74

|

|

28,000

|

|

May 30, 2024

|

|

Common Shares(22)

|

|

C$2.25

|

|

70,000

|

|

May 30, 2024

|

|

Common Shares(19)

|

|

C$2.22

|

|

135,000

|

|

May 30, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

72,950

|

|

May 31, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

75,000

|

|

June 3, 2024

|

|

Common Shares(20)

|

|

C$1.50

|

|

2,000

|

|

June 3, 2024

|

|

Common Shares(7)

|

|

C$1.60

|

|

12,000

|

|

June 3, 2024

|

|

Common Shares(9)

|

|

C$1.60

|

|

10,000

|

|

June 3, 2024

|

|

Common Shares(11)

|

|

C$1.74

|

|

24,000

|

|

June 3, 2024

|

|

Common Shares(2)

|

|

C$2.00

|

|

157,200

|

|

June 6, 2024

|

|