Very strong

broad-based growth of Sales and PRO1 in first half

Strong pricing

dynamic, maintaining overall volume growth, sustaining

margins

+12% organic Sales Growth (+19%

reported)

+12% organic growth in PRO (+21%

reported)

Regulatory News:

Pernod Ricard (Paris:RI):

Press release - Paris, 16 February 2022

SALES

Sales for H1 FY23 reached €7,116m and grew +12%

organically (+19% reported), with a favourable FX impact of

+€355m linked mainly to the strength of US Dollar vs.

Euro.

H1 FY23 Organic Sales growth was broad-based across all

regions:

- Americas +7%: dynamic growth driven notably by USA with

favorable phasing2, Brazil and Canada,

- Asia-RoW +18%: excellent growth driven by India, Turkey,

Travel Retail and South East Asia recovery. H1 Sales in China

reflecting solid Q1 with good Mid Autumn Festival, but soft Q2

partly offset by favorable shipment phasing ahead of Chinese New

Year3. Confident outlook for China following lifting of Covid

restrictions,

- Europe +6%: very strong performance with Western Europe

and Travel Retail.

All spirits segments are growing double-digit:

- Strategic International Brands +13%: strong momentum

notably with the Scotch portfolio, Jameson and Absolut,

- Strategic Local Brands +13%: driven by growth of

Seagram’s Indian whiskies and Seagram’s Gin,

- Specialty Brands +14%: continued very strong development

of Lillet, Italicus, Malfy, Redbreast, Aberlour and Altos,

- Strategic Wines -2%: softness mostly from UK.

Strong broad-based pricing dynamic at +10%, thanks

to strong brand equity. Further price increases planned in H2.

Innovations and Prestige are in strong growth, +16% and

+10% respectively.

Q2 Sales were €3,808m, with +12% organic growth,

accelerating vs. Q1 organic Sales (+11%).

RESULTS

H1 FY23 PRO reached €2,423m, an organic growth of +12%,

with broadly stable organic operating leverage (-1 bp):

- Gross margin expanding +5 bps:

- Strong broad-based pricing dynamic across brands and

geographies and focus on operational efficiencies,

- offsetting high inflation in Costs of Goods.

- A&P growing in line with Net Sales with acceleration

expected in H2 to fuel future growth. (Ratio of c. 16% of Net Sales

expected for FY23),

- Structure costs +12% to support business dynamics and

digital transformation momentum,

- Favorable FX impact on PRO +€139m mainly from US Dollar

appreciation vs. Euro.

Group share of Net PRO was €1,743m, +21% reported vs. H1

FY22 and the Group share of Net Profit was €1,792m, +29%

reported, mainly reflecting increase in Profit from Recurring

Operations.

Very strong Earnings Per Share growth +23%, reflecting

growth in PRO, limited increase of recurring financial expenses

thanks to active liability management (with average cost of debt of

2.5%) in first half and the accretive impact of share buy-back

program.

FREE CASH FLOW AND DEBT

Solid cash generation with Recurring Free Cash Flow at c.

€1bn, -28% vs H1 FY22, reflecting higher operating working

capital outflows normalizing post covid recovery and increase in

CAPEX and strategic inventories to support future growth of aged

portfolio.

Net debt increased by €1,131m vs. 30 June 2022 to

€9,789m.

The Net Debt/EBITDA ratio at average rate4 was

2.6x at 31 December 2022.

OUTLOOK

In a persistently volatile context, Pernod Ricard has

reinforced confidence in delivering a strong performance in

FY23 driven by our global footprint and the attractiveness of our

diversified, premium portfolio :

- Dynamic, broad-based Net Sales growth albeit in a

normalising environment

- Continuing focus on revenue growth management and

operational efficiencies to offset cost pressure, in high

inflationary environment

- A&P ratio at c. 16% of Net Sales and continuing

disciplined investments in structure

- Sustaining Operating margin

- Accelerating investments in CAPEX and strategic

inventories, thanks to solid cash generation

- Confirming €750m share buy-back for FY23 with a new

€300m tranche to be launched imminently

- Positive currency effect expected

Alexandre Ricard, Chairman and Chief Executive Officer,

stated,

“Our first half performance was very strong, marked by

broad-based and diversified growth across all regions and

categories. In addition, particularly strong pricing dynamic

illustrates the attractiveness of our portfolio of premium brands

and enabled us to sustain margins in an inflationary context.

We will continue to invest behind our brands, our group-wide

transformation and S&R strategy, deliver operational

efficiencies and prepare for exciting future growth

opportunities.

