Unifiedpost continues its strategic focus on growing core digital

services alongside portfolio rationalisation

REGULATED INFORMATION

Unifiedpost continues its strategic focus

on growing core digital services alongside portfolio

rationalisation

La Hulpe, Belgium – August 27, 2024,

7:00 a.m. CET – [REGULATED INFORMATION] Unifiedpost Group SA

(Euronext: UPG) (Unifiedpost), a leading provider of integrated

business communications solutions, presents its results for H1

2024. Digital Services revenue reported solid growth of 12,8% y/y,

excluding the divestments of 21 Grams, FitekIN and ONEA. This is

reflected in Unifiedpost’s growing customer base, which exceeded

1,3 million businesses at the end of H1 2024.

Strategic & Operational Highlights

- On July 5, 2024, Unifiedpost signed an agreement to sell all

shares of 21 Grams to PostNord Strålfors and formed a partnership.

PostNord Strålfors will exclusively distribute Banqup in the Nordic

countries for at least 5 years and use Unifiedpost's e-invoicing

connections. Therefore, this set of results is presented as a

discontinued operation with H1 2023 also restated.

- On July 8, 2024, Unifiedpost successfully closed the divestment

of the stand-alone products FitekIN and ONEA for a cash

consideration of €7,2 million post balance sheet. This was used to

accelerate the reimbursement of the subordinated loan of € 1,2

million and for working capital management.

- On August 26, 2024, Unifiedpost signed a binding term sheet

with Your.World BV to sell its Wholesale Identity Access business

in the Netherlands for an enterprise value of € 133,0 million

including an earn-out of € 7,7 million. This agreement includes a

partnership to distribute Unifiedpost’s Banqup platform to over one

million Your.World customers across Europe.

H1 2024 Financial Highlights – Continuing

operations1

- Digital services revenue growth of 10,9% y/y.

- Excluding all divestments (21 Grams, FitekIN and ONEA), our

digital services revenue growth amounts to 12,8% y/y

- Digital service gross margin improved by 2,1 % y/y to

67,0%

- Revenue in traditional communication services decreased by

11,1% y/y due to the conversion of services into digital and

decreasing volume in management services

- Cash and cash equivalents at the end of H1 2024 amounted to €

18,7 million, of which € 7,4 million is restricted cash including €

6,2 million is to be considered as client money2

- Continued focus on free cash flow3 with a reset of

expectations to account for realised and planned divestments in the

year. We are committed to achieve a free cash flow break-even

position by the end of 2025.

Commenting on the H1 2024 results, Hans

Leybaert, CEO and founder, remarked: "The company continues to

focus on growing its core digital services and during the first

half we reported solid growth, with further upside potential to be

unlocked following the expected regulatory wave. We are pleased

with the progress made on the divestment of 21 Grams whilst

leveraging the partnership opportunity with PostNord to distribute

our Banqup in the Nordic countries. With the completion of the

FitekIN and ONEA stand-alone product divestment, we were able to

accelerate the repayment of our outstanding loan. Furthermore, we

recently announced the sale of our Wholesale Identity Access

business in the Netherlands, which presents a unique opportunity to

crystalise the value of the business and ensure that Unifiedpost

will be in a stronger financial position moving forward. Amid these

ongoing developments, we remain focused and committed to

future-proofing the business and enhancing the board composition

and overall corporate governance.”

