TIDMACIC

RNS Number : 1160E

abrdn China Investment Company Ltd.

28 June 2023

abrdn China Investment Company Limited

Legal Entity Identifier (LEI): 213800RIA1NX8DP4P938

Half Yearly Report 30 April 2023

Performance Highlights

NAV per Ordinary share NAV per ordinary share total return(A)

As at 30 April 2023 Six months ended 30 April 2023

580.9p +14.0%

As at 31 October 2022 512.0p Year ended 31 October 2022 -37.0%

Ordinary share price Ordinary share price total return(A)

As at 30 April 2023 Six months ended 30 April 2023

497.0p +11.5%

As at 31 October 2022 448.0p Year ended 31 October 2022 -35.5%

Discount(A) MSCI China All Share Index

total return (in sterling

terms)

As at 30 April 2023 Six months ended 30 April 2023

14.4% +16.7%

As at 31 October 2022 12.5% Year ended 31 October 2022 +31.5%

Net assets Net gearing/(cash)(A)

As at 30 April 2023 As at 30 April 2023

GBP253.1m 2.6%

As at 31 October 2022 GBP231.8m As at 31 October 2022 -3.6%

Revenue return per Ordinary share Ongoing charges ratio ('OCR')(AB)

Six months ended 30 April 2023 Forecast for year ending 31 October

2023

-2.52p 1.09%

Six months ended 30 April

2022 -0.47p Year ended 31 October 2022 0.60%

(A) Considered to be an Alternative Performance Measure.

(B) The OCR for the year ended 31 October 2022 benefited from a six

months' waiver of the management fee charged by abrdn plc and a twelve

months' waiver of marketing fees.

Financial Calendar and Highlights

Financial year end 31 October 2023

========================================== ================

Expected announcement of results for year February 2024

ended 31 October 2023

========================================== ================

Annual General Meeting (London) April 2024

========================================== ================

Performance (total return)

Six months Year ended 31 October

ended 2021 -

30 April 31 October 30 April

2023 2022 2023

% % %

----------------------------------------- ----------- ----------- -----------

Net asset value(A) 14.0 -37.0 -28.2

========================================= =========== =========== ===========

Share price(A) 11.5 -35.5 -28.1

========================================= =========== =========== ===========

MSCI China All Share Index (in sterling

terms) 16.7 -31.5 -20.1

========================================= =========== =========== ===========

(A) Considered to be an Alternative Performance Measure.

Chairman's Statement

Overview

I am pleased to share with you the half-yearly report for abrdn

China Investment Company Limited ("the Company"), covering the six

months to 30 April 2023 ("the Period"). During the Period, the

Company's net asset value ("NAV") total return was 14.0% in

sterling terms, while the share price total return was 11.5%. The

MSCI China All Shares Index, the Company's Reference Index returned

16.7% over the Period. The share price discount to NAV was 14.5% at

30 April 2023.

Compared with the investment backdrop at our financial year end

in October 2022, the Period covered by this half-yearly report was

much more positive for investors in Chinese equities. Whilst not

always evident from reporting in the Western media, domestic

sentiment now appears far more positive and China's swift rollback

of its zero-Covid measures during November and December, and a full

reopening of borders by early January, drove a strong stock market

rally with onshore and offshore Chinese companies seeing sharp

gains across the board. The Shanghai Stock Exchange A Shares Index

rose 11% in the six weeks following the lifting of Covid

restrictions in early November. The rally was particularly strong

as it followed a severe test of investors' nerves in the wake of a

host of domestic concerns, including Covid-related disruptions and

growing pressure on the domestic real estate sector, compounded by

the worsening global economic environment.

Despite the positive early indicators, the economic recovery has

not been as smooth as many expected. The predicted rebound in

consumption has failed to match the market's high expectations. As

a result, consumer companies, including many of those held by the

Company, have come under selling pressure since February. The

Company's Investment Manager believes that the bulk of this

recovery, aided by a restoration of consumer confidence, will

happen in the second half of this year and into 2024 as employment

and income prospects meaningfully improve for households. I am

encouraged by the fact that the Chinese Government publicly

declared its intention to support growth at the National People's

Congress in March 2023. This implies that the policy landscape is

likely to remain accommodative in the months ahead .

Lawmakers have moved swiftly to ease pressure on a heavily

indebted real estate sector, which is both a major driver of

economic growth and a key source of personal wealth in China. Last

year, the central government unveiled a swathe of measures,

including easing home-buying requirements for individuals as well

as a raft of policy tools, such as loan financing, bond issuance

and equity financing assistance, to help developers avoid the worst

effects of the liquidity crunch.

However, external pressures on China persist. There is still the

looming spectre of global recession as central banks raise interest

rates to fight rising inflation. China, where inflation is

comparatively low compared to the West, is one of the few nations

that is still able to employ looser monetary policy including

lowering interest rates. Meanwhile, tensions simmer between China

and Taiwan, and continue to flare between the US and China, as was

illustrated by the US shooting down an alleged Chinese spy balloon

that had strayed into its airspace.

Against this backdrop, the Company's performance was supported

by a rebound in some sectors that had dragged down performance over

the last financial year. The financial sector had been one of the

main detractors to performance for the 12 months to 31 October

2022. However, it was one of the strongest performing sectors

during the Period, after the Company's holdings, particularly in

the retail banks, rallied. The performance of investments in

healthcare and materials were also positive during the Period. On a

more negative note, given the Company's consumer focus, consumer

discretionary stocks detracted, reflecting how the pace of recovery

in consumption has, so far, not lived up to investors'

expectations.

In terms of positioning, the Company's Investment Manager

continues to focus on five core themes: Aspiration, Digitalisation,

Going Green, Health and Wealth. These are aligned to the Chinese

government's policy objectives and tap into the vast consumer

market and rising affluence of a growing middle class in China. The

Company's Investment Manager has reviewed exposure to internet

companies, increasing some positions and lowering the portfolio

weight to others, for stock-specific reasons. More detail on the

performance of the portfolio and changes to the holdings can be

found in the Investment Manager's Review.

China's reopening has had another direct positive impact for the

Company. With the lifting of Covid restrictions heralding the

return of travel, one of the Company's portfolio managers,

Elizabeth Kwik, was able to update shareholders in person at the

Company's Annual General Meeting in London in April. This provided

our shareholders with a useful insight into the long-term outlook

for China and the differences between how the region is reported in

the Western media and the investment opportunities the Investment

Manager sees locally. The Board is also due to travel to China

later this year in order to meet with the abrdn investment team on

the ground, as well as visit some of the companies in the

Investment Portfolio. By then, it will have been two years since

the mandate change, but it will be the first opportunity the Board

has had to travel to the region together and meet with the broader

team in Hong Kong and Shanghai.

