- eyonis™ LCS pivotal REALITY study met all primary and secondary

endpoints

- A webcast including Key Opinion Leaders will be held on

November 7, 2024, to discuss the REALITY study results

- On track to file U.S. & European marketing authorization

for eyonis™ LCS in H1 2025

- €6.2 million Q3 2024 quarterly revenue, second highest ever, up

10.7% vs Q3 2023

- €17.1 million total year-to-date revenue as of September 30,

2024

- First 2 projects awarded in Q3 to Median iCRO as preferred

provider to a Top 3 pharma in oncology

- €11.5 million cash and cash equivalents as of September 30,

2024

Regulatory News:

Median Technologies (FR0011049824, ALMDT, PEA/SME eligible,

“Median” or “The Company”), a leading developer of eyonis™, a suite

of artificial intelligence (AI) powered Software as a Medical

Device (SaMD) for early cancer diagnostics, and a globally leading

provider of AI analyses and imaging services for oncology drug

developers, announces today that its Board of Directors approved

the consolidated IFRS financial statements for the first half of

2024 on October 23, 2024, and provides operational and financial

updates from the third quarter of 2024.

Fredrik Brag, CEO and Founder of Median Technologies,

said: “We are extremely encouraged that our wholly owned lead

SaMD1 eyonis™ Lung Cancer Screening (LCS) met all primary and

secondary endpoints in REALITY during the third quarter. This was

the first of two pivotal studies for this promising early lung

cancer diagnostic candidate. We look forward to communicating data

from RELIVE, the ongoing second pivotal trial of eyonis™ LCS in the

coming months. In parallel, we are already getting ready to rapidly

complete U.S. and European regulatory filings for marketing

authorizations in the first half of 2025.

“Lung cancer is the number one cancer killer because it is

usually diagnosed too late. We believe eyonis™ LCS will enable

physicians to diagnose lung cancer earlier – when it may still be

cured. Curing early-stage lung cancer would also mean avoiding

extremely costly advanced cancer care – offering tremendous savings

for our healthcare systems globally. In the U.S, Lung Cancer

Screening has been reimbursed since 2015. However, its broad

adoption is hampered by the absence of approved software as medical

devices proven to provide reliable and accurate early diagnosis,

which is what the eyonis™ LCS aims to achieve.

“We also are delighted to report Q3 saw continuing revenue

growth of our iCRO business unit. We have rapidly become the

preferred partner for biopharma companies globally, including two

of the top three global pharma companies in oncology. In addition,

during Q3, we have established lucrative new deals in South Korea

and Japan. Median iCRO’s central imaging services have offered

trusted efficiency for over a decade now, and our new and advanced

AI analyses capabilities offer valuable knowledge, so our clients

can conduct more efficient, and data driven drug development.”

Q3 2024 Operational and Financial Update

eyonis™ LCS

SaMD: further to major advances in pivotal studies, regulatory

submissions to obtain marketing authorizations, FDA 510(k)

clearance and CE marking, are planned in H1 2025

The Company released in August the definitive positive results

from REALITY (Clinicaltrials.gov identifier: NCT06576232), the

first of the two pivotal eyonis™ LCS clinical studies, evaluating

the standalone performance of eyonis™ LCS for accurately diagnosing

lung cancer. Despite the inclusion of many challenging Low Dose

Computed Tomography (LDCT) images, the eyonis™ LCS SaMD achieved

exceptional results and met all primary and secondary endpoints

with statistical significance. eyonis™ LCS achieved an area under

the curve (AUC) value of 0.904 at patient level versus an AUC of

0.80 – the minimum value set as the primary endpoint for

REALITY.

The positive REALITY outcome is a particularly impressive

demonstration of the Median SaMD’s AI powered capability given the

unusually challenging patient data that participating sites

provided for analysis during the study. REALITY was enriched,

compared to an average patient population, with small

non-spiculated cancers, and large spiculated benign nodules, both

of which are challenging for radiologists to diagnose in a

real-world setting, without any robust computer-aided diagnosis

system. A full 80% of the staged LDCT images included in the study

were considered by the sites providing them to be

difficult-to-diagnose Stage 1 cancers. The REALITY analyses by

eyonis™ LCS were conducted on data from 1,147 patients provided by

five major cancer centers in the US and Europe and two clinical

data providers.

