TIDMMTC

RNS Number : 7791O

Mothercare PLC

11 February 2021

MOTHERCARE PLC

(incorporated and registered in England and Wales with

registered number 01950509)

APPIX TO SCHEDULE ONE ANNOUNCEMENT

FURTHER INFORMATION RELATING TO MOTHERCARE PLC IN CONNECTION

WITH

THE PROPOSED ADMISSION OF ITS ORDINARY SHARES TO TRADING ON

AIM

This Appendix has been prepared in accordance with the

requirements of Rule 2 of, and Schedule One (including the

Supplement to Schedule One for a quoted applicant) to, the AIM

Rules that, for a quoted applicant, all information that is

equivalent to that required for an 'admission document' which is

not currently public shall be made public. Information which is

public includes, without limitation, all information available in

respect of the Company accessed at the London Stock Exchange

(available at www.londonstockexchange.com ), all information

available in respect of the Company on the FCA's National Storage

Mechanism (available at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism ) , all

information available in respect of the Company at the website of

Companies House at www.beta.companieshouse.gov.uk/ , all

information available on the Company's website (

www.mothercareplc.com ) and the contents of this Appendix (together

comprising the "Company's Public Record").

Definitions used in this Appendix are set out on pages 3 -

5.

AIM

AIM is a market designed primarily for emerging or smaller

companies to which a higher investment risk tends to be attached

than to larger or more established companies. AIM securities are

not admitted to the Official List of the FCA.

A prospective investor should be aware of the risks of investing

in such companies and should make the decision to invest only after

careful consideration and, if appropriate, consultation with an

independent financial adviser.

Each AIM company is required pursuant to the AIM Rules to have a

nominated adviser. The nominated adviser is required to make a

declaration to the London Stock Exchange on admission in the form

set out in Schedule Two to the AIM Rules for Nominated

Advisers.

The London Stock Exchange has not itself examined or approved

the contents of this document.

Nominated Adviser and Brokers

Numis Securities Limited ("Numis"), which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

as nominated adviser and joint broker to the Company in connection

with the proposed AIM Admission and will not be responsible to any

person other than the Company for providing the protections

afforded to its customers or for advising any other person on the

contents of this Appendix or in connection with the proposed AIM

Admission. The responsibilities of Numis as the Company's nominated

adviser under the AIM Rules and the AIM Rules for Nominated

Advisers are owed solely to the London Stock Exchange and are not

owed to the Company or to any Director or to any other person in

respect of such person's decision to acquire shares in the Company

in reliance on any part of this Appendix. Numis does not accept any

responsibility whatsoever for the contents of this Appendix, and no

representation or warranty, express or implied, is made by Numis

with respect to the accuracy or completeness of this Appendix or

any part of it. No representation or warranty, express or implied,

is made by Numis as to any of the contents of this Appendix and

Numis has not authorised the contents of any part of this Appendix

and accepts no liability whatsoever for the accuracy of any

information or opinions contained in this Appendix or for the

omission of any material information from this Appendix for which

the Company and the Directors are solely responsible.

finnCap Ltd. ("finnCap"), which is authorised and regulated in

the United Kingdom by the FCA, is acting as joint broker to the

Company in connection with AIM Admission and will not be

responsible to any person other than the Company for providing the

protections afforded to its customers or for advising any other

person on the contents of this Appendix or in connection with AIM

Admission. finnCap has not authorised the contents of any part of

this Appendix for the purposes of the AIM Rules. finnCap does not

accept any responsibility whatsoever for the contents of this

Appendix, and no representation or warranty, express or implied, is

made by finnCap with respect to the accuracy or completeness of

this Appendix or any part of it.

Responsibility

The Company and the Directors, whose names and functions appear

on page 2 of this Appendix, accept responsibility, individually and

collectively, for the information contained in this Appendix

including individual and collective responsibility for compliance

with the AIM Rules. To the best of the knowledge and belief of the

Directors (having taken all reasonable care to ensure that such is

the case), the information contained in this Appendix, for which

they are responsible, is in accordance with the facts and does not

omit anything likely to affect the import of such information.

DIRECTORS, COMPANY SECRETARY, REGISTERED OFFICE, AND

ADVISERS

Directors Clive Whiley (Non-executive

Chairman)

Andrew Cook (Chief Financial

Officer)

Brian Small (Non-executive

Director)

Gillian Kent (Non--executive

Director)

Mark Newton--Jones (Non-executive

Director)

Company Secretary Lynne Medini

Registered Office Mothercare plc

Westside 1

London Road

Hemel Hempstead

Hertfordshire HP3 9TD

+44 (0)1923 241 000

Joint Corporate Broker Numis Securities Limited

and Nominated Adviser The London Stock Exchange

Building

10 Paternoster Square

London

EC4M 7LT

Joint Corporate Broker finnCap Ltd.

One Bartholomew Close

London

EC1A 7BL

Legal Advisers to the DLA Piper UK LLP

Company 160 Aldersgate Street

London

EC1A 4HT

Legal Advisers to the Simmons & Simmons LLP

Nominated Adviser Citypoint

One Ropemaker Street

London

EC2Y 9SS

Auditors and Reporting Grant Thornton UK LLP

Accountant 30 Finsbury Square

London

EC2A 1AG

Registrar Equiniti Limited

Aspect House

Spencer Road

Lancing, West Sussex

BN99 6DA

DEFINITIONS

The definitions set out below apply throughout this document

unless the context requires otherwise.

"1798 Volantis" 1798 Volantis Fund Ltd;

"1798 Small Cap" 1798 Small Cap UK Best Ideas Fund Ltd;

"2018 Prospectus" the Prospectus dated 9 July 2018 published

by the Company in relation to, inter

alia, the placing and open offer of

new Ordinary Shares in the Company

to the premium listing segment of the

Official List and to trading on the

Main Market of the London Stock Exchange;

"2018 Shareholder Loans" shareholder loans from DC Thomson,

Lombard Odier (acting for LMAP Epsilon

and 1798 Volantis) and Blake Holdings,

each of which being convertible into

Ordinary Shares at the option of such

Shareholder and which were approved

by Shareholders at the general meeting

of the Company on 26 July 2018;

"2019 Shareholder Loans" the shareholder loans from Lombard

Odier (acting for 1798 Small Cap and

1798 Volantis) and Blake Holdings,

each of which being convertible to

New Ordinary Shares at the option of

such Shareholder;

"2020 Annual Report the Company's annual report and accounts

& Accounts" for the 52 weeks ended 28 March 2020;

" 2021 Circular " the Circular dated 25 January 2021

published by the Company in relation

to, inter alia, the Delisting, the

CULS, the Warrants, the Waiver and

the AIM Admission;

" 2020 Interim Results the Company's interim results for the

" 26 weeks ended 10 October 2020, announced

on 26 November 2020;

"AIM" AIM, a market operated by the London

Stock Exchange;