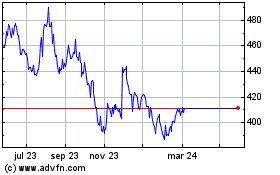

Discount and Share Buy Backs

The discount at which the Company's shares trade relative to the

NAV operated in a narrow band between around -12% to -15% for most

of the Period. At the end of April 2023 the share price was trading

at a discount of 14.4% and since then the discount has remained

unchanged.

The Board has continued to buy back shares in order to try to

mute the volatility of the discount. During the Period, 1,721,633

shares were bought back at a total cost of GBP9.2m and a weighted

average discount of 13.9%. This represented 3.8% of the issued

share capital and added 3.2p, or 0.51%, to the Net Asset Value per

Share. The shares are held in treasury.

The Company's share price has typically traded at a wider

discount than that of its peers, albeit with less variation in

level than other trusts in the sector. Although, there are times

when all the peers' discounts have widened to match that of the

Company .

Revenue Account & Dividend Outlook

In the previous financial year, the Company paid a dividend of

2.2 pence per Ordinary share. The dividend was paid in order that

the Company complied with the rules governing investment trusts,

which includes the requirement that most of the net income is

distributed to shareholders.

The surplus revenue last year arose largely as a result of the

Company benefiting from a waiver of the management fee following

the merger with Aberdeen New Thai Investment Trust PLC in November

2021. In the current year, the Company will pay a full year of

management fees and, as a result, the charge in the current year is

more representative of the ongoing expense than last year.

Loan Facility and Gearing

In April 2022, the Company entered into a two year GBP15m,

unsecured, multi-currency, revolving loan facility with Industrial

and Commercial Bank of China, London Branch. The facility was

undrawn at the start of the Period, but GBP12.8m (CNH 106m) was

drawn down in two tranches in December 2022 and January 2023. At

the end of the Period, the cost of the funding was 4.11%. Since the

end of the Period, the remaining GBP2.2m (CNH 19.8m) of the

facility has been drawn. At the end of Period, the net gearing was

2.6%.

Change of Portfolio Administrator, Depositary, Registered

Office, Custodian and Company Secretary

In April 2023, the Company completed the process of moving most

of its support functions to various entities within BNP Paribas

S.A. Group ("BNP"). The depositary and administration of the

portfolio moved to BNP Paribas S.A., Guernsey Branch. The

registered office of the Company moved to BNP Paribas House, St

Julian's Avenue, St Peter Port, Guernsey, GY1 1WA. The custodian

was also moved to BNP Paribas S.A. At the same time abrdn Holdings

Limited was appointed Company Secretary.

The Board decided to make these changes as BNP is the preferred

service partner of the Company's Investment Manager, abrdn plc, and

currently BNP provides these services to the majority of the

investment companies that abrdn manages. The Company will be able

to access a more competitive rate card for the provision of these

vital services and at the same time, bringing the Company into

abrdn's administration model should result in improved reporting to

the Board.

I would like to thank the teams at Northern Trust (Guernsey)

Limited and Vistra Fund Services (Guernsey) Limited for the

professional services and support they have provided to the Company

over the years, including through the merger with Aberdeen New Thai

in 2021 and, more recently, in the transfer of responsibilities to

BNP.

Outlook

It has been a challenging time for the Company since our mandate

change in November 2021.

However, the Chinese economy appears to be moving in the right

direction. After a lengthy period of social and travel

restrictions, we believe there is pent-up consumer demand in China.

The reopening that is already underway should lead to a multi-stage

recovery, with a gradual revival of domestic consumption. In turn,

this should boost sectors ranging from tourism to healthcare, and

property to banks.

China's economic recovery appears to be underway, albeit at a

slower and more gradual pace than elsewhere in Asia. This recovery

is aided by supportive financial conditions. China's inflation is

lower than surrounding countries, meaning authorities have been

more able to introduce accommodative monetary and fiscal policies

to support economic growth. Projections from the International

Monetary Fund ("IMF") earlier this year forecast that China's

economy will grow 5.2% in 2023 (compared with 3% in 2022). China's

economy is also expected to contribute one third of overall global

growth. Although the IMF also points out that "comprehensive

macroeconomic policies and structural reforms" are still

required.

At the heart of China's economic growth is its rising middle

class, supporting the high-quality companies favoured by the

Company's Investment Manager and providing opportunities to invest

in companies that are set to deliver long-term capital growth.

These companies are benefiting from rising affluence leading to

growth in consumption, growing digital integration and more

widespread technology adoption, the move to a greener, lower-carbon

world, greater demand for healthcare products, and structural

growth in consumer finance.

The Board and I remain convinced of China's long-term potential.

We are confident of the Company's Investment Manager's approach and

believe the portfolio is well positioned for the future.

Helen Green

Chairman

27 June 2023

Investment Manager's Review

Market Environment

The gloom surrounding Chinese equities and the economy has

lifted and growth is returning, albeit tentatively, after three

years of the economic malaise caused by the Covid-19 pandemic.

Optimism was in short supply as the Company's financial year got

underway. The central government's strict zero-Covid policy weighed

heavily on share prices for much of 2022 and disrupted swathes of

the economy. Yet throughout stock market history, patient investors

who have been prepared to sit tight during periods of volatility

have often been rewarded. The turning point for China came at the

start of November 2022, the very beginning of the reporting Period.

Share prices surged after the government unexpectedly announced

that it was abandoning its seemingly steadfast commitment to its

controversial zero-Covid policy. Increased liquidity support for

the struggling property sector from the government and state-owned

banks also improved investor sentiment. Share prices rallied

further in December as the prospect of an economic reopening became

a reality. All social distancing measures were lifted and Covid-19

cases surged as a result, but China responded by encouraging herd

immunity. China's Center for Disease Control and Prevention stated

in January 2023 that the current wave of infections was "coming to

an end".

Investor spirits, buoyed by hopes of a rebound in economic

growth, drove the market higher and, with a strong rebound in share

prices from November onwards, February's profit-taking was perhaps

inevitable. However, share prices resumed their upward trajectory

in March. Investors chased short-term "hot themes", including those

relating to ChatGPT, wider artificial intelligence ("AI")

opportunities and state-owned enterprise reforms, rotating out of

previous winners in the process. April saw the AI hype dissipate

somewhat as investors refocused on fundamentals.

Turning to broader economic themes, one of the most eye-catching

statistics of the Period was the reported GDP for the first quarter

of 2023. It showed 4.5% year-on-year growth, up from 2.9% in Q4

2022, and easily surpassed market estimates of 4% annual growth.