Key financial figures – Continuing

operations

| (EUR thousands) |

H1 2024 |

H1 2023 |

Change (%) |

|

Group revenue |

50.823 |

50.393 |

+0,9% |

|

Digital service revenue |

30.362 |

27.385 |

+10,9% |

|

Recurring |

27.676 |

25.361 |

+9,1% |

|

Non-recurring |

2.686 |

2.024 |

+32,7% |

|

Traditional communication service revenue |

20.461 |

23.008 |

-11,1% |

| Recurring digital revenue (in % of

total digital service revenue) |

91,2% |

92,6% |

-1,4%pts |

| Gross margin digital service |

67,0% |

64,9% |

+2,1%pts |

| EBITDA |

-26 |

-3.564 |

|

| Loss for the period |

-24.354 |

-24.041 |

-1,3% |

| Cash and cash equivalents at end of

period |

18.721 |

26.323 |

-28,9% |

Key business KPI’s

| (# in thousands) |

End Q2 2024 |

End Q1 2024 |

End Q4 2023 |

End Q3 2023 |

End Q2 2023 |

|

Paying customers |

500 |

485 |

470 |

456 |

443 |

|

Customers paid by 3rd parties |

775 |

760 |

714 |

707 |

681 |

|

Other paying customers |

52 |

52 |

50 |

49 |

48 |

|

Customers served |

1.327 |

1.297 |

1.234 |

1.212 |

1.172 |

|

Of which Banqup customers |

174 |

168 |

162 |

156 |

152 |

|

ARPU on subscriptions |

€ 5,8 |

€ 5,6 |

€ 6,1 |

€ 6,1 |

€ 6,0 |

Aligning financial reporting with the

business strategy model

Our business strategy revolves around 4

interconnected digital products: e-Identity, e-Invoice, e-Payment,

and e-Reporting. These products are available through Unifiedpost’s

secure, cloud-based Banqup platform. We target 3 key market

segments: Corporate, SME, and Governmental. Our goal for each

product line is to drive growth by upselling from single-product

usage to a step-by-step comprehensive adoption of our entire

digital product suite.

Our go-to-market strategy varies by market

segment. For the Corporate segment, we prioritise direct sales,

while for the SME segment, we focus on forging partnerships to

boost sales through the SME channel. Expanding within the

Government sector requires a tailored approach, necessitating a

dedicated team with specialised expertise.

In addition to our digital offerings, our

traditional communication services, though non-digital, remain

valuable as they support and enhance our digital business

model.

Our financial reporting and KPIs have been

updated and integrated into our internal reporting tools to align

with this strategic structure.

Significant divestments and investments

were closed or successfully initiated in H1 2024

Following the binding term sheet dated December

29, 2023, Unifiedpost successfully closed the transaction on July

5, 2024. The entire transaction was sold for a cash consideration

of € 7,2 million. This divestment is a strategic move for the

Group, enabling a sharper focus on its core offerings. At closing,

the carrying value of the related assets and liabilities amounts to

€ 4,6 million. The business associated with this transaction

generates stable annual digital services revenue of € 3,5 million

with a near break-even EBITDA. In the financial position, this

transaction is presented as an asset held for sale but is still

presented as continued business in the income statement.

On April 30, 2024, Unifiedpost announced

exclusive negotiations with PostNord Strålfors regarding the sale

of all shares in the 21 Grams subgroup, culminating in a binding

agreement on July 5, 2024. The completion of this transaction is

subject to three pre-closing conditions: (i) approval from the

Swedish Competition Authority, (ii) release of pledges on shares

and bank accounts, and (iii) obtaining a review report on the

consolidated accounts of the subgroup as of December 31, 2023. The

enterprise value is SEK 200 million, subject to adjustments for net

financial debt and working capital at closing. This transaction is

presented as an asset held for sale in the financial position and

is classified as a discontinued operation effective from January 1,

2024, including comparative figures. The business associated with

this transaction generated in 2023 an annual digital services

revenue of € 28,5 million and an annual traditional communication

services revenue of € 54,8 million, and contributed € 0,6 million

to our EBITDA. This transaction's fair value preliminary impact

amounts to a negative of € 4,9 million.

On June 28, 2024, Unifiedpost divested its

majority stake in the Balkan printing activities New Image doo,

reducing its ownership to 22%, and decreased its shareholding in a

real estate entity Sirius Star Ltd to 20%. Conversely, Unifiedpost

increased its stake in the digital company Unifiedpost doo by 20%

up to 95%, strengthening its position in the digital sector. These

transactions, including the settlement of intergroup current

accounts, were executed on a cash-neutral basis. The realised gain

due to consolidation of these entities results in a positive impact

in the financial result of € 1,3 million.