A webcast will be held on November 7, 2024, including

internationally renowned Key Opinion Leaders who participated in

the REALITY study, to discuss what these data mean for

pulmonologists like themselves who regularly treat lung cancer

patients in their clinical practice. An invitation with the

specifics will be published shortly.

The second pivotal trial, RELIVE, is a Multi-Reader Multi-Case

(MRMC) study that will offer clinical validation of eyonis™ LCS to

complement the analytical validation already achieved with REALITY.

The RELIVE study objective is to compare the ability of

radiologists to successfully diagnose lung cancer in patients with

or without the help of eyonis™ LCS. RELIVE is ongoing and scheduled

for completion in the coming months, with an anticipated data

read-out in Q1 2025.

Median Technologies expects to submit regulatory filings in the

US for eyonis™ LCS FDA 510(k) clearance and for CE mark in Europe

in H1 2025. In addition, the company is preparing health economic

studies to demonstrate the compelling life- and cost-saving

benefits of eyonis™ LCS SaMD, which it expects to strongly support

reimbursement with payers in the U.S. and Europe. Median also is in

active discussion with a variety of potential regional and global

distribution partners to prepare commercialization of eyonis™ LCS

primarily in the US.

iCRO business performance and major

achievements in Q3, 2024

Median Technologies’ iCRO business delivers trusted central

imaging services paired with unparalleled AI image analyses.

Oncology drug developers all around the world work with Median

iCRO, including two of the top three pharmaceutical companies

(based on oncology sales), both of which have designated Median

iCRO as “preferred provider”, and many more leading oncology

companies. As of today, the iCRO business unit has supported over

270 cancer trials, including more than 100 Phase III studies.

Launched in 2022, the iCRO Imaging Lab provides partners with AI

and machine learning for a diverse array of complex oncology drug

development challenges. The iCRO’s AI image analysis capabilities

offer a powerful catalyst to increase the attractiveness of

Median’s imaging services to biopharmaceutical companies and unique

added value compared to competitors.

In August 2024, the Company announced the signature of an

initial agreement with a Top 10 oncology pharmaceutical company2.

The agreement aims at conducting AI-based imaging biomarker3

discovery on the clinical data of a drug candidate and could lead

to a broader collaboration between the pharmaceutical company and

Median. The drug-specific imaging biomarkers could ultimately be

utilized as companion diagnostics4 to select patients who are most

likely to benefit from the drug. The agreement involves Imaging

Lab, a dedicated entity of Median’s iCRO Business Unit, providing

biopharma companies with advanced AI-based decision-making

capabilities.

In September 2024, earlier than expected, Median was awarded two

initial studies as part of its preferred provider status with the

recently signed top 3 pharmaceutical company. This client has the

largest pipeline of studies in oncology and could provide

significant growth for Median in the coming quarters.

In September 2024, Median’s offices in Shanghai obtained the ISO

9001:2015 Certification for the provision of software development

of image evaluation and data processing for clinical trials, and

the provision of independent image evaluation service solution for

clinical trials. The ISO 9001:2015 certification represents a key

milestone for Median. In addition, earlier this year, Median was

awarded its first deals in Japan and South Korea for a total amount

of €3.1 million. The Company expects the combination of these new

Asian deals outside China, together with the newly obtained ISO

9001:2015 certification, to be strong catalysts for future sales in

the dynamic East Asia clinical trial market.

The Company's Q3 2024 revenue was €6.2 million, up 10.7%

from Q2 2024 (€5.6 million) and 10.7% compared to Q3 2023 revenue

(€5.6 million). Q3 2024 revenue is the second highest quarterly

revenue ever recorded by the Company.

