TIDMANIC

RNS Number : 5767L

Agronomics Limited

04 January 2023

4 January 2023

Agronomics Limited

("Agronomics" or the "Company")

Performance Shares issued to Shellbay Investments Limited

Directors' Dealings and Exercise of Warrants

TVR

Further to the publication of its annual results for the

financial year to 30 June 2022 on 20 December 2022, by mutual

agreement with Shellbay Investments Limited ("Shellbay"), the

Company has resolved to issue 14,257,963 New Ordinary Shares of the

Company ("Fee Shares") in settlement of 50% of the fees due to

Shellbay under the Consultancy Agreement for the year to 30 June

2022. The Fee Shares are issued at a price equal to GBP0.16 per Fee

Share (in aggregate equal to GBP2,281,274), being the mid-market

price of Ordinary Shares of the Company at close of markets on the

last day of the relevant period, being 30 June 2022. The Company

has also resolved to transfer GBP2,281,274 cash to Shellbay in

settlement for the remaining 50% balance of the fees due to

Shellbay under the Consultancy Agreement.

Award of Fee Shares and Transfer of Fee Shares to Galloway

Limited

In accordance with consulting and other incentive agreements,

Shellbay has granted 7,114,722 Fee Shares (the "Award Shares") for

nil consideration to certain of its management and advisory

consultants subject to various vesting criteria, including 312,500

Award Shares to Mr Denham Eke, the Finance Director of the

Company.

Shellbay is a company indirectly wholly owned by Mr James

Mellon, a Director of the Company. Immediately on receipt of the

Fee Shares, Shellbay has agreed to transfer the remaining 7,143,241

Fee Shares directly to Galloway Limited ("Galloway"), also

indirectly wholly owned by Mr Mellon. Mr Denham Eke is also a

director of both Galloway and Shellbay.

Following the transfer of the shares to Galloway, Shellbay shall

hold, in aggregate, 12,097,782 Ordinary Shares of the Company.

Following the issue of Fee Shares and transfer of shares to

Galloway, the interests of the Directors in Ordinary Shares is as

set out below:

No. of Ordinary % of current issued

Shares Ordinary Shares

Jim Mellon* 152,820,363 15.40%

---------------- -------------------

Richard Reed** 6,354,412 0.64%

----------------- ---------------- -------------------

David Giampaolo 2,434,783 0.25%

---------------- -------------------

Denham Eke 739,390 0.07%

---------------- -------------------

*Jim Mellon is currently interested in a total of 152,820,363

Ordinary Shares. 139,448,621 are held by Galloway Limited and

12,097,782 are held by Shellbay, companies which are both

indirectly wholly owned by Jim Mellon, and 1,273,960 Ordinary

Shares are held directly by Mr Mellon. Denham Eke is a director of

Galloway Limited and Shellbay Investments Limited.

** Richard Reed is currently interested in 6,354,412 Ordinary

Shares held by Reepa Limited. Reepa Limited is wholly owned by

Richard Reed.

Terms of Shellbay engagement

Shellbay is not paid a fixed annual consultancy fee, but the

Company shall reimburse it for all reasonable and properly

documented direct expenses incurred in performing the services

(including the direct costs of remunerating employees and/or

consultants).

As previously reported, Shellbay is entitled to an annual fee

equal to the value of 15% of any increase between the Company's net

asset value ("NAV") on a per issued share basis at the start of a

reporting period and 30 June each year during the term of its

engagement, thus aligning the interests of Shellbay with those of

the Company. The opening and closing NAV for each period will be

based on the audited financial statements of the Company for the

relevant financial year, with the opening NAV for each reporting

period being the highest NAV per share reported at a financial year

end for the previous reporting periods during the term of the

agreement (establishing a rolling high-watermark for Shellbay to

qualify for such fee). Any increase in NAV per share will then be

applied to the issued share capital at the end of the relevant

period for the purposes of determining the 15% fee.

Further details regarding the terms of Shellbay's engagement by

the Company are set out in the announcement of the Company dated 6

May 2021.