Opportunity for value crystallisation

through the sale of the Wholesale Identity Access

Business

On August 26, 2024, Unifiedpost announced that

it had signed a binding term sheet with Your.World B.V to sell its

Wholesale Identity Access business in the Netherlands, which forms

part of Unifiedpost’s e-Identity product line, for an enterprise

value of € 133,0 million including an earn-out amount of € 7,7

million. This agreement includes a partnership to distribute the

Banqup platform in the Netherlands via Your.World.

Consistent growth in digital services

business with future upside from regulatory wave to be

unlocked

In the first half of 2024, Unifiedpost continued

to achieve steady year-over-year growth in its digital services

business, recording low-teens growth overall. Specifically,

Unifiedpost realised a 9,1% y/y growth in its recurring activities

and a 32,7% y/y growth in its non-recurring business, driven by

successful project completions. Notably, this growth was achieved

without the benefit of regulatory tailwinds, which signals strong

potential for further acceleration in the near future. In

total the digital services business grew with 10,9% and

excluding the all the divestments the growth amounts even to 12,8%

y/y.

The gross margin in the digital services segment

increased by € 2,5 million year-over-year, driven by two key

factors: (i) an improvement in efficiency which impacted the gross

margin percentage, as it increased from 64,9% in H1 2023 to 67,0%

in H1 2024 (a positive impact of € 0,6 million), and (ii) a rise in

transaction volumes and subscription levels (impact € 1,9

million).

Traditional communication services

business

The traditional communication services business

has not met expectations, driven by a continued shift towards

digital solutions and a decrease in managed service volumes.

Year-over-year, revenue declined by € 2,5 million, leading to a

corresponding reduction in gross profit of € 0,9 million.

Additionally, the gross margin percentage decreased by 1% point to

25,5%.

Execution of cost-saving plan

2023-2024

Unifiedpost launched a cost-saving plan in H1

2023, with significant impacts observed in H2 2023 and H1 2024.

- R&D expenses slightly increased from € 9,2 million to € 9,5

million year-over-year. However, the cash component within these

costs decreased by nearly € 1,0 million, while non-cash expenses

(amortisation) rose by € 1,2 million. R&D Capex spending in H1

2024 totaled € 8,2 million, compared to € 9,0 million in H1

2023. R&D staff costs (cash out Opex and Capex) represent

31,0 % of digital services revenue in H1 2024.

- G&A expenses decreased by € 1,3 million year-over-year to €

17,1 million. It is important to note that G&A expenses for H1

2024 included € 0,5 million in non-recurring costs directly

associated with the aforementioned divestment transactions. The

recurring G&A expenses represent 32,6% of total revenue level

in H1 2024.

- S&M expenses decreased by € 1,7 million year-over-year to €

10,2 million. The recurring S&M expenses represent 20,1% of

total revenue level in H1 2024.

The recent divestments will allow us to take

further efficiency measures and align the cost structure with the

size of the business.

Liquidity position normalised with cash

inflow from divestment

At the end of H1 2024, Unifiedpost Group

reported a financial position with cash and cash equivalents

totaling € 18,7 million, including € 6,2 million of client money

and € 1,2 million of restricted cash. This cash position was

further strengthened on July 5, 2024 following the completion of

the FitekIN/ONEA transaction, which generated additional cash

proceeds of € 7,2 million. Of this amount, € 1,2 million was

immediately used to accelerate the repayment of a subordinated loan

to SFPIM. While working capital was under pressure compared

to December 31, 2023, it has since then normalized following the

post-balance sheet cash inflow from the FitekIN/ONEA

transaction.

