Storm Ahead? Bitcoin Price Could Tumble 20% Due To M2 Supply Concerns

28 Noviembre 2024 - 8:30AM

NEWSBTC

Investors have expressed apprehension regarding the recent price

fluctuations of Bitcoin, particularly in light of analysts’

predictions of a 20-25% decline in the global M2 money supply.

Related Reading: Crypto Bloodbath: Over $500 Million Liquidated As

Bitcoin Slides To $92K – Report At $92,864, bitcoin is down nearly

9% from its recent high of just under $100,000. That fall is part

of a trend of profit-taking by long-term holders, who sold 366,000

BTC in the last month, the most since April 2024. Introduction To

The M2 Money Supply Connection Market researchers have been

studying the relationship between Bitcoin prices and global M2

money circulation. Crypto analyst Joe Consorti noted that Bitcoin

prices have regularly tracked M2 pricing, albeit 70 days later.

Bitcoin has tracked global M2 with a ~70-day lag since September

2023. I don’t want to alarm anyone, but if it continues, bitcoin

could be in for a 20-25% correction. Global M2 in ⚪️ Bitcoin in 🟠

pic.twitter.com/PlPoaHUoFR — Joe Consorti ⚡️ (@JoeConsorti)

November 25, 2024 That is, Bitcoin’s price is likely to follow the

trend of M2 going down in the near future. The latest drop in M2

shows that Bitcoin might fall to important support levels of

$88,000 or even $80,000 if things keep going the way they are.

UPDATE: One day after my last chart, bitcoin is now $5,000 lower,

following the path set by global M2 several weeks ago very closely.

So far, this correlation is shockingly accurate. We’ll have to see

if BTC follows it all the way down, or stops short & finds

support. 🍿🍿🍿 pic.twitter.com/oEGOuYYRio — Joe Consorti ⚡️

(@JoeConsorti) November 26, 2024 Bitcoin has been weakening as it

can’t stay over $94,000. Because breaking these liquidity zones

could cause greater declines, analysts are watching them

attentively. Investors are worried because Bitcoin’s chance of

reaching $100,000 by year’s end has plummeted from 92% to 64%.

Long-Term Holders’ Pressure To Sell Glassnode’s most recent data

indicates that long-term holders (LTHs) have been more active in

selling, with over 507,000 BTC distributed since September 2023.

This selling pressure is substantial and indicates that numerous

investors are liquidating their profits in the context of the

current market volatility. The potential shift in market sentiment,

which is suggested by the increased activity among LTHs, could

further exacerbate the downward pressure on Bitcoin’s price.

Additionally, the Realized Profit/Loss (P/L) ratio has reached new

historical highs, indicating an overheated market. An increase in

this ratio typically means that a sizable portion of investors are

benefiting from price increases. Analysts caution that Bitcoin’s

rising momentum may be waning due to the current trend of

profit-taking and decreasing liquidity. Related Reading: Shiba Inu

Eyes Explosive Growth: Over 200% Surge Ahead, Analyst Says Bitcoin

Future Outlook – What Is In Store? As it works its way through

these challenges, the future of Bitcoin is still quite foggy.

Despite the fact that there are market observers who believe that

the price of the top crypto can normalize at lower levels, there

are also analysts who warn that additional corrections might be

required if global liquidity continues to decrease. Featured image

from DALL-E, chart from TradingView

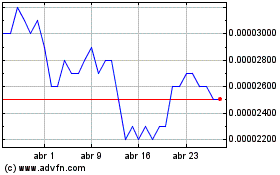

SHIBA INU (COIN:SHIBUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

SHIBA INU (COIN:SHIBUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024