However, other data, such as an unexpected decline in the Caixin

Manufacturing Purchasing Managers' Index, generally considered a

reliable indicator of the strength of the Chinese economy, declined

from 51.6 in February to 50 in March, suggesting the recovery

remains patchy.

The concerns over the speed and strength of the economic

recovery after the easing of the zero-Covid policy has been

reflected in company earnings. First-quarter results from A-share

companies largely pointed to recovery, although the rebound is not

yet proving to be as robust and broad-based as expected. Based on

our conversations with company management teams, we believe that

growth and recovery will be more pronounced as we move into the

second half of 2023.

Portfolio Performance

During the Period the Company's net asset value ("NAV") total

return was 14.0%, which compares with the MSCI China All Shares

Index, the Company's Reference Index's, return of 16.7%. The

Ordinary share price total return was 11.5%, as the discount to NAV

at which the Company's Ordinary shares trade widened to 14.4% from

12.5% at the start of the financial year.

The portfolio initially performed strongly after the re-opening

of the Chinese economy. The market recognised our high-quality

holdings and the opportunity for them to benefit from the return to

normal economic activity after three years of stifled growth.

However, profit-taking affected the portfolio in February. Our

limited exposure to artificial AI-related stocks also negatively

impacted performance as investors chased this "hot" trend in March.

We do not believe this trend is sustainable as we expect that

investors will find earnings delivery does not match their

expectations, forcing them to refocus on fundamentals. We have

already seen this to a degree, as AI-related stocks suffered a dip

in April.

Stock-selection accounted for the Company's modest

underperformance versus the Reference Index. Our consumer

discretionary holdings were the main source of underperformance,

although our information technology holdings also had a negative

impact on overall portfolio returns. Our financials and healthcare

holdings partially offset the rest of the portfolio's negative

performance.

China Merchants Bank (CMB) and Tencent were the top two

performers. CMB rallied on the economic reopening while Tencent

benefited from a recovery in sentiment as regulation towards the

internet sector eased. Elsewhere, Kweichow Moutai benefited from

strong initial interest in consumer stocks after the re-opening.

The company's special dividend and proposed capacity expansion also

boosted sentiment. Other holdings also benefited from the improved

investor confidence in consumption, including sportswear firm

Li-Ning and electrical appliance manufacturer Midea Group . Other

beneficiaries of China's re-opening included pan-Asian life insurer

AIA and the Hong Kong Stock Exchange.

Turning to the laggards, LONGi Green Energy , Yunnan Energy New

Material and Sungrow Power Supply were all affected by the weakness

in renewable energy-related stocks. Starpower Semiconductor

suffered from softening semiconductor prices. Not owning Ping An

Insurance also hurt relative performance, given its strong

first-quarter results. Holding JD.com was unhelpful based on market

concerns over rising competition in e-commerce. This may weigh on

the stock over the near term, but we remain positive on the

company's long-term competitiveness.

Portfolio Activity

We believe our bottom-up stock-picking approach, grounded in

fundamental research and local expertise, provides an advantage in

finding the best quality companies in which to invest. We engage

collaboratively with companies, prior to investment as well as part

of our ongoing due diligence, with the aim of sharing expectations

and encouraging best practices. Please see the Case Studies of

Engagement Activity below for examples of the work we have been

doing in this area. We continue to construct and manage the

Company's portfolio based on the themes of Aspiration, Digital,

Green, Health and Wealth. Whilst this approach will not prevent us

from investing in stocks where we see fundamental value, we would

expect most of our holdings to align to these key themes.

During the Period the Company received regulatory approval for a

Qualified Foreign Investor ("QFI") licence status, which provides

access to the broader Chinese equity market. As a result of this,

we purchased two new stocks: Centre Testing International and OPT

Machine Vision . Centre Testing International is a leading

third-party testing company that enjoys stable and diversified

growth. OPT Machine Vision is a leading machine vision company with

good growth prospects, driven by the upgrade of automation

manufacturing in China.

We also initiated a position in PDD , owner of popular shopping

app Pinduoduo. It is gaining market share within China's ecommerce

sector. We added to our existing position in Alibaba Group in

January, based on its attractive valuation, easing regulatory

pressures and an improving outlook thanks to the earlier than

expected reopening of the economy.

We exited positions in Anhui Conch Cement and GDS due to

weakening conviction and in view of better opportunities

elsewhere.

Revenue Account

The loss for the Period was GBP1.1m compared to a loss of

GBP0.221m for the same period last year. While investment income

was up almost 34% to GBP0.604m, the prior year numbers benefited

from a waiver of the management fee for the first six months

following the completion of the combination with Aberdeen New Thai

Investment Trust in November 2021. As a result, the current year

management fee charge is more representative of the ongoing expense

than the prior year.

In 2022 90% of the income in the year was generated in the

second half of the Company's financial year and we expect that the

split is likely to be similar in the current year.

Outlook

The past three years have undeniably been challenging for China

and those who are invested in the country. Stringent social curbs

and onerous travel restrictions placed a great burden on the

population. Now is the time for optimism, however, even if there

has not been a 'V' shaped economic rebound as some had

expected.

We see the Chinese consumer at the heart of the recovery. After

a very long period of widespread lockdowns, there is considerable

pent-up consumer demand. Furthermore, elevated household savings

should provide a powerful tailwind for consumer spending. As jobs

and income prospects improve, we expect consumers to spend their

savings across different sectors, including tourism, travel,

healthcare and property.

The policy environment is another reason for optimism. Many

Western economies are still wrestling with stubbornly high

inflation, resorting to repeated interest-rate rises in a bid to

manage the problem, with varying degrees of success. In contrast,

the inflation picture in China remains benign. This has given the

authorities the freedom to introduce accommodative monetary and

fiscal policies to support economic growth. In late April the

central government acknowledged the need to sustain the economic

recovery at a meeting of the Politburo. Policy guidance is

therefore likely to remain supportive. With growth in many

developed Western economies set to slow as higher interest rates

bite, China represents a real counter-cyclical opportunity.

Finally, but crucially, valuations in China remain highly

attractive. We believe that quality companies - the type our

investment process favours - are still discounted by the market,

but their prospects have improved significantly and we believe that

the market will recognise this valuation discrepancy over time.

Across our five themes of Aspiration, Digital, Green, Healthcare

and Wealth, companies are still trading below historical

valuations. These companies have weathered the pandemic storm and

continue to exhibit solid fundamentals. We believe this is a great

opportunity to invest in quality companies at compelling

valuations.

