Unifiedpost shows double-digit growth and addressable market

expansion

High organic revenue and customer

growth, combined with

European platform roll-out

La Hulpe, Belgium –

September 16,

2022,

7:00 a.m.

CET – Unifiedpost Group

(Euronext: UPG) (Unifiedpost, the Group or the Company) is pleased

to announce a double-digit

organic digital revenue growth over

H1 2022. The

recurring digital processing revenue grew

by 21.7% y/y to

€55.9

million in H1 2022. The

Group revenue grew by 13.6% y/y to €91.7 million over the same

period. The customer base grew by a

strong 14.9% in H1

2022 to reach close to

one million customers. Unifiedpost was

also able to bring the key

investment phase of the European platform roll-out to a

good end. This sets the Company in a unique position to take

advantage of the expected market

growth in the coming years driven

by regulation. It also allows management to shift the focus

towards becoming cash flow positive.

Highlights

- Group revenue

grew by 13.6% y/y to €91.7 million in H1 2022, with recurring

digital processing revenue up 21.7% y/y

- Strong growth of

customer base by 14.9% in H1 2022 compared to end 2021

- On the back of

platform and roll-out investments, the Group EBITDA amounts to

-€6.5 million

- Cash and cash

equivalents amount to €42.7 million and an additional €39.3 million

available in undrawn financing. Sufficient cash to allow

Unifiedpost to achieve a positive cash flow

- Becoming cash

flow positive by H2 2023 is the key priority for the Company

Commenting on the H1 2022 results, Hans

Leybaert, CEO and founder stated: “I am proud of how our businesses

have continued to grow in H1 2022. Unifiedpost again shows

double-digit organic growth, while investing in the European

expansion of our teams, solutions and products. Our performance is

in line with management expectations and budget. The peak of our

investments is now behind us. We strongly believe our long-term

growth and profitability profile is fully intact. The focus will be

on gross margin improvement and cost efficiency, balancing

investments for long-term growth while managing near-term

profitability. The pipeline is well-stocked with major licensing

deals and we are also working on major partnerships. We see

important economies such as France and Poland reaching milestones

in making digital invoicing mandatory. These developments give us

confidence for the future. I wish to thank our global teams for

their commitment to the development of Unifiedpost so far, and in

the future.”

Key financial

figures

|

(EUR million) |

H1 2022 |

H1 2021 |

Change (%) |

|

Group revenue |

91.7 |

80.7 |

+13.6% |

|

Digital processing revenue |

59.3 |

50.4 |

+17.7% |

|

Postage & parcel optimisation revenue |

32.4 |

30.3 |

+6.9% |

|

Recurring revenue (in % of total revenue) |

96.3% |

94.5% |

+1.8%pts |

|

Gross margin digital processing |

40.0% |

42.8% |

-2.8%pts |

|

EBITDA |

-6.5 |

-1.4 |

-5.1 |

|

R&D costs (expensed and capitalised) |

17.9 |

15.3 |

+17.0% |

|

Loss for the period |

21.1 |

11.1 |

+90.1% |

|

Cash and cash equivalents |

42.7 |

25.1 |

+70.1% |

Key business

KPI’s

|

(#) |

End H1 2022 |

End 2021 |

Change (%) |

|

Customers |

910,845 |

792,594 |

+14.9% |

|

Companies in business network |

1,745,401 |

1,504,895 |

+16.0% |

|

Banqup

customers |

68,645 |

35,408 |

+93.9% |

Impact of macro-economic and

geopolitical situation

Unifiedpost has not been directly

impacted by the Russian aggression against Ukraine.

The Group has no business in Ukraine, nor in Russia. It also has no

development centres in these countries. All countries where the

Group is active are however experiencing levels of inflation that

have not been observed in decades.

Double-digit growth rates in digital

processing business

Unifiedpost grew its revenue in

H1 2022 by 13.6% y/y in H1 to €91.7 million,

driven by a double-digit organic growth of the digital processing

revenue combined with a sound growth in postage and parcel

optimisation services.

The Group saw its revenue from digital

processing increasing by 17.7% y/y to €59.3 million in H1 2022.

