Unifiedpost shows significant growth in recurring digital

processing achieving threshold of 1 million of customers

Focus on cash flow starts to become

visible – positive EBITDA in H2 2022

La Hulpe, Belgium – March 6, 2023, 7:00

a.m. CET – [INSIDE INFORMATION] - Unifiedpost Group (Euronext: UPG)

(Unifiedpost, the Group or the Company) is pleased to announce for

FY2022 a significant double-digit recurring digital processing

revenue growth (19,1% y-o-y). The customer base grew by a strong

34,2% in 2022, exceeding the threshold of one million customers,

2,1 million companies were YE2022 in the Unifiedpost digital

network. Unifiedpost has finalised its accelerated investment phase

and shifted its focus to cash flow generation and is well on the

way to become cash flow positive for the period of H2

2023.

Highlights

- Strong growth of core recurring digital processing revenue

19,1% y-o-y

- FY2022 Group revenue increased by 12,0% y-o-y to €190,9

million

- Acceleration of customer growth in 2022 (+34,2%), strong growth

for core SME product Banqup (+251,1%)

- Good EBITDA improvement over the year, positive EBITDA in H2

2022, in Q4 2022 up to +€1,8 million

- A positive cash flow for the full H2 2023 is the key priority

for Unifiedpost

Commenting on the FY2022 results, Hans Leybaert,

CEO and founder, stated: “In 2022, Unifiedpost underpinned its

ambitious growth path. In a year of geopolitical tensions, the war

in Ukraine, the energy crisis in Europe and general price

increases, our double-digit growth remained undisputed. The

significant acceleration of new customer onboarding in 2022 proves

the growing momentum for full digital invoicing and payments. A

further acceleration is expected in the coming years as

the European Commission has submitted a legislative proposal

on December 8th 2022 as part of their 'VAT in the digital age'

program. This is a first step towards mandatory e-invoicing for all

European companies. I would like to thank all Unifiedpost employees

and partners for their continued contribution to our strategic

execution and for joining us in our ambitious way forward.”

Key financial figures

| (EUR million) |

FY2022 |

FY2021 |

Change (%) |

|

Group revenue |

190,9 |

170,5 |

+12,0% |

|

Digital processing revenue |

126,9 |

106,9 |

+18,8% |

|

Recurring digital processing revenue |

112,7 |

94,6 |

+19,1% |

|

Non-recurring digital revenue (licences + project) |

14,2 |

12,3 |

+15,4% |

|

Postage & parcel optimisation revenue |

64,0 |

63,6 |

+0,6% |

| Recurring revenue (in % of total

revenue) |

92,5% |

92,8% |

-0,3%pts |

| Gross margin digital processing |

41,9% |

43,7% |

-1,8%pts |

| EBITDA margin |

-3,4% |

-2,6% |

-0,8%pts |

| R&D costs (expensed and

capitalised) |

36,2 |

33,1 |

+9,4% |

| Loss for the period |

-43,5 |

-25,6 |

-69,9% |

| Cash and cash equivalents |

40,0 |

17,0 |

+135,3% |

Key business KPI’s

| (#) |

End Q4 2022 |

End Q4 2021 |

Change (%) |

| Customers |

1.063.776 |

792.594 |

+34,2% |

| Paying

customers |

468.128 |

368.277 |

+27,1% |

| Customers paid

by 3rd parties |

595.648 |

424.317 |

+40,4% |

| Companies in business network |

2.109.297 |

1.504.895 |

+40,2% |

| Banqup

customers |

124.333 |

35.408 |

+251,1% |

|

Growth (new subscriptions) |

18.255 |

16.346 |

- |

|

Migrated |

70.582 |

- |

- |

| Banqup customers

Belgium (Billtobox) |

40.363 |

28.864 |

+39,8% |

| Banqup customers

France (JeFacture) |

5.428 |

2.072 |

+162,0% |

Double-digit growth rates in digital

processing business

Unifiedpost grew its revenue in FY2022 by 12,0%

y-o-y to €190,9 million, driven by double-digit growth of the

digital processing revenue of 18,8% combined with a limited growth

in postage and parcel optimisation services.

The Group saw its revenue from digital

processing increasing to €126,9 million in FY2022. This was

predominantly thanks to the strong growth rate of 19,1% y-o-y in

recurring digital processing revenue, i.e. digital platform revenue

excluding the project and licence business. The growth is spread

over different countries and markets, with the Nordics, Serbia,

Romania, the Baltics, and the Benelux showing accelerating growth

rates. The subscription revenue growth (i.e. SME business) was high

with a 35,6% growth y-o-y.

The project and licence business, which is

non-recurring, contributed €14,2 million to the FY2022 revenue. As

indicated in the H1 2022 financial update, the non-recurring

revenue is depending on the timely closing of major deals (before

YE). In Q4 a large distribution deal for the French market was

realised with ECMA (the French accountants federation), which

includes the creation of a joint venture between the two companies.

Unifiedpost made also promising progress with several other deals,

without closing them prior to YE2022. The Group expects to close

these in 2023.

The gross margin of the digital processing

business decreased to 41,9%, a decrease of 1,8%pts y-o-y,

reflecting some inflationary effects and larger customers with

hybrid communication going live.