"AIM Admission" the admission of the Ordinary Shares

to trading on AIM becoming effective

in accordance with the AIM Rules;

"AIM Rules" the "AIM Rules for Companies", published

by the London Stock Exchange from time

to time;

"Alshaya" the Alshaya Group, the Group's most

significant Franchise Partner;

"Appendix" this document;

"Articles of Association" the articles of association of the

or "Articles" Company, as amended from time to time;

"Blake Holdings" Blake Holdings Limited;

"Board" the board of directors of the Company

from time to time;

"Boots" Boots UK Limited;

"certificated" or "in a share or other security which is

certificated form" not in uncertificated form (that is,

not in CREST);

"Companies Act" the Companies Act 2006, as amended,

modified or re--enacted from time to

time;

"Company" Mothercare plc, a company incorporated

in England and Wales with registered

no. 01950509;

"Company's Public Record" information which is in the public

domain and which includes, without

limitation, all information available

in respect of the Company accessed

at the London Stock Exchange (available

at www.londonstockexchange.com ) ,

all information available in respect

of the Company on the FCA's National

Storage Mechanism (available at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

), all information available in respect

of the Company at the website of Companies

House at www.beta.companieshouse.gov.uk/

and all information available on the

Company's website at www.mothercareplc.com

;

"Concert Party" Richard Griffiths, Michael Bretherton,

James Ede-Golightly Blake Holdings

and Serendipity Capital Limited;

"Conversion Shares" up to 189,644,132 new Ordinary Shares

to be issued by the Company pursuant

to the conversion of the Shareholder

Loans into new Ordinary Shares pursuant

to the CULS Arrangement (excluding

any new Ordinary Shares which may be

issued upon exercise of any Warrants);

"Covid-19" the disease caused by a novel strain

of coronavirus;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001 No. 3755), as amended

from time to time;

"CULS" the GBP13.5 million convertible unsecured

loans issued pursuant to the Shareholder

Loans;

"CULS Arrangement" the arrangements entered into on 26

November 2020 by the Company with Blake

Holdings, DC Thompson and Lombard Odier

(on behalf of 1798 Volantis, LMAP Epsilon

and 1798 Small Cap) in connection with

the irrevocable commitment to convert

the existing Shareholder Loans into

Ordinary Shares and to enter into Warrants

over an additional 14,999,997 new Ordinary

Shares with the holders of the Shareholder

Loans;

"DB Schemes" the Company's defined benefit pension

schemes being (i) the Mothercare Executive

Pension Scheme; and (ii) the Mothercare

Staff Pension Scheme;

"DC Thomson" DC Thomson & Co Limited;

"Delisting" the proposed cancellation of the listing

of the Company's Ordinary Shares on

the Of cial List and from trading on

the London Stock Exchange's main market

for listed securities;

"Directors" the directors of the Company at the

date of this document and "Director"

means any one of them;

"EBITDA" earnings before taxation, net financing

costs, depreciation and amortisation;

"Equiniti" Equiniti Limited;

"Euroclear" Euroclear UK & Ireland Limited;

"Existing Ordinary Shares" the ordinary shares of 1 pence each

in the capital of the Company;

"FCA" or "Financial the Financial Conduct Authority of

Conduct Authority" the United Kingdom or any successor

body or bodies carrying out the functions

currently carried out by the Financial

Conduct Authority;

"finnCap" finnCap Ltd;

"Franchise Partner" the third parties with whom the Group

has entered into franchise arrangements

to sell its products in territories

other than the UK (including, for the

avoidance of doubt, the Group's joint

venture in Ukraine);

"FSMA" the Financial Services and Markets

Act 2000, as amended;

"GDPR" the EU General Data Protection Regulation

(EU) 2016/679;

"GBB" GB Europe Management Services Limited

;

"General Principles" the principles set out within section

B1 of the Takeover Code;

"Group" the Company together with its subsidiaries

and subsidiary undertakings;

"IFRS" International Financial Reporting Standards

as adopted for use by the EU;

"LMAP Epsilon" LMAP Epsilon Limited;

"Lombard Odier" Lombard Odier Asset Management (USA)

Corp;

"London Stock Exchange" London Stock Exchange plc or its successor(s);

"MGB" Mothercare Global Brand Limited;

"Mothercare" or "the Mothercare plc, a company incorporated

Company" in England and Wales with registered

number 01950509, whose registered office

is at Westside 1, London Road, Hemel

Hempstead, Hertfordshire HP3 9TD;

"Nominated Adviser & the agreement dated 11 February 2021

Broker Agreement" entered into between the Company, the

Directors and Numis, details of which

are set out in paragraph 10.1 of this

Appendix;

"Numis" Numis Securities Limited;

"Official List" the list maintained by the UK Listing

Authority in accordance with section

74(1) of FSMA for the purposes of Part

VI of FSMA;

"Ordinary Shares" ordinary shares of 1 pence each in

the capital of the Company;

"Pounds" or "GBP" or the lawful currency of the United Kingdom;

"pound sterling" or "pounds sterling";

"QCA Code" the corporate governance code for small

and mid-size companies issued by the

Quoted Company Alliance, as amended

from time to time;

"Reference Date" 10 February 2021, the latest practicable

date prior to publication of this document;

"Registrar" Equiniti Limited;

"Registrar of Companies" the Registrar of Companies in England

and Wales;

"Schedule One Announcement" the announcement by the Company pursuant

to Rule 2 and Schedule One to the AIM

Rules to Companies, to which this Appendix

is attached, in connection with AIM

Admission;

"SDRT" stamp duty reserve tax;

"Shareholder Loans" the 2018 Shareholder Loans and the

2019 Shareholder Loans;

"Shareholder(s)" holder(s) of Ordinary Shares;

"subsidiary" has the meaning given in section 1159

of the Companies Act;

"subsidiary undertaking" has the meaning given in section 1162

of the Companies Act;

"Takeover Code" the City Code on Takeovers and Mergers

issued by the Takeover Panel, as amended

from time to time;

"Takeover Panel" the Panel on Takeovers and Mergers;

"uncertificated" or a share or other security recorded

"in uncertificated form" on the relevant register of the share

or security concerned as being held

in uncertificated form in CREST and

title to which by virtue of the CREST

Regulations may be transferred by means

of CREST;

"United Kingdom" or the United Kingdom of Great Britain

"UK" and Northern Ireland;

"Waiver" the waiver granted by the Takeover

Panel (subject to the passing of Resolution

4) in respect of the obligation which

would otherwise arise in respect of

the Concert Party to make a mandatory

general offer pursuant to Rule 9 of

the Takeover Code as a result of the

issue and allotment to it of Conversion

Shares and new Ordinary Shares on exercise

of its Warrants;

"Warrants" the warrants to be issued by the Company

to Blake Holdings, DC Thompson and

Lombard Odier (on behalf of 1798 Volantis,

LMAP Epsilon and 1798 Small Cap) over

an aggregate of 14,999,997 new Ordinary

Shares as part of the CULS Arrangement.

