Commodity Currencies Rise Amid Risk Appetite

06 Agosto 2024 - 10:49PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Wednesday amid risk appetite, following the

broadly positive cues from Wall Street overnight, as traders across

most markets are picking up stocks at a bargain after the recent

strong sell-off amid fears about the world's largest economy

slipping into recession.

Crude oil prices settled modestly higher, snapping a

four-session losing streak, as the shutdown of Libya's 270,000

barrel per day Sharara oil field offered mild support. West Texas

Intermediate Crude oil futures for September ended up $0.26 or 0.36

percent at $73.20 a barrel.

In economic news, the official data showed that China's exports

grew less than expected at the start of the third quarter, while

imports rebounded on domestic demand. Exports posted an annual

growth of 7.0 percent in July, the customs data revealed. This was

weaker than the forecast of 9.7 percent and followed an 8.6 percent

expansion in June.

On the other hand, imports surged 7.2 percent annually,

reversing the 2.3 percent decrease in June and also stronger than

consensus of 3.5 percent increase.

As a result, the trade surplus narrowed to $84.65 billion from

$99.05 billion in June. The surplus was seen at $97.5 billion.

Meanwhile, the NZ dollar started gaining against its major

rivals in the Asian session today, aided by the latest jobs

report.

Data from Statistics New Zealand showed that the unemployment

rate in New Zealand came in at a seasonally adjusted 4.6 percent in

the second quarter of 2024. That beat forecasts for an increase of

4.7 percent and was up from 4,3 percent in the previous three

months.

In the Asian trading today, the Australian dollar rose to 9-day

high of 0.6565 against the U.S. dollar, from yesterday's closing

value of 0.6518. The aussie may test resistance around the 0.67

region.

Against the yen and the euro, the aussie advanced to 5-day highs

of 97.08 and 1.6627 from Tuesday's closing quotes of 94.05 and

1.6756, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 100.00 against the yen and 1.64

against the euro.

Against the Canada and the New Zealand dollars, the aussie

climbed to 2-day highs of 0.9038 and 1.0890 from yesterday's

closing quotes of 0.8985 and 1.0947, respectively. The next

possible resistance levels for the aussie are seen around 0.91

against the loonie and 1.07 against the kiwi.

The NZ dollar rose to more than a 2-week high of 0.6018 against

the U.S. dollar, from yesterday's closing value of 0.5953. On the

upside, 0.61 is seen as the next resistance level for the kiwi.

Against the yen and the euro, the kiwi advanced to 5-day highs

of 88.98 and 1.8129 from Tuesday's closing quotes of 85.90 and

1.8357, respectively. If the kiwi extends its uptrend, it is likely

to find resistance around 93.00 against the yen and 1.77 against

the euro.

The Canadian dollar rose to 5-day highs of 1.5021 against the

euro and 107.43 against the yen, from yesterday's closing quotes of

1.5067 and 104.67, respectively. If the loonie extends its uptrend,

it is likely to find resistance around 1.48 against the euro and

111.00 against the yen.

Against the U.S. dollar, the loonie edged up to 1.3766 from

Tuesday's closing value of 1.3785. The loonie may test resistance

around the 1.36 region.

Looking ahead, Canada Ivey PMI for July, U.S. MBA weekly

mortgage approvals data, used car prices data for July, consumer

credit change for July and U.S. EIA crude oil data are slated for

release in the New York session.

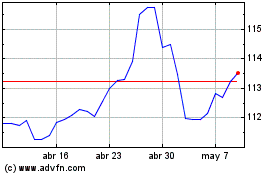

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Oct 2024 a Oct 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Oct 2023 a Oct 2024