Marula Mining Plc Update on the Proposed Dual Listings in Nairobi and Johannesburg

22 Diciembre 2023 - 6:40AM

UK Regulatory

TIDMMARU

Marula Mining PLC

("Marula" or the "Company")

London, 22 December 2023

Update on the Proposed Dual Listings in Nairobi and Johannesburg

Marula Mining (AQSE: MARU), an African focused mining and development company,

is pleased to provide an update on the Company's planned dual listing of its

securities on the Johannesburg Stock Exchange("JSE") and the Nairobi Securities

Exchange Plc ("NSE").

Highlights:

· Marula Mining is proceeding with its plans to list its securities on the

Growth Enterprise Market Segment ("GEMS") of the NSE and on the AltX Market of

the JSE as initially announced on 29 June 2023.

· Faida Investment Bank, one of the leading investment banks in Kenya, has

been appointed as the Company's Nominated Advisor and Sponsoring Stockbroker and

is managing the process in preparation for the listing on the Growth Enterprise

Market Segment of the NSE.

· South African corporate advisory group Bridge Capital Advisors Pty Limited

("Bridge Capital") has continued in its role as the Company's Corporate Advisor

and is managing and overseeing the proposed listing on the JSE.

· All other key consultants and advisors including share registrars in the two

jurisdictions and legal advisors have also been appointed and are progressing

with the necessary listing activities.

· The proposed dual listings and plans to move Marula's primary listing in

London to the Standard List of the London Stock Exchange ("LSE") forms part of

the Company's broad strategy to establish itself as one of the leading African

battery metals focused mining, exploration and development companies.

· The Board is confident that the proposed listings will attract investors in

both Kenya and South Africa and will be supported by the Company's key

stakeholders in these regions.

· On the NSE, Marula will become the first metals mining company to be listed

on the Exchange and one of only a few dual listed companies, and through its

listing the Company believes it will offer local and international investors

exposure to Kenya's and Africa's mining sectors and economic growth.

· The NSE is a founder member of the African Securities Exchange Association

and the East African Securities Exchanges Association. It is a full member of

the World Federation of Exchanges and the Association of Futures Markets, and a

partner Exchange in the United Nations Sustainable Stock Exchanges Initiative.

· In addition, through its proposed dual listings on both the NSE and JSE, the

Company will benefit from the NSE and JSE participation in the African Exchanges

Linkage Project, which allows investors in Africa cross-border trading between

Africa's leading participating stock exchanges.

· The planned listing on both the JSE and NSE demonstrates Marula's commitment

to the key countries it operates in and to its stakeholders within the African

continent and recognises the vast potential and growth of the continent's

capital markets.

· The Company is now finalising all other outstanding regulatory requirements

in Kenya and South Africa to allow the proposed listings to proceed.

· The dual listings on the NSE and JSE are expected to now be completed in Q1

2024.

Commenting on the progress of the listings, Mr. Jason Brewer, Marula Mining PLC

CEO said, "The decision to list on both the NSE and JSE is a testament of our

commitment to become a truly African focused mining and development company in

the battery metals sector. The dual listing will enable Marula Mining to expand

its reach within the countries that we operate in and ensure that all

stakeholders share in our success.

"The dual listing also provides the opportunity to increase our visibility to

the market and will allow us to raise the growth capital needed to develop our

projects. Additionally, we will be able to establish Marula as one of the

leading battery metals focused mining and development company that is truly

African focused.

"Whilst we had hoped that these dual listings would have been completed earlier

in the year, our focus in 2023 has been on the accelerated development of our

battery metals projects to ensure we are now able to attract strong investors

to these dual listings and demonstrate our ability to bring high value mining

projects into production. The dual listings are in addition to our planned move

of our primary listing in London to the Standard List of the LSE, which we are

continuing to progress as well." he added.

"I look forward to updating the shareholders, old and new, on our progress with

the dual listing as we seek to return shareholder value."

Reiterating his remarks, Mr. Geoffrey Odundo, Chief Executive, NSE noted, "The

proposed listing of Marula Mining on the NSE is a welcome development and

underscores NSE's continued leadership as the preferred financial market

infrastructure platform for companies seeking to raise initial and ongoing

capital in Africa."

"The planned listing will enable Marula Mining to access the wide pool of

individual and institutional investors in Kenya, supporting the Company's

capital raising initiatives to accelerate its growth and development in Kenya."

he added.