Exercise of Warrants

Pursuant to the receipt of notice for the exercise of warrants,

the Company is issuing 1,142 new Ordinary Shares with a nominal

value of GBP0.000001 each in the capital of the Company ("Shares")

at a subscription price of 30.0p per Share. The Company has

received gross proceeds of GBP342.60.

Admission & Total Voting Rights

Application has been made for the 14,259,105 new Shares (being

the Fee Shares and Warrant Shares) to be admitted to trading on AIM

("Admission"), with Admission expected to occur on or around 6

January 2023. The new Shares will rank pari passu with the existing

Shares, including the right to receive all dividends and other

distributions declared after the date of their issue.

Following the issue of the Fee Shares, the Company's total

issued share capital will comprise 992,244,668 Ordinary Shares,

each with voting rights. This figure may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, securities of the Company under the Financial

Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

About Agronomics

Agronomics is a leading listed alternative proteins company with

a focus on cellular agriculture and cultivated meat. The Company

has established a portfolio of over 20 companies at the Pre-Seed to

Series C stage in this rapidly advancing sector. It seeks to secure

minority stakes in companies owning technologies with defensible

intellectual property that offer new ways of producing food and

materials with a focus on products historically derived from

animals. These technologies are driving a major disruption in

agriculture, offering solutions to improve sustainability, as well

as addressing human health, animal welfare and environmental

damage. This disruption will decouple supply chains from the

environment and animals, as well as being fundamental to feeding

the world's expanding population. A full list of Agronomics'

portfolio companies is available at https://agronomics.im/ .

About Cellular Agriculture

Cellular Agriculture is the production of agriculture products

directly from cells, as opposed to raising an animal for slaughter,

or growing crops. This encompasses cell culture to produce

cultivated meat and materials, and fermentation processes that

harness a combination of molecular biology, synthetic biology,

tissue engineering and biotechnology to massively simplify

production methods in a sustainable manner.

Over the coming decades, the source of the world's food supply

traditionally derived from conventional agriculture is going to

change dramatically. We have already witnessed the first wave of

this shift with the consumer adoption of plant-based alternative

proteins but today, we are on the cusp of an even bigger wave of

change. This is being facilitated by advances in cellular

agriculture. This change is necessary, given scientists claims that

if we maintain existing animal protein consumption patterns, then

we will not meet the Paris Agreement's goal of limiting warming to

1.5 '

AT Kearney, a global consultancy firm, projects that cultivated

meat's market share will reach 35% by 2040. This combined with the

Good Food Institute's estimate that a US $1.8 trillion investment

will be required in order to produce just 10% of the world's

protein using this technology, means that we are on the cusp of a

multi-decade flow of capital to build out manufacturing facilities.

Funding in the field of cellular agriculture is accelerating,

however still less than US$ 4 billion has been invested worldwide

since the industry's inception in 2016.

For further information please contact:

Agronomics Beaumont Canaccord Cenkos Peterhouse

Limited Cornish Genuity Securities Capital TB Cardew

Limited Limited Plc Limited

The Company Nomad Joint Joint Broker Joint Public Relations

Broker Broker

---------- -------------- ------------------ --------------- ------------------------

Richard Reed Roland Andrew Giles Balleny Lucy Williams

Denham Eke Cornish Potts Max Gould Charles Ed Orlebar

James Harry Michael Johnson Goodfellow Alistair Walker

Biddle Rees

Alex Aylen

(Head

of Equities)

---------- -------------- ------------------ --------------- ------------------------

+44 (0) 20 7930

0777

+44 (0) 1624 +44 (0) +44 (0) +44 (0) +44 (0) 7738 724

639396 207 628 207 523 +44 (0) 207 207 469 630

info@agronomics.im 3396 8000 397 8900 0936 agronomics@tbcardew.com

---------- -------------- ------------------ --------------- ------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFZGGMLFMGFZM

(END) Dow Jones Newswires

January 04, 2023 02:00 ET (07:00 GMT)

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

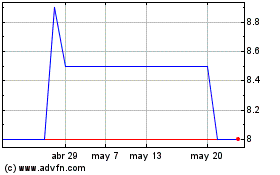

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025