Additionally, the Group maintains € 16,1 million

in an undrawn invoice financing facility, which is based on

experience, only callable at 30% of the current usage level.

Recent divestments, substantially improving the

balance sheet, require a reset of expectations regarding the free

cash flow breakeven position for 2024. Management remains committed

to achieving this goal by the end of 2025. The incoming cash

proceeds from the divestments provide a sufficient cash buffer,

enabling Unifiedpost to navigate this extended period while

positioning us to capitalise on the global digital transformation

wave in the coming years.

Current organic customer growth ensures

our future model

Unifiedpost's strong focus on customer

onboarding continues to yield attractive results. By the end of Q2

2024, our customer base exceeded 1,3 million, reflecting a 7,5%

growth since the end of 2023. In Q1 and Q2 2024, we onboarded 15

thousand in each quarter. Our paid customer segment has grown to

500 thousand, while third-party financed customers have reached 775

thousand, and other customers now total 52 thousand.

Our business network—which includes our own

customers and other companies we can reach digitally—now

encompasses over 2,6 million companies, up from 2,4 million at the

close of 2023. This expansion solidifies our leadership in the

e-Invoice and e-Payment segments, particularly among Europe's

SMEs.

Our core SME platforms, including Banqup,

Billtobox, and jefacture.com, have also demonstrated continuous

growth, with a combined customer base reaching 174 thousand by Q2

2024. In H1 2024, we onboarded 12 thousand new subscriptions across

these platforms. Key markets like Belgium and France have shown

positive momentum as well. Banqup's Belgian customer base (via

Billtobox) increased to 30 thousand, while in France, early

adopters of jefacture.com reached 19 thousand by the end of Q2

2024.

The ARPU on subscription revenue dropped

slightly in Q1 2024 to € 5,6/month due to a changing product mix,

whereby new e-Identity onboardings were registered at the start of

the year. In Q2 2024, the ARPU on subscription revenue improved to

€ 5,8/month.

Collection of ‘client money’ is becoming

an active source of revenue

Unifiedpost Payments SA is certified as a

payment institute. As announced on August 7, 2024, Unifiedpost

Payments obtained certification from the National Bank of Belgium

to purchase receivables. This certification takes immediate effect

and can be passported into the EU. Out of our current customer

base, especially on contracted business in the Netherlands,

Unifiedpost is collecting additional funds as client money.

These funds generate net interest revenues which are currently

presented as financial result. The level of client money in our

financial position is thus increasing and amounts to € 6,2 million

at end of H1 2024.

These achievements will further strengthen and

grow our e-payment business.

Reiterating guidance

- Digital services revenue growth 2024: low teens

- Search for additional Board members to strengthen the Board and

align it with evolving good corporate governance standards

- Subject to successful closing of all announced divestments,

attaining FCF breakeven by the end of 2025

Investors

& Media webcast

Management will host a

live video webcast for analysts, investors and media today at 11:00

a.m. CET.

To register and attend the webcast,

please click here:

https://unifiedpost-group-hy24-financial-results-august-2025.open-exchange.net/

A full replay will be

available after the webcast at:

https://investors.unifiedpostgroup.com/

Financial Calendar:

- 14 November 2024: Publication Q3 2024 Business Update

- 13 March 2025: Publication FY 2024 Financial Results

- 18 April 2025: Publication of the annual report for 2024

- 15 May 2025: Publication of the Q1 2025 business update

- 20 May 2025: General Shareholder Meeting

Contact

Alex Nicoll

Investor Relations

Unifiedpost Group

alex.nicoll@unifiedpost.com

Interim consolidated statement of profit or loss and

other comprehensive income (unaudited)

