- Repositioning of glenzocimab in the treatment of ST-segment

elevation myocardial infarction (STEMI)

- Receivership proceedings: extension of the call for tenders

for a continuation or sale plan until November 5, 2024

- Approval by shareholders of all resolutions at the Combined

General Meeting on October 25, 2024

Regulatory News:

ACTICOR BIOTECH (FR0014005OJ5 - ALACT), a clinical stage

biopharmaceutical company developing glenzocimab, an innovative

drug for the treatment of cardiovascular emergencies, today

publishes its half-year results to June 30, 2024, approved by the

Board of Directors on October 23, 2024, and provides an update on

its clinical developments.

The 2024 half-year financial report is available to the public

on the Investors/Regulated Information section of the company's

website. The limited review procedures on the interim financial

statements have been performed. The limited review report is in the

process of being issued.

Financial highlights

(limited review - statutory accounts)

Given the Company's stage of clinical development, it does not

generate revenues.

Research & Development costs1 amounted to 4,244

thousand euros as of June 30, 2024, compared to 5,918 thousand

euros as of June 30, 2023.

General and Administrative expenses totalled 2,692

thousand euros as of June 30, 2024, versus 2,093 thousand euros for

the same period in 2023.

Operating loss reached 7,202 thousand euros for the first

half of 2024, compared to 9,171 thousand euros in the same period

of 2023.

As a result, the Company recorded a net loss of 7,305

thousand euros as of June 30, 2024, compared to 9,471 thousand

euros as of June 30, 2023.

As of June 30, 2024, cash and cash equivalents amounted

to 4,8 million euros, compared to 3.9 million euros as of December

31, 2023. As a reminder, on March 15, 2024, the Company raised 8

million euros through a capital increase. On August 6, 2024, the

Paris Commercial Court ordered the opening of receivership

proceedings, enabling the Company to finance its operations until

January 2025.

Clinical point: repositioning of

glenzocimab in the treatment of myocardial

infarction

On October 11, 2024, Acticor Biotech provided an update on its

clinical developments, evaluating glenzocimab in the treatment of

myocardial infarction.

As part of its clinical programme, Acticor Biotech is conducting

the LIBERATE phase 2b study in partnership with the University of

Birmingham to evaluate glenzocimab in the treatment of ST-segment

elevation myocardial infarction (STEMI). To date, 30 patients have

been recruited, with results expected by the end of 2026. At the

same time, the company is preparing the GLORIA study, a phase 2

study also targeting STEMI, to explore different doses and

administration optimisations, with a view to a phase 3 study as

early as 2027. Recruitment for GLORIA could begin in early 2025,

subject to funding.

Receivership proceedings

On September 13 2024, the court-appointed administrator

(administrateur judiciaire) has published an advertisement in the

newspaper Les Echos seeking new investors to provide a

restructuring plan (plan de continuation, articles L.626-1 et seq.

of the French Commercial Code), or failing that, potential buyers

for the business and assets of the Company (plan de cession,

articles L.642-1 et seq. of the French Commercial Code). The

court-appointed administrator has granted an extension of the

invitation to tender until Tuesday 5 November 2024 at 12:00

pm.

Interested parties wishing to respond to the extended call for

tenders are invited to express their interest by e-mail to the

following addresses:

- Marine Pace: m.pace@aj-2m.com

- Roxane Brodin: r.brodin@aj-2m.com

For further information: acticor-biotech.com

As a reminder, on 6 August 2024, the Paris Commercial Court

ordered the opening of receivership proceedings. The purpose of

these proceedings is to enable the Company to assess all the

options available to it to pursue its development, the development

of its product, glenzocimab, and its search for financing and

partners. This procedure will also enable the Company to finance

its operations until January 2025.

Annual General Meeting

Shareholders present, represented or voting by post held

4,364,472 votes, giving a quorum of 28.19%. All the resolutions put

to the vote at this Annual General Meeting were adopted, in

particular the renewal of the appointments of the directors

submitted to the vote.

The consolidated result of the vote by resolution and the report

of the Annual General Meeting of October 25, 2024 will be available

on the Company's website, in the Investors/ Shareholders' Meetings

section, within the legal deadlines.

About ACTICOR BIOTECH

ACTICOR BIOTECH, a clinical-stage biopharmaceutical company

founded in 2013 from the work of INSERM, is developing glenzocimab,

a humanized monoclonal antibody fragment (fab) targeting the GPVI

platelet receptor for the treatment of cardiovascular emergencies

and acute thrombotic diseases.

The main clinical indication being evaluated is acute ischemic

stroke, due to the strong need for safer treatments, particularly

those that do not increase the risk of bleeding, and its high

incidence. In three international clinical trials involving over

600 stroke patients, no significant impact on neurological

improvement (mRS score at 3 months) was demonstrated, with the

exception of a sub-population of patients with intracerebral

haemorrhage, where mortality was significantly reduced by a factor

of 3 (p=0.035) (Mazighi et al. 2024).

LIBERATE, a Phase 2 clinical trial in the acute phase of

myocardial infarction (STEMI), is currently being recruited through

an academic partnership with the University of Birmingham (UK).