Solid low single-digit growth in postage

& parcel optimisation business

Revenue of postage and parcel optimisation

services slightly increased over the year (+0,6% y/y to €64,0

million). For existing customers, the shift from paper to digital

continues and is accelerating. As a result, Unifiedpost realised

lower revenue growth in the postage and parcel optimisation

business. However, this was offset by two factors: Unifiedpost

onboarded major new customers and increased its prices in this

segment. Consequently, Unifiedpost still managed to achieve a

slight growth in postage and parcel revenue over the year. It is

important to underline that the postage and parcel optimisation

business, which yields lower margins, is being overtaken by the

digital services business, which generates higher margins and is

experiencing steady double-digit growth. The postage & parcel

optimisation realised a gross margin of 10,9% for FY2022, slightly

down by 0,4%pts compared to FY2021, also as a consequence of

inflationary effects.

Unifiedpost services over 1 million

companies representing 8% of all SMEs in Europe

Unifiedpost was and is ambitious in its targets

for new customer onboarding. At the end of the period the customer

growth was 34,2% y-o-y, a third consecutive year with a growth of

at least 30%. In the fourth quarter of 2022 a new high of 76.805

new customers were onboarded onto our platform, most of them SME’s.

At year-end, the Group had a total of 1.063.776 paying customers,

either directly paying or paid by third parties. Unifiedpost’s

business network expanded in 2022 to over 2 million companies

(2.109.297), representing an estimated 8,4% of SMEs in Europe.

Today Unifiedpost is the most dominant e-invoice and e-payment

provider in the SME-segment.

The number of Banqup (incl. Billtobox and

JeFacture) customers strongly grew to 124.333, reflecting a growth

rate of 251,1% y-o-y. Although France has delayed the adoption of

mandatory e-invoicing, over 5.428 early adopters onboarded on the

JeFacture solution.

Overall average revenue per user (ARPU) in the

digital processing business amounted to €27,3 in Q4 2022. This is

an increase due to the strong quarter for non-recurring digital

revenue. 88,8% of the total digital processing revenue resulted

from recurring services.

FY2022 EBITDA / result impacted by a

peak in roll-out cost and inflation

Both segments combined, i.e. combining the

digital processing revenue and postage and parcel optimisation

services, led to total revenue of €190,9 million and a gross profit

of €60,2 million. Gross margin slightly decreased to 31,5% (FY

2021: 31,6%).

During FY2022, the Group spent €36,2 million on

research and development (R&D), of which 61% was capitalised.

The R&D spending is equivalent to 28,5% (down 2,5%pts y-o-y) of

digital processing revenue. After having self-developed the

platform successfully and rolling out the product, Unifiedpost has

now been able to reduce its R&D spending as a percentage of

total digital processing revenue.

General and Administrative cost (G&A)

accounted to €45,8 million, 24,0% of the Group’s total revenue. The

Group was able to stabilise its G&A costs in a year with

increasing service and labour cost. Consequently, G&A cost

ratio went up by just 0,3%pts compared to last year. Some

operational costs related to the roll-out of Banqup have reached

their peak during 2022 and have started to decline in absolute

levels.

Sales & Marketing expenses went up from

€24,9 million in 2021 to €29,2 million in FY2022, or from 14,6% of

total revenue to 15,3% in FY2022. The increase is caused by

investments of the Group in local sales teams that are close to the

business and customers. This platform and sales set-up was an

important step for the Group in 2022. It was in line with the

strategic approach to operate the global platform locally, with

local teams and software that is adapted to local requirements and

legislation.

The Group reported an EBITDA loss of -€6,4

million for FY 2022. After a negative H1 2022 (H1 2022 EBITDA of

-€6,5 million), Unifiedpost released a slightly positive EBITDA in

H2, in Q42022 even +€1,8 million. The positive development on the

EBITDA-level proves that Unifiedpost is well on track to reach its

goal delivering a positive cash flow for H2 2023.

The loss from operations for the period amounted

to €29,9 million. The loss for the period is €43,5 million. The

loss for the period is impacted by higher financial expenses (-€9,4

million of which -€8,0 million is linked to Francisco Partners

funding), by a loss of -€1,9 million on an associate company

(Facturel, joint investment with ECMA in France) and by the change

in fair value of financial liabilities (-€4,3 million). The latter

is linked to the settlement of the earn-out with the former

Crossinx shareholders, as published on 21st October 2022 (-€4,8

million). By settling the earn-out agreement with Crossinx,

Unifiedpost eliminated the risk of having to pay out an earn-out of

€60 million in the future - of which €20 million in cash. The

settlement of the earn-out through the repayment of 1,3 million

shares worth €4,8 million is therefore fully in line with our

announced focus on making our cash flow positive.

Funding secured

The cash flow from financing activities amounted

to +€67,6 million at the end of the period. Unifiedpost’s cash and

cash equivalents increased from €17,0 million at YE 2021 to €40,0

million at YE 2022. The Group also has €17,7 million of undrawn

financing facilities. The increase in cash position was due to the

€100 million five-year senior facilities agreement, provided by

Francisco Partners, a leading global investment firm that

specialises in partnering with technology-enabled businesses. The

facility is structured in a term loan facility A of €75 million

which has been drawn at closing and a capex facility B of €25

million which has been drawn in December 2022. Unifiedpost met all

covenants checks during the year 2022.