Nicholas Yeo and Elizabeth Kwik

abrdn Hong Kong Limited

27 June 2023

Ten Largest Investments

As at 30 April 2023

Tencent Holdings Ltd Kweichow Moutai Co Ltd

(9.6% of portfolio value) (6.3% of portfolio value)

An innovative leader in China's The largest maker of Chinese alcohol

internet sector with a strong spirit Baijiu, positioned in the

presence in fintech and cloud ultra-premium space where there

segments, backed by are few competitors. The company

an entrenched social media and is well placed to capture rising

payment ecosystem. domestic consumption trends in

China.

Alibaba Group Holding Ltd China Merchants Bank Co Ltd

(5.2% of portfolio value) (3.9% of portfolio value)

The Chinese internet group is A best-in-class retail bank in

a global e-commerce company with China, offering diversified financial

leading platforms including Taobao services with a solid track record

and T-mall in the mainland. The and sound risk management practices.

company also has interests in

logistics and media as

well as cloud computing platforms

and payments.

Contemporary Amperex Technology Bank of Ningbo Co Ltd

Co Ltd (3.3% of portfolio value)

(3.3% of portfolio value)

The largest lithium battery maker A city bank focused on lending

in the world with leading technology to small and medium enterprises

and supply chain advantage, set in the affluent Ningbo-Zhejiang

to benefit from the rise of electric region. The bank has shown superior

vehicles and energy storage. returns and asset quality over

the years.

Meituan AIA Group Ltd

(3.0% of portfolio value) (2.9% of portfolio value)

A diversified online services A leading pan-Asian life insurance

platform with over 400 million company, it is poised to take

users, offering services including advantage of Asia's growing affluence,

food delivery, travel bookings backed by an effective agency

and wedding planning. It is optimally sales force and a strong balance

placed to capture rising consumption sheet.

in mainland China.

JD.com Inc China Tourism Group Duty Free

(2.3% of portfolio value) Corp Ltd

(2.3% of portfolio value)

An online retailer with an edge China's largest duty-free operator

in its strong logistics network. that is well placed to benefit

The company has shown improving from supportive government policy

corporate governance and management and

quality over the years. rising demand for duty-free cosmetics

on the mainland.

Investment Portfolio

As at 30 April 2023

================================ =============================== ========= =====

Value Value

Company Industry (sub-sector) (GBP'000) (%)

================================ =============================== ========= =====

Tencent Holdings Ltd Interactive Media & Services 25,037 9.6

================================ =============================== ========= =====

Kweichow Moutai Co Ltd (A) Beverages 16,517 6.3

================================ =============================== ========= =====

Alibaba Group Holding Ltd Broadline Retail 13,449 5.2

================================ =============================== ========= =====

China Merchants Bank Co Ltd

(H) Banks 10,050 3.9

================================ =============================== ========= =====

Contemporary Amperex Technology

Co Ltd (A) Electrical Equipment 8,586 3.3

================================ =============================== ========= =====

Bank of Ningbo Co Ltd (A) Banks 8,505 3.3

================================ =============================== ========= =====

Meituan Dianping - Class B Hotels, Restaurants & Leisure 7,761 3.0

================================ =============================== ========= =====

AIA Group Ltd Insurance 7,520 2.9

================================ =============================== ========= =====

JD.com Inc - Class A Broadline Retail 6,158 2.3

================================ =============================== ========= =====

China Tourism Group Duty Free

Corp Ltd (AH) Specialty Retail 5,981 2.3

-------------------------------- ------------------------------- --------- -----

Top ten investments 109,564 42.1

----------------------------------------------------------------- --------- -----

Hong Kong Exchanges & Clearing

Ltd Capital Markets 5,356 2.1

================================ =============================== ========= =====

Ping An Bank Co Ltd (A) Banks 5,109 2.0

================================ =============================== ========= =====

Textiles, Apparel & Luxury

Li Ning Co Ltd Goods 4,796 1.8

================================ =============================== ========= =====

NetEase Inc Entertainment 4,790 1.8

================================ =============================== ========= =====

Wanhua Chemical Group Co Ltd

(A) Chemicals 4,755 1.8

================================ =============================== ========= =====

Sungrow Power Supply Co Ltd

(A) Electrical Equipment 4,697 1.8

================================ =============================== ========= =====

Shenzhen Mindray Bio-Medical Health Care Equipment &

Electronics Co Ltd (A) Supplies 4,655 1.8

================================ =============================== ========= =====

Proya Cosmetics Co Ltd (A) Personal Care Products 4,629 1.8

================================ =============================== ========= =====

Aier Eye Hospital Group Co Health Care Providers &

Ltd Services 4,622 1.8

================================ =============================== ========= =====

PDD Holdings Inc Broadline Retail 4,555 1.8

-------------------------------- ------------------------------- --------- -----

Top twenty investments 157,528 60.6

----------------------------------------------------------------- --------- -----

LONGi Green Energy Technology Semiconductors & Semiconductor

Co Ltd (A) Equipment 4,317 1.7

================================ =============================== ========= =====

Centre Testing International

Group Co Ltd Consulting Services 4,249 1.6

================================ =============================== ========= =====

Sinoma Science & Technology

Co Ltd (A) Chemicals 4,097 1.6

================================ =============================== ========= =====

Health Care Providers &

Wuxi Biologics Cayman Inc Services 3,903 1.5

================================ =============================== ========= =====

Glodon Co Ltd (A) Software 3,869 1.5

================================ =============================== ========= =====

Fuyao Glass Industry Group

Co Ltd (H) Automobile Components 3,828 1.5

================================ =============================== ========= =====

Real Estate Management

China Resources Land Limited & Development 3,785 1.5

================================ =============================== ========= =====

Foshan Haitian Flavouring

& Food Co Ltd (A) Food Products 3,776 1.4

================================ =============================== ========= =====

Real Estate Management

China Vanke Co Ltd & Development 3,763 1.4

================================ =============================== ========= =====

Inner Mongolia Yili Industrial

Group Co Ltd (A) Food Products 3,602 1.4

-------------------------------- ------------------------------- --------- -----

Top thirty investments 196,717 75.7

----------------------------------------------------------------- --------- -----

By-health Co Ltd (A) Personal Care Products 3,488 1.3

================================ =============================== ========= =====

Midea Group Co Ltd (A) Household Durables 3,452 1.3

================================ =============================== ========= =====

Shanghai M&G Stationery Inc

(A) Commercial Services & Supplies 3,349 1.3

================================ =============================== ========= =====

Hefei Meiya Optoelectronic

Technology Inc (A) Machinery 3,343 1.3

================================ =============================== ========= =====

Chacha Food Co Ltd (A) Food Products 3,315 1.3

================================ =============================== ========= =====

Nari Technology Co Ltd (A) Electrical Equipment 3,299 1.3

================================ =============================== ========= =====

Hundsun Technologies Inc (A) Software 3,210 1.2

================================ =============================== ========= =====

Zhejiang Weixing New Building

Materials Co Ltd (A) Building Products 3,157 1.2

================================ =============================== ========= =====

Venustech Group Inc (A) Software 2,945 1.1

================================ =============================== ========= =====

Amoy Diagnostics Co Ltd (A) Biotechnology 2,865 1.1

-------------------------------- ------------------------------- --------- -----

Top forty investments 229,140 88.1

----------------------------------------------------------------- --------- -----

