Vantiva Announces Plan to Sell its Supply Chain Solutions Division

to Funds Managed by Variant Equity

Press Release

Vantiva Announces Plan to Sell its Supply

Chain Solutions Division

to Funds Managed by Variant Equity

The potential sale further enables both

Connected Home and Supply Chain Solutions (SCS) to focus on their

respective core businesses

Paris, France – December 19, 2024 – Vantiva (Euronext

Paris: VANTI), a global technology leader enabling Network

Service Providers to connect consumers worldwide, announces its

plans to sell its Supply Chain Solutions (SCS) division to funds

managed by private equity firm, Variant Equity, by entering into a

Put Option Agreement.

After a competitive and impartial selection process, the Board

of Directors has chosen Variant Equity as the best partner to

support SCS’s future and ensure alignment with the company’s

corporate interests.

The transaction is based on an SCS valuation of $40 million,

subject to the usual adjustments, including a working capital

adjustment at closing.

In accordance with IFRS 5, SCS will be classified as

discontinued operations in Vantiva’s Fiscal Year 2024 accounts.

Vantiva will also record a necessary asset impairment, and its

valuation process is currently underway.

The group's 2024 guidance remains unchanged. However, for

ongoing activities, they are as follows: EBITDA exceeding €100

million and a positive free cash flow after financial expenses and

taxes and before restructuring and integration costs related to the

CommScope Home Networks acquisition.

“We are very pleased with the prospect of selling SCS to

Variant. Given their focus on corporate divestitures and previous

industry experience, we believe they are the best-suited partner

for moving the business forward,” said Tim O’Loughlin, CEO of

Vantiva, “I am excited about SCS’s future with Variant.”

Farhaad Wadia, Managing Partner of Variant Equity, also

expressed enthusiasm for the prospect of SCS joining Variant as a

stand-alone portfolio company, stating, “Over the years, SCS has

developed valuable customer relationships, a comprehensive set of

capabilities and a robust global infrastructure. We look forward to

partnering with the SCS team to unlock continued growth and

capitalize on the business that has been built under Vantiva’s

ownership.”

Rob Wipper, President of Supply Chain Solutions, added, “We’re

excited about the prospect of joining the Variant portfolio. As a

stand-alone company, SCS can accelerate diversification strategies,

including expanding our precision manufacturing and third-party

logistics services, while maintaining our focus on the production

and distribution of physical media content.”

The pending sale of SCS demonstrates Vantiva’s commitment to

innovation and is the next step in implementing a more customer

centric strategy. Whereas earlier acquisitions, such as the January

2024 acquisition of Home Networks, strengthened Vantiva’s portfolio

of assets and expertise, the pending sale of SCS will now allow

Vantiva to concentrate on optimizing those assets and expertise to

deliver cutting-edge solutions to customers in the video,

broadband, and related technology spaces.

The transaction, in which Moelis & Company LLC is serving as

exclusive financial advisor to Vantiva, is contingent on Vantiva’s

exercise of the Put Option to enter into a binding Equity Purchase

Agreement, pending the completion of consultation processes with

Vantiva’s Works Council, along with other typical and customary

conditions. Both parties are confident of a positive outcome in the

coming weeks.

*****

Warning: Forward Looking Statements

This press release contains certain statements that constitute

"forward-looking statements", including but not limited to

statements that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions or which

do not directly relate to historical or current facts. Such

forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted, or implied by such

forward-looking statements. For a more complete list and

description of such risks and uncertainties, refer to Vantiva’s

filings with the French Autorité des marchés financiers (AMF). The

Universal Registration Document (Document d’enregistrement

universel) for fiscal year 2023 was filed with the Autorité des

marchés financiers on April 30, 2024, under no. D.24-0375.

*****

About Vantiva

Pushing the Edge

Vantiva shares are admitted to trading on the regulated market

of Euronext Paris (VANTI).

Vantiva, formerly known as Technicolor, is headquartered in

Paris, France. It is an independent company which is a global

technology leader in designing, developing and supplying innovative

products and solutions that connect consumers around the world to

the content and services they love – whether at home, at work or in

other smart spaces. Vantiva has also earned a solid reputation for

optimizing supply chain performance by leveraging its decades-long

expertise in high-precision manufacturing, logistics, fulfillment

and distribution. With operations throughout the Americas, Asia

Pacific and EMEA, Vantiva is recognized as a strategic partner by

leading firms across various vertical industries, including network

service providers, software companies and video game creators for

over 25 years. The group’s relationships with the film and

entertainment industry goes back over 100 years by providing

end-to-end solutions for its clients.

Following the acquisition of CommScope’s Home Networks in

January 2024, Vantiva continues its 130-year legacy as a global

leader in the connected home market.

Vantiva is committed to the highest standards of corporate

social responsibility and sustainability across all aspects of

their operations.

For more information, please visit vantiva.com and follow

Vantiva on LinkedIn and X (Twitter).

Contacts

Vantiva Press

Relations Image

7 for Vantiva

press.relations@vantiva.com vantiva.press@image7.fr

Vantiva Investor Relations

investor.relations@vantiva.com

About Variant Equity

Founded in 2017, Variant Equity is a Los Angeles based private

equity firm that makes control investments in corporate divestiture

and similarly operationally intensive transactions across a wide

range of industries including transportation and logistics,

technology and business services. The firm’s investment approach

focuses on businesses it believes are best suited to reach their

full potential as stand-alone enterprises through the deployment of

Variant’s operations and technology resources. For more

information, visit variantequity.com.

- pr-vantiva-plans-to-sell-scs-december-19-2024-en

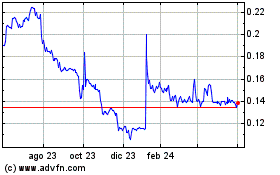

Vantiva (EU:VANTI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

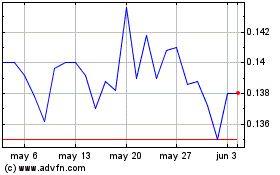

Vantiva (EU:VANTI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025