Trading update 31 March 2022

19 Abril 2022 - 11:01AM

Trading update 31 March 2022

FURTHER RECOVERY COMPARED TO THE PREVIOUS FINANCIAL

YEAR

- Net result from core activities: € 10.18M (31 March

2021: € 9.96M);

- Net asset value per share: € 78.93 (31 December 2021:

€ 77.19);

- Debt ratio of 27.3% (31 December 2021:

28.2%);

- EPRA occupancy rate total portfolio: 91.8% (31

December 2021: 93.9%);

- EPRA occupancy rate retail portfolio: 96.1% (31

December 2021: 97.2%);

- Fair value of the investment properties portfolio: €

929,5M (31 December 2021: € 926M);

- Increase of the indication of net result of core activities

to € 4.80 - € 4.90 per share (previously € 4.70 - € 4.80).

- Press release - Trading update 31 March 2022

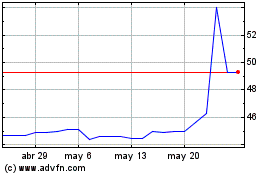

Wereldhave Belgium (EU:WEHB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

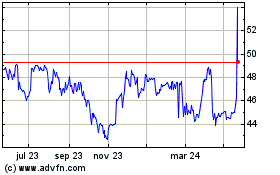

Wereldhave Belgium (EU:WEHB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024