Semiconductors & Semiconductor

Silergy Corp Equipment 2,733 1.1

================================ =============================== ========= =====

Shenzhou International Group Textiles, Apparel & Luxury

Holdings Ltd Goods 2,672 1.0

================================ =============================== ========= =====

Jiangsu Hengrui Medicine Co

Ltd (A) Pharmaceuticals 2,576 1.0

================================ =============================== ========= =====

Yunnan Energy New Material

Co Ltd (A) Chemicals 2,576 1.0

================================ =============================== ========= =====

Estun Automation Co Ltd (A) Machinery 2,508 1.0

================================ =============================== ========= =====

Maxscend Microelectronics Electronic Eqpt Instruments

Co Ltd (A) & Components 2,501 1.0

================================ =============================== ========= =====

StarPower Semiconductor Ltd Semiconductors & Semiconductor

(A) Equipment 2,393 0.9

================================ =============================== ========= =====

China Meidong Auto Holdings

Ltd Specialty Retail 2,188 0.8

================================ =============================== ========= =====

Luxshare Precision Industry Electronic Eqpt Instruments

Co Ltd & Components 1,991 0.8

================================ =============================== ========= =====

Hangzhou Tigermed Consulting

Co Ltd (H) Life Sciences Tools & Services 1,899 0.7

-------------------------------- ------------------------------- --------- -----

Top fifty investments 253,177 97.4

----------------------------------------------------------------- --------- -----

OPT Machine Vision Tech Co Electronic Eqpt Instruments

Ltd & Components 1,863 0.7

================================ =============================== ========= =====

Yantai China Pet Foods Co

Ltd (A) Food Products 1,772 0.7

================================ =============================== ========= =====

Zai Lab Ltd Biotechnology 1,549 0.6

================================ =============================== ========= =====

Komodo Fund Unit Trusts 1,049 0.4

================================ =============================== ========= =====

Wuliangye Yibin Co Ltd (A) Beverages 559 0.2

-------------------------------- ------------------------------- --------- -----

Total investments 259,969 100.0

----------------------------------------------------------------- --------- -----

Sector Breakdown as at 30 April 2023

Percentage

------------------------ -----------

Consumer Discretionary 21.1

Consumer Staples 14.5

Financials 14.4

Industrials 12.8

Communication Services 11.5

Information Technology 9.9

Healthcare 8.5

Materials 4.4

Real Estate 2.9

Case Studies of Engagement Activity

Chacha Food

(1.3% of portfolio value)

Chacha Food Company Limited ("Chacha") has been a leading player

in China's sizeable packaged roasted seeds and nuts market since it

was founded in 1996. Its main products include sunflower,

watermelon and pumpkin seeds, beans, pistachios, walnuts, almonds,

and other nut products. The seeds segment has a market share in

excess of 50%, and accounts for 70% of

Chacha's sales.

Following management and strategy changes, including the return

of a former chairman, we believe that Chacha is well-positioned for

further growth. Its superior product quality, nimble organisational

structure, strong branding, and deep-rooted distribution channels

should support its growth trajectory in a fast-changing snack

market.

Recently, we engaged with Chacha to understand its

risk-management policies better, and to encourage it to produce a

standalone Environmental, Social and Governance ("ESG") report.

During our engagements, we were impressed with Chacha's daily

operations and its efforts to improve its ESG disclosure and

business integration.

Chacha has recently released its first ESG report. Within the

report, Chacha described its improving processes, including the use

of recyclable packaging, water-saving efforts in the manufacturing

process, improvements in supply-chain management and resulting

client satisfaction scores.

We believe that this additional insight into Chacha will result

in MSCI upgrading its ESG rating. We continue to work with Chacha

to help improve these non-financial disclosures over time.

Shanghai M&G Stationery

(1.3% of portfolio value)

Shanghai M&G Stationery Inc ("SM&GS") is a leading

stationery brand in China with a market share of around 7%.

SM&GS manufactures and sells student and office stationery in

three business lines:

-- Stationery business - which accounts for close to half of

overall sales.

-- Office-supply business - an emerging business-to-business arm

that trades under the Colipu brand and generates over 40% of

sales.

-- Zakka business - an emerging retail business with over 500

stores, operating under the M&G Life and M&G Shops

brands.

In 2021, we were the first investor to engage with SM&GS on

its ESG practices. We held multiple discussions with the SM&GS

team on its management of chemical safety, anti-corruption and

bribery practices and carbon emissions, as well as external ESG

scores and disclosures.

Following our engagements, SM&GS released its first ESG

report in 2022. Based on our suggestions, it has built up its

sustainability strategy and implemented it across its business

units. The company has improved in key areas including chemical

safety, by replacing and reducing its reliance upon substances

which are not sustainable. In supply chain management, it has

established ESG targets and introduced plans for its suppliers. It

has created a business conduct and anti-corruption system and

introduced enhanced disclosures.

SM&GS has established a highly competitive business, with

potential for further growth. The outlook for office stationery

supply is positive, and SM&GS is well-positioned to build upon

the rapid growth already experienced in its direct supply business.

We expect the company to benefit from its investments in recent

years. It is well placed to capitalise on the structural domestic

consumer trend towards premium products as disposable incomes

continue to rise. This is underpinned by its R&D expenditure

and premium product development, shared retail capabilities and

timely consumer insights.

Interim Management Report and Directors' Responsibility

Statement

The Chairman's Statement and the Investment Manager's Review

provide details on the performance of the Company. Those reports

also include an indication of the important events that have

occurred during the first six months of the financial year ending

31 October 2023 and the impact of those events on the condensed

unaudited financial statements included in this Half-Yearly

Financial Report.

Details of investments held and the sector breakdown at the

Period end is shown above.

Principal Risks, Emerging Risks and Uncertainties

The Board has an ongoing process for identifying, evaluating and

managing the principal and emerging risks and uncertainties facing

the Company. The Board has carried out a robust review of these

risks. Most of the principal risks and uncertainties are market

related and are no different from those of other investment trusts

that primarily invest in Chinese equities. These are contained

within the Annual Report for the year ended 31 October 2022 and

comprise the following risk categories:

-- Risks relating to the Company;

-- Risks relating to the investment policy;

-- Risks relating to the Manager/Investment Manager;

-- Risks relating to regulation, taxation and the Company's

operating environment;

-- Internal Risks;

-- Emerging Risks; and

-- Failure to manage premium and/or discount.