Year-to-Date revenue amounted to €17.1 million, as of

September 30, 2024, a slight increase compared to 2023 revenue over

the same period. Strong levels of revenue in the third quarter made

it possible to make up for the delays accumulated, primarily in

China, during the first half of the year. All revenue comes from

Median Technologies’ iCRO business unit.

The order backlog5 stood at €68.2 million on September 30,

2024, vs €71.7 million as of June 30, 2024, and vs €62.7

million on September 30, 2023. In Q3 2024, the order backlog was

negatively impacted by the Euros to US Dollars exchange rate.

Cash and cash equivalents of €11.5 million

on September 30, 2024

Median Technologies' cash and cash equivalents stand at €11.5

million, as of September 30, 2024, compared to €16 million as of

June 30, 2024. The cash position doesn’t include the France’s 2023

research and innovation tax credit expected at €1.6 million this

year, which had not yet been received as of September 30, 2024.

The Company’s operations are fully financed until the second

quarter of 2025.

Moreover, Median has received approval from the European

Investment Bank (EIB) to extend the maturity of its 2020 loan by

six months until October 2025, subject to completion of legal

documentation, and there are several options, currently in

negotiation, to increase the cash runway including (but not limited

to) finalizing an agreement with the EIB to establish a new

financing facility; significant operational improvements to enhance

the profitability of the iCRO business unit; as well as additional

funding from strategic partners.

Based on these elements, the going concern assumption was

adopted by the Board of Directors when approving the 2024 half-year

financial statements.

H1 2024 Financial Highlights (IFRS consolidated financial

statements)

Consolidated

Statement of Cash-Flow

Cash flow (€ thousands)

06/30/2024

(6 months)

06/30/2023

(6 months)

Operating cash flow

(11,348)

(9,045)

Change in operating working capital

requirement

1,058

(2,668)

Net cash flow from operating

activities

(10,909)

(12,083)

Net cash flow from investing

activities

(662)

(514)

Net cash flow from financing

activities

8,020

(324)

Impact of changes in exchange rates

47

(207)

Net change in cash and cash

equivalents

(3,503)

(13,128)

Cash at beginning of period

19,495

21,467

Cash at end of period

15,992

8,338

The €2.3 million increase in operating cash flow burn was offset

by a working capital improvement of €3.7 million. Additionally,

Median drew down a €8.5 million tranche of the 2019 EIB financing

agreement early January, which resulted in an improved cash

position at June end versus previous year.

Net consolidated

income statement under IFRS accounting rules

€ thousands

H1 2024

H1 2023

Revenue from ordinary

activities

10,936

11,394

Personnel costs

(13,391)

(13,360)

External costs

(10,260)

(8,910)

Operating profit (loss)

(13,295)

(11,189)

Net financial income

853

1,221

Net profit (loss)

(12,457)

(10,088)

H1 2024 revenues were €10.9 million, versus €11.4 million in H1

2023, due to delays experienced on some sizeable projects that have

been recovered since then, in Q3 2024. All revenue comes from the

iCRO business.

Personnel costs remained stable in H1 2024 compared to H1 2023,

as an increase of €1.0 million in payroll expenses, was offset by

lesser share-based payments in an equivalent amount.

External costs amounted to €10.3 million as of June 30, 2024,

compared with €8.9 million a year before. The €1.4 million

difference in expenses essentially reflects an increase in Median’s

IT infrastructure costs to support the eyonis™ LCS development, and

an increase in image reading costs (iCRO business).

Net financial income, which is a non-cash item mainly driven by

stock price fluctuations, decreased by €0.4 million.

Median Technologies informs its shareholders

and the financial community that its half year financial report on

the accounts for the half year ending June 30, 2024, has been made

available and filed with the French financial market authority

(Autorité des Marchés Financiers).