INFORMATION RELATING TO MOTHERCARE PLC

1. INFORMATION AND STATUS ON THE COMPANY

1.1 The Company was incorporated and registered in England and

Wales on 26 September 1985 with registered number 01950509 as a

private limited company with the name '15(th) Legibus plc'. The

Company changed its name to 'Storehouse plc' on 6 December 1985 and

was subsequently re-named 'Mothercare plc' on 3 August 2000.

1.2 The principal legislation under which the Company operates

and which the Existing Ordinary Shares have been, and the new

Ordinary Shares will be, issued is the Companies Act and

regulations made thereunder. The Company is a public limited

company and, accordingly, the liability of its members is limited

to the amount paid up or to be paid up on their shares.

1.3 The Company is domiciled in the United Kingdom.

1.4 The business of the Group and its principal activity is the

operation as a global brand for parents and young children.

Presently and going forwards, the Group's revenue principally

derives from royalties payable on global Franchise Partners retail

sales.

1.5 The legal entity identifier of the Company is 213800ZL6RPV9Z9GFO74 .

1.6 The Company is the holding company for a number of

subsidiaries, and the Group an investor in one joint venture,

details of which are set out in Note 13 (Subsidiaries and joint

ventures) on page 87 of the 2020 Annual Report & Accounts,

which form part of the Company's Public Record. MGB, a wholly-owned

subsidiary of the Company, is a UK company incorporated and

registered in England and Wales and the main trading company within

the Group.

2. SHARE CAPITAL OF THE COMPANY

2.1 The Company does not have any authorised share capital and

does not place any limit on the number of shares which the Company

may issue.

2.2 The issued fully paid up share capital of the Company: (i)

as at the Reference Date ; and (ii) as it is expected to be

following the conversion of the Shareholder Loans in full shortly

after, the date of the AIM Admission, is as set out below:

Number of Ordinary Nominal Amount

Shares

At the date of this 374,192,494 GBP3,741,924.94

Appendix and on Admission

------------------- ----------------

Post AIM Admission 563,836,626 GBP5,638,366.26

following conversion

of the CULS

------------------- ----------------

2.3 In addition, the Company will enter into the Warrants with

the holders of the CULS over an additional aggregate number of

14,999,997 Ordinary Shares (representing 4.01% of the Company's

existing issued share capital).

2.4 All Ordinary Shares in the capital of the Company are

created under the Companies Act, registered and may be held in

either certificated or uncertificated form.

2.5 The ISIN number for the Ordinary Shares is GB0009067447.

2.6 The Directors were given the authority and power to allot

and issue all of the new Ordinary Shares in connection with the

conversion of the Shareholder Loans and the exercise of the

Warrants, pursuant to Resolution 2, Resolution 3 and in respect of

the conversion of Blake Holdings only, Resolution 4 of the

Shareholders of the Company passed on 10 February 2021. Resolution

1 was also passed on 10 February 2021 in connection with the

Delisting and the AIM Admission. The new Ordinary Shares will rank

pari passu in all respects with the Existing Ordinary Shares and

will rank in full for all dividends and other distributions

thereafter declared, made or paid on the ordinary share capital of

the Company.

2.7 The Company's Existing Ordinary Shares are currently

admitted to listing on the FCA's Official List (premium listing

segment) and to trading on the London Stock Exchange's Main Market,

having first been so admitted on 8 January 1986. Application will

be made to the London Stock Exchange for both the Existing Ordinary

Shares and the new Ordinary Shares to be admitted to trading on

AIM. It is expected that admission of the Existing Ordinary Shares

and the new Ordinary Shares will become effective and trading in

the Existing Ordinary Shares and the new Ordinary Shares will

commence on AIM on or around 12 March 2021 and that admission of

the Existing Ordinary Shares to listing on the FCA's Official List

(premium listing segment) and to trading on the London Stock

Exchange's Main Market will simultaneously be cancelled on the same

date. The Existing Ordinary Shares and the new Ordinary Shares will

not be admitted to trading on any other investment exchange.

2.8 As at the Reference Date, no Ordinary Shares were held by or

on behalf of the Company. However, Mothercare Employees' Share

Trustee Limited, held 5,986 Mothercare plc shares in trust on 28

March 2020 (representing 0.0016% of the Company's existing issued

share capital) (30 March 2019: 5,986 shares). A separate trust, the

Mothercare Employee Trust, held 925,342 shares on 28 March 2020

(representing 0.25% of the Company's existing issued share capital)

(30 March 2019: 988,022 shares).

2.9 Save for awards and options granted by the Company under the

share schemes detailed below and the Warrants detailed above, no

person has any rights to purchase the unissued share capital of the

Company.

2.10 Further information on the share capital of the Company is

set out within paragraph 3 (Information on the share capital) of

Part X (Additional Information) of the 2018 Prospectus and in the

Company's Public Record.

3. ARTICLES OF ASSOCIATION

3.1 A summary of the principal provisions of the Articles

(adopted on 18 July 2013 and amended on 26 July 2018) is contained

in paragraph 12 (Summary of the Articles of Association) of Part X

(Additional Information) of the 2018 Prospectus, which forms part

of the Company's Public Record, and which may be accessed at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

3.2 A complete copy of the Articles may be accessed at: www.mothercareplc.com .

4. RISK FACTORS

The following specific risk factors relating to the business and

operations of the Group and to the Ordinary Shares should be

considered carefully in evaluating whether to make an investment in

the Company. An investment in the Company is only suitable for

investors who are capable of evaluating the risks and merits of

such investment and who have sufficient resources to bear any loss

which might result from such investment. If you are in any doubt as

to the action you should take, you should consult a professional

adviser authorised under the FSMA who specialises in advising on

the acquisition of shares and other securities. This summary of

risk factors is not intended to be exhaustive.

4.1 Risks relating to the business and operations of the Group

(i) Liquidity risk

Global trading challenges arising from Covid-19 could result in

the Group not generating the cash as forecasted. Failure to control

cash management and working capital may result in breaches to

banking covenants and a lack of ability to meet the Group's

strategic intentions. The current Covid-19 impact and predicted

global trade decline may continue to impact Franchise Partner sales

and result in a margin and revenue squeeze. A reduced number of

global Franchise Partners could impact revenue available and limit

future growth of the business.

(ii) Dependency on a small number of partners

Since 2019, the Group's partner base has contracted, by design,

by a third resulting in a smaller footprint for MGB. Whilst this

reduction took out some smaller unprofitable partners, the Group

now has a greater reliance on fewer key Franchise Partners, such as

Alshaya and Boots. The success of the Group is directly dependent

upon their success. Any damage to, or loss of, the Group's

relationship with key Franchise Partners could have a material

impact on the success of the MGB franchise model and therefore its

results of operation or financial condition.

