Cardano Goes Toe-To-Toe With Ethereum As Whales Scoop Up 120 Million ADA

02 Agosto 2024 - 10:30AM

NEWSBTC

Cardano (ADA) is currently competing with Ethereum in terms of

large transaction volume. This is undoubtedly a positive

development for the ADA ecosystem, especially since it indicates a

wave of accumulation among the token’s large holders. Cardano

Matches Ethereum In Large Transaction Volume Data from the market

intelligence platform IntoTheBlock shows that Cardano is witnessing

a similar large transaction volume as Ethereum. In the last 24

hours, Cardano recorded a large transaction volume of $6.7 billion,

while Ethereum witnessed a large transaction volume of $6.71

billion. Related Reading: Why Did This Crypto Whale Spend

$400 Million Buying Bitcoin Yesterday? This development suggests

that Cardano whales have been active these past few days as they

look to add more tokens to their positions, especially with the

market currently on a dip and as these investors anticipate the

much-awaited price rally from ADA. Further data from IntoTheBlock

confirms this, as there has been an over 15% increase in large

holders’ net flow over the last seven days. Data from the

on-chain analytics platform Santiment also shows that Cardano

whales have added to their positions. These investors, wallets

holding between 100,000 and 10 million ADA tokens, collectively

bought 120 million ADA tokens between July 17 and August 1. These

wallets now hold over 5.69 billion ADA tokens. An increase in

whale activity presents a bullish outlook for the Cardano

ecosystem. These investors could influence market prices, and these

purchases could spark a significant surge in ADA’s price. This will

provide a much-needed boost for Cardano, seeing how the crypto

token has underperformed since the start of the year. Cardano

has a year-to-date (YTD) loss of over 35% and is one of the most

shorted altcoins, thanks to this unimpressive price action.

However, Santiment has suggested that a massive turnaround for the

crypto token cannot be ruled out since Cardano being heavily

shorted increases the “chances of liquidations leading to pumps.”

The on-chain analytics platform claimed these liquidations could

act as “rocket fuel” for a price rally for Cardano. What Will

Eventually Spark That ADA Rally? Cardano has failed to enjoy any

significant rally despite several bullish developments in its

ecosystem this year. The most recent bullish fundamental was the

news that the US Securities and Exchange Commission (SEC) no longer

considers ADA a security following the amendment of its complaint

against Binance. Related Reading: Crypto Analyst Says

Dogecoin Price Will Rise Over 7,200% To Reach $10, Here’s Why

Meanwhile, the Chang Hard Fork is underway as Cardano transitions

to the Voltaire era and ushers in its most advanced governance

system. It is worth mentioning that ADA’s price maintained a tepid

price movement following the release of node validator software,

version 9.1.0, which incorporates the Chang Hard Fork. As such,

Cardano’s price action begs the question of what needs to happen

for the crypto token to finally witness that much-anticipated price

rally and catch up with the rest of the major cap tokens in terms

of YTD gains. At the time of writing, Cardano is trading at

around $0.38, down in the last 24 hours, according to data from

CoinMarketCap. Featured image created with Dall.E, chart from

Tradingview.com

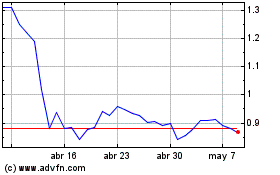

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024