This was mainly driven by the strong organic growth rate

of 21.7% y/y of

the recurring digital

revenue, i.e. digital platform revenue excluding the

project and license business. The growth is spread over different

countries and markets, with the Nordic countries, Serbia, Romania,

the Baltics, and the Benelux showing accelerated growth rates.

The project and license

business, which is non-recurring, contributed €3.4

million to the H1 2022 revenue. Project revenue is ahead

of management expectations.

The number of customers increased by

14.9% in H1 2022 to a total of 910,845 at H1 2022. Overall

average revenue per user (ARPU) in digital

processing business amounts to

€23.0 for Q2 2022. This reflects

some decline as expected by the management due to the increase in

SME business of the Group.

96.3% of the

total digital processing revenue resulted from recurring

services, slightly higher due to the limited number of

large projects.

The gross margin of the digital

processing business decreased slightly to

40.0% (H1 2021 42.8%). The

decrease in the first half of the year is predominantly caused by

the launching costs of the new services and by inflation impacting

suppliers and salaries.

Sound growth in postage & parcel

optimisation business

Group revenue was also supported by

robust growth in postage

and parcel optimisation services (+ 6.9% y/y in H1

to €32.4 million). Unifiedpost saw its postage and parcel

optimisation business having a good H1 2022, resulting in a revenue

of €32.4 million. This is an increase of €2.1 million compared to

H1 2021. The increase was caused by onboarding of large new

customers and general price increases. The postage & parcel

optimisation realised a gross margin of 10.3% for H1 2022, down

0.7%pts from H1 2021. Likewise, this decrease has been caused by

inflation.

H1 2022 result impacted by peak in

roll-out cost

Both segments combined, i.e. the digital

processing revenue and postage and parcel optimisation services,

led to a gross profit of €27.0 million at a total

revenue of €91.7 million. This resulted in a gross margin

of 29.4% (H1 2021: 30.8%).

During H1 2022, the Group spent

17.9€ million on

research and

development (R&D), of which

57.2% was capitalised. The R&D spending is equivalent to 30% of

digital processing revenue, which is the Group's current targeted

rate for R&D investments.

General and

Administrative

(G&A) expenses for

the period increased by 22.0% y/y to a total of €22.7

million. The increase is mainly due to the three

acquisitions in Q2 2021 and includes operational expenses for the

pan-European structure. The operational costs related to

the roll-out of Banqup

which peaked in

H1 2022 are expected to

decline in the coming periods. Banqup

demonstrates the significant additional growth potential of the

Group. Unifiedpost has already obtained regulatory approval in 19

countries to issue local payment accounts with their own IBAN

numbers. The Group is extending its European footprint by starting

up these countries, launching branch payment offices, getting the

payment business accredited by local authorities and launching new

business in countries with a current limited revenue. This

process includes one-off costs

that can be considered investments in the further scalability

of Banqup as more and more countries in

Europe introduce mandatory digital invoicing.

Sales & Marketing

expenses were up 29.6% y/y for the period and amounted to

€14.6

million. This was caused by the increasing efforts

in marketing and the additional cost related to the expansion of

the pan-European structure.

Unifiedpost has now brought the key investment

phase of the European platform roll-out to a

good end. This sets the Company in a unique

position to take advantage of the market growth in the coming years

driven by regulation. It also allows the management to shift the

focus towards becoming cash flow positive.

The Group reported an EBITDA of

-€6.5 million

for H1 2022 (H1 2021: -€1.4 million). The EBITDA

is impacted by €1.4 million non-recurring items.

The loss from operations for the period amounted

to €21.1 million (H1 2021: €11.1 million).

Growth secured

with funding

The cash flow from financing activities amounted

to +€51.6 million for the period. Unifiedpost’s

cash and cash equivalents increased to €42.7

million at H1 2022. The increase was realised by the

Company by signing a committed €100 million five-year senior

facilities agreement, provided by Francisco Partners, a leading

global investment firm that specializes in partnering with

technology-enabled businesses. The facility is structured in a term

loan facility A of €75 million which has been drawn and an uncalled

capex facility B of €25 million. It remains available for 24 months

from the closing date of the facilities agreement (7 March

2022).

