Will Bitcoin See Another ‘Thanksgiving Day Massacre’? Experts Weigh In

27 Noviembre 2024 - 5:30AM

NEWSBTC

Almost four years ago to the day, Bitcoin experienced a dramatic

17% plunge from $19,500 to $16,200 in 2020, an event that became

infamously known as the “Thanksgiving Day Massacre.” As the holiday

approaches once again, market participants are questioning whether

history might repeat itself. On Monday and Tuesday, Bitcoin’s price

underwent an 8% correction, dropping from $98,871 to a low of

$90,791. This sudden downturn has sparked discussions among

analysts if history could be repeating for the BTC price. Bitcoin

‘Thanksgiving Day Massacre’ 2024? Alex Thorn, Head of Research at

Galaxy Digital, took to X to draw parallels between the current

market and the events of 2020. “Who remembers the Thanksgiving dump

of 2020? Bitcoin dumped 17% between Wednesday, Nov 25, and Friday,

Nov 27, 2020. BTCUSD later went on to more than 3x over the next 5

months. Does history rhyme?” A potential catalyst for the crash

could be the global M2 money supply. Currently, a chart

illustrating the correlation between Bitcoin and global M2 is

circulating on X. Joe Consorti, an analyst at Theya, observed that

since September 2023, “Bitcoin has closely tracked global M2 with a

~70-day lag.” Over the past two months, global M2 has declined from

$108.3 trillion to $104.7 trillion, driven by factors such as a

strengthening US dollar—devaluing foreign currency-denominated M2

when converted into dollars—and economic slowdowns dampening

lending and deposit creation. Related Reading: Pantera’s Vision:

Bitcoin Fund Forecasts $740,000 Price Tag By April 2028 Consorti

cautions, “If it continues to follow the current contraction in M2,

a 20-25% correction could materialize, potentially pulling bitcoin

down to roughly $73,000—not a price prediction, but a stark

reminder of Bitcoin’s tether to the global money supply.” However,

he also acknowledged that Bitcoin might defy this trend, as it has

in the past, particularly “from 2022-2023 due to the FTX collapse

and interest in the space evaporating as a result.” He suggests

that structural ETF inflows and corporate buying pressure could

help Bitcoin resist the current M2 deflation. Consorti concludes,

“Either way, a correction at this point seems about right. As

mentioned before, these rapid run-ups in Bitcoin’s price always

have pitstops along the way, […] it’s vital to understand the asset

you hold, the macro environment it exists in, and the forces

driving it higher long-term. If you truly understand bitcoin, you

don’t panic sell.” Related Reading: Institutions Just ‘Waiting To

Buy Up’ Bitcoin, Says MARA CEO Despite the cautious outlook, some

analysts believe the dip may be short-lived. Jamie Coutts, Chief

Crypto Analyst at Real Vision, points out via X that “a Bitcoin bid

has overshadowed tightening liquidity over the past month.” While

acknowledging that Bitcoin appears “overstretched vs. global M2”

and that his liquidity model suggested caution, especially with

leverage, Coutts highlights potential policy shifts that could

favor risk assets. He references insights from economist Andreas

Steno, indicating that the Federal Reserve is “in effect,

discussing a put for USD liquidity—changes to support liquidity

developments as early as December.” Coutts concludes: “DXY could

have topped here. The lag effect that Fintwit is focused on atm is

still real, but ultimately, the Fed is waving the bull flag for

risk assets again. Bullish 2025. Bullish BTC.” At press time, BTC

traded at $93,250. Featured image created with DALL.E, chart from

TradingView.com

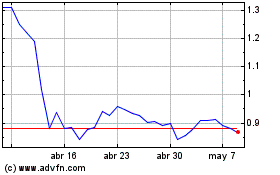

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024