(iii) New business model

The UK administration and resulting creation of MGB means that

the business has substantially changed. The new business model and

purpose may not be clear to all partners and potential partners

impacting the Group's ability to grow the business and resulting in

poor financial results. A lack of articulation of the new business

model may result in: (i) a lack of clarity around MGB's purpose and

resultant inability to attract new partners, (ii) reduced profit

and increased international debt, (iii) pricing challenges and/or

(iv) poor buy-in from existing partners impacting long term

profitability of the Group.

(iv) Legacy technology

MGB's dependency on legacy IT systems and potential failure of

or attack on those could result in the loss of the Group's ability

to operate. A failure of the IT infrastructure could result in an

inability to support the global partners to trade effectively. Any

such failure or attack relating to the warehousing systems or

finance systems, especially, would impact operational efficiency of

the Group.

(v) Regulatory and legal

A failure to comply with increasing regulatory requirements by

MGB or any of the Group's partners could result in brand damage,

fines or impact our ability to operate. MGB is reliant on

manufacturers, suppliers and distributors to comply with

employment, environmental and other laws. Increasing regulatory

pressure (GDPR, EUTR, Modern Slavery Act) requires monitoring and

reporting. Should any of the Group's partners (franchise or

manufacturing partners) breach any such regulations damage to our

brand could occur. Security breaches of Franchise Partner customer

data could result in privacy issues (including financial fines) and

a lack of trust in the brand by customers and partners.

(vi) Challenging global economic and political conditions

MGB may be negatively affected by challenging economic

conditions and political developments affecting the international

markets in which it operates. Economic and political uncertainty

enveloping Europe, the Middle East, and those dependant on China

could have a material adverse effect on the Group's business. The

impacts of Covid-19 on global economies, along with rising tensions

could impact the Franchise Partners' ability to operate

successfully, therefore impacting on the Group's revenue.

(vii) Brand, reputation and relationships

As a franchisor, the Group's brand is its main asset. Failure to

create a strong and desirable brand will negatively impact the

Group's ability to operate a successful franchisor model. The

franchisor model is built upon successful relationships with the

Group's partners. Should these be negatively impacted, the model

may not be successful in the longer term. The brand could be

impacted by (i) product failures and/or ineffective management of

product incidents, (ii) public scandals relating to any of the

Group's partners, (iii) inappropriate behaviours and/or (iv) data

breaches. The relationships could also be impacted by global trade

deterioration.

4.2 Financial risks

(i) Foreign currency risk

All International sales to franchisees are invoiced in Pounds

sterling or US dollars. The Group therefore has some currency

exposure on these sales, but they are used to offset or hedge in

part the Group's US dollar denominated product purchases.

(ii) Credit risk

The Group has exposure to credit risk inherent in its trade

receivables. The Group has no significant concentration of credit

risk. The Group operates effective credit control procedures in

order to minimise exposure to overdue debts. Before accepting any

new trade customer, the Group obtains a credit check from an

external agency to assess the credit quality of the potential

customer and then sets credit limits on a customer by customer

basis. IFRS 9 'Financial Instruments' has been applied such that

receivables balances are held net of a provision calculated using a

risk matrix, taking micro and macro-economic factors into

consideration.

4.3 Risks relating to the Ordinary Shares

(i) The price of the Ordinary Shares may fluctuate

The value of an investment in the Ordinary Shares may go down as

well as up. The price of the Ordinary Shares may fall in response

to a range of external factors including the results of the Group,

appointments to and resignations from the board of directors and

executive management team, speculation in the market regarding the

Group's business or other events affecting the Group and general

stock market conditions. In addition, significant sales of Ordinary

Shares by major Shareholders, could have a material adverse effect

on the market price of Ordinary Shares as a whole.

(ii) Dilution of shareholding in the Company

The conversion of the CULS and the exercise of the Warrants

will, and any future non pre-emptive issue of shares will further,

dilute the holdings of Shareholders and could adversely affect the

market price of Ordinary Shares.

(iii) There is no guarantee that the Company will pay dividends

The Company has not paid dividends on the Ordinary Shares since

3 February 2012 and may not be able to declare and pay any

dividends in the future. Under the agreement reached with the

Pension Protection Fund, the Company will also have to make cash

payments to the pension schemes if the Company makes divided

payments to its Shareholders.

(iv) Investment in AIM securities

An investment in companies whose shares are traded on AIM is

perceived to involve a higher degree of risk and be less liquid

than an investment in companies whose shares are listed on the

Official List. AIM is a market designed primarily for emerging or

smaller companies. An investment in the Ordinary Shares may be

difficult to realise. Existing and prospective investors should be

aware that the value of an investment in the Company may go down as

well as up and that the market price of the Ordinary Shares may not

reflect the underlying value of the Company. Investors may realise

less than their investment. Further, a quotation on AIM will afford

shareholders a lower level of regulatory protection than that

afforded to shareholders in a company with its shares listed on the

premium segment of the Official List.

5. INformation on directors

5.1 As at the date of this Appendix and immediately following

AIM Admission becoming effective in accordance with the AIM Rules,

the interests (including related financial products as defined in

the AIM Rules) of the Directors (including persons connected with

the Directors within the meaning of section 252 of the Companies

Act and any member of the Director's family (as defined in the AIM

Rules)) in the issued share capital of the Company are as

follows:

Director Legally LTIP awards STIP deferred SAYE (unvested)

owned Ordinary (unvested) shares (unvested)

Shares

Executive Director

Andrew Cook 862,375 3,299,601 N/A 180,000

Non--executive

Directors

Clive Whiley 1,225,890 774,110 N/A Nil

Brian Small Nil N/A N/A N/A

Gillian Kent Nil N/A N/A N/A

Mark Newton-Jones 2,796,710 752,486 Nil Nil

5.2 Save as stated above:

(i) none of the Directors (nor any person connected with any of

them within the meaning of section 252 of the Companies Act) has

any interest, whether beneficial or non-beneficial, in the share or

loan capital in the Company or any company in the Group or in any

related financial product (as defined in the AIM Rules) referenced

to the Ordinary Shares;

(ii) there are no outstanding loans granted or guarantees

provided by any member of the Group to or for the benefit of the

Directors or provided by any Director to any member of the

Group;

(iii) none of the Directors has any interest, direct or

indirect, in any assets which have been or are proposed to be

acquired or disposed of by, or leased to, any member of the

Group;

(iv) none of the Directors has any option or warrant to

subscribe for any shares in the Company; and

(v) none of the Directors has any interest, direct or indirect,

in any contract or arrangement which is or was unusual in its

nature or conditions or significant to the business of the Group

taken as a whole, which were effected by any member of the Group

and which remains in any respect outstanding or unperformed.

