Thursday in Asia, most Southeast Asian currencies advanced

against the U.S. dollar on the back of strong Asian equities after

U.S. economic data raised hopes that the global economic recovery

was strengthening.

Japan's Nikkei 225 was up 0.9% with Australia's S&P/ASX 200

advancing 1.7% and South Korea's Kospi Composite gaining 0.4%. Hong

Kong's Hang Seng Index added 1.7%, while the Shanghai Composite

index rose 1.5%.

Elsewhere, Singapore's Straits Times Index rose 0.3%, Malaysia's

KLCI gained 0.3%, Taiwan's Taiex added 0.8%, while Indonesian

shares were up 0.9%. New Zealand's NZX-50 rose 1.0% and Thai stocks

were up 0.7%.

On Wall Street, stocks had a good session on Wednesday with some

upbeat data on industrial production, capacity utilization and

homebuilder confidence generating strong buying interest. The major

averages advanced for the third day in a row and have now seen

gains in eight of the past nine trading sessions.

The Dow closed up 108.3 points, or 1.1% at 9,792, the Nasdaq

advanced by 30.5 points, or 1.5%, to 2,133 and the S&P 500 rose

by 16.1 points, or 1.5% to 1,069.

The Singapore dollar, which closed yesterday's trading at 1.4118

against the U.S. currency rose to a 1-year high of 1.4092 in early

Asian deals on Thursday. The next upside target level for the

Singapore dollar is seen at 1.405.

During early Asian deals on Thursday, the Hong Kong dollar

weakened to a 3-day low of 7.7509 against the U.S. currency. This

may be compared to yesterday's close of 7.7501. If the Hong Kong

dollar declines further, it may test support around the 7.7512

level.

Today, Hong Kong will announce seasonally adjusted unemployment

data for August. Forecasts predict that the rate will climb to 5.5

percent, up from the current level of 5.4 percent.

During early Asian deals on Thursday, the Thai baht jumped to a

13-month high of 33.6050 against the U.S. dollar. On the upside,

33.18 is seen as the next target level for the Thailand currency.

At yesterday's close, the dollar-baht pair was quoted at 33.74.

The Malaysian ringgit climbed to an 8 1/2 -month high of 3.467

against the U.S. dollar in early Asian trading on Thursday. The

next upside target level for the Malaysian currency is seen at

3.44. The dollar-ringgit pair was worth 3.4725 at Wednesday's

close.

The Department of Statistics Malaysia said yesterday that the

consumer price index dropped 2.4 percent year-on-year in August,

remained unchanged from the previous month. The consumer price

index came in line with economists' expectations.

On a monthly basis, the CPI rose 0.2 percent in August, faster

than the 0.1 percent growth in the preceding month. For the January

to August period, consumer prices climbed 1.3 percent compared to

the same period of the previous year.

In early Asian deals on Thursday, the Philippine peso surged up

to a 5-week high of 47.77 against the dollar. This may be compared

to Wednesday's closing value of 48.06. If the peso advances

further, it may likely target the 47.715 level.

The Taiwan dollar that closed yesterday's trading at 32.4350

against the U.S. currency strengthened to 32.3020 in early Asian

deals on Thursday. This set the highest point for the Taiwan dollar

since July 29. On the upside, 31.785 is seen as the next target

level for the Taiwan dollar.

The South Korean won strengthened against the currency of US

during Thursday's early Asian trading. The won reached an 11-month

high of 1205.10 against the dollar, with 1203.5 seen as the next

upside target level. At yesterday's New York session close, the

pair was quoted at 1206.10.

A barometer of future economic activity for South Korea

increased in July. The Conference Board's Leading Economic Index

for South Korea advanced 1.4 percent for the month, the board

reported today. The Coincident Index, a measure of current

activity, increased 0.1 percent for July.

The Chinese yuan that jumped to a 3 1/2 -month high of 6.8260

against the U.S. dollar at 8:55 pm ET Wednesday slipped thereafter.

The yuan dropped to 6.8295 per dollar by about 11:40 pm ET. If the

Chinese currency falls further, it may target the 6.8335 level. The

dollar-yuan pair closed yesterday's North American session at

6.8262.

The People's Bank of China has set today's central parity rate

for the dollar-yuan pair is 6.8272. The pair is allowed to

strengthen or weaken 0.5% from the parity rate.

In early deals on Thursday, the Pakistan rupee declined to a

3-day low of 82.99 against the U.S. dollar. The next downside

target level for the Pakistan currency is seen at 83.07. The

dollar-rupee pair closed Wednesday's New York session at 82.81.

The Indian rupee that strengthened to a 5-week high of 47.9250

against the U.S. dollar at 10:45 pm ET Wednesday declined

thereafter. As of now, the dollar-rupee pair is worth 48.07,

compared to yesterday's New York session at 48.1250. On the

downside, 48.25 is seen as the next target level for the Indian

currency.

The U.S. housing starts report is slated to be released at 8:30

am ET today. Economists estimate housing starts of 580,000 for

August.

At the same time, the Labor Department is due to release its

customary jobless claims report for the week ended September 12th.

Economists expect a modest increase in claims to 555,000.

The results of the Philadelphia Federal Reserve's manufacturing

survey are due out at am ET. Economists expect the diffusion index

of current activity to show a reading of 8 for September.

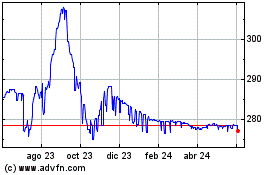

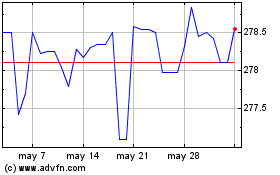

US Dollar vs PKR (FX:USDPKR)

Gráfica de Divisa

De Feb 2025 a Mar 2025

US Dollar vs PKR (FX:USDPKR)

Gráfica de Divisa

De Mar 2024 a Mar 2025