Unifiedpost settles earn-out obligations to former Crossinx

shareholders

La Hulpe – 21 October 2022, 7:00 a.m.

CET – [INSIDE INFORMATION] Unifiedpost Group (Euronext: UPG)

(Unifiedpost, or the Company) completed the

acquisition of the German e-invoicing market leader Crossinx on

April 9, 2021. In agreement with the former Crossinx shareholders,

Unifiedpost now settles the earn-out obligations in exchange for a

one-time payment of € 4.829.792,94 through the issuance in

aggregate of 1.277.723 new shares of Unifiedpost.

The original transaction

In April 2021, Unifiedpost acquired with

Crossinx a real-time data-driven e-invoice solution. By acquiring

this technology, the Unifiedpost solutions will now be able to

support data-driven communication in its order-to-cash and

procure-to-pay solution with substantive data validation. These

digital solutions are now ready for the market transition to data

e-invoices validated in real-time. This brings the Company ahead of

the market curve, certainly with upcoming mandatory e-invoicing

regulation in the EU.

In addition to the technology Unifiedpost

achieved with the acquisition a direct access to the large DACH

market (Germany, Austria, Switzerland) and can benefit from the

expected growth opportunities. On top of that, the Company can now

serve corporate clients internationally with a full offering.

Unifiedpost acquired Crossinx in April 2021 with

a cash consideration and share consideration paid in April 2021.

The former shareholders of Crossinx were possible entitled to a

deferred conditional consideration of up to a maximum of € 60

million, partly payable in cash and partly payable in shares. These

earn-out payments were due if certain revenue targets were reached

in the financial years 2021, 2022 and 2023.

Current transaction details

Through an addendum dated 20 October 2022 to the

share purchase agreement, the parties have decided to replace any

potential obligations by the Company to the former Crossinx

shareholders in respect of any earn-amount by a one-time fixed

payment of € 4.829.792,94 in aggregate. As the one-time

payment is fully settled in shares of Unifiedpost, there is no cash

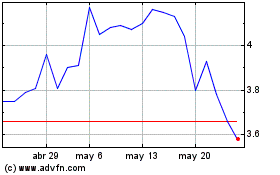

payment by the Company. At an issuance price of € 3,78 per share,

this corresponds to 1.277.723 new shares which have been issued by

the Company on 20 October 2022.

Pursuant to the addendum, the former Crossinx

shareholders have agreed to a lock-up. For the four main former

Crossinx shareholders (representing 65,77 % of the new shares), the

lock-up will last for 12 months, with release of 50% of the new

shares after 6 months, and 25% more shares being released three

months thereafter. For the other former Crossinx shareholders the

lock-up lasts 6 months, with release of 50% of the new shares after

three months.

Related parties

The former Crossinx shareholders include Mr.

Michael Kleindl and Mr. Marcus Laube as related parties. Mr.

Kleindl is through his company First Performance AG currently a

member of the Board of Directors of the Company and Mr. Marcus

Laube is the Chief Sales Officer and member of the Management

Committee of the Company. The announcement required by the

related party rules is set out in the appendix.

Appendix

Public announcement pursuant

to article 7:97, §4/1 of the Companies and Associations Code

relating to the buy-out of the potential earn-out claims of former

Crossinx shareholders

1.

The Board of Directors of the Company held on 20 October 2022

decided to approve the addendum to the sale and purchase agreement

of 9 April 2021 between the former Crossinx shareholders and the

Company.

Two of the former Crossinx shareholders include

(i) Mr. Michael Kleindl (through his company KOMM Investment AG)

and (ii) Mr. Marcus Laube. Following the completion of the

acquisition of Crossinx, they have joined the Company. Mr. Michael

Kleindl (through his company First Performance AG) is currently a

member of the Board of Directors of the Company and Mr. Marcus

Laube is the Chief Sales Officer and member of the Management

Committee of the Company.

Given their functions, First Performance AG

(with permanent representative Mr. Kleindl) and Mr. Laube qualify

as related parties within the meaning of IFRS and article 7:97

CAC.

In this context, the Board of Directors applied

Article 7:97 of the Companies and Associations Code (“CAC”)

relating to decisions and transactions concerning a party related

to the Company. This provision implies, among other things, the

intervention of a committee of independent directors to give an

opinion to the Board of Directors. The conclusion of this opinion

is set out at the end of this communication.

In addition, this provision provides that when

the decision or transaction involves a director, such person cannot

not take part in the deliberations or vote of the Board of

Directors. Mr. Michael Kleindl (through his company First

Performance AG) decided not to be present at the Board of Directors

which decided on the transaction and did thus not participate in

the deliberations or votes.

The Company has also applied Article 7:96 CAC,

relating to decisions in which a director has a direct or indirect

interest of a proprietary nature that is opposed to the interest of

the Company. This provision also provides that this director does

not participate in the deliberation or votes. The director

concerned is the one indicated in the previous paragraph.

2.

The addendum to the transaction documentation was signed on 20

October 2022. It provides that the former Crossinx shareholders

shall receive in aggregate 1.277.723 shares of the Company,

replacing the previously agreed potential earn-out amounts, if

certain revenue targets were reached in the financial years 2021,

2022 and 2023.