This new granted loan facility was used for the

refinancing of existing financial debts for a

total amount of €21.7 million and for the

financing of the working capital needs of the Group (€6.8 million).

The Group’s net debt position at H1 2022 amounts

to €50.5 million. Besides the undrawn capex

facility of €25 million of the Francisco Partners agreement, the

Group has €14.3 million of other undrawn financing

facilities. Based upon the cash forecast for the upcoming

twelve months (period: July 2022 until June 2023), the Group should

be well equipped with sufficient

liquidity.

Positive cash flow

expected for H2 2023

Throughout the remainder of the FY 2022,

Unifiedpost expects to generate additional revenue by license deals

for the B2B e-invoicing market. The pipeline for license sale is

well stocked and will have a positive effect on the growth the

Company is aiming for. These deals will support the growth rate to

the targeted organic growth of at least 25% in digital processing

revenues in FY 2022.

In FY 2023 Group management expects to benefit

from the growth of key markets. The mandatory digital e-invoicing

that is taking place in several European countries is a change

imposed by government on Banqup's end-users or final customers.

Due to the changed economic circumstances and

business conditions, the Company has decided to make the target to

become cash flow positive its predominant

priority. The target is to be cash flow positive for H2

2023.

Investors

& Media webcast

Management will host a

live video webcast for analysts, investors and media today at 10:00

a.m. CET.

A recording will be available shortly

after the event. To attend, please register at

https://onlinexperiences.com/Launch/QReg/ShowUUID=5D4FD600-F6FE-4EFA-82CA-6834FE36247F

A full replay be available after the

webcast at: https://www.unifiedpost.com/en/investor-relations

Financial Calendar 2022

- 10 November

2022 Publication

Q3 2022 Business Update

- 30 November

2022 Investor

Day 2022

Investor Relations & Media

Sarah Heuninck+32 491 15 05

09sarah.heuninck@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform for SME business

services built on “Documents”, “Identity” and “Payments”.

Unifiedpost operates and develops a 100% cloud-based platform for

administrative and financial services that allows real-time and

seamless connections between Unifiedpost’s customers, their

suppliers, their customers, and other parties along the financial

value chain. With its one-stop-shop solutions, Unifiedpost’s

mission is to make administrative and financial processes simple

and smart for its customers. Since its founding in 2001,

Unifiedpost has grown significantly, expanding to offices in 32

countries, with more than 500 million documents processed in 2021,

reaching over 1,600,000 SMEs and more than 2,500 Corporates across

its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven

track record

- 2021 turnover €171 million

- 1400+ employees

- Diverse portfolio of clients across a

wide variety of industries (banking, leasing, utilities, media,

telecommunications, travel, social security service providers,

public organisations, etc.) ranging from large internationals to

SMEs

- Unifiedpost Payments, a fully owned

subsidiary, is recognised as a payment institution by the National

Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of

Euronext Brussels, symbol: UPG

(*) Warning about future statements: The statements contained

herein may contain forecasts, future expectations, opinions and

other future-oriented statements concerning the expected further

performance of Unifiedpost Group on the markets in which it is

active. Such future-oriented statements are based on the current

insights and assumptions of management concerning future events.

They naturally include known and unknown risks, uncertainties and

other factors, which seem justified at the time that the statements

are made but may possibly turn out to be inaccurate. The actual

results, performance or events may differ essentially from the

results, performance or events which are expressed or implied in

such future-oriented statements. Except where required by the

applicable legislation, Unifiedpost Group shall assume no

obligation to update, elucidate or improve future-oriented

statements in this press release in the light of new information,

future events or other elements and shall not be held liable on

that account. The reader is warned not to rely unduly on

future-oriented statements.

-

20220916_UnifiedpostGroup_PressRelease_H12022_FinancialResults_ENG

- 20220916_UPG_Financial_Statement_H12022

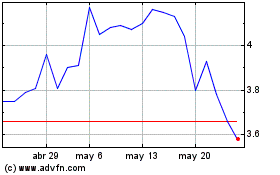

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025