TIDMANIC

RNS Number : 2676N

Agronomics Limited

22 September 2023

22 September 2023

Agronomics Limited

("Agronomics" or the "Company")

Share Buyback Programme announced

The Board of Agronomics announce s that it will execute an

on-market Share buyback programme for an aggregate amount of up to

GBP3 million (the "Buyback Programme"). The term of the Buyback

Programme shall be 6 months, commencing on 2 October 2023. The

Company intends to cancel any repurchased Shares under the

programme unless used to cover obligations under share-based

remuneration arrangements.

The Board notes that the price of the Company's Shares is

currently significantly below the last reported net asset value per

share ("NAV Per Share") of 15.8 pence and believes that the Buyback

Programme will help reduce this discount. In particular, as

reported on 2 August 2023, the Company's unaudited NAV Per Share as

at 30 June 2023 was 15.8 pence per share (whereas the price of the

Company's shares at close of business on 19 September 2023, was 9.9

pence per share, a discount of approximately 37.3%). The Company

reports NAV Per Share on a quarterly basis within 90 days of the

end of each calendar quarter ("Quarterly NAV Statement").

The Buyback Programme will be executed within the limitations of

the existing authority in the Company's Articles of Association.

The Board will authorise each buyback transaction during the

Buyback Programme which will be undertaken by Cavendish Securities

Plc as the Company's joint broker and each such transaction will be

reported and announced once executed.

The Company has determined that in conducting the Buyback

Programme it will not rely on the safe harbour conditions for

trading set out in Article 3(2) and Article 3(3) of the Commission

Delegated Regulation (EU) 2016/1052 (which forms part of domestic

UK law pursuant to the European Union (Withdrawal) Act 2018) and,

as such, the Company may purchase on any trading day materially in

excess of 25 per cent of the average daily volume in the 20 trading

days preceding the date on which the purchase is carried out.

The terms of the Buyback Programme are set out below:

Name of Programme 2023 Share Buyback Programme

Purpose of the Programme To reduce the capital of the issuer

---------------------------------------------

Duration of the Programme 2 October 2023 to 29 March 2024

---------------------------------------------

Maximum amount allocated GBP3.0 million

to the Programme

---------------------------------------------

Maximum monthly amount GBP500,000

allocated to Programme

---------------------------------------------

Maximum price The higher of:

a) the price of the last independent trade;

and

b) the highest current independent purchase

bid on the trading venue where the purchase

is carried out,

SAVE THAT no share shall be bought back

by the Company at a price per share higher

than 75% of the last reported NAV Per Share

published in the Company's most recent

Quarterly NAV Statement.

---------------------------------------------

There is no guarantee that the Buyback Programme will be

implemented in full or that any purchases will be made.

As at the time of this announcement, the Company's total issued

share capital consists of 993,153,870 Ordinary Shares with one

voting right per share. The Company does not hold any Ordinary

Shares in treasury, therefore, the total number of Ordinary Shares

carrying voting rights is 993,153,870 .

The above figure 993,153,870 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

About Agronomics

Agronomics is the leading listed venture capital firm with a

focus on cellular agriculture. The Company has established a

portfolio of over 20 companies at the Pre-Seed to Series C stage in

this rapidly advancing sector. It seeks to secure minority stakes

in companies owning technologies with defensible intellectual

property that offer new ways of producing food and materials with a

focus on products historically derived from animals. These

technologies are driving a major disruption in agriculture,

offering solutions to improve sustainability, as well as addressing

human health, animal welfare and environmental damage. This

disruption will decouple supply chains from the environment and

animals, as well as being fundamental to feeding the world's

expanding population.

About Cellular Agriculture

Cellular Agriculture is the production of agriculture products

directly from cells, as opposed to raising an animal for slaughter

or growing crops. This encompasses cell culture to produce

cultivated meat and materials, and fermentation processes that

harness a combination of molecular biology, synthetic biology,

tissue engineering and biotechnology to massively simplify

production methods in a sustainable manner.

Over the coming decades, the source of the world's food supply

traditionally derived from conventional agriculture is going to

change dramatically. We have already witnessed the first wave of

this shift with the consumer adoption of plant-based alternative

proteins but today, we are on the cusp of an even bigger wave of

change. This is being facilitated by advances in cellular

agriculture. This change is necessary, given scientists' claims

that if we maintain existing animal protein consumption patterns,

then we will not meet the Paris Agreement's goal of limiting

warming to 1.5 .

AT Kearney, a global consultancy firm, projects that cultivated

meat's market share will reach 35% by 2040. This combined with the

Good Food Institute's estimate that a US $1.8 trillion investment

will be required in order to produce just 10% of the world's

protein using this technology, means that we are on the cusp of a

multi-decade flow of capital to build out manufacturing facilities.

Funding in the field of cellular agriculture is accelerating,

however, still, less than US$ 5 billion has been invested worldwide

since the industry's inception in 2016.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

For further information please contact:

Agronomics Beaumont Canaccord Cavendish Peterhouse SEC Newgate

Limited Cornish Genuity Securities Capital

Limited Limited Plc Limited

The Company Nomad Joint Broker Joint Joint Broker Public Relations

Broker

========== ============ ============= =============== =============================

Richard Reed Roland Andrew Giles Lucy Williams Bob Huxford

Denham Eke Cornish Potts Balleny Charles George Esmond

James Harry Rees Michael Goodfellow Anthony Hughes

Biddle Alex Aylen Johnson Alice Cho

(Head of

Equities)

========== ============ ============= =============== =============================

+44 (0) 1624 +44 (0) +44 (0) +44 (0) +44 (0)

639396 207 628 207 523 207 397 207 469

info@agronomics.im 3396 8000 8900 0936 agronomics@secnewgate.co.uk

========== ============ ============= =============== =============================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSNKDBPQBKDNCB

(END) Dow Jones Newswires

September 22, 2023 02:00 ET (06:00 GMT)

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

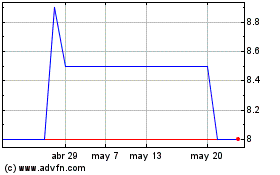

Agronomics (AQSE:ANIC.GB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024