Ethereum ICO Participant Moves $9.96 Million Of ETH To Kraken. Will He Sell?

18 Septiembre 2023 - 5:00PM

NEWSBTC

An Ethereum initial coin offering (ICO) participant and one of the

earliest supporters of the smart contract platform has moved 6,000

ETH worth $9.96 million to Kraken, a cryptocurrency exchange,

recent data from Lookonchain on September 18 reveals. The

unidentified whale received 254,908 ETH when each traded for 40.31

during the crowdfunding in 2014. This amount is currently worth

over $466 million at spot rates. Ethereum Whale Transfers Over

$9.96 Million To Kraken The anonymous nature of public blockchains,

including Ethereum, makes it harder to decipher the owner’s

identity. Determining whether an entity or an individual controls

the address is also more complex. Whale transfers to a crypto

exchange are usually considered bearish since the ramp provides an

easier swapping option for token holders to cash out. Typically,

crypto whales have the potential to impact the market due to the

sheer size of their holdings. Accordingly, their trading decisions

can influence prices, increasing volatility. Therefore, the recent

deposit to Kraken may suggest that the whale plans to sell, taking

a profit. Related Reading: Coinbase’s BASE Shows Teeth As TVL Nears

Solana On the brighter side, the whale could be moving their coins

via an intermediary, in this case, Kraken, before transferring them

to other platforms like Rocket Pool or Lido Finance for

staking. In the current proof-of-stake consensus algorithm

used by Ethereum, whales can earn annual staking rewards if they

lock at least 32 ETH. While the whale can set up a node and stake,

liquidity staking providers like Rocket Pool allow users to stake

coins and earn staking rewards using their infrastructure. As

of September 18, there are over 804,000 validators, that is,

users who have locked at least 32 ETH operating an Ethereum full

node. Cumulatively, over 25.7 million ETH have been locked. ETH

Prices Recovering As of this writing, the transfer on September 18

is amid the broader recovery in the crypto market. Of note,

Ethereum (ETH) prices are up roughly 6% from September lows.

Overall, supporters are bullish, expecting more growth in the days

ahead. The pump also means bulls have reversed some of the losses

of September 11, and the current formation may anchor the next leg

up that could propel the coin above $1,750, or August 29 highs, and

later peel back sharp losses recorded on August 17. Related

Reading: This Bitcoin Metric Continues To Retest Bear-Bull

Junction, Will A Break Happen? From the candlestick arrangement in

the daily chart, ETH remains under pressure, dropping 23% from 2023

highs of around $2,140. However, since bears didn’t reverse losses

of the June to July leg up, buyers have a chance following the

rejection of lower lows from around the 78.6% Fibonacci retracement

level of the Q3 2023 trade range. Presently, the September and

August 2023 lows remain critical support levels for ETH, with the

retest of August 17 lows on September 11 causing concern for

optimistic traders. Feature image from Canva, chart from

TradingView

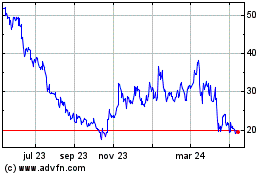

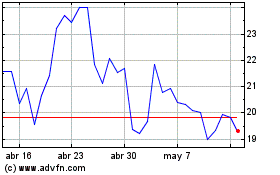

Rocket Pool (COIN:RPLUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Rocket Pool (COIN:RPLUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024