I expect this dynamic growth to continue through FY23 albeit in

a normalizing environment, demonstrating the strength of our

strategy and the agility, dedication and exceptional engagement of

our teams around the world.”

All growth data specified in this press release refers to

organic growth (at constant FX and Group structure), unless

otherwise stated. Data may be subject to rounding.

A detailed presentation of H1 FY23 Sales and Results can be

downloaded from our website: www.pernod-ricard.com

Limited review procedures have been carried out by the Statutory

Auditors on the condensed half-yearly consolidated financial

statements. The Statutory Auditors’ Review Report on the

Half-yearly Financial Information is being issued.

Definitions and reconciliation of non-IFRS measures to IFRS

measures

Pernod Ricard’s management process is based on the following

non-IFRS measures which are chosen for planning and reporting. The

Group’s management believes these measures provide valuable

additional information for users of the financial statements in

understanding the Group’s performance. These non-IFRS measures

should be considered as complementary to the comparable IFRS

measures and reported movements therein.

Organic growth

- Organic growth is calculated after

excluding the impacts of exchange rate movements, acquisitions and

disposals and changes in applicable accounting principles and

hyperinflation.

- Exchange rates impact is calculated by

translating the current year results at the prior year’s exchange

rates.

- For acquisitions in the current year, the

post-acquisition results are excluded from the organic movement

calculations. For acquisitions in the prior year, post-acquisition

results are included in the prior year but are included in the

organic movement calculation from the anniversary of the

acquisition date in the current year.

- Where a business, brand, brand distribution

right or agency agreement was disposed of, or terminated, in the

prior year, the Group, in the organic movement calculations,

excludes the results for that business from the prior year. For

disposals or terminations in the current year, the Group excludes

the results for that business from the prior year from the date of

the disposal or termination.

- The impact of hyperinflation on Net Sales

in Turkey is excluded from P&L organic growth calculations by

capping unit price increases to a maximum of +26% per year,

equivalent to +100% over 3 years.

- This measure enables to focus on the

performance of the business which is common to both years and which

represents those measures that local managers are most directly

able to influence.

Profit from recurring

operations

Profit from recurring operations corresponds to the operating

profit excluding other non-current operating income and

expenses.

About Pernod Ricard

Pernod Ricard is the No.2 worldwide producer of wines and

spirits with consolidated sales amounting to €10,701 million in

fiscal year FY22. The Group, which owns 17 of the Top 100 Spirits

Brands, holds one of the most prestigious and comprehensive

portfolios in the industry with over 240 premium brands distributed

across more than 160 markets. Pernod Ricard’s portfolio includes

Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal

Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey,

Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur or

Mumm and Perrier-Jouët champagnes. The Group’s mission is to unlock

the magic of human connections by bringing “Good Times from a Good

Place”, in line with its Sustainability and Responsibility roadmap.

Pernod Ricard’s decentralised organisation empowers its 19,480

employees to be on-the-ground ambassadors of its purposeful and

inclusive culture of conviviality, bringing people together in

meaningful, sustainable and responsible ways to create value over

the long term. Executing its strategic plan, Transform &

Accelerate, Pernod Ricard now relies on its “Conviviality

Platform”, a new growth model based on data and artificial

intelligence to meet the ever-changing demand of consumers.

Pernod Ricard is listed on Euronext (Ticker: RI; ISIN

Code:FR0000120693) and is part of the CAC 40 and Eurostoxx 50

indices.

1 PRO: Profit from Recurring Operations

2 USA H1 Organic Sales growth +5%, ahead of underlying value

depletions +3%

3 Earlier vs. LY

4 Based on average EUR/USD rate: 1.05 in calendar year 2022

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230215005972/en/

Florence Tresarrieu / Global SVP Investors Relations and

Treasury +33 (0) 1 70 93 17 31 Edward Mayle / Investor Relation

Director +33 (0) 6 76 85 00 45 Charly Montet / Investor Relation

Manager +33 (0) 1 70 93 17 13 Emmanuel Vouin / Head of External

Engagement +33 (0) 1 70 93 16 34

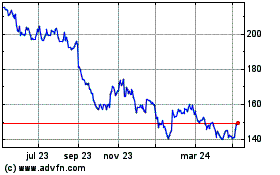

Pernod Ricard (EU:RI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

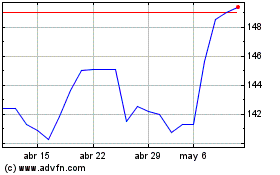

Pernod Ricard (EU:RI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025