The Group’s net debt position at year end 2022

amounted to €69,4 million.

Sufficient liquidity for growth

path

Unifiedpost’s management expects that the Group

is equipped with sufficient liquidity until cash flow break-even

will be reached. The Group targets to be cash flow positive by the

second semester of 2023. The Group is well on the way with the cost

management program and can benefit from the growth of the customer

base and increasing recurring processing revenue.

Increasing tailwinds in the addressable

markets: EU Commission publishes law proposal to revamp EU’s VAT

system

With the geographical expansion in 2021,

Unifiedpost unlocked the market potential in these countries in the

course of 2022 driven by the rollout-out of business. The momentum

and trend of digitisation as well as governments wanting to close

the VAT-gap remain key in all markets. In response to sustainably

growing digitisation of the economy, on 8 December 2022 the

European Commission published its long-awaited proposals to revamp

the EU’s VAT system. With this proposal, the EU wants to further

modernise VAT

reporting obligations and to address the

challenges of the platform economy, by updating the VAT rules

applicable. These are positive proposals in view of Unifiedpost’s

business model.

ESG

A good corporate citizenship has always been

fundamental and part of Unifiedpost’s DNA. The Company recognizes

its responsibility to consider the impact of its business on the

environment and society, and is committed to integrating

sustainability into our business strategy. In 2022, the ESG-roadmap

drawn up the year before, was further implemented and for the first

time, data gathering across all entities was kicked off.

Positive cash flow expected for H2

2023

[INSIDE INFORMATION] In 2023 and the years

ahead Group management expects to significantly benefit from the

growth in its key markets. The mandatory digital e-invoicing

policies several European countries have implemented and will

implement will have a positive effect on customers and revenue.

With the changed economic circumstances and business conditions,

the Company has decided to make the target to become cash flow

positive its only target. The target remains to be cash flow

positive for H2 2023.

<End>

The auditor, BDO Réviseurs d’Entreprises SRL,

has confirmed that audit of the consolidated financial information

for the year ended 31 December 2022 as included in this press

release is substantially completed.

Investors

& Media webcast

Management will host a

live video webcast for analysts, investors and media today at 10:00

a.m. CET.

A recording will be available shortly

after the event. To attend, please register at

https://onlinexperiences.com/Launch/QReg/ShowUUID=72838B62-440A-4AF9-938F-7725F11EA13F.

Participants can also join via telephone. They can obtain their

personal dial-in details by registering with this link:

https://register.vevent.com/register/BI0e29ae9ca20e46b2acba56c18730b31e.

A full replay be

available after the webcast at:

https://www.unifiedpost.com/en/investor-relations

Financial Calendar 2023

- 14 April 2023

Publication Annual Report 2022

- 16 May

2023

Annual General Meeting of Shareholders

- 22 May

2023

Publication Q1 2023 Business Update

- 29 August

2023

Publication H1 2023 Financial Results

- 16 November

2023

Publication Q3 2023 Business Update

Contact

Laurent Marcelis

+32 477 61 81 37

laurent.marcelis@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform for SME business

services built on “Documents”, “Identity” and “Payments”.

Unifiedpost operates and develops a 100% cloud-based platform for

administrative and financial services that allows real-time and

seamless connections between Unifiedpost’s customers, their

suppliers, their customers, and other parties along the financial

value chain. With its one-stop-shop solutions, Unifiedpost’s

mission is to make administrative and financial processes simple

and smart for its customers. Since its founding in 2001,

Unifiedpost has grown significantly, expanding to offices in 32

countries, with more than 500 million documents processed in 2021,

reaching over 1,600,000 SMEs and more than 2,500 Corporates across

its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2022 turnover €191 million

- 1400+ employees

- Diverse portfolio of clients across a wide variety of

industries (banking, leasing, utilities, media, telecommunications,

travel, social security service providers, public organisations,

etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised

as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol:

UPG

(*) Warning about future statements: The statements contained

herein may contain forecasts, future expectations, opinions and

other future-oriented statements concerning the expected further

performance of Unifiedpost Group on the markets in which it is

active. Such future-oriented statements are based on the

current insights and assumptions of management concerning future

events. They naturally include known and unknown risks,

uncertainties and other factors, which seem justified at the time

that the statements are made but may possibly turn out to be

inaccurate. The actual results, performance or events may

differ essentially

from the results, performance or events which are expressed or

implied in such future-oriented statements. Except where

required by the applicable legislation, Unifiedpost Group shall

assume no obligation to update, elucidate or improve

future-oriented statements in this press release in the light of

new information, future events or other elements and shall not be

held liable on that account. The reader is warned not to rely

unduly on future-oriented statements.

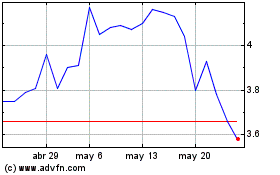

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025