The Board continues to monitor closely the political and

economic uncertainties which could affect markets, particularly the

heightened interest rate risk and the knock-on impact of the

collapse of the likes of Silicon Valley Bank, Credit Suisse and

First Republic Bank. The Board also considers the impact of

geopolitical risk on the Company and its portfolio, including the

ongoing tensions between China and Taiwan, China and the West, and

potential sanctions, as well as the ongoing war in Ukraine.

The Board is also very conscious of the risks emanating from

increasing Environmental, Social and Governance ("ESG") challenges

together with climate change and continues to monitor, through its

Investment Manager, the potential risk that investee companies may

fail to keep pace with the rates of ESG and Climate Change

adaptation and mitigation that are required.

Going Concern

In accordance with the FRC's Guidance on Risk Management,

Internal Control and Related Financial and Business Reporting, the

Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern.

The Company's assets consist substantially of equity shares in

companies listed on recognised stock exchanges and in most

circumstances are realisable within a short timescale. The Company

has adequate resources to continue in operational existence for the

foreseeable future and the ability to meet all its liabilities and

ongoing expenses from its assets.

The Directors are mindful of the principal and emerging risks

and uncertainties disclosed above, and review on a regular basis

forecasts detailing revenue and liabilities and the Company's

operational expenses. Having reviewed these matters, the Directors

believe that the Company has adequate financial resources to

continue its operational existence for the foreseeable future and

for at least 12 months from the date of this Half Yearly Report.

Accordingly, they continue to adopt the going concern basis in

preparing the Half Yearly Report.

Related Party Transactions

There have been no material changes in the related party

transactions described in the 2022 Annual Report. A summary of

changes to the Company's Service Providers during the Period is set

out in the Chairman's Statement. Please also see the Related Party

Disclosures in note 10 to the financial statements.

Responsibility Statement of the Directors in respect of the

Half-Yearly Financial Report

The Disclosure Guidance and Transparency Rules require the

Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and

Financial Statements.

The Directors confirm that to the best of their knowledge:

-- The condensed set of financial statements contained within

the Half Yearly financial report has been prepared in accordance

with IAS 34 Interim Financial Reporting and gives a true and fair

view of the assets, liabilities, financial position and return of

the Company for the period ended 30 April 2023.

-- The Interim Management Report, together with the Chairman's

Statement and Investment Manager's Review, includes a fair review

of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the first

six months of the financial year and that have materially affected

the financial position or performance of the Company during that

period, and any changes in the related party transactions described

in the last Annual Report that could do so.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website, but not for the content of any information

included on the website that has been prepared or issued by third

parties, and for the preparation and dissemination of financial

statements. Legislation in Guernsey governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

The Half-Yearly Financial Report was approved by the Board and

the above Directors' Responsibility Statement was signed on its

behalf by the Chair.

For abrdn China Investment Company Limited

Helen Green

Chairman

27 June 2023

Condensed Unaudited Statement of Comprehensive Income

Six months ended Six months ended Year ended

30 April 2023 30 April 2022 31 October 2022

(unaudited) (unaudited) (audited)

======================= ==== ========================= ============================= =============================

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Gains/(losses)

on investments - 33,044 33,044 - (82,328) (82,328) - (142,451) (142,451)

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Gains/(losses)

on currency movements - 283 283 - (508) (508) - (354) (354)

----------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

Net investment

gains/(losses) - 33,327 33,327 - (82,836) (82,836) - (142,805) (142,805)

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Investment income 604 - 604 452 - 452 4,108 - 4,108

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Investment management

fees 10 (947) - (947) (75) - (75) (1,020) - (1,020)

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Other expenses (616) - (616) (455) - (455) (913) - (913)

----------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

Operating (loss)/profit

before finance

costs and tax (959) 33,327 32,368 (78) (82,836) (82,914) 2,175 (142,805) (140,630)

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Finance costs 5 (182) - (182) (107) - (107) (109) - (109)

----------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

Operating (loss)/profit

before taxation (1,141) 33,327 32,186 (185) (82,836) (83,021) 2,066 (142,805) (140,739)

======================= ==== ======= ======= ======= ======= ========= ========= ======= ========= =========

Taxation 27 (56) (29) (36) - (36) (215) - (215)

----------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

Total (loss)/profit

and comprehensive

income for the

period (1,114) 33,271 32,157 (221) (82,836) (83,057) 1,851 (142,805) (140,954)

----------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

(Losses)/earnings

per Ordinary share

(pence) 6 (2.52)p 75.28p 72.76p (0.47)p (177.94)p (178.41)p 4.00p (308.70)p (304.70)p

----------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

The total column of this statement represents the Company' s Statement

of Comprehensive Income, prepared under IAS 34 Interim Financial Reporting.

The revenue and capital columns, including the revenue and capital

(losses)/earnings per Ordinary share data, are supplementary information

prepared under guidance published by the Association of Investment

Companies.

All revenue and capital items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the

period.

The notes are an integral part of the condensed financial statements.

Condensed Unaudited Statement of Financial Position

As at As at As at

30 April 2023 30 April 2022 31 October

2022

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

================================== ==== ============= ============= ==========

Non-current assets

================================== ==== ============= ============= ==========

Investments at fair value through

profit or loss 259,969 283,012 224,064

================================== ==== ============= ============= ==========

Current assets

================================== ==== ============= ============= ==========

Cash and bank 5,722 13,433 8,534

================================== ==== ============= ============= ==========

Sales for future settlement - 1,555 -

================================== ==== ============= ============= ==========

Other receivables 174 6 56

---------------------------------- ---- ------------- ------------- ----------

5,896 14,994 8,590

---------------------------------- ---- ------------- ------------- ----------

Total assets 265,865 298,006 232,654

================================== ==== ============= ============= ==========

Current liabilities

================================== ==== ============= ============= ==========

Purchases for future settlement - (1,244) (222)

================================== ==== ============= ============= ==========

Other payables (551) (261) (564)

================================== ==== ============= ============= ==========

Finance costs payable (68) (43) (25)

================================== ==== ============= ============= ==========

Bank loan (12,181) - -

---------------------------------- ---- ------------- ------------- ----------

Total liabilities (12,800) (1,548) (811)

---------------------------------- ---- ------------- ------------- ----------

Net assets 253,065 296,458 231,843

---------------------------------- ---- ------------- ------------- ----------

Equity

================================== ==== ============= ============= ==========

Share capital 7 138,216 154,462 147,744

================================== ==== ============= ============= ==========

Capital reserve 119,603 147,708 87,739

================================== ==== ============= ============= ==========

Revenue reserve (4,754) (5,712) (3,640)

---------------------------------- ---- ------------- ------------- ----------

Equity shareholders' funds 253,065 296,458 231,843

---------------------------------- ---- ------------- ------------- ----------

Net assets per Ordinary share

(pence) 8 580.93 637.68 511.98

---------------------------------- ---- ------------- ------------- ----------

The notes are an integral part of the condensed financial statements.