5.3 The Directors hold, or have during the five years preceding

the date of this Appendix held, the following directorships or

partnerships:

Director Age Current Directorships/Partnerships Past Directorships/Partnerships

Clive Whiley 60 Dignity plc Grand Harbour Marina

Y-Lee Limited plc

China Venture Capital Camper & Nicholsons

Management Limited Marina Investments

First China Venture Limited

Capital Limited Stanley Gibbons Group

plc

Mallett Inc

Evolution Securities

China Limited

Evolution Securities

Asia Limited

Dreweatts 1759 Limited

--- ---------------------------------- -------------------------------

Andrew Cook 57 Stanley Gibbons Group

Stanley Gibbons Limited

A.H.Baldwin & Sons

Limited

Baldwin's of St James's

Limited

Stanley Gibbons Finance

Limited

Stanley Gibbons (Guernsey)

Ltd

Dreweatts 1759 Limited

Orchard & Shipman

Group Limited

Kiosk Limited

--- ---------------------------------- -------------------------------

Mark Newton-Jones 53 INGKA Holding B.V. Boohoo.com plc

Concentric Team Technology

I Founder Partner LLP

Pockit Limited

--- ---------------------------------- -------------------------------

Gillian Kent 57 NAHL Group plc Coull Limited

Ascential Plc Pendragon Plc

Howsy Limited

Theo Topco Limited

Portswigger Ltd

SIG plc

Dignity plc

--- ---------------------------------- -------------------------------

Brian Small 64 Pendragon plc DDD Investments Limited

Pendragon Finance and Peter Werth Limited

Insurance Services First Sport Limited

Limited Athleisure Limited

Retail Trust (Trustee Sonneti Fashions Limited

Director) JD Sports Fashion

plc

Allsports.co.uk Limited

R.D. Scott Limited

J D Sports Limited

The John David Group

Limited

Focus Group Holdings

Limited

Focus Sports and Leisure

International Limited

Focus Equipment Limited

Focus Brands Limited

Focus International

Limited

Allsports (Retail)

Limited

Varsity Kit Limited

Pink Soda Limited

Nicholas Deakins Ltd.

KGR Rugby Limited

Duffer of St George

Limited

Nanny State Limited

Kukri Sports Ltd.

Marathon Sports Limited

Kukri GB Limited

Blacks Outdoor Retail

Limited

Millets Limited

Source Lab Limited

Tessuti Retail Limited

Prima Designer Limited

Tessuti Limited

Tessuti Group Limited

Blue Retail Ltd

Premium Fashion Limited

Onetruesaxon Limited

Henleys Clothing Limited

Cloggs Online Limited

Ark Fashion Limited

Open Fashion Limited

Topgrade Sportswear

Limited

Size? Limited

Activinstinct Holdings

Limited

Activinstinct Ltd

Millet Sports Limited

JD Sports Gyms Limited

Alpine Group (Scotland)

Limited

George Fisher Limited

The Alpine Group Limited

The Alpine Store Limited

Graham Tiso Limited

Alpine Bikes Limited

Tiso Group Limited

Sundown Limited

George Fisher Holdings

Limited

Exclusive Footwear

Limited

Ultimate Outdoors

Limited

Mainline Menswear

Limited

Mainline Menswear

Holdings Limited

Oswald Bailey Limited

Hip Store Limited

Topgrade Trading Limited

Getthelabel.com Limited

Topgrade Sportswear

Holdings Limited

Footpatrol London

2002 Limited

The JD Foundation

--- ---------------------------------- -------------------------------

JD Sports Active Limited

Aspecto Holdings Limited

Aspecto Trading Limited

Simon & Simon Fashion

Limited

Infinities Retail

Group Holdings Limited

Infinities Retail

Group Limited

Clothingsites Holdings

Limited

Clothingsites.co.uk

Limited

Touchwood Sports Limited

Gol Realisations Limited

C.C.C. (Wholesale

Leisure) Limited

CCCOutdoors Limited

Outdoorclearance Company

Limited

Gol Realisations Holdings

Limited

Mitchell's Practical

Campers Limited

C.C.C. (Camping &

Caravan Centre) Limited

Go Explore Consulting

Limited

Go Outdoors Fishing

Limited

I R G Bury Limited

IRG Denton Limited

IRG Warrington Limited

IRG Blackburn Limited

IRG Chesterfield Limited

IRG Bradford Limited

IRG Stoke Limited

I R G Stockport Limited

IRG Derby Limited

IRG Altrincham Limited

IRG Birkenhead Ltd

Castlebrook Management

Company Limited

JD Sports Gyms Acquisitions

Limited

Dantra Limited

Old Brown Bag Clothing

Limited

Genesis Finco Limited

Choice Limited

Choice 33 Limited

Dapper (Scarborough

Limited)

Planet Fear Limited

Peter Storm Limited

Fly53 Limited

JD Sports Fashion

Distribution Limited

Jog Shop Limited

------------------ --- ---------------------------------- -------------------------------

5.4 Save as referred to in paragraphs 5.5 and 5.6 below, none of the Directors has:

(i) any unspent convictions relating to indictable offences;

(ii) had a bankruptcy order made against them or entered into

any individual voluntary arrangements;

(iii) been a director of a company which has been placed in

receivership, compulsory liquidation, creditors' voluntary

liquidation or administration or entered into a company voluntary

arrangement or any composition or arrangement with its creditors

generally or any class of its creditors whilst they were a director

of that company at the time of, or within the twelve months

preceding, such events;

(iv) been a partner of a firm which has been placed in

compulsory liquidation or administration or which has entered into

a partnership voluntary arrangement whilst they were a partner of

that firm at the time of, or within twelve months preceding, such

events;

(v) had any asset belonging to them placed in receivership or

been a partner of a partnership any of whose assets have been

placed in receivership whilst they were a partner at the time of,

or within twelve months preceding, such receivership; or

(vi) been publicly criticised by any statutory or regulatory

authority (including any recognised professional body) or been

disqualified by a court from acting as a director of a company or

from acting in the management or conduct of the affairs of any

company.

5.5 Andrew Cook was a director of Stanley Gibbons (Guernsey) Ltd

when it went into administration on 21 November 2017. Andrew

resigned on 29 March 2019 and the company moved into liquidation on

2 April 2019.

5.6 Mark Newton-Jones was a director of Mothercare UK Limited

when it went into administration on 5 November 2019.

6. major shareholders

6.1 The names and shareholdings in the Company held by

'significant shareholders' (being persons holding 3% or more of the

Ordinary Shares in the Company), with such shareholdings expressed

as a percentage of the Company's issued share capital both before

and upon AIM Admission are set out in the Schedule One

Announcement.

6.2 As at the date of this Appendix, no major shareholder has

any different voting rights to the other holders of ordinary shares

in the capital of the Company.

6.3 The Company is not aware of any person or persons who,

directly or indirectly, jointly or severally, exercise(s) or could

exercise control of the Company or any arrangements the operation

of which may, at a subsequent date, result in a change in the

control of the Company.