This study aims to demonstrate the efficacy of glenzocimab in

reducing the size of myocardial infarction, a critical factor for

long-term cardiac function.

In all, more than 800 subjects were included in the clinical

trials, over 400 of whom were exposed to glenzocimab without safety

concerns.

The use of glenzocimab in thrombotic diseases is covered by 3

patent families, with an expiry date in 2036 for the first family.

ACTICOR BIOTECH also has the right to develop a biomarker for

stroke patients.

Acticor Biotech is backed by a panel of European and

international investors (Mediolanum farmaceutici, Karista, Go

Capital, Newton Biocapital, CMS Medical Venture Investment (HK)

Limited, A&B (HK) Limited, Anaxago, and the Armesa Foundation)

and has been listed on Euronext Growth Paris since November 2021

(ISIN: FR0014005OJ5 - ALACT).

For further information, visit: www.acticor-biotech.com

Disclaimer

This press release contains forward-looking statements with

respect to Acticor Biotech and its business. Acticor Biotech

believes that these forward-looking statements are based on

reasonable assumptions. However, no assurance can be given that the

expectations expressed in such forward-looking statements will

prove to have been correct, as they are subject to risks, including

those described in the Universal Registration Document as filed

with the Autorité des marchés financiers on July 9, 2024, and to

changes in economic conditions, financial markets and the markets

in which Acticor Biotech operates. The forward-looking statements

contained in this press release are also subject to risks that are

unknown to Acticor Biotech or that Acticor Biotech does not

currently consider material. The occurrence of some or all of these

risks could cause Acticor Biotech's actual results, financial

condition, performance or achievements to differ materially from

those expressed in the forward-looking statements.

Appendices

Income statement

30/06/2024

30/06/2023

Statutory

6 months

6 months

K€

K€

Research and development costs, net

(4,244)

(5,918)

Of which research and

development costs

(4,249)

(7,074)

Of which grants

5

1,156

Operating and administrative expenses

(2,692)

(2,093)

Costs relating to share-based payments

(2)

(810)

Other operating income and expenses

(including CIR)

(264)

(350)

Operating income (loss)

(7,202)

(9,171)

Financial expenses

(240)

(308)

Financial income

137

8

Income (loss) before tax

(7,305)

(9,471)

Income tax

Net profit (loss) for the

period

(7,305)

(9,471)

Attributable to shareholders of the parent

company

(7,305)

(9,471)

Non-controlling interests

-

Weighted average number of shares in

circulation

15,755,227

11,631,540

Basic earnings per share (€/share)

(0.46)

(0.81)

Diluted earnings per share (€/share)

(0.46)

(0.81)

Statement of financial position

30/06/2024

30/06/2023

K€

K€

ASSETS

Intangible assets

169

744

Property, plant and equipment

16

28

Non-current financial assets

392

522

Total non-current assets

577

1,294

Trade receivables and related accounts

-

-

Other receivables

4,774

2,535

Current financial assets

-

Prepaid expenses

57

656

Cash and cash equivalents

4,816

7,955

Total current assets

9,647

11,146

Total Assets

10,224

12,440

LIABILITIES AND EQUITY

Shareholders' equity

Share Capital

788

617

Additional paid-in capital

45,350

35,209

Other comprehensive income

-

-

Accumulated losses - attributable to

shareholders of the parent

(27,256)

(27,256)

Net profit (loss) - attributable to equity

holders of the parent

(24,171)

(9,471)

Equity attributable to shareholders of

the parent company

(5,290)

(901)

Non-controlling interests

-

-

Total shareholders' equity

(5,290)

(901)

Non-current liabilities

Obligations to employees

-

-

Non-current financial debts

4,153

3,171

Non-current derivative liabilities

-

-

Provisions

-

-

Non-current liabilities

4,153

3,171

Current liabilities

Current financial debts

3,092

3,192

Trade payables

7,358

6,347

Social and fiscal debts

911

631

Other current liabilities

-

-

Total current liabilities

11,361

10,170

Total liabilities and equity

10,224

12,440

____________________________ 1 Net of research tax credit and

grants.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031547113/en/

ACTICOR BIOTECH Gilles AVENARD, MD CEO and Founder

gilles.avenard@acticor-biotech.com

Sophie BINAY, PhD General Manager and CSO

Sophie.binay@acticor-biotech.com

NewCap Mathilde BOHIN Investor Relations

acticor@newcap.eu T. : +33 (0)1 44 71 94 95

NewCap Arthur ROUILLÉ Media Relations acticor@newcap.eu

T. : +33 (0)1 44 71 00 15

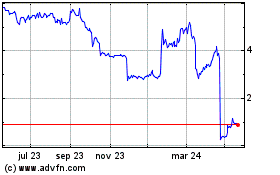

Acticor Biotech (EU:ALACT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

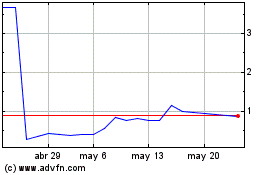

Acticor Biotech (EU:ALACT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024