Condensed Unaudited Statement of Changes in Equity

Six months ended 30 April 2023 (unaudited)

Share Capital Revenue

capital reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000

=============== ======================== ============= ======== ========= ======= ==========

Balance at 1 November 2022 147,744 87,739 (3,640) 231,843

========================================= ============= ======== ========= ======= ==========

Profit/(loss) for the period - 33,271 (1,114) 32,157

========================================= ============= ======== ========= ======= ==========

Buyback of shares 7 (9,528) - - (9,528)

========================================= ============= ======== ========= ======= ==========

Dividends paid 9 - (1,407) - (1,407)

----------------------------------------- ------------- -------- --------- ------- ----------

Balance at 30 April 2023 138,216 119,603 (4,754) 253,065

----------------------------------------- ------------- -------- --------- ------- ----------

Six months ended 30 April 2022 (unaudited)

Share Capital Revenue

capital reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000

============== ========================= ============= ======== ========= ======= ==========

Balance at 1 November 2021 148,735 230,544 (5,491) 373,788

========================================= ============= ======== ========= ======= ==========

Loss for the period - (82,836) (221) (83,057)

========================================= ============= ======== ========= ======= ==========

Scheme of reconstruction:

========================================= ============= ======== ========= ======= ==========

Ordinary shares issued 62,037 - - 62,037

==================================== ============= ======== ========= ======= ==========

Ordinary shares repurchased (55,291) - - (55,291)

==================================== ============= ======== ========= ======= ==========

Tender offer and share issue

costs 7 (177) - - (177)

==================================== ============= ======== ========= ======= ==========

Buyback of shares 7 (842) - - (842)

----------------------------------------- ------------- -------- --------- ------- ----------

Balance at 30 April 2022 154,462 147,708 (5,712) 296,458

----------------------------------------- ------------- -------- --------- ------- ----------

Year ended 31 October 2022 (audited)

Share Capital Revenue

capital reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000

============== ========================= ============= ======== ========= ======= ==========

Balance at 1 November 2021 148,735 230,544 (5,491) 373,788

========================================= ============= ======== ========= ======= ==========

(Loss)/profit for the year - (142,805) 1,851 (140,954)

========================================= ============= ======== ========= ======= ==========

Scheme of reconstruction:

========================================= ============= ======== ========= ======= ==========

Ordinary shares issued 62,037 - - 62,037

==================================== ============= ======== ========= ======= ==========

Ordinary shares repurchased (55,291) - - (55,291)

==================================== ============= ======== ========= ======= ==========

Tender offer and share issue

costs 7 (177) - - (177)

==================================== ============= ======== ========= ======= ==========

Buyback of shares 7 (7,560) - - (7,560)

----------------------------------------- ------------- -------- --------- ------- ----------

Balance at 31 October 2022 147,744 87,739 (3,640) 231,843

----------------------------------------- ------------- -------- --------- ------- ----------

The capital reserve at 30 April 2023 is split between realised gains

of GBP193,654,000 and unrealised losses of GBP74,051,000 (30 April

2022 - realised gains of GBP218,088,000 and unrealised losses of GBP70,380,000;

31 October 2022 - realised gains of GBP207,445,000 and unrealised losses

of GBP119,706,000).

The revenue reserve and realised element of the capital reserve represents

the amount of the Company's retained reserves.

The notes are an integral part of the condensed financial statements.

Condensed Unaudited Statement of Cash Flows

Six months Six months Year ended

ended ended

30 April 2023 30 April 2022 31 October

2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

================================================ ===== ============= ============= ============

Operating activities

================================================ ===== ============= ============= ============

Cash inflow from investment income 488 540 4,187

================================================ ===== ============= ============= ============

Cash outflow from management expenses (1,580) (868) (2,009)

================================================ ===== ============= ============= ============

Cash outflow from withholding tax (29) (36) (215)

------------------------------------------------ ----- ------------- ------------- ------------

Net cash (used in)/from operating activities (1,121) (364) 1,963

------------------------------------------------ ----- ------------- ------------- ------------

Cash flows from investing activities

================================================ ===== ============= ============= ============

Cash outflow from purchase of investments (55,608) (378,180) (446,496)

================================================ ===== ============= ============= ============

Cash inflow from disposal of investments 52,525 244,052 311,504

------------------------------------------------ ----- ------------- ------------- ------------

Net cash outflows from investing activities (3,083) (134,128) (134,992)

------------------------------------------------ ----- ------------- ------------- ------------

Cash flows from financing activities

================================================ ===== ============= ============= ============

Dividends paid (1,407) - -

================================================ ===== ============= ============= ============

Proceeds from bank borrowings 12,181 - -

================================================ ===== ============= ============= ============

Borrowing commitment fee and interest

charges (137) (98) (118)

================================================ ===== ============= ============= ============

Scheme of reconstruction(A) :

================================================ ===== ============= ============= ============

Ordinary shares issued - 3,257 3,257

================================================== ============= ============= ============

Ordinary shares repurchased - (55,291) (55,291)

================================================== ============= ============= ============

Tender offer and share issue costs - (388) (388)

================================================== ============= ============= ============

Buyback of shares (9,528) (842) (7,338)

------------------------------------------------ ----- ------------- ------------- ------------

Net cash inflow/(outflow) from financing

activities 1,109 (53,362) (59,878)

------------------------------------------------ ----- ------------- ------------- ------------

Decrease in cash and cash equivalents (3,095) (187,854) (192,907)

------------------------------------------------ ----- ------------- ------------- ------------

Analysis of changes in cash and cash

equivalents during the period

======================================================= ============= ============= ============

Opening balance 8,534 201,795 201,795

================================================ ===== ============= ============= ============

Decrease in cash and cash equivalents

as above (3,095) (187,854) (192,907)

================================================ ===== ============= ============= ============

Effect of foreign exchange 283 (508) (354)

------------------------------------------------ ----- ------------- ------------- ------------

Cash and cash equivalents at end of

period 5,722 13,433 8,534

------------------------------------------------ ----- ------------- ------------- ------------

(A) Actual proceeds received as a result of the Scheme of reconstruction

on 9 November 2021 amounted to GBP3,257,000 with the remainder being

received in the form of a UK Treasury Bill amounting to GBP57,980,000.