7. COMpany's financial information

7.1 The Group's audited consolidated financial statements

included in the Group's 2020 Annual Report and Accounts, the

Group's Annual Report and Accounts for FY 2018/19 and the Group's

Annual Report and Accounts for FY 2017/18, respectively, together

with the audit reports thereon, are incorporated by reference into

this document. The Group's audited consolidated financial

statements for FY 2019/20, FY 2018/2019 and FY 2017/18 were

prepared in accordance with IFRS. The Group's unaudited interim

results for the 28 week period ended 10 October 2020, which contain

comparative statements for the same period in the prior financial

year, are also incorporated by reference into this document. These

documents are all available from the Company's website at

www.mothercareplc.com:

Reference document Information incorporated by Page number

reference in the reference

documents

Mothercare plc interim

results for the 28

week period ended

10 October 2020

Condensed Consolidated Income Page 5

Statement

Condensed Consolidated Statement Pages 5

of Comprehensive Income to 6

Condensed Consolidated Balance Page 6

Sheet

Condensed Consolidated Statement Pages 6

of Changes in Equity to 7

Condensed Consolidated Cash Pages 7

Flow Statement to 8

Notes to the Condensed Consolidated Pages 8

Financial Statements to 14

Mothercare plc Annual Audited Remuneration Information Pages 39

Reports and Accounts Independent Auditors' Report to 44

for the 52 week period Consolidated Income Statement Pages 55

ended 28 March 2020 Consolidated Statement of Comprehensive to 60

Income Page 61

Consolidated Statement of Balance Page 62

Sheet Page 63

Consolidated Statement of changes Page 64

in Equity Page 65

Consolidated Cash Flow Statement Pages 66

Notes to Consolidated Financial to 113

Statements

Mothercare plc Annual

Report and Accounts

for 53 week period Pages 53

ended 30 March 2019 Audited Remuneration Information to 70

Independent Auditors' Report Pages 73

Consolidated Income Statement to 83

Page 84

Consolidated Statement of Comprehensive Page 85

Income

Consolidated Statement of Balance Page 86

Sheet

Consolidated Statement of Changes Page 87

in Equity

Consolidated Cash Flow Statement Page 88

Notes to the Consolidated Financial Pages 89

Statements to 135

Mothercare plc Annual

Report and Accounts

for 52 week period Pages 59

ended 24 March 2018 Audited Remuneration Information to 63

Independent Auditors' Report Pages 81

Consolidated Income Statement to 89

Page 90

Consolidated Statement of Comprehensive Page 91

Income

Consolidated Statement of Balance Page 92

Sheet

Consolidated Statement of Changes Page 93

in Equity

Consolidated Cash Flow Statement Page 94

Notes to the Consolidated Financial Pages 95

Statements to 130

7.2 Grant Thornton UK LLP of 30 Finsbury Square, London EC2A 1AG

are the current auditors of the Company. Deloitte LLP of 1 New

Street Square, London EC4A 3HQ were the auditors for the Company up

to the financial period to 30 March 2019.

8. dividend policy

8.1 The Board's dividend policy was most recently stated on page

6 in the Chairman's Statement contained in the 2020 Annual Report

& Accounts which forms part of the Company's Public Record: "

The Company has not paid a dividend since 3 February 2012. The

Directors do not expect to pay dividends until the business is

returned to a sustainable and stable financial footing. The

Directors understand the importance of optimising value for

Shareholders and it is the Directors' intention to return to paying

a dividend as soon as this is possible under the Company's

agreements with GBB and the pension trustees and as soon as the

Directors believe it is financially prudent for the Group to do

so".

8.2 Under the terms of the agreement reached with the trustees

of the DB Schemes as to revised deficit payments for the next five

years, the Company and MGB will pay additional contributions to the

DB Schemes if the Company resumes the payment of dividends to

shareholders.

9. litigation and arbitration

Neither the Company nor any member of the Group is, nor has it

been at any time during the 12 months immediately preceding the

date of this Appendix, involved in any governmental, legal or

arbitration proceedings, which may have, or have had in the recent

past, a significant effect on the Company's and/or the Group's

financial position or profitability and there are no such

proceedings of which the Company is aware which are pending or

threatened.

10. material contracts

Save as set out in the Company's Public Record, the following

are all of the contracts (not being contracts entered into in the

ordinary course of business) that have been entered into by the

Group in the two years prior to the date of this Appendix and are,

or may be, material to the Group or have been entered into by any

member of the Group at any time and contain obligations or

entitlements which are, or may be, material to the Group, in each

case as at the date of this Appendix:

10.1 Nominated Adviser and Broker Agreement

On 11 February 2021, the Company entered into an agreement with

Numis under which Numis agreed to act as nominated adviser and

joint corporate broker to the Company, as required by the AIM Rules

for Companies. Following Admission the Nominated Adviser and Broker

Agreement is terminable by either party on one months' notice and

Numis will be entitled to terminate the agreement in certain

customary circumstances, including if there has been a material

breach by the Company of its obligations under the agreement or if

the Ordinary Shares cease to be admitted to trading on AIM. The

Company has given customary undertakings, warranties and

indemnities to Numis.

11. corporate governance

11.1 Up to the date of this Appendix, the recognised corporate

governance code that the Board has been applying is the UK

Corporate Governance Code. As set out in the Corporate Governance

Report on pages 24 - 28 of the 2020 Annual Report & Accounts,

the Directors consider that the Group complied with those

provisions of the UK Corporate Governance Code throughout the 52

week period ended on 28 March 2020.

11.2 The recognised corporate governance code that the Board

will comply with following the AIM Admission is the QCA Code.

12. the takeover code and the companies act

12.1 Mandatory takeover bids

(i) The Takeover Code applies to all takeover and merger

transactions in relation to the Company and operates principally to

ensure that shareholders are treated fairly and are not denied an

opportunity to decide on the merits of a takeover and that

shareholders of the same class are afforded equivalent treatment.

The Takeover Code provides an orderly framework within which

takeovers are conducted and the Takeover Panel has now been placed

on a statutory footing.

(ii) The Takeover Code is based upon a number of General

Principles which are essentially statements of standards of

commercial behaviour. General Principle One states that all holders

of securities of an offeree company of the same class must be

afforded equivalent treatment and if a person acquires control of a

company, the other holders of securities must be protected. This is

reinforced by Rule 9 of the Takeover Code which requires a person,

together with persons acting in concert with him, who acquires

shares carrying voting rights which amount to 30 per cent. or more

of the voting rights to make a general offer. "Voting rights" for

these purposes means all the voting rights attributable to the

share capital of a company which are currently exercisable at a

general meeting. A general offer will also be required where a

person who, together with persons acting in concert with him, holds

not less than 30 per cent. but not more than 50 per cent. of the

voting rights, acquires additional shares which increase his

percentage of the voting rights. Unless the Takeover Panel

consents, the offer must be made to all other shareholders, be in

cash (or have a cash alternative) and cannot be conditional on

anything other than the securing of acceptances which will result

in the offeror and persons acting in concert with him holding

shares carrying more than 50 per cent. of the voting rights.

(iii) There are not in existence any current mandatory takeover

bids in relation to the Company.