|

Thousands of Euro, except per share data |

|

For the six-month period ended 30

June |

|

|

|

2024 |

2023 (*) |

|

|

|

|

|

|

Digital services revenues |

|

30.362 |

27.385 |

|

Digital services cost of services |

|

(10.030) |

(9.602) |

|

Digital services gross profit |

|

20.332 |

17.783 |

|

|

|

|

|

|

Traditional communication services revenues |

|

20.461 |

23.008 |

|

Traditional communication services cost of services |

|

(15.236) |

(16.912) |

|

Traditional communication services gross

profit |

|

5.225 |

6.096 |

|

|

|

|

|

|

Research and development expenses |

|

(9.538) |

(9.247) |

|

General and administrative expenses |

|

(17.074) |

(18.431) |

|

Selling and marketing expenses |

|

(10.208) |

(11.930) |

|

Other income / (expenses) |

|

180 |

1.230 |

|

Loss from operations |

|

(11.083) |

(14.498) |

|

|

|

|

|

|

Financial income |

|

289 |

69 |

|

Financial expenses |

|

(8.417) |

(7.444) |

|

Gain realised upon losing control over subsidiaries |

|

1.295 |

- |

|

Share of profit / (loss) of associates |

|

236 |

- |

|

Loss before tax |

|

(17.680) |

(21.873) |

|

|

|

|

|

|

Corporate income tax |

|

(1.207) |

(1.064) |

|

Deferred tax |

|

(63) |

262 |

|

LOSS FOR THE PERIOD FROM CONTINUING

OPERATIONS |

|

(18.950) |

(22.675) |

|

|

|

|

|

|

Net profit / (loss) from discontinued operations |

|

(5.404) |

(1.366) |

|

LOSS FOR THE PERIOD |

|

(24.354) |

(24.041) |

|

Other comprehensive income / (loss): |

|

(416) |

(1.388) |

|

Items that will or may be reclassified to profit or loss, net

of tax: |

|

|

|

|

Exchange gains / (losses) arising on translation of foreign

operations |

|

92 |

217 |

|

Exchange gains / (losses) arising on translation of foreign

operations related to discontinued operations |

|

(507) |

(1.605) |

|

TOTAL COMPREHENSIVE LOSS FOR THE PERIOD |

|

(24.770) |

(25.429) |

|

Total loss for the period is attributable to: |

|

|

|

|

Owners of the parent |

|

(24.469) |

(24.058) |

|

Continuing operations |

|

(19.065) |

(22.692) |

|

Discontinued operations |

|

(5.404) |

(1.366) |

|

Non-controlling interests |

|

115 |

17 |

|

Total comprehensive loss for the period is attributable

to: |

|

|

|

|

Owners of the parent |

|

(24.885) |

(25.446) |

|

Continuing operations |

|

(18.974) |

(22.475) |

|

Discontinued operations |

|

(5.911) |

(2.971) |

|

Non-controlling interests |

|

115 |

17 |

|

Loss per share attributable to the equity holders of the

parent: |

|

|

|

|

Basic |

|

(0,68) |

(0,67) |

|

Diluted |

|

(0,68) |

(0,67) |

|

Loss from continuing operations per share attributable to

the equity holders of the parent: |

|

|

|

|

Basic |

|

(0,53) |

(0,63) |

|

Diluted |

|

(0,53) |

(0,63) |

(*) The comparative figures for six-month period

ended 30 June 2023 have been restated to reflect the restatement of

the profit and loss related to the discontinued operations in

accordance with IFRS 5 as explained in note 5.4 and 5.7, and to

demonstrate the new reporting structure as explained in note

5.4

Interim consolidated statement of financial

position (unaudited)

