drobx

5 años hace

drobx

5 años hace

This company really is a disaster:

MGX Minerals Announces Date of Meeting of Shareholders and Appointment of Patrick Power as Director and CEO

Mon March 23, 2020 4:05 PM|Accesswire|About: MGXMF

VANCOUVER, BC / ACCESSWIRE / March 23, 2020 / MGX Minerals Inc. (MGXMF) ("MGX" or the "Company") (CSE:XMG)(FKT:1MG)(OTC:MGXMF) announces that the board of directors of the Company (the "Board") has called a meeting of the Company's shareholders (the "Meeting") in response to the requisition (the "Requisition") that the Company received on March 6, 2020, from certain shareholders (the "Dissidents").

The Meeting is scheduled to take place on June 30, 2020, at a time and location to be determined. The record date for determining shareholders entitled to notice of the Meeting, and to vote at the Meeting, has been set as May 20, 2020. The Company will provide further information about the meeting in a management information circular that will be mailed to shareholders and posted on SEDAR in due course. The Board believes that the Dissidents' actions are without merit and will only continue to force the Company to incur unnecessary expenses and distraction.

Appointment of CEO, Director and Chairman

MGX also announces the engagement of Patrick Power as CEO and Director and the appointment of Jared Lazerson as Chairman. Mr. Power has extensive venture capital, mining and technology experience. As Founder and VP of Finance of Western Potash Corp. (WPSHF), Mr. Power was responsible for raising approximately $200 Million and arranging the sale of the company. In addition to experience in industrial minerals such as potash and lithium, Mr. Power has experience in solution mining and extraction of minerals from fluids. As well, Mr. Power has industry knowledge and experience in renewable energy storage, in particular vanadium redox flow batteries.

The Board approved Mr. Power's and Mr. Lazerson's appointments on March 22, 2020, effective immediately. Mr. Power has filled a vacancy on the Board.

The current Board is Patrick Power, Jared Lazerson, Andris Kikuaka, and Lyndon Patrick.

Pennsylvania Petrolithium

MGX announces that, contrary to instruction and understanding, the commissioning and operation of its first commercial rapid lithium recovery system at an environmental wastewater facility in Pennsylvania has ceased. MGX's subsidiary, PurLucid Treatment Systems ("PTS"), left the facility and has had no meaningful communication with MGX's CEO or VP of Operations for an extended period, providing no comprehensible details of their actions. Further, the PTS' CEO has claimed to have unilaterally cancelled the lithium extraction technology agreement with MGX. As such, MGX has advised PTS' CEO that he is in gross breach of his duty and requested plans for repayment of the approximately $10 Million invested to date, and reasonable explanation of PTS' actions. MGX owns approximately 64% of PTS, and finds no basis for the CEO's action. MGX has begun a search for a new CEO for PTS, and continues to request clarification on repayment of its investment, the status of the Pennsylvania project, and a variety of other lithium, potash, and water purification projects. Additionally, the petrolithium site operator has requested repayment of $114,000 in claimed installation costs prior to any further discussions as a result of the abandonment.

Dawson Arbitration

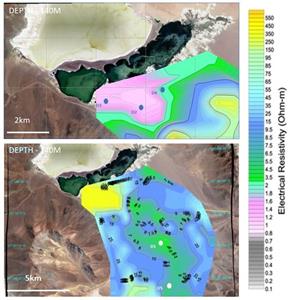

An arbitration award in favor of Dawson Geophysics Inc. (the "Claimant" or "Dawson") in regard to planned geophysical survey and pre-survey work on its formerly optioned Utah Petrolithium property has been awarded as follows:

Unpaid invoice amount of $183,728.85 USD

5% surcharge of $9,186.44 USD

Lost profits of $580,511.00 USD

Total sum of $773,426.29 USD

The Claimant was not awarded legal costs of $150,000 USD.

MGX finds the award of lost profits egregious as the Claimant provided no proof of actual losses simply that had the contract been executed. MGX did not pay the deposit to initiate the actual geophysical survey and the outstanding amount was the preparation work for the survey. Lost profits were not part of the original claim. The Claimant added the claim of such lost profits in the amount increasing the amount far in excess of the arbitration limit of $400,000 USD and the original claim of $183,728.85 USD. MGX's defense largely rested on its reliance on the operator of its Utah Petrolithium property to properly manage the project and only became aware of the excessive work planned on the project after the period that became the subject of litigation. The operator aggressively and forcefully insisted on a $4 Million USD, 64 square mile geophysical survey - far in excess of what was required to meet property obligations and the requirement of drilling 2 holes to earn a 75% interest in the property over 3 years. As a result of the decision, MGX plans to appeal and, failing that, will commence litigation against the operator.

Accounts Payable and Issuance of Shares for Debt

The Company advises shareholders that due to a failure to significantly monetize its MGX Renewables and PurLucid investments in 3rd and 4th Quarter 2019, as planned, and unanticipated interference in capital raising activities, MGX has incurred significant overdue accounts payable, legal claims and related litigation. The Company has been issued a notice of payment by the Canadian Revenue Agency of approximately $517,036.21 related to an incomplete flow through exploration expenditures. The failure to acquire a permit to drill, as anticipated but now issued, at its Driftwood Creek Magnesium project prior to December 31, 2018 was the primary reason for this liability. The Company expects to meet this obligation shortly, with recently announced transactions expected to net the Company $2.1 million (see press release dated March 11, 2020). Further, to reduce payables the Company has reached the following shares for debt arrangements:

1,808,000 common shares of the Company (the "Common Shares") be issued to OCI Holdings Inc., at a price of $0.075 per share.

924,000 Common Shares be issued to Generation IACP Inc., at a price of $0.075 per share.

Upon issuance, the Common Shares will be subject to a hold period of four months and one day.

Advisors

Norton Rose Fulbright Canada LLP is acting as legal advisor to the Company in connection with the Requisition and Meeting. Kingsdale Advisors is acting as strategic shareholder, communications and proxy advisor to the Company in connection with the Requisition and Meeting.

About MGX Minerals

MGX Minerals is a diversified Canadian resource and technology company with interests in advanced materials, battery technologies, gold and industrial minerals.

Contact Information

Patrick Power

CEO

Telephone: 1.604.681.7735

Web: www.mgxminerals.com

Hot Features

Hot Features