Unifiedpost takes the lead in building a compliant network for

businesses

PRESS RELEASE - REGULATED INFORMATION

Steady progress towards cash flow positivity strengthens

commitment to financial sustainability

La Hulpe, Belgium

– May 22, 2023, 7:00 a.m. CET -

Unifiedpost Group (Euronext: UPG) (Unifiedpost, the Group, or the

Company) is pleased to report strong Q1 2023 performance, driven by

a double-digit increase in digital processing revenue. Positive

results were observed in Belgium, France, Serbia, and the Nordic

countries. The customer base surpassed 1,1 million, with 473.679

paying businesses and 660.027 customers paid by third parties. The

Banqup product experienced continued growth, with a surge in new

subscriptions. Unifiedpost Group reaffirms its target to achieve

cash flow positivity over H2 2023, following the planned trajectory

with diligent monitoring.

Highlights

- Unifiedpost Group's recurring digital processing revenue

reached €32,0 million, showing a growth of 14,7% y-o-y.

- The company effectively executes its program to reach the

target of being cash flow positive over H2 2023.

- The Group witnessed a significant rise in its customer base

surpassing 1,1 million customers.

- The Banqup platform experienced substantial customer growth,

with a total of 143.902 customers by the end of Q1 2023, showcasing

the platform's popularity and robust organic growth.

- Unifiedpost Group's Banqup customers in Belgium (Billtobox)

reached 45.359, while Banqup customers in France (JeFacture) rose

to 11.973, underscoring the company's success in expanding its

customer base.

Commenting on the business update, Hans

Leybaert, CEO and founder stated: "We are pleased to see continued

growth of our network, with increased adoption in Belgium and

France. As we expand throughout Europe, we are ideally placed to

build a compliant network for businesses of all sizes and types.

The VAT in the digital age (VIDA) initiative is driving more and

more markets towards compliance, and Unifiedpost is leading the way

in providing solutions for businesses to operate fully digitally,

be compliant, and handle reporting requirements seamlessly. Our

mission is to help all businesses in Europe achieve this goal so

they can focus on their core business while we take care of the

rest."

Key financial figures

| (EUR million) |

Q1 2023 |

Q1 2022 |

Change (%) |

| Digital processing

revenue |

33,4 |

29,6 |

+12,8% |

|

Recurring digital processing revenue |

32,0 |

27,9 |

+14,7% |

|

Non-recurring digital revenue |

1,4 |

1,7 |

-17,6% |

| Postage &

parcel optimisation revenue |

14,8 |

16,5 |

-10,3% |

| Group revenue |

48,2 |

46,1 |

+4,1% |

Key business KPI’s

| (#) |

End Q1 2023 |

End Q4 2022 |

End Q3 2022 |

End Q2 2022 |

| Customers |

1.133.706 |

1.063.776 |

986.971 |

910.845 |

| Paying

customers |

473.679 |

468.128 |

453.417 |

430.524 |

| Customers paid

by 3rd parties |

660.027 |

595.648 |

533.554 |

480.321 |

| Companies in business network |

2.186.270 |

2.109.297 |

2.023.460 |

1.745.401 |

| Banqup

customers |

143.902 |

124.333 |

80.420 |

68.546 |

|

Organic growth (new

subscriptions) |

19.569 |

18.255 |

3.928 |

5.529 |

|

Migrated |

0 |

70.582 |

7.847 |

7.116 |

| Banqup customers

Belgium (Billtobox) |

45.359 |

40.363 |

37.459 |

35.382 |

| Banqup customers

France (JeFacture) |

11.973 |

5.428 |

4.087 |

3.591 |

Robust revenue growth and strategic

focus drive success

Unifiedpost Group demonstrated robust growth in

the first quarter of 2023, with revenue reaching €48,2 million,

fuelled by a 14,7% y-o-y increase in recurring digital processing

revenue. The Company is pleased to report a strong performance in

digital revenue across Belgium, Serbia, and the Nordic countries,

despite the negative impact of the SEK-EUR exchange rate on revenue

in Sweden. These regions have consistently delivered positive

results. In terms of geographical distribution, the top five

countries for digital processing revenue remain consistent. Belgium

leads the way with 22%, followed by Sweden with 19%, The

Netherlands with 13%, Serbia with 8%, and Lithuania with 7%.