Six of the thirty one Sellers (the “ESOP

Sellers”), including Mr Laube, were party to an employee stock

option program in Crossinx before the original Crossinx

transaction. Shortly before the signing of the original Crossinx

transaction, the ESOP Sellers converted their claims under the ESOP

into actual Crossinx shares. Despite this conversion, Crossinx

remains responsible as tax indemnitor for any wage taxes of the

ESOP Sellers. As this is a continuing obligation, it is therefore

agreed under the addendum that the value of such taxes (“ESOP

Charges”) are held back.

As a result, the number of new shares issued by

the Company on 20 October 2022 amounts to 1.277.723 in aggregate

(the “Effective Buy-Off Shares”), among which Mr Kleindl has

received 20,98% shares and Mr Laube received 18,54% shares. These

shares have been allocated proportionally based on the former share

percentage in Crossinx but taking into account the hold-back for

the ESOP Sellers.

The issuance amount per share is equal to the

lowest trading price of the shares of the Company on the day that

the new shares have been issued by the Company to the former

Crossinx shareholders, i.e. € 3,78. The capital increase of the

Company amounts to € 4.829.792,94.

As the value of the shares is based on an open

public market price where mechanism of supply and demand plays, the

price should be seen as the current fair price of the share as all

trading parties are fully informed with same financial data.

3.

The new shares have been issued as registered shares and are

subject to a lock-up period.

The lock-up period will depend on the percentage

which the former Crossinx shareholder held in Crossinx prior to the

original transaction. Both the company of Mr. Kleindl and Mr. Laube

will be subject to the extended lock-up of 12 month with staggering

release.

4.

The immediate early termination of the earn-out terms under the

original Crossinx documentation and the entering into the addendum

facilitates the full integration of Crossinx with the Company. In

the absence thereof, the implementation of the company change and

integration project “one product, one company” might be delayed

until the end of the earn-out period (i.e. 31 December 2023).

The change and integration project is aimed to

have a substantial operational and financial impact on the Company.

Further, the addendum will eliminate any potential future risk for

the Company to pay earn-out. The addendum does not include any cash

payment by the Company.

5.

A committee of all 5 independent directors of Unifiedpost has

assessed the transaction described above, in accordance with

Article 7:97 CAC, and has issued a written and substantiated

opinion on this matter to the board of directors of Unifiedpost.

The conclusions of the opinion of the committee of independent

directors are as follows:

“Based on the above argumentation, the Committee

is of the opinion that the completion of the Crossinx Addendum

Transaction resulting in an early termination of the Orginal

Crossinx Agreement is in the best interest of the Company.

The early termination of the Original Crossinx

Agreement is a necessary condition precedent if the Company wants

to start to implement with immediate effect a change and

integration project which is aimed and expected to have a

substantial operational and financial impact on the Company that

largely outweighs the disadvantage of the cost and dilutive effect

of the new shares to be issued as provided for in the Crossinx

Addendum Transaction.

In view of this, the Committee unanimously

advises the Board of Directors of the Company to approve the

Crossinx Addendum Transaction.”

Finally, the assessment made by the auditor in

accordance with Article 7:97 CAC reads as follows: Based on our

assessment, nothing has come to our attention that causes us to

believe that the financial and accounting data included in the

opinion of the committee of independent directors dated 19 October

2022 and in the minutes of the meetings of the board of directors

dated 20 October 2022, justifying the proposed transaction, are not

fair and sufficient in all material respects in light of the

information available to us in connection with our engagement.

Financial Calendar 2022

- 10 November 2022

Publication Q3 2022 Business Update

- 30 November

2022

Investor Day 2022

Investor Relations & Media

Sarah Heuninck+32 491 15 05

09sarah.heuninck@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform for SME business

services built on “Documents”, “Identity” and “Payments”.

Unifiedpost operates and develops a 100% cloud-based platform for

administrative and financial services that allows real-time and

seamless connections between Unifiedpost’s customers, their

suppliers, their customers, and other parties along the financial

value chain. With its one-stop-shop solutions, Unifiedpost’s

mission is to make administrative and financial processes simple

and smart for its customers. Since its founding in 2001,

Unifiedpost has grown significantly, expanding to offices in 32

countries, with more than 500 million documents processed in 2021,

reaching over 1,600,000 SMEs and more than 2,500 Corporates across

its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2021 turnover €171 million

- 1400+ employees

- Diverse portfolio of clients across a wide variety of

industries (banking, leasing, utilities, media, telecommunications,

travel, social security service providers, public organisations,

etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised

as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol:

UPG

(*) Warning about future statements: The statements contained

herein may contain forecasts, future expectations, opinions and

other future-oriented statements concerning the expected further

performance of Unifiedpost Group on the markets in which it is

active. Such future-oriented statements are based on the

current insights and assumptions of management concerning future

events. They naturally include known and unknown risks,

uncertainties and other factors, which seem justified at the time

that the statements are made but may possibly turn out to be

inaccurate. The actual results, performance or events may

differ essentially from the results, performance or events which

are expressed or implied in such future-oriented statements.

Except where required by the applicable legislation, Unifiedpost

Group shall assume no obligation to update, elucidate or improve

future-oriented statements in this press release in the light of

new information, future events or other elements and shall not be

held liable on that account. The reader is warned not to rely

unduly on future-oriented statements.

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025