Ahold Delhaize successfully priced its inaugural Green Bond

28 Marzo 2023 - 9:07AM

Ahold Delhaize successfully priced its inaugural Green Bond

Zaandam, the Netherlands, March 28, 2023 – Ahold Delhaize (the

“Company”) today announced that it successfully priced a €500

million Green Bond, with a term of 5 years, maturing on April 4,

2028.

The transaction marks Ahold Delhaize’s inaugural Green Bond

issuance and follows its Sustainability Bond issuance in 2019, the

€1bn Sustainability-Linked RCF launched in 2020 and refinanced to

€1.5bn in 2022, and the Sustainability-Linked Bond issuance in

2021. All these ESG-labelled financings together reinforce the

continued alignment of the Company’s funding strategy to its

sustainability strategy and overall ESG ambitions. Use of

bond proceeds The bond proceeds will be used to finance

and re-finance Ahold Delhaize’s new or existing environmentally

friendly assets with a positive measurable environmental impact in

the following categories:

- Green Buildings

- Renewable Energy

- Energy Efficiency

- Clean Transportation

- Pollution Prevention and Control

Updated Green Finance Framework Ahold

Delhaize has published an updated Green Finance Framework (the

“Framework”) structured in accordance with the International

Capital Markets Association (ICMA) Green Bond Principles (2021) and

Loan Market Association (LMA) Green Loan Principles (2023) to

detail the quality of the Eligible Green Projects and the

governance process around green finance. The Framework has been

reviewed by the external ESG agency Sustainalytics which has

provided a positive Second-Party Opinion. The Green Finance

Framework and the relative Second Party Opinion are available

here. Confirming commitment Jan Ernst de

Groot, Chief Sustainability Officer said: “We’re excited to

announce the issuance of the first Green Bond and fourth ESG

financing instrument for the Company. This transaction confirms

Ahold Delhaize’s aspiration to taking up its sustainability

challenges and mobilizing its teams to strive to create sustainable

value for all its stakeholders. This step supports our updated

climate plans announced last year, and allows us to accelerate our

contribution to the transition to sustainable food systems.”

Pricing of issuance The issuance is priced at

99.851 per cent and carries an annual coupon of 3.500 per cent. The

notes will settle on April 4, 2023 and shall be listed on Euronext

Amsterdam. BofA Securities and ING acted as Green Structuring

Co-ordinators. BNP Paribas, BofA Securities, Deutsche Bank, Goldman

Sachs Bank Europe SE, ING and Wells Fargo Securities acted as Joint

Bookrunners.

- Ends -

Cautionary notice This communication is

not for release, distribution or publication, whether directly or

indirectly and whether in whole or in part, into or in the United

States, Australia, Canada or Japan or any (other) jurisdiction

where any of such activities would constitute a violation of the

relevant laws of such jurisdiction. The offer of bonds

referred to in this communication was limited in the EEA and the

United Kingdom to qualified investors only. The bonds have not been

and will not be registered under the US Securities Act of 1933, as

amended (the “US Securities Act”) and will also not be registered

with any authority competent with respect to securities in any

state or other jurisdiction of the United States of America. The

bonds may not be offered or sold in the United States of America

without either registration of the securities or an exemption from

registration under the US Securities Act being applicable.

This communication includes forward-looking statements. All

statements other than statements of historical facts may be

forward-looking statements. Words and expressions such as maturing,

2028, continued, alignment, strategy, ambitions, will, new,

aspiration, strive, accelerate, transition, shall or other similar

words or expressions are typically used to identify forward-looking

statements. Forward-looking statements are subject to risks,

uncertainties and other factors that are difficult to predict and

that may cause actual results of Koninklijke Ahold Delhaize N.V.

(the “Company”) to differ materially from future results expressed

or implied by such forward-looking statements. Such factors

include, but are not limited to, the risk factors set forth in the

Company’s public filings and other disclosures. Forward-looking

statement reflect the current views of the Company’s management and

assumptions based on information currently available to the

Company’s management. Forward-looking statements speak only as of

the date they are made and the Company does not assume any

obligation to update such statements, except as required by law.

For more information

- Press office Ahold Delhaize: +31 88 6595134 /

media.relations@aholddelhaize.com

- Investor relations: +31 88 659 5213 /

investor.relations@aholddelhaize.com

- Social media: Instagram: @Ahold-Delhaize | LinkedIn:

@Ahold-Delhaize | Twitter: @AholdDelhaize

About Ahold Delhaize Ahold Delhaize is one of

the world’s largest food retail groups and a leader in both

supermarkets and e-commerce. Its family of great local brands

serves 60 million customers each week, both in stores and online,

in the United States, Europe, and Indonesia. Together, these brands

employ more than 414,000 associates in 7,659 grocery and specialty

stores and include the top online retailer in the Benelux and the

leading online grocers in the Benelux and the United

States. Ahold Delhaize brands are at the forefront of sustainable

retailing, sourcing responsibly, supporting local communities and

helping customers make healthier choices. The company’s focus on

four growth drivers – drive omnichannel growth, elevate healthy and

sustainable, cultivate best talent and strengthen operational

excellence – is helping to fulfil its purpose, achieve its vision

and prepare its brands and businesses for tomorrow. Headquartered

in Zaandam, the Netherlands, Ahold Delhaize is listed on the

Euronext Amsterdam and Brussels stock exchanges (ticker: AD) and

its American Depositary Receipts are traded on the over-the-counter

market in the U.S. and quoted on the OTCQX International

marketplace (ticker: ADRNY). For more information, please visit:

www.aholddelhaize.com.

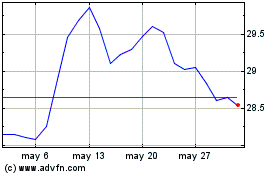

Koninklijke Ahold Delhai... (EU:AD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Koninklijke Ahold Delhai... (EU:AD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024