U.S. Dollar Advances As Treasury Yields Rally

23 Octubre 2024 - 8:34AM

RTTF2

The U.S. dollar climbed against its most major counterparts in

the New York session on Wednesday, as treasury yields continued to

climb on prospects for a slower pace of Federal Reserve rate cuts

and concerns about fiscal deficit.

Treasury yields continued to rise as traders pondered the

prospect of a Donald Trump presidency.

It is feared that Trump policies including tariffs and

restrictions on undocumented immigration could increase inflation

and keep interest rates relatively high for a

longer-than-anticipated period.

The yield on the benchmark ten-year note is up by 4.4 basis

points at 4.250 percent.

After the Fed slashed interest rates by 50 basis points last

month, CME Group's FedWatch Tool is currently indicating an 89.0

percent chance of just a 25 basis point rate cut next month.

Data from the National Association of Realtors unexpectedly

showed a continued decrease by existing home sales in the U.S. in

the month of September.

NAR said existing home sales slid by 1.0 percent to an annual

rate of 3.84 million in September after tumbling by 2.0 percent to

a revised rate of 3.88 million in August.

Economists had expected existing home sales to increase by 1.0

percent to a rate of 3.90 million from the 3.86 million originally

reported for the previous month.

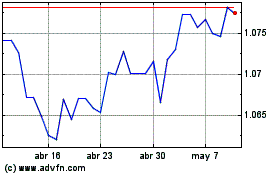

The greenback climbed to a 3-1/2-month high of 1.0760 against

the euro, more than 2-month high of 1.2922 against the pound and

near a 3-month high of 153.18 against the yen, off its early lows

of 1.0806, 1.2994 and 150.97, respectively. The currency is poised

to challenge resistance around 1.06 against the euro, 1.26 against

the pound and 159.00 against the yen.

The greenback strengthened to a 2-1/2-month high of 1.3862

against the loonie, 1-1/2-month high of 0.6625 against the aussie

and more than a 2-month high of 0.5999 against the kiwi, from its

early lows of 1.3816, 0.6691 and 0.6053, respectively. The next

possible resistance for the greenback is seen around 1.40 against

the loonie, 0.64 against the aussie and 0.58 against the kiwi.

In contrast, the greenback retreated to 0.8662 against the

franc, from an early more than 2-month high of 0.8686. If the

currency falls further, it is likely to test support around the

0.83 region.

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Oct 2024 a Nov 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Nov 2023 a Nov 2024