TIDMANIC

RNS Number : 4787D

Agronomics Limited

20 October 2022

20(th) October 2022

Agronomics Limited

("Agronomics" or the "Company")

Investment in Liberation Labs US $ 20 million Seed Round

Agronomics (ANIC:LSE), the leading listed company focused on the

field of cellular agriculture, is pleased to announce it has today

executed an unconditional subscription agreement to invest up to

US$ 7 million (the "Subscription") in the US$ 20 million Seed

funding round of precision fermentation contract manufacturer

Liberation Labs Holdings Inc ("Liberation Labs"). The Subscription

will be made in tranches with the initial investment of US$ 3.5

million occurring yesterday, and the remaining US$ 3.5 million

subject to call at Liberation Labs' discretion at any time within

90 days of the initial close. Acting as co-lead investor is Siddhi

Capital , a prominent and highly respected investor in innovative

food products and technologies. Other investors including CPT

Capital have also participated with additional investors

anticipated to participate by year end. The Subscription will be

made using cash from the Company's own resources.

In June 2022 , Agronomics invested US$ 627,000 in Liberation

Labs' initial round of financing for a 47% equity interest. Subject

to audit, Agronomics' original investment, inclusive of the initial

close of the Subscription, will be carried at US$ 18.9 million,

including an unrealised gain of US$ 14.8 million. Following the

initial investment of $3.5 million and a 100,000 for 1 stock split

of Liberation Labs shares, the Company will hold a total of

4,700,000 ordinary shares and 1,067,074 seed preferred shares, with

an equity stake of 38.5% on a fully diluted basis. The aggregate

investment will account for approximately 9.7% of Agronomics' 30

September 2022 Net Asset Value (as adjusted for this investment).

The Company will make a further announcement should the second

tranche of the Subscription be advanced.

Liberation Labs was formed to address the acute shortage in

precision fermentation capacity for the production of proteins for

use in food, including dairy, egg and other proteins. In addition

to being in extremely short supply, the fermentation capacity being

used today was built for other purposes, mainly pharmaceuticals,

and does not fit the need of most precision fermentation proteins.

Many of the facilities currently in use are over 40 years old, and

do not have the modern downstream equipment to drive quality,

yield, and production efficiency needed to compete in a global

marketplace. Further, much of this existing infrastructure is

located in Europe, where the sharp increase in energy prices is

calling into question the economic viability of these

facilities.

Since its formation, Liberation Labs has made rapid progress in

building out its team and capabilities and will soon announce a

site in the US Midwest where it intends to construct its first

600,000 litre Launch Facility, the initial step in a plan that has

Liberation Labs targeting the installation of over 24 million

litres of fermentation capacity over the coming decade. The US has

been prioritised given the shortage of contract manufacturing

capacity, the size of the market and because there is an abundance

of competitively priced sugar, power and labour. The market is also

more mature than other major jurisdictions with the US Food &

Drug Administration having already approved the first high

inclusion precision fermentation produced dairy and egg proteins,

from companies such as Perfect Day , Remilk , The EVERY Company and

others, each of which address multi-hundred billion dollar

markets.

Liberation Labs will use the proceeds from the Seed round to

finalise its site selection, complete pre-construction engineering,

order long-lead equipment, and continue to build out its team. The

company further expects to begin the process of contracting

fermentation capacity for its first facility, with an eye towards

having that volume fully committed ahead of a planned 2024

operational launch.

Jim Mellon, executive director of Agronomics commented:-

"We are excited to continue our support of Mark and Etan at

Liberation Labs. We believe they are on a path to deliver the

world's first large scale fermentation facility that is purpose

built for food applications. This large-scale infrastructure is one

of the final bottle necks in the broad-based adoption of precision

fermentation proteins as it unlocks the path to cost

competitiveness with conventional production methods."

Mark Warner, co-founder and CEO of Liberation Labs added:-

"We are thrilled to have expanded our cap table with some of the

best investors in the alternative-protein space. Liberation Labs

will use these funds to continue our heads-down approach towards

getting our first facility up and running by the end of 2024."

Since the Subscription is considered a Substantial Transaction

under AIM Rule 12, this announcement requires certain disclosures

under Schedule Four. Liberation Labs is an early-stage company with

no revenues and operating costs of approximately US$ 75,000 per

month, and total assets as at 30 September 2022 of approximately

US$ 735,000 with no material liabilities.

New Agrarian Company Limited, an affiliate of Agronomics, has

also signed an unconditional subscription agreement to invest up to

US$ 3 million in Liberation Labs on identical terms and tranching

as Agronomics.

About Liberation Labs

Liberation Labs is commercialising precision fermentation with a

global network of purpose built, international manufacturing

facilities that enable the next wave of biotechnology advancements

to produce alternative protein at scale.

Our cutting-edge process combining modern technology and design

brings reliable, first-for-purpose approach, and cost-effective

solutions that meet consumer demand across the world.

Founded by industry pioneers with a combined 50 years of

experience, Liberation Labs is powering a new, innovative way

forward that sets the standard for the precision food fermentation

industry and has a lasting impact on achieving collective

sustainability goals.

About Siddhi Capital

Siddhi Capital is a leading Food and Beverage growth equity firm

that combines its investment and operating expertise to accelerate

growth and unlock value for our stakeholders. They invest in

visionary entrepreneurs and businesses that are reshaping the

landscape of food with innovative products and technologies. For

more information about Siddhi Capital, please visit

www.siddhicapital.co .

About Agronomics

Agronomics is a leading listed alternative proteins company with

a focus on cellular agriculture and cultivated meat. The Company

has established a portfolio of 24 companies at the Pre-Seed to

Series C stage in this rapidly advancing sector. It seeks to secure

minority stakes in companies owning technologies with defensible

intellectual property that offer new ways of producing food and

materials with a focus on products historically derived from

animals. These technologies are driving a major disruption in

agriculture, offering solutions to improve sustainability, as well

as addressing human health, animal welfare and environmental

damage. This disruption will decouple supply chains from the

environment and animals, as well as being fundamental to feeding

the world's expanding population. A full list of Agronomics'

portfolio companies is available at https://agronomics.im/ .

For further information please contact:

Agronomics Beaumont Canaccord Cenkos Peterhouse

Limited Cornish Genuity Securities Capital TB Cardew

Limited Limited Plc Limited

The Company Nomad Joint Broker Joint Broker Joint Broker Public Relations

---------------- ------------- --------------- --------------- ------------------------

Richard Roland Cornish Andrew Potts Giles Balleny Lucy Williams

Reed James Biddle Harry Rees Max Gould Charles Ed Orlebar

Denham Eke Alex Aylen Michael Goodfellow Alistair

(Head of Johnson Walker

Equities)

---------------- ------------- --------------- --------------- ------------------------

+44 (0) 20

7930 0777

+44 (0) +44 (0) +44 (0) +44 (0) +44 (0) +44 (0) 7738

1624 639396 207 628 207 523 207 397 207 469 724 630

info@agronomics.im 3396 8000 8900 0936 agronomics@tbcardew.com

---------------- ------------- --------------- --------------- ------------------------

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCVKLFFLBLFFBV

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

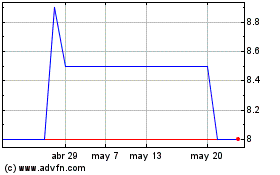

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025