Commodity Currencies Slides Amid Risk Aversion

04 Agosto 2024 - 10:57PM

RTTF2

The Commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against other major currencies in the

Asian session on Monday amid risk aversion, as traders react to

weak U.S. monthly jobs data and recent weak data on U.S.

manufacturing activity that stocked fears the world's largest

economy could slip into a recession after the U.S. Fed seems to

have waited too long to cut interest rates. Markets in Japan, South

Korea and Taiwan are plunging more than 5 percent.

The unexpected increase in the unemployment rate reached its

highest level since hitting 4.5 percent in October 2021.

Weakness across all sectors led by energy, financial and

technology stocks, also weighed on the investor sentiment.

Crude oil prices fell sharply to a two-month low, sliding for a

second successive session on rising concerns about the outlook for

demand due to slowing growth in the U.S. West Texas Intermediate

Crude oil futures for September fell $2.79 or 3.66 percent at

$73.52 a barrel.

In economic news, data from Judo Bank showed that the services

sector in Australia continued to expand in July, albeit at a slower

pace, with a services PMI score of 50.4. That's down from 51.2 in

June.

Also, data published by S&P Global showed that China's

service sector growth accelerated in July on faster growth in new

business inflows. The Caixin services Purchasing Managers' Index

rose to 52.1 in July from 51.2 in June. The score was expected to

rise to 51.4.

In the Asian trading today, the Australian dollar fell to an

8-month low of 93.89 against the yen and nearly a 9-month low of

1.6841 against the euro, from Friday's closing quotes of 95.38 and

1.6756, respectively. If the aussie extends its downtrend, it is

likely to find support around 92.00 against the yen and 1.69

against the euro.

Against the U.S. and the Canadian dollars, the aussie dropped to

5-day low of 0.6482 and 0.8999 from last week's closing quotes of

0.6509 and 0.9029, respectively. On the downside, 0.63 against the

greenback and 0.88 against the loonie are seen as the next support

levels for the aussie.

The aussie slipped to more than a 1-month low of 1.0903 against

the NZ dollar, from Friday's closing value of 1.0925. The next

possible downside target level for the AUD/NZD pair is seen around

the 1.08 region.

The NZ dollar fell to a 6-day low of 1.8382 against the euro and

a 1-year low of 86.08 against the yen, from Friday's closing quotes

of 1.8312 and 87.29, respectively. If the kiwi extends its

downtrend, it is likely to find support around 1.85 against the

euro and 85.00 against the yen.

Against the U.S. dollar, the kiwi edged down to 0.5938 from

Friday's closing value of 0.5957. The NZD/USD pair is likely to

find its support around the 0.57 region.

The Canadian dollar fell to nearly a 3-1/2-year low of 1.5162

against the euro and an 8-month low of 104.28 against the yen, from

Friday's closing quotes of 1.5134 and 105.62, respectively. If the

loonie extend its downtrend, it is likely to find support around

against 1.52 against the euro and 103.00 against the yen.

Against the U.S. dollar, the loonie edged down to 1.3887 from

Friday's closing value of 1.3872. On the downside, the USD/CAD pair

may find its support around the 1.39 area.

Meanwhile, the safe-haven yen strengthened against its major

rivals in the Asian trading today amid risk aversion.

Data from Jibun Bank showed that the services sector in Japan

bounced back up into expansion territory in July, with a services

PMI score of 53.7. That's up from 49.4 in June.

The yen rose to near 7-month highs of 157.97 against the euro,

144.61 against the U.S. dollar and 185.05 against the pound, from

Friday's closing quotes of 159.88, 146.54 and 187.54, respectively.

If the yen extends its uptrend, it is likely to find resistance

around 156.00 against the euro, 143.00 against the greenback and

186.00 against the pound.

Against the Swiss franc, the yen advanced to a 4-day high of

169.48 from Friday's closing value of 170.81. On the upside, 166.00

is seen as the next resistance level for the yen.

Looking ahead, services PMI data from various European economies

and U.K. for July and Eurozone PPI for June are due to be released

in the European session.

In the New York session, U.S. ISM services PMI data for July and

Canada average hourly wages for July are slated for release.

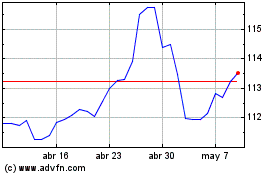

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Oct 2024 a Oct 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Oct 2023 a Oct 2024