12.2 Squeeze out

(i) Section 979 of the Companies Act provides that if, within

certain time limits, an offer is made for the share capital of the

Company, the offeror is entitled to acquire compulsorily any

remaining shares if it has, by virtue of acceptances of the offer,

acquired or unconditionally contracted to acquire not less than 90

per cent. in value of the shares to which the offer relates and in

a case where the shares to which the offer relates are voting

shares, not less than 90 per cent. of the voting rights carried by

those shares. The offeror would effect the compulsory acquisition

by sending a notice to outstanding shareholders telling them that

it will compulsorily acquire their shares and then, six weeks from

the date of the notice, pay the consideration for the shares to the

Company to hold on trust for the outstanding shareholders. The

consideration offered to shareholders whose shares are compulsorily

acquired under the Companies Act must, in general, be the same as

the consideration available under the takeover offer.

12.3 Sell out

(i) Section 983 of the Companies Act permits a minority

shareholder to require an offeror to acquire its shares if the

offeror has acquired or contracted to acquire shares in the Company

which amount to not less than 90 per cent. in value of all the

voting shares in the Company and carry not less than 90 per cent.

of the voting rights. Certain time limits apply to this

entitlement. If a shareholder exercises its rights under these

provisions the offeror is bound to acquire those shares on the

terms of the offer or on such other terms as may be agreed.

13. uk taxation

The following summary is intended as a general guide only for

Shareholders who are UK tax resident as to their tax position under

current UK tax legislation and HMRC practice as at the date of this

Appendix. Such law and practice (including, without limitation,

rates of tax) is in principle subject to change at any time.

The Company is at the date of this Appendix resident for tax

purposes in the United Kingdom and the following is based on that

status.

This summary is not a complete and exhaustive analysis of all

the potential UK tax consequences for holders of Ordinary Shares.

It addresses certain limited aspects of the UK taxation position

applicable to shareholders resident and domiciled for tax purposes

in the United Kingdom (except in so far as express reference is

made to the treatment of non-UK residents) and who are absolute

beneficial owners of their Ordinary Shares (as applicable) and who

hold their Ordinary Shares as an investment and not as party to an

arrangement that would produce a return that is economically

equivalent to interest or which has the main purpose, or one of the

main purposes, the obtaining of a tax advantage. This summary does

not address the position of certain classes of shareholders who

(together with associates) have a 10 per cent. or greater interest

in the Company, or, such as dealers in securities, market makers,

brokers, intermediaries, collective investment schemes, pension

funds, charities or UK insurance companies or whose shares are held

under a self-invested personal pension or an individual savings

account or are 'employment related securities' as defined in

section 421B of the Income Tax (Earnings and Pensions) Act

2003.

Any person who is in any doubt as to his tax position or who is

subject to taxation in a jurisdiction other than the United Kingdom

should consult his or her professional advisers immediately as to

the taxation consequences of his or her ownership and disposition

of Ordinary Shares.

This summary is based on current United Kingdom tax legislation.

Shareholders should be aware that future legislative,

administrative and judicial changes could affect the taxation

consequences described below.

13.1 Taxation of Dividends

Under current UK taxation legislation, there is no UK

withholding tax on dividends, including cases where dividends are

paid to a shareholder who is not resident (for tax purposes) in the

United Kingdom.

UK tax resident and domiciled or deemed domiciled individual

shareholders

All dividends received from the Company by an individual

shareholder who is resident and domiciled (or deemed domiciled) in

the UK will, except to the extent that they are earned through an

ISA, self-invested pension plan or other regime which exempts the

dividend from tax, form part of the shareholder's total income for

income tax purposes and will represent the highest part of that

income.

A nil rate of income tax applies to the first GBP2,000 of

dividend income received by an individual shareholder in a tax year

(the "Nil Rate Amount"), regardless of what tax rate would

otherwise apply to that dividend income. If an individual receives

dividends in excess of this allowance in a tax year, the excess

will be taxed at 7.5 per cent. (for individuals not liable to tax

at a rate above the basic rate), 32.5 per cent. (for individuals

subject to the higher rate of income tax) and 38.1 per cent. (for

individuals subject to the additional rate of income tax) for

2020/21.

To the extent that total income exceeds any remaining standard

rate band (maximum GBP1,000), trustees of discretionary trusts

receiving dividends from shares are liable to account for income

tax at the dividend trust rate, currently 38.1 per cent (a rate of

7.5 per cent applies to dividend income within the standard rate

band). Trustees do not qualify for the GBP2,000 dividend allowance

available to individuals. This is a complex area and trustees of

such trusts should consult their own tax advisers.

UK pension funds and charities are generally exempt from tax on

dividends which they receive.

Corporate shareholders within the charge to UK corporation

tax

Shareholders within the charge to UK corporation tax which are

'small companies' for the purposes of Chapter 2 of Part 9A of the

Corporation Tax Act 2009 will generally not be subject to UK

corporation tax on any dividend received provided certain

conditions are met (including an anti-avoidance condition).

A UK resident corporate shareholder (which is not a 'small

company' for the purposes of the UK taxation of dividends

legislation in Part 9A of the Corporation Tax Act 2009) will be

liable to UK corporation tax (currently at a rate of 19 per cent as

from 1 April 2020) unless the dividend falls within one of the

exempt classes set out in Part 9A. Examples of exempt classes (as

defined in Chapter 3 of Part 9A of the Corporation Tax Act 2009)

include dividends paid on shares that are 'ordinary shares' (that

is shares that do not carry any present or future preferential

right to dividends or to the Company's assets on its winding up)

and which are not 'redeemable', and dividends paid to a person

holding less than 10 per cent. of the issued share capital of the

payer (or any class of that share capital in respect of which the

distribution is made). However, the exemptions are not

comprehensive and are subject to various conditions and

anti-avoidance rules.

Non-resident shareholders

Non-UK resident corporate shareholders are not generally subject

to UK tax on dividend receipts.

Non-UK resident individual shareholders who receive a dividend

from the Company are treated as having paid UK income tax on their

dividend income at the dividend ordinary rate (7.5 per cent.). Such

income tax will not be repayable to a non-UK resident individual

shareholder. A non-UK resident individual shareholder is not

generally subject to further UK tax on dividend receipts.

Non-UK resident shareholders may however be subject to taxation

on dividend income under local law, in their country or

jurisdiction of residence and/or citizenship. Non-UK resident

shareholders should consult their own tax advisers in respect of

the application of such provisions, their liabilities on dividend

payments and/or what relief or credit may be claimed in the

jurisdiction in which they are resident.

13.2 Taxation of Chargeable Gains

Individual Shareholders

If an individual shareholder is within the charge to UK capital

gains tax, a disposal (or deemed disposal) of all or some of his or

her Ordinary Shares may give rise to a chargeable gain or an

allowable loss for the purposes of capital gains tax, depending on

his or her circumstances. The rate of capital gains tax on disposal

of shares is 10 per cent. (2020/2021) for individuals who are

subject to income tax at the basic rate and 20 per cent.

