- Consolidated sales of €45.2 million, +10.8% at constant

exchange rates, after the restatement of foot and ankle activities

as activities held for sale

- Increase in EBITDA to €11.7 million (+14.0%), EBITDA margin of

25.8%

- Recurring operating profit of €4.9 million

- Cash position of €11.0 million at December 31, 2022

Regulatory News:

Amplitude Surgical (ISIN: FR0012789667, Ticker: AMPLI, eligible

for PEA-PME savings plans) (Paris:AMPLI), a leading French player

on the surgical technology market for lower-limb orthopedics,

announces its results for the first half of its 2022-23 financial

year.

Olivier Jallabert, Amplitude Surgical’s CEO, said:

“Amplitude Surgical’s sales for the first half of its 2022-23

financial year, excluding foot and ankle activities for which a

strategic review is underway, recorded an increase of 10.8% at

constant exchange rates compared with the first half of the

previous year. The growth in activity combined with good control

over operating costs led to a 14.0% improvement in EBITDA to €11.7

million. There was a recurring operating profit of €4.9 million, a

substantial improvement on the previous year”.

Financial summary – actual exchange rates:

In June 2022, the Board of Directors issued a recommendation

that a strategic review of the Group’s foot and ankle activities be

launched. This review, which is still underway, could lead to the

divestment of this activity driven by Novastep and Novastep Inc. As

of December 31, 2022, the criteria set out in IFRS 5 are complied

with. Therefore, and in accordance with IFRS 5 “Non-current assets

held for sale and discontinued activities” principles, the two

subsidiaries fulfill the criteria of a discontinued activity and

are presented separately in the Group’s income statement as

Profit/loss from discontinued activities, after tax. 2021-22

first-half accounts have been restated accordingly.

€m - IFRS

H1 2022-23

H1 2021-2022

Δ

Sales

45.2

40.2

12.5%

Gross margin

32.4

29.5

9.9%

as a % of sales

71.6%

73.3%

-168 bps

Sales & Marketing costs

13.8

12.8

8.0%

General & Administrative costs

6.2

5.6

10.7%

Research & Development costs

0.8

0.9

-14.2%

EBITDA

11.7

10.2

14.0%

as a % of sales

25.8%

25.4%

+35 bps

Recurring operating profit/loss

4.9

2.9

Non-recurring operating income and

expenses

-1.0

-0.3

Operating profit/loss

3.9

2.6

Financial profit/loss

-6.9

-4.4

Current and deferred tax

-0.3

-0.4

Profit/loss from discontinued

activities, after tax

-0,9

-0.8

Net profit/loss - Group share

-4.2

-2.8

December 31, 2022

June 30, 2022

Net financial debt

128.3

118.0

Cash position at end of period

11.0

21.0

EBITDA up by 14.0% with an EBITDA margin of 25.8%

Over the first half of its 2022-23 financial year (from July to

December 2022), Amplitude Surgical generated sales, after

application of IFRS 5, of €45.2 million, up 12.5% in actual terms

and 10.8% at constant exchange rates compared with the previous

year. The Group’s consolidated sales after application of IFRS 5

correspond to sales from knee and hip activity.

Before application of IFRS 5, total Group sales including foot

and ankle activity came to €56.4 million, up 17.3% in actual terms

and 14.2% at constant exchange rates.

Amplitude Surgical recorded a gross margin of 71.6% in H1

2022-23, down 168 bps, impacted primarily by an increase in the

cost price of its products.

The Group’s operating expenses totaled €20.7 million, up 7.7%

compared with end-December 2021.

Sales & Marketing costs were up by 8.0%, as a result of the

growth in activity, principally in France.

General & Administrative spending rose by 10.7% to €6.2

million, with an increase in personnel expenses and costs notably

for quality and regulatory activities.

In the first half of 2022-2023, Research and Development

expenses represented 1.7% of sales, versus 2.3% in the first half

of 2021-22. However, including capitalized R&D costs, the

Group’s global investment in Research & Development increased

from €1.8 million in 2021/2022 to €2.3 million in the first half of

2022-23.

At the end of December 2022, excluding foot and ankle

activities, Amplitude Surgical had a workforce of 414 staff,

compared with 389 at end-June 2022. Personnel costs were up 8.9%

compared with the first half of 2021-2022.

EBITDA was thus €11.7 million, an increase of 14.0%, giving an

EBITDA margin of 25.8%, up 35 bps compared with the figure for the

first half of 2021-22.

Amplitude Surgical recorded a Recurring Operating Profit of €4.9

million in H1 2022-23, compared with a profit of €2.9 million in

the first half of 2021-2022, thanks to the positive sales trend and

good control over operating costs. Operating Profit totaled €3.9

million, versus €2.6 million in H1 2021-2022.

The Financial Result was -€6.9 million, and consisted primarily

of an interest expense of €5.2 million and the booking of currency

losses and gains giving a net loss of €1.5 million at end-December

2022.

The Net Result (Group share) was a loss of €4.2 million, versus

a net loss of €2.8 million in the first half of the previous

year.

Financial structure: cash position of €11.0 million at the

end of 2022

The net cash flow generated by operating activity was a positive

€1.0 million over the half, compared with a positive €1.7 million

in the first half of 2021-22.

Investments totaled €9.3 million in the first half of 2022-23,

versus €4.9 million in H1 2021-22.

At the end of December 2022, the Group had cash and cash

equivalents of €11.0 million and Net Financial debt of €128.3

million.

Availability of the financial report

Amplitude Surgical has made its half-year report to December 31,

2022 available to the public and filed it with the AMF French stock

market authorities.

This half-year financial report can be found on Amplitude

Surgical’s website at www.amplitude-surgical.com/fr, in the

“Documentation / Financial Report” section.

Next financial press release: Sales for the first 9

months of 2022-23, on Thursday April 20, 2023 (after

market).

About Amplitude Surgical

Founded in 1997 in Valence, France, Amplitude Surgical is a

leading French player on the global surgical technology market for

lower-limb orthopedics. Amplitude Surgical develops and markets

high-end products for orthopedic surgery covering the main

disorders affecting the hip, knee and extremities, and notably foot

and ankle surgery. Amplitude Surgical develops, in close

collaboration with surgeons, numerous high value-added innovations

in order to best meet the needs of patients, surgeons and

healthcare facilities. A leading player in France, Amplitude

Surgical is developing abroad through its subsidiaries and a

network of exclusive distributors and agents distributing its

products in more than 30 countries. Amplitude Surgical operates on

the lower-limb market through the intermediary of its Novastep

subsidiaries in France and the United States. At June 30, 2022,

Amplitude Surgical had a workforce of 460 employees and recorded

sales of nearly 104.8 million euros (including foot and ankle

activity and before application of IFRS 5).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230322005521/en/

Amplitude Surgical CFO Dimitri Borchtch

finances@amplitude-surgical.com +33 (0)4 75 41 87 41

NewCap Investor Relations Thomas Grojean

amplitude@newcap.eu +33 (0)1 44 71 94 94

NewCap Media Relations Nicolas Merigeau

amplitude@newcap.eu +33 (0)1 44 71 94 98

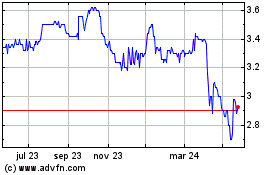

Amplitude Surgical (EU:AMPLI)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

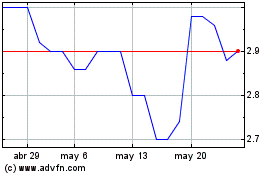

Amplitude Surgical (EU:AMPLI)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025