Euro Advances Against Majors

15 Junio 2015 - 5:09AM

RTTF2

The euro strengthened against the other major currencies in the

early European session on Monday, after declining on concerns about

Greece's stalled negotiations with its international creditors.

Traders now focus their attention towards the Eurozone finance

ministers meeting, due on Thursday.

The Eurogroup meeting to be held on June 18 in Luxembourg is

largely in focus as it decides Greece 's ability to repay its debt

defaults and its future existence among the 19-nations in the euro

area.

"While some progress was made, the talks did not succeed as

there remains a significant gap between the plans of the Greek

authorities and the joint requirements of Commission," the EU

executive said in a statement. "On this basis, further discussion

will now have to take place in the Eurogroup," he added.

The EU officials dismissed the Greek government's latest

proposals on Sunday, calling them "vague and repetitive".

Uncertainty over Greece grew, as it have to unlock bailout funds

before its euro-area bailout package expires on June 30.

The European Central Bank's president Mario Draghi testimony on

monetary policy before the European Parliament's Economic and

Monetary Affairs Committee, in Brussels, due later in the day, is

also largely awaited.

Also, the U.S. Federal Reserve holds its June meeting on Tuesday

and Wednesday, with analysts waiting to see if there's going to be

any change in the Fed's language in the policy statement.

In the Asian session, the euro fell against its major

rivals.

In early European session, the euro rose to 0.7237 against the

pound, 1.1247 against the U.S. dollar and 138.88 against the yen,

from early lows of 0.7202, 1.1188 and 138.09, respectively. If the

euro extends its uptrend, it is likely to find resistance around

0.74 against the pound, 1.15 against the greenback and 141.00

against the yen.

Moving away from an early near 2-week lows of 1.0420 against the

Swiss franc and 1.4468 against the Australian dollar, the euro

advanced to 1.0469 and 1.4551, respectively. The euro may test

resistance near 1.06 against the franc and 1.48 against the

aussie.

Against the New Zealand and the Canadian dollars, the euro edged

up to 1.6102 and 1.3852 from early lows of 1.6031 and 1.3800,

respectively. On the upside, 1.63 against the kiwi and 1.41 against

the loonie area seen as the next resistance levels for the

euro.

Looking ahead, U.S. industrial production for May and U.S. NAHB

housing market index for June are slated for release in the New

York session.

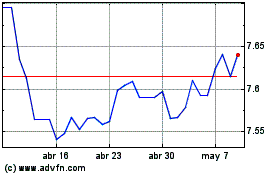

Euro vs CNY (FX:EURCNY)

Gráfica de Divisa

De Ene 2025 a Feb 2025

Euro vs CNY (FX:EURCNY)

Gráfica de Divisa

De Feb 2024 a Feb 2025