MARKET WRAPS

Watch For:

UK monthly retail sales; trading updates from Investor AB,

Deliveroo, Sasol

Opening Call:

Stock futures advanced as a tech-driven rally boosted sentiment.

Asian stock benchmarks were largely higher; the dollar weakened

slightly; Treasury yields were little changed; oil futures were

mixed fell and gold edged higher.

Equities:

European stock futures rose early Friday, extending an upbeat

mood spurred by technology names, which powered indexes in the U.S.

and Asia higher.

Meanwhile, investors are still concerned that the Federal

Reserve may not wind down its aggressive monetary tightening as

quickly as market participants expect following strong December

retail-sales data and after policymakers talked down expectations

for an early start to rate cuts.

Investors in both stock and bond markets are now speculating

that the central bank will be in no rush to cut borrowing costs as

the economy shows signs of resilience.

"This is an economy that continues to surprise to the upside,"

said Nadia Lovell, senior U.S. equity strategist for the chief

investment office at UBS Wealth Management.

"People were maybe too optimistic about how many are coming this

year," said Doug Evans, chief investment officer at Callan Family

Office. "Yes, the Fed will ease-but probably not at the cadence

people were expecting."

Forex:

Tight monetary policy in Brazil and Mexico reduce the importance

of global growth for emerging market currencies, Bank of America

said.

"EM currencies have become more idiosyncratic," the bank said,

adding that the dollar remains "the main driver of EM FX and its

first principal component."

BofA said that contrary to the pre-Covid pattern, EM currencies

could benefit if commodity prices, especially oil, fall.

Bonds:

The decline in Treasury yields in the past couple of months "has

rendered the long-duration trade probably moot," said Kevin

Flanagan, head of fixed income strategy at WisdomTree.

Investors would have to envision the 10-year yield falling

closer to 3% to buy long-duration bonds, since these highly

interest-rate-sensitive bonds gain value when borrowing costs

decline.

The duration trade gained traction in October, as the 10-year

rose toward 5%. The benchmark declined to 3.8% in December and is

now near 4.15%, as investors expect the Fed to start cutting rates

soon. "The Treasurys market has priced in a lot of good news,"

Flanagan said."

Energy:

Oil futures were mixed early Friday amid divergent signals. On

the one hand, lingering tensions in the Middle East and higher

equity markets have supported oil prices, ING said.

On the other hand, the IEA's latest oil-market report was

somewhat bearish, ING said, noting that the agency forecast that

global oil demand growth will slow to 1.2 million barrels a day in

2024 from 2.3 million barrels a day in 2023.

Metals:

Gold edged higher in Asia, supported by the mild weakness of

USD, which typically has an inverse correlation with the precious

metal.

Attacks by the U.S. military on Houthi weaponry in Yemen as well

as Pakistan's airstrikes in Iran have resulted in an escalation of

tensions in the region, said IG. Geopolitical tensions can often

spur demand for gold.

-

Copper prices advanced amid supply concerns. Low prices and a

tough regulatory environment have led to mine closures across

base-metal markets, ANZ said.

The shutdown of the Cobre Panama mine and cuts to output at

Anglo American operations have raised supply risks, ANZ added. New

projects are also being delayed, further fueling supply worries.

That is helping offset concerns around weaker demand, the bank

said.

-

Iron-ore prices rose, rebounding from recent weakness. However,

analysts reckon iron-ore prices could continue to be weighed amid

concerns about Chinese steel mills' production cuts due to poor

profitability and a lack of new stimulus measures.

The iron-ore market continues to see relatively sufficient

supply, neutral demand and accumulating inventories, Xinhu Futures

said. Market sentiment remains subdued in the absence of strong

Chinese stimulus measures on the macro front, Xinhu said.

TODAY'S TOP HEADLINES

A Hot Debt Market Is Slashing Borrowing Costs for Riskier

Companies

Companies with low credit ratings are rushing to slash their

borrowing costs even before the Federal Reserve makes a single

interest-rate cut.

As of Thursday morning, companies such as SeaWorld Entertainment

and Dave & Buster's had asked investors to cut the interest

rates on some $62 billion of sub-investment grade loans in

January-already the largest monthly total in three years, according

to PitchBook LCD.

AI Is the Talk of Davos. Is It Time to Sell?

The mood of the global elite meeting in Davos, Switzerland, is a

useful indicator for investors-as long as they do the opposite.

When the elite are depressed, buy. When they're positive, sell.

When they're focused on crypto, as in 2021, get out. This year it

was impossible to move in the snow-blanketed resort without having

artificial intelligence pushed at you.

Fed's Bostic makes case for first rate cut in July-September

quarter

Atlanta Fed President Raphael Bostic on Thursday laid out the

case for the central bank holding off from any interest-rate cut

until the July-September quarter.

Bostic said he has recently moved up his projected time to begin

reducing the Fed's benchmark rate to the third quarter from the

fourth quarter because of the unexpected progress on inflation and

economic activity.

The Red Sea Conflict Is Scrambling Shipping. Europe Is Bearing

the Brunt.

For the second time in three years, a conflict in Europe's

unruly neighborhood is threatening to weaken an already struggling

economy while a more robust U.S. is watching from a safer

distance.

This time, attacks by Houthi rebels in Yemen targeting cargo

ships in the Red Sea have persuaded more carriers to opt for the

safer but longer and more expensive journey around Africa via the

Cape of Good Hope.

EU Commission Intends to Block Amazon's iRobot Acquisition

The European Union's competition watchdog intends to block

Amazon's $1.7 billion bid to purchase Roomba maker iRobot, people

familiar with the matter said.

Competition officials from the European Commission, the bloc's

executive body, met Thursday with representatives from Amazon to

discuss the deal, one of those people said. Amazon was told during

the meeting that the deal was likely to be rejected, the person

said. Amazon declined to comment.

Drugmakers Raise Prices of Ozempic, Mounjaro and Hundreds of

Other Drugs

Drugmakers kicked off 2024 by raising the list prices for

Ozempic, Mounjaro and dozens of other widely used medicines.

Companies including Novo Nordisk, the maker of Ozempic, and Eli

Lilly, which sells Mounjaro, raised list prices on 775 brand-name

drugs during the first half of January, according to an analysis

for The Wall Street Journal by 46brooklyn Research, a nonprofit

drug-pricing analytics group.

Write to singaporeeditors@dowjones.com

Expected Major Events for Friday

07:00/GER: Dec PPI

07:00/UK: Dec UK monthly retail sales figures

07:30/SWI: Dec PPI

07:30/SWI: Dec Import Price Index

09:00/ICE: Dec Harmonized CPI

09:00/POL: Dec PPI

15:59/GRE: Nov Balance of Payments

All times in GMT. Powered by Onclusive and Dow Jones.

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 19, 2024 00:17 ET (05:17 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

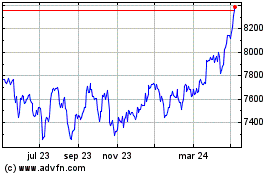

FTSE 100

Gráfica de índice

De Oct 2024 a Nov 2024

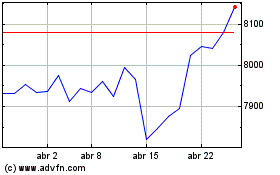

FTSE 100

Gráfica de índice

De Nov 2023 a Nov 2024