(2020/2021) for individuals who are subject to income tax at the

higher or additional rates. An individual shareholder is entitled

to realise an annual exempt amount (GBP12,300 from 6 April

2020).

Corporate Shareholders

For a corporate shareholder within the charge to UK corporation

tax, a disposal (or deemed disposal) of Ordinary Shares may give

rise to a chargeable gain at the rate of corporation tax applicable

to that shareholder (currently 19 per cent) or an allowable loss

for the purposes of UK corporation tax. Indexation allowance may

reduce the amount of chargeable gain that is subject to corporation

tax by increasing the chargeable gains tax base cost of an asset in

accordance with the rise in the retail prices index from the month

of acquisition up to 31 December 2017. Indexation allowance is

currently 'frozen' so that it does not increase the chargeable

gains tax base cost for any period from 1 January 2018 onwards,

even if the date of disposal occurs at a later point in time.

Non-resident shareholders

A shareholder who is not resident in the United Kingdom for tax

purposes, but who carries on a trade, profession or vocation in the

United Kingdom through a permanent establishment (where the

shareholder is a company) or through a branch or agency (where the

shareholder is not a company) and has used, held or acquired the

Ordinary Shares for the purposes of such trade, profession or

vocation or such permanent establishment, branch or agency (as

appropriate) may be subject to UK tax on capital gains on the

disposal of Ordinary Shares.

In addition, holders of Ordinary Shares who are individuals and

who dispose of Ordinary Shares while they are temporarily

non-resident may be treated as disposing of them in the tax year in

which they again become resident in the United Kingdom.

13.3 Inheritance Tax

Individual and trustee Shareholders domiciled or deemed to be

domiciled in any part of the United Kingdom may be liable on

occasions to inheritance tax ("IHT") on the value of any Ordinary

Shares held by them. Under current law, the primary occasions on

which IHT is charged are on the death of the Shareholder, on any

gifts made during the seven years prior to the death of the

Shareholder (which will also be brought into account when

calculating the IHT on the death of the Shareholder), and on

certain lifetime transfers, including transfers to trusts or

appointments out of trusts to beneficiaries, save in very limited

and exceptional circumstances.

However, a relief from IHT known as business property relief

("BPR") may apply to ordinary shares or preference shares in

unlisted trading companies once these have been held with such

status for two years by the Shareholder. This relief may apply

notwithstanding that a company's shares will be admitted to trading

on AIM (although it does not apply to companies whose shares are

listed on the Official List, which was the case for the Ordinary

Shares prior to admission to AIM). BPR operates by reducing the

value of shares by 100 per cent. for IHT purposes which means that

there will be no IHT to pay.

Shareholders should consult an appropriate professional adviser

if they intend to make a gift of any kind or intend to hold any

Ordinary Shares through trust arrangements. They should also seek

professional advice in a situation where there is a potential for a

double charge to UK IHT and an equivalent tax in another

country.

13.4 Stamp Duty and Stamp Duty Reserve Tax ("SDRT")

Neither UK stamp duty nor SDRT should arise on transfers of

Ordinary Shares on AIM (including instruments transferring Ordinary

Shares and agreements to transfer Ordinary Shares) based on the

following assumptions:

(i) the Ordinary Shares are admitted to trading on AIM, but are

not listed on any market (with the term 'listed' being construed in

accordance with section 99A of the Finance Act 1986), and this has

been certified to Euroclear; and

(ii) AIM continues to be accepted as a 'recognised growth

market' (as construed in accordance with section 99A of the Finance

Act 1986). In the event that either of the above assumptions does

not apply, stamp duty or SDRT may apply to transfers of Ordinary

Shares in certain circumstances, at the rate of 0.5 per cent. of

the amount or value of the consideration (rounded up in the case of

stamp duty to the nearest GBP5).

13.5 AIM

Companies whose shares trade on AIM are deemed unlisted for the

purposes of certain areas of UK taxation. Following the AIM

Admission, Ordinary Shares held by individuals for at least two

years from the AIM Admission may qualify for more generous

exemptions from inheritance tax on death or in relation to lifetime

transfers of those Ordinary Shares. Shareholders should consult

their own professional advisers on whether an investment in an AIM

security is suitable for them, or whether the tax benefit referred

to above may be available to them.

The comments set out above are intended only as a general guide

to the current tax position in the United Kingdom at the date of

this Appendix. The rates and basis of taxation can change and will

be dependent on a shareholder's personal circumstances.

Neither the Company nor its advisers warrant in any way the tax

position outlined above which, in any event, is subject to changes

in the relevant legislation and its interpretation and

application.

14. related party transactions

14.1 Details of related party transactions are set out in note

34 to the 2020 Annual Report & Accounts, in note 32 to the

Company's annual report & accounts for the 53 weeks ended 30

March 2019 and in note 30 to the Company's annual report &

accounts for the 52 weeks ended 24 March 2018.

15. investments

15.1 Details of related party transactions are set out in note 3

to the company financial statements within the 2020 Annual Report

& Accounts, in note 3 to the company financial statements

within the Company's annual report & accounts for the 53 weeks

ended 30 March 2019 and in note 3 to the company financial

statements within the Company's annual report & accounts for

the 52 weeks ended 24 March 2018.

16. EMPLOYEES

16.1 For the 52 week period ending 28 March 2020, the average

monthly number of full and part-time employees throughout the Group

in respect of continuing operations, including executive directors,

was 210 employees in UK stores, 189 employees in head office and 9

employees overseas.

17. general

17.1 Numis has given and not withdrawn its written consent to

the issue of this Appendix with the inclusion of its name and

references to it in the form and context in which it is

included.

17.2 finnCap has given and not withdrawn its written consent to

the issue of this Appendix with the inclusion of its name and

references to it in the form and context in which it is

included.

17.3 No public takeover bids have been made by third parties in

respect of the Company's issued share capital during the 52 weeks

accounting period ended 28 March 2020 or during the current

accounting period up to the date of this Appendix.

17.4 There are no environmental issues that affect the Group's

utilisation of its tangible fixed assets.

17.5 Save as disclosed in the Company's Public Record (including

the 2020 Interim Results and the 2021 Circular), the Directors are

not aware of any known trends, uncertainties, demands, commitments

or events that are reasonably likely to have a material effect on

the Company's prospects for at least the current financial

year.

11 February 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUAVBRANUUARR

(END) Dow Jones Newswires

February 11, 2021 03:00 ET (08:00 GMT)

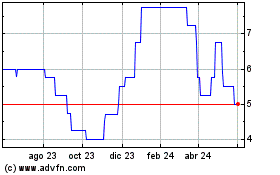

Mothercare (AQSE:MTC.GB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

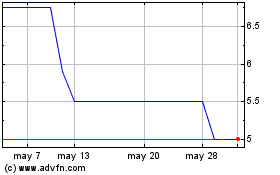

Mothercare (AQSE:MTC.GB)

Gráfica de Acción Histórica

De May 2023 a May 2024