Chainlink Investors In Accumulation Mode – LINK Price Primed For A Rally?

13 Julio 2024 - 5:00AM

NEWSBTC

The price of Chainlink has mostly struggled in the past few weeks,

mirroring the stagnant condition of the general market.

Interestingly, investors seem motivated to keep faith in the

altcoin rather than be discouraged by the sluggish price action

observed in recent weeks. According to the latest on-chain

revelation, investors appear to be shifting to a long-term holding

strategy, with a focus on the future promise of the Chainlink

token. This leaves the question — could the LINK price be primed

for a rally? $110 Million Worth Of LINK Leave Centralized Exchanges

According to the latest on-chain observation, the Chainlink token

appears to be undergoing an accumulation trend, with investors

moving their assets from centralized exchanges. Latest data from

IntoTheBlock shows that approximately 8.7 Million LINK tokens

(worth about $110 million) have been withdrawn from exchanges in

the last two weeks. Related Reading: Analyst Predicts 2,750%

Celestia (TIA) Price Explosion To $188, Here’s The Roadmap This

observation is based on the Netflows metric, which tracks the

difference between the amount of tokens that are transferred in and

out of centralized exchanges. When the value of this metric is

negative, it implies that more assets are leaving than entering

crypto exchanges. Conversely, a positive value of the Netflows

metric indicates that more assets are flowing in than out of

exchanges. While it is difficult to unravel the rationale behind

the increased outflow of Chainlink tokens from exchanges, the

exodus of massive LINK amounts signals a shift in investor

sentiment. Specifically, the direction of the funds’ movement

suggests an increase in investor confidence, as they appear to be

moving their tokens away from trading platforms. IntoTheBlock said

in the post: Such activity is typically associated with an

accumulation phase, indicating that investors are moving $LINK off

exchanges and into long-term holdings. A corroborating data point

came from another blockchain firm, signaling major accumulation by

major Chainlink stakeholders. According to Santiment’s data,

investors holding between 10,000 – 1,000,000 coins have added 9.2

Million LINK since June 24. This brings the holdings of this

investor cohort to 207.29 million coins, an 8-month high. Chainlink

Price At A Glance As of this writing, the price of LINK stands

around $12.94, reflecting a 3.4% increase in the past 24 hours.

According to CoinGecko data, the Chainlink token is up by 2.5% in

the past week. However, this recent show of strength hasn’t been to

reverse Chainlink’s almost 10% decline in the past two weeks. On a

positive note, though, the declining supply of LINK tokens on

centralized exchanges could set the stage for a bullish rally for

the altcoin. Related Reading: Bitcoin Price Trajectory

Remains Bearish, $49,000 Liquidity Zone Looms As Next Downside

Target Featured image from Binance Academy, chart from TradingView

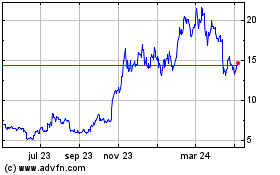

ChainLink Token (COIN:LINKUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

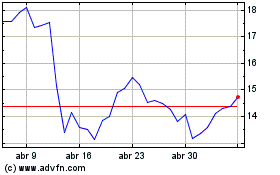

ChainLink Token (COIN:LINKUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024