|

Thousands of Euro |

|

At 30

June

At 31 December |

|

|

|

2024 |

2023 |

|

|

|

|

|

|

ASSETS |

|

|

|

|

Goodwill |

|

103.371 |

113.069 |

|

Other intangible assets |

|

69.824 |

82.856 |

|

Property and equipment |

|

1.852 |

7.420 |

|

Right-of-use-assets |

|

9.686 |

9.734 |

|

Investments in associates |

|

2.475 |

1.493 |

|

Non-current contract costs |

|

437 |

475 |

|

Deferred tax assets |

|

53 |

776 |

|

Other non-current assets |

|

2.751 |

2.086 |

|

Non-current assets |

|

190.449 |

217.909 |

|

Inventories |

|

534 |

612 |

|

Trade and other receivables |

|

14.937 |

23.420 |

|

Contract assets |

|

113 |

617 |

|

Contract costs |

|

1.117 |

1.281 |

|

Current tax assets |

|

97 |

770 |

|

Prepaid expenses |

|

1.752 |

1.901 |

| Cash

and cash equivalents |

|

18.721 |

26.323 |

|

Current assets from continuing operations |

|

37.271 |

54.924 |

|

Assets classified as held for sale |

|

36.953 |

5.145 |

|

Current assets |

|

74.224 |

60.069 |

|

TOTAL ASSETS |

|

264.673 |

277.978 |

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY AND LIABILITIES |

|

|

|

|

Share capital |

|

329.238 |

326.806 |

|

Costs related to equity issuance |

|

(16.029) |

(16.029) |

|

Share premium reserve |

|

492 |

492 |

|

Accumulated deficit |

|

(260.075) |

(232.257) |

|

Reserve for share-based payments |

|

175 |

1.831 |

|

Other reserve |

|

2.144 |

(1.581) |

|

Cumulative translation adjustment reserve |

|

(4.266) |

(3.851) |

|

Equity attributable to equity holders of the

parent |

|

51.679 |

75.411 |

|

Non-controlling interests |

|

773 |

499 |

|

Total shareholders’ equity |

|

52.452 |

75.910 |

|

Non-current loans and borrowings |

|

113.101 |

110.517 |

|

Liabilities associated with puttable non-controlling interests |

|

- |

200 |

|

Non-current lease liabilities |

|

6.691 |

6.193 |

|

Non-current contract liabilities |

|

4.968 |

4.430 |

|

Retirement benefit obligations |

|

- |

- |

|

Deferred tax liabilities |

|

2.123 |

4.636 |

|

Non-current liabilities |

|

126.883 |

125.976 |

|

Current loans and borrowings |

|

7.477 |

5.059 |

|

Current liabilities associated with puttable non-controlling

interests |

|

4.470 |

7.560 |

|

Current lease liabilities |

|

3.229 |

3.547 |

|

Trade and other payables |

|

37.607 |

43.930 |

|

Contract liabilities |

|

15.219 |

13.487 |

|

Current income tax liabilities |

|

2.801 |

1.845 |

|

Current liabilities from continuing

operations |

|

70.803 |

75.428 |

|

Liabilities directly associated with assets classified as held for

sale |

|

14.535 |

664 |

|

Current liabilities |

|

85.338 |

76.092 |

|

TOTAL EQUITY AND LIABILITIES |

|

264.673 |

277.978 |

Interim consolidated statement of changes in equity

(unaudited)

Thousands of Euro

|

|

Share capital |

Costs related to equity issuance |

Share premium reserve |

Accumulated deficit |

Share based payments |

Other reserves |

Cumulative translation adjustment reserve |

Non-controlling interests |

Total equity |

|

Balance at 1 January 2024 |

326.806 |

(16.029) |

492 |

(232.257) |

1.831 |

(1.581) |

(3.851) |

499 |

75.910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Result for the period |

|

- |

- |

- |

(24.469) |

- |

- |

- |

115 |

(24.354) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income / (loss) |

|

- |

- |

- |

- |

- |

- |

(416) |

- |

(416) |

|

Total comprehensive loss for the period |

|

- |

- |

- |

(24.469) |

- |

- |

(416) |

115 |

(24.770) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Conversion subscription rights |

|

2.432 |

- |

- |

- |

(1.656) |

1.656 |

- |

- |

2.432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current period profit AND OCI of NCI with put option |

|

- |

- |

- |

- |

- |

108 |

- |

(108) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in carrying value of liabilities associated with puttable