The half year financial report is available on

the Company’s website:

http://www.mediantechnologies.com/investors/

About eyonis™ LCS: eyonis™ Lung Cancer Screening (LCS) is

an artificial intelligence (AI) powered diagnostic device that uses

machine learning to help analyze imaging data generated with low

dose computed tomography (LDCT) to diagnose lung cancer at the

earliest stages, when it can still be cured in many patients.

eyonis™ LCS has been classified by regulators as “Software as

Medical Device”, or SaMD, and is the subject of two pivotal studies

required for marketing approvals in the U.S. and Europe: REALITY

(successfully completed) and RELIVE (ongoing). Filing applications

including these pivotal data are scheduled to be submitted for FDA

510(k) premarket clearance and CEmarking in 2025. Separately,

Median’s AI technology is being sold and deployed across cancer

indications, via Median’s iCRO business unit, to companies

performing clinical trials of experimental therapeutics, including

the world’s leading pharmaceutical companies in cancer.

About Median Technologies: Pioneering innovative imaging

solutions and services, Median Technologies harnesses cutting-edge

AI to enhance the accuracy of early cancer diagnoses and

treatments. Median's offerings include iCRO, which provides medical

image analysis and management in oncology trials, and eyonis™, an

AI/ML tech-based suite of software as medical devices (SaMD).

Median empowers biopharmaceutical entities and clinicians to

advance patient care and expedite the development of novel

therapies. The French-based company, with a presence in the U.S.

and China, trades on the Euronext Growth market (ISIN:

FR0011049824, ticker: ALMDT). Median is also eligible for the

French SME equity savings plan scheme (PEA-PME). For more

information, visit www.mediantechnologies.com.

Forward-Looking Statements

This press release contains forward-looking statements. These

statements are not historical facts. They include projections and

estimates as well as the assumptions on which these are based,

statements concerning projects, objectives, intentions, and

expectations with respect to future financial results, events,

operations, services, product development and potential, or future

performance.

These forward-looking statements can often be identified by the

words "expects," "anticipates," "believes," "intends," "estimates"

or "plans" and any other similar expressions. Although Median's

management believes that these forward-looking statements are

reasonable, investors are cautioned that forward-looking statements

are subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of Median

Technologies, that could cause actual results and events to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements.

All forward-looking statements in this press release are based

on information available to Median Technologies as of the date of

the press release. Median Technologies does not undertake to update

any forward-looking information or statements, subject to

applicable regulations, in particular Articles 223-1 et seq. of the

General Regulation of the French Autorité des Marchés

Financiers.

____________________ 1 SaMD: Software as a Medical Device 2

Arjun Murthy – Top 15 biopharma companies by Oncology Sales in 2023

3 An imaging biomarker is a “defined characteristic that is

measured as an indicator of normal biological processes, pathogenic

processes or responses to an exposure or intervention, including

therapeutic interventions” -

https://www.ncbi.nlm.nih.gov/books/NBK326791/ 4

https://www.fda.gov/medical-devices/in-vitro-diagnostics/companion-diagnostics

5 The order backlog is the sum of orders received but not yet

fulfilled. An increase or decrease in the order backlog corresponds

to the order intake of the reporting period, net of invoiced

services, completed or cancelled contracts, and currency impact for

projects in foreign currency (re-evaluated at the exchange rate on

closing date). Orders are booked once the customer confirms, in

writing, its retention of the Company’s services for a given

project. The contract is usually signed a few months after written

confirmation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024987671/en/

MEDIAN TECHNOLOGIES Emmanuelle Leygues Head of Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Investors Ghislaine Gasparetto SEITOSEI ACTIFIN

+33 6 21 10 49 24 ghislaine.gasparetto@seitosei-actifin.com

U.S. media & investors Chris Maggos COHESION

BUREAU +41 79 367 6254 chris.maggos@cohesionbureau.com

Press Caroline Carmagnol ALIZE RP +33 6 64 18 99

59 median@alizerp.com

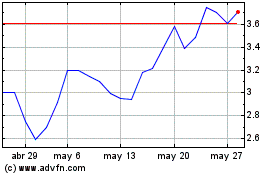

Median Technologies (EU:ALMDT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Median Technologies (EU:ALMDT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024