Mr Bob Karina, the Chairman of Faida Investment Bank noted, "Through the listing

of Marula Mining on the NSE, investors will have an opportunity to diversify

their investments and participate in the mining sector, an asset class that has

not been previously available locally to investors in Kenya and the region."

Further Information

The Company's decision to list on the JSE and NSE is driven by the objective to

provide wider access for stakeholders in the region the Company operates in and

provides Marula with the opportunity to increase its market visibility and

offers a wider range of shareholders to invest in the Company. Additionally,

this will provide the Company the chance to raise the necessary growth capital

to develop the Company's portfolio, and to deliver on shareholder value. Marula

expects the listings to be completed in Q1 2024 at the earliest opportunity.

In addition to the dual listing on the JSE and NSE, Marula Mining plans to move

its primary listing in London to the Standard List of the LSE.

The Directors of Marula are responsible for the contents of this announcement.

This announcement contains inside information for the purposes ofUKMarket Abuse

Regulation.

About Marula Mining

Marula Mining (AQSE: MARU) is an African focused battery metals investment and

exploration company and has interests in several high value mine projects in

Africa; the Blesberg Lithium and Tantalum Mine and Korridor Lithium Project in

South Africa, the Kinusi Copper Mine, the Nyorinyori Graphite Project, the

NyoriGreen Graphite Project and the Bagamoyo Graphite Project all in Tanzania

and the Nkombwa Hill Project in Zambia. As we advance operations at these

battery metals focused projects, Marula will continue to build and expand its

interests in other high-quality projects in Africa.

Marula's strategy is to identify and invest in advanced and high-value mining

projects throughout East, Central and Southern Africa that the Directors believe

would deliver returns for its shareholders. The Board and management team aims

to establish Marula as a socially and environmentally responsible, sustainable,

and profitable producer of critical metals and commodities that are of

increasingly strategic importance to modern technologies and the global economy.

Marula's shares are traded on the AQUIS Stock Exchange (AQSE), Marula is

exploring opportunities to admit its shares to trading on the London Stock

Exchange plc's Standard List or AIM Market, Kenya's Nairobi Securities Exchange

and South Africa's Johannesburg Stock Exchange.

For enquiries contact:

+--------------------------------------+------------------------------+

|Marula Mining PLC |Email : jason@marulamining.com|

| | |

|Jason Brewer, |Email : info@marulamining.com |

| | |

|Chief Executive Officer | |

| | |

|Faith Kinyanjui Mumbi | |

| | |

|Investor Relations | |

+--------------------------------------+------------------------------+

|AQSE Corporate Adviser |+44 (0)20 7213 0880 |

| | |

|Cairn Financial Advisers LLP, | |

| | |

|Liam Murray / Ludovico Lazzaretti | |

+--------------------------------------+------------------------------+

|Broker |+44 (0)20 7469 0930 |

| | |

|Peterhouse Capital Limited, | |

|Charles Goodfellow / Duncan Vasey | |

+--------------------------------------+------------------------------+

|Financial PR and IR |+44 (0)20 7138 3204 |

| | |

|BlytheRay | |

| | |

|Tim Blythe / Megan Ray / Said Izagaren| |

+--------------------------------------+------------------------------+

Caution:

Certain statements in this announcement, are, or may be deemed to be, forward

looking statements. Forward looking statements are identi?ed by their use of

terms and phrases such as "believe", "could", "should" "envisage",

"estimate", "intend", "may", "plan", "potentially", "expect", "will"

or the negative of those, variations or comparable expressions, including

references to assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations and

assumptions regarding the Company's future growth, results of operations,

performance, future capital and other expenditures (including the amount, nature

and sources of funding thereof), competitive advantages, business prospects and

opportunities. Such forward looking statements re?ect the Directors' current

beliefs and assumptions and are based on information currently available to the

Directors.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 22, 2023 07:40 ET (12:40 GMT)

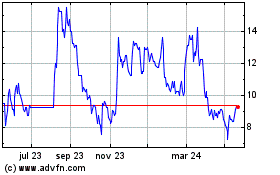

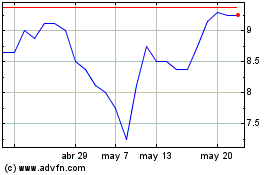

Marula Mining (AQSE:MARU)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Marula Mining (AQSE:MARU)

Gráfica de Acción Histórica

De May 2023 a May 2024