Importantly, there were no substantial deviations from the budget

for the countries where we are active, indicating stable and

aligned performance across operations.

The revenue from postage & parcel

optimisation, linked to the acquired business in the Scandinavian

countries, showed a decline of 10,3% in revenue. This is largely

attributed to the impact of the SEK-EURO exchange rate change.

During the first three months of the year, the

project-based business is typically limited, a pattern observed in

the previous years and also in 2023. The absolute differences

compared to the previous year remained minimal.

Notably, 97% of the Group’s revenue was

recurring, highlighting the strong foundation of its business and

the stability provided by the Group’s loyal customer base.

Unifiedpost Group continues to navigate the business landscape with

resilience and adaptability, focusing on sustained growth and the

development of innovative solutions that meet the evolving needs of

the customers.

Unifiedpost Group achieved an average revenue

per user (ARPU) of €23,5 in the first quarter, reflecting the

ongoing growth and diversification of the digital processing

business. The ARPU level is lower compared to the previous quarter

(€27,3) primarily due to the absence of license revenue in the

first quarter of this year, which was included in Q4 2022 with the

closure of a large deal with ECMA (the French accountants

federation). An increasing revenue contribution from Unifiedpost's

SME business has also influenced the overall ARPU. This segment of

the business typically exhibits a structurally lower ARPU, which

results from its focus on serving a broader customer base and

offering competitive pricing tailored to the needs of small and

medium-sized enterprises.

Customer growth and network expansion

fuelling Europe's digital transformation

Unifiedpost continues to witness remarkable

growth in its customer base, reaching new heights in the first

quarter of 2023. The number of customers surged to 1.133.706,

reflecting a significant increase compared to the end of the

previous year. Paying customers also showed a positive trajectory,

with 473.679 businesses choosing Unifiedpost's services,

highlighting the value and trust placed in the Unifiedpost

solutions. Moreover, the company experienced a notable expansion in

the number of customers paid by third parties, reaching 660.027,

further solidifying Unifiedpost's position as a preferred partner

for businesses across various industries.

Unifiedpost's commitment to building a robust

business network remains unwavering, as the total number of

companies in the network surpassed 2 million. This extensive

network represents a substantial portion of businesses in Europe,

estimated to encompass approximately 8% of the market.

Within the core SME product, Banqup, the growth

trajectory continues. The number of Banqup customers grew strongly

to 143.902, indicating a continued surge in adoption and showcasing

the platform's appeal among SMEs. Notably, organic growth in new

subscriptions contributed significantly to this achievement, with

19.569 new subscriptions added during the first quarter alone.

Unifiedpost's presence in key markets is

thriving, as evidenced by the increasing number of Banqup customers

in Belgium (Billtobox) and France (JeFacture). In Belgium, the

Banqup customer base reached an impressive 45.359, while in France,

the number rose to

11.973 at the end of the first quarter. These

figures demonstrate the growing recognition and adoption of

Unifiedpost's services, setting the stage for accelerated growth in

the coming periods, particularly in the French market where

e-invoicing will be mandatory as from 07/2024.

Unifiedpost remains dedicated to empowering

businesses throughout Europe to embrace digitalisation, compliance,

and streamlined reporting. With the comprehensive solutions, we

enable businesses to focus on their core operations while relying

on Unifiedpost for their essential financial and administrative

needs.

Catalysing growth: Unifiedpost empowers

businesses in the digital financial revolution

The market landscape is experiencing significant

growth and transformation driven by the implementation of VIDA (VAT

in the digital age) across various countries, revolutionising

digital invoicing and reporting practices. This regulatory shift is

prompting businesses to seek comprehensive solutions that encompass

not only payments but also validation services, including tax

compliance.

Unifiedpost has been diligently preparing its

platform and solutions to meet these evolving market needs and is

now well-positioned to capitalise on the emerging opportunities.