NCI |

|

- |

- |

- |

- |

- |

(210) |

- |

- |

(210) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of 20% of the shares in Unifiedpost d.o.o. |

|

- |

- |

- |

(2.437) |

- |

2.437 |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Release of NCI due to acquisition of 20% of the shares in

Unifiedpost d.o.o. |

|

- |

- |

- |

- |

- |

(266) |

- |

266 |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend payments |

|

- |

- |

- |

(904) |

- |

- |

- |

- |

(904) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

- |

- |

- |

(8) |

- |

- |

1 |

1 |

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at 30 June 2024 |

329.238 |

(16.029) |

492 |

(260.075) |

175 |

2.144 |

(4.266) |

773 |

52.452 |

Thousands of Euro

|

Note

|

Share capital |

Costs related to equity issuance |

Share premium reserve |

Accumulated deficit |

Share based payments |

Other reserves |

Cumulative translation adjustment reserve |

Non-controlling interests |

Total equity |

|

Balance at 1 January 2023 |

326.806 |

(16.029) |

492 |

(148.497) |

1.813 |

(2.863) |

(3.713) |

281 |

158.290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Result for the period |

|

- |

- |

- |

(24.058) |

- |

- |

- |

17 |

(24.041) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income / (loss) |

|

- |

- |

- |

- |

- |

- |

(1.388) |

- |

(1.388) |

|

Total comprehensive loss for the period |

|

- |

- |

- |

(24.058) |

- |

- |

(1.388) |

17 |

(25.429) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payments |

|

- |

- |

- |

- |

18 |

- |

- |

- |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current period profit AND OCI of NCI with put option |

|

- |

- |

- |

- |

- |

(169) |

- |

169 |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

- |

- |

- |

14 |

- |

- |

- |

- |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at 30 June 2023 |

326.806 |

(16.029) |

492 |

(172.541) |

1.831 |

(3.034) |

(5.101) |

467 |

132.891 |

Interim consolidated statement of cash flows (unaudited)

|

Thousands of Euro |

For the six-month period ended 30

June |

|

|

|

2024 |

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

Loss for the period |

|

(24.354) |

(24.041) |

|

Adjustments for: |

|

|

|

- Amortisation and impairment of intangible fixed assets

|

|

10.545 |

10.351 |

- Impairment losses of goodwill

|

|

- |

- |

- Depreciation and impairment of property, plant &

equipment

|

|

657 |

746 |

- Depreciation of right-of-use-assets

|

|

2.047 |

2.162 |

- Impairment of trade receivables

|

|

151 |

35 |

- Gain on disposal of fixed assets

|

|

(13) |

(25) |

|

|

|

(315) |

(87) |

|

|

|

8.648 |

7.640 |

- (Gain) realised upon losing control over subsidiaries

|

|

(1.295) |

- |

- Result of remeasurement at fair value less costs to sell for

disposal groups

|

|

4.884 |

- |

- Share of profit / (loss) of associate

|

|

(236) |

- |

- Income tax expense / (income)

