KBC Group: Third-quarter result of 877 million euros

09 Noviembre 2023 - 12:00AM

KBC Group: Third-quarter result of 877 million euros

Press Release

Outside Outside trading hours - Regulated information

Brussels, 9 November 2023, 7.00 a.m. CET

‘We recorded an excellent net profit of 877 million euros in the

third quarter of 2023. Compared to the result of the previous

quarter, our total income benefitted from several factors,

including better insurance results and a slightly higher level of

net fee and commission income, though these were offset by lower

levels of net interest income, trading and fair value income and

dividend income (following the traditional peak in the previous

quarter). Costs, including bank and insurance taxes, were down

slightly quarter-on-quarter, while impairment charges went up.

Consequently, when adding up the results for the first three

quarters of the year, our net profit amounted to 2 725 million

euros, up 30% year-on-year.

Our loan portfolio continued to expand, increasing by 2%

compared to a year ago, with growth being recorded in each of the

group’s core countries. Customer deposits were down 2%

year-on-year, as they were largely affected by deposit outflows

caused by the issuance of the retail State Note (‘Staatsbon’) in

Belgium at the start of September 2023.

On 11 August 2023, we started implementing our share buyback

programme of 1.3 billion euros, which we announced in the previous

quarter. By early November 2023, we had bought back approximately 5

million shares for a total consideration of around 0.3 billion

euros. The share buyback is planned to run until 31 July 2024. In

line with our general dividend policy, we will also pay out an

interim dividend of 1 euro per share on 15 November 2023 as an

advance on the total dividend for financial year 2023.

Our solvency position remained solid, with a fully loaded common

equity ratio of 14.6% at the end of September 2023, which already

fully incorporates the effect of the share buyback programme of 1.3

billion euros and the net increase in risk-weighted assets

following the ECB’s model review, as announced in August. Our

liquidity position remained excellent, as illustrated by an NSFR of

139% and LCR of 157%.

Lastly, it gives me great pleasure to announce that the

independent international research agency Sia Partners has once

again named KBC Mobile the best mobile banking and insurance app in

Belgium. KBC Mobile has further consolidated the leading position

it held last year and secured a top-three position worldwide. And

to top things off, Sia Partners also awarded our app with the title

of best user experience for car and home insurance.

In that respect, I’d like to sincerely thank all our employees

for their contribution to our group’s continued success. I also

want to thank all our customers, shareholders and all other

stakeholders for their trust and support, and assure them that we

remain committed to being the reference in bank-insurance and

digitalisation in all our home markets.’

Johan Thijs,Chief Executive Officer

Full press release attached

- 3q2023-quarterly-report

- 3q2023-pb-en

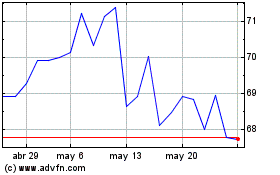

KBC Groep NV (EU:KBC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

KBC Groep NV (EU:KBC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024