The Group’s extensive experience and expertise enable us to offer

robust and tailored solutions that seamlessly integrate invoicing,

payments, and tax validation services. By providing a holistic

approach to digital financial processes, we empower businesses to

streamline their operations, enhance efficiency, and ensure

compliance with tax regulations.

As the market continues to evolve, the demand

for comprehensive invoicing solutions coupled with tax compliance

is expected to grow significantly in the coming years.

Unifiedpost's forward-thinking approach and innovative solutions

place the Company at the forefront of this market expansion. With

its proven track record and established presence in numerous

countries, Unifiedpost is strategically positioned to capture

market share and forge strong partnerships with businesses seeking

to optimise their financial processes.

Unifiedpost remains committed to driving growth,

delivering exceptional value to its customers, and continuously

innovating its solutions to stay ahead of market demands. By

leveraging its extensive network, advanced technologies, and deep

industry knowledge, Unifiedpost is poised to seize the exciting

opportunities arising from the expanding market landscape and

further strengthen its position as a leading provider of digital

financial solutions across multiple countries.

Unifiedpost Group advances towards cash

flow positivity

Unifiedpost Group remains committed to achieving

cash flow positivity as its primary objective, considering the

evolving economic landscape and business conditions. The company

has implemented strategies to increase business contribution

through sustained growth and diligent management of direct costs.

Additionally, efforts have been made to reduce indirect costs,

ensuring optimal efficiency throughout the organization.

The first-quarter results align with the planned

trajectory, providing reassurance of the company's progress. The

management team and board closely monitor the cash flow evolution

on a monthly basis, promptly addressing any deviations from the

plan. This proactive approach allows for swift interventions and

adjustments to maintain the goal of becoming cash flow

positive.

Based on the Q1 performance and the diligent

monitoring and control measures in place, Unifiedpost Group

confidently reconfirms its target to achieve cash flow positivity

over the second half of 2023. The company's unwavering focus on

financial sustainability and continuous improvement positions it

well to realise this objective.

<End>

Financial Calendar 2023

- 29 August 2023

Publication H1 2023 Financial

Results

- 16 November

2023

Publication Q3 2023 Business Update

Contact

Laurent Marcelis

+32 477 61 81 37

laurent.marcelis@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform

for SME business services built on “Documents”, “Identity” and

“Payments”. Unifiedpost operates and develops a 100% cloud-based

platform for administrative and financial services that allows

real-time and seamless connections between Unifiedpost’s customers,

their suppliers, their customers, and other parties along the

financial value chain. With its one-stop-shop solutions,

Unifiedpost’s mission is to make administrative and financial

processes simple and smart for its customers. Since its founding in

2001, Unifiedpost has grown significantly, expanding to offices in

32 countries, with more than 500 million documents processed in

2021, reaching over 1.600.000 SMEs and more than 2.500 Corporates

across its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2022 turnover €191 million

- 1400+ employees

- Diverse portfolio of clients across a wide variety of

industries (banking, leasing, utilities, media, telecommunications,

travel, social security service providers, public organisations,

etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised

as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol:

UPG

(*) Warning about future statements: The

statements contained herein may contain forecasts, future

expectations, opinions and other future-oriented statements

concerning the expected further performance of Unifiedpost Group on

the markets in which it is active. Such future-oriented

statements are based on the current insights and assumptions of

management concerning future events. They naturally include

known and unknown risks, uncertainties and other factors, which

seem justified at the time that the statements are made but may

possibly turn out to be inaccurate. The actual results,

performance or events may differ essentially

from the results, performance or events which

are expressed or implied in such future-oriented statements.

Except where required by the applicable legislation, Unifiedpost

Group shall assume no obligation to update, elucidate or improve

future-oriented statements in this press release in the light of

new information, future events or other elements and shall not be

held liable on that account. The reader is warned not to rely

unduly on future-oriented statements.

- 20230522 UnifiedpostGroup PressRelease 2023Q1 BusinessUpdate FR

v1.0

- 20230522 UnifiedpostGroup PressRelease 2023Q1 BusinessUpdate

ENG v1.0

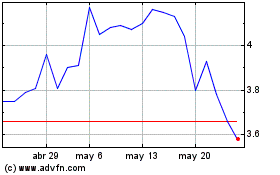

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025