|

|

1.075 |

292 |

- Share-based payment expense / own shares

|

|

- |

18 |

|

|

|

|

|

|

Subtotal |

|

1.794 |

(2.909) |

|

|

|

|

|

|

Changes in Working Capital |

|

|

|

- (Increase) / decrease in trade receivables and contract assets

& costs

|

|

(1.096) |

4.566 |

- (Increase) / decrease in other current and non-current

receivables

|

|

(677) |

(141) |

- (Increase) / decrease in Inventories

|

|

(64) |

131 |

- Increase / (decrease) in trade and other liabilities

|

|

6.607 |

(2.561) |

|

|

|

|

|

|

Cash generated from / (used in) operations |

|

6.564 |

(914) |

|

|

|

|

|

|

Income taxes paid |

|

(1.051) |

(1.592) |

|

|

|

|

|

|

Net cash provided by / (used in) operating

activities |

|

5.513 |

(2.506) |

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

Payments made for acquisition of subsidiaries, net of cash

acquired |

|

(282) |

- |

|

Payments made for purchase of intangibles and development

expenses |

|

(8.530) |

(9.050) |

|

Proceeds from the disposals of intangibles and development

expenses |

|

37 |

- |

|

Payments made for purchase of property, plant & equipment |

|

(160) |

(344) |

|

Proceeds from the disposals of property, plant & equipment |

|

572 |

94 |

|

Interest received |

|

315 |

87 |

|

|

|

|

|

|

Net cash provided by / (used in) investing

activities |

|

(8.048) |

(9.213) |

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

Conversion of subscription rights |

|

2.432 |

- |

|

Proceeds from loans and borrowings |

|

1.832 |

5.752 |

|

Repayments of loans and borrowings |

|

(1.426) |

(4.762) |

|

Repayment of lease liabilities |

|

(2.071) |

(2.373) |

|

Interest paid on loans, borrowings and leasings |

|

(2.536) |

(2.235) |

|

|

|

|

|

|

Net cash provided by / (used in) financing

activities |

|

(1.769) |

(3.618) |

|

FX impact cash |

|

- |

- |

|

Net increase / (decrease) in cash &

cash equivalents |

|

(4.304) |

(15.337) |

|

Cash classified within current assets held for sale |

|

(3.123) |

- |

|

Cash movement due to change in consolidation range |

|

(174) |

|

|

Net increase/(decrease) in cash & cash

equivalents, including cash classified within current assets held

for sale |

|

(7.601) |

(15.337) |

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

26.323 |

40.033 |

|

Cash and cash equivalents at end of period |

|

18.721 |

24.696 |

|

|

|

|

|

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform

for SME business services built on “Documents”, “Identity” and

“Payments”. Unifiedpost operates and develops a 100% cloud-based

platform for administrative and financial services that allows

real-time and seamless connections between Unifiedpost’s customers,

their suppliers, their customers, and other parties along the

financial value chain. With its one-stop-shop solutions,

Unifiedpost’s mission is to make administrative and financial

processes simple and smart for its customers. For more information

about Unifiedpost Group and its offerings, please visit our

website: Unifiedpost Group | Global leaders in digital

solutions

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2023 group revenue €191 million

- 1.200+ employees

- Offices in 33 countries

- Diverse portfolio of clients across a wide variety of

industries (banking, leasing, utilities, media, telecommunications,

travel, social security service providers, public organisations,

etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised

as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol:

UPG

Cautionary note regarding forward-looking

statements: The statements contained herein may include prospects,

statements of future expectations, opinions, and other

forward-looking statements in relation to the expected future

performance of Unifiedpost Group and the markets in which it is

active. Such forward-looking statements are based on management's

current views and assumptions regarding future events. By nature,

they involve known and unknown risks, uncertainties, and other

factors that appear justified at the time at which they are made

but may not turn out to be accurate. Actual results, performance or

events may, therefore, differ materially from those expressed or

implied in such forward-looking statements. Except as required by

applicable law, Unifiedpost Group does not undertake any obligation

to update, clarify or correct any forward-looking statements

contained in this press release in light of new information, future

events or otherwise and disclaims any liability in respect hereto.

The reader is cautioned not to place undue reliance on

forward-looking statements.

1 Excluding discontinued operations related to the 21

Grams business

2 Money a company receives from or holds for, or on

behalf of, a client (application IAS 7).

3 Free cash flow is defined as net income (i)

plus non-cash items in the income statement, (ii) minus cash out

for IFRS 16 adjustments, (iii) minus capital expenditure, (iv)

minus reimbursement on loans and leasing for the reporting

period

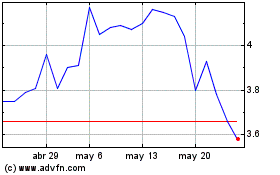

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025