The UK Treasury Bill was immediately sold on 10 November 2021 and subsequently

deployed into Chinese equities.

The notes are an integral part of the condensed financial statements.

Selected Explanatory Notes to the Condensed Unaudited Financial

Statements

For the six-month period ended 30 April 2023

1. Reporting entity

abrdn China Investment Company Limited (the "Company") is a closed-ended

investment company, registered in Guernsey on 16 September 2009.

The Company's registered office is BNP Paribas House St Julian's

Avenue St Peter Port Guernsey GY1 1WA. The Company's Ordinary

shares have a premium listing on the London Stock Exchange and

commenced trading on 10 November 2009. The condensed interim financial

statements of the Company are presented for the six months ended

30 April 2023.

The Company invests in companies listed, incorporated or domiciled

in the People's Republic of China ("China"), or companies that

derive a significant proportion of their revenues or profits from

China operations or have a significant proportion of their assets

there. In furtherance of the investment policy, the portfolio

will normally consist principally of quoted equity securities

and depositary receipts although unlisted companies, fixed interest

holdings or other non-equity investments may be held. Investments

in unquoted companies will be made where the Manager has a reasonable

expectation that the company will seek a listing in the near future.

The portfolio is actively managed and may be invested in companies

of any size and in any sector.

Manager. Management of the Company's investment activities were

delegated to abrdn Hong Kong Limited by abrdn Fund Managers Limited

("aFML") during the Period.

Non-mainstream pooled investments ("NMPIs"). The Company currently

conducts its affairs so that the Ordinary shares issued by the Company

can be recommended by Independent Financial Advisers to ordinary

retail investors in accordance with the Financial Conduct Authority's

rules in relation to NMPIs and intends to continue to do so for

the foreseeable future.

2. Basis of preparation

Statement of compliance . The condensed interim financial statements

have been prepared in accordance with IAS 34 Interim Financial

Reporting and the Disclosure Guidance and Transparency Rules ("DTRs")

of the UK's Financial Conduct Authority. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the financial statements

of the Company as at and for the year ended 31 October 2022. The

financial statements of the Company as at and for the year ended

31 October 2022 were prepared in accordance with International

Financial Reporting Standards ("IFRS") as issued by the International

Accounting Standards Board ("IASB"). The accounting policies used

by the Company are the same as those applied by the Company in

its financial statements as at and for the year ended 31 October

2022.

Where presentational guidance set out in the Statement of Recommended

Practice (SORP") for Investment Companies issued by the Association

of Investment Companies ("AIC") in July 2022 is consistent with

the requirements of IFRS, the Directors have prepared the financial

statements on a basis compliant with the recommendations of the

SORP.

The "Total" column of the Condensed Unaudited Statement of Comprehensive

Income is the profit and loss account of the Company. The "Revenue"

and "Capital" columns provide supplementary information.

This report will be sent to shareholders and copies will be made

available to the public at the Company's registered office. It

will also be made available on the Company's website: www.abrdnchina.co.uk

.

Going concern. The Directors have adopted the going concern basis

in preparing the financial statements. The Board formally considered

the Company's going concern status at the time of the publication

of these financial statements and a summary of the assessment is

provided below.

Since the adoption of new investment policy, as approved by Shareholders

at the EGM held on 26 October 2021, the Board considered it appropriate

to reset the interval between Continuation Resolutions so that

the next Continuation Resolution will be put to Shareholders at

the annual general meeting of the Company to be held in 2027.

The Directors believe that the Company has adequate resources to

continue in operational existence for at least twelve months from

the date of approval of this document. In reaching this conclusion,

the Directors have considered the liquidity of the Company's portfolio

of investments as well as its cash position, income and expense

flows.

As at 30 April 2023, the Company held GBP5.7 million in cash and

GBP260.0 million in investments. It is estimated that approximately

99% of the investments held at the period end could be realised

in one month. The total operating expenses for the period ended

30 April 2023 were GBP1.6 million, which on an annualised basis

represented approximately 1.09% of average net assets during the

period. The Company also incurred 0.15% of finance costs. At the

date of approval of this Report, based on the aggregate of investments

and cash held, the Company has substantial operating expenses cover.

The Company's net assets at 26 June 2023 were GBP228.0 million.

The Company has a GBP15 million revolving credit facility with

Industrial and Commercial Bank of China, London Branch ("ICBC")

terminating in April 2024. As at 30 April 2023 GBP12,181,000 of

the ICBC was drawn down at an interest rate of 4.108%. The liquidity

of the Company's portfolio, as mentioned above, sufficiently supports

the Company's ability to repay its borrowings at short notice.

In light of the impact of the heightened interest rate risk and

geopolitical risk, the Directors have fully considered and assessed

the Company's portfolio of investments. A prolonged and deep market

decline could lead to falling values of the investments or interruptions

to cashflow. However, the Company currently has more than sufficient

liquidity available to meet any future obligations.

The Directors are satisfied that it is appropriate to adopt the

going concern basis in preparing the financial statements and,

after due consideration, that the Company is able to continue in

operation for a period of at least twelve months from the date

of approval of these condensed financial statements.

Equity and reserves

Share capital . Share capital represents the 1p nominal value of

the issued share capital plus any share premium arising from the

net proceeds of issuing shares less the aggregate cost of shares

repurchased (to be held in treasury or for cancellation).

Capital reserve . Profits achieved by selling investments and changes

in fair value arising upon the revaluation of investments that

remain in the portfolio are all charged to profit or loss in the

capital column of the Condensed Statement of Comprehensive Income

and allocated to the capital reserve. The capital reserve attributable

to realised profits is also used to fund dividend distributions.

Revenue reserve . The balance of all items allocated to the revenue

column of the Condensed Statement of Comprehensive Income in each

period is transferred to the Company's revenue reserve. The revenue

reserve is also used to fund dividend distributions.

Use of estimates, assumptions and judgements. The preparation of

the condensed interim financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the to make

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets, liabilities,

income and expenses. Actual results may differ from these estimates.

Use of estimates and assumptions. Estimates and underlying assumptions

are reviewed on an on-going basis. Revisions to accounting estimates

are recognised in the period in which the estimates are revised

and in any future periods affected.

Classification and valuation of investments. Investments are designated

as fair value through profit or loss on initial recognition and

are subsequently measured at fair value. The valuation of such

investments requires estimates and assumptions made by the management

of the Company depending on the nature of the investments as described

below and fair value may not represent actual realisable value

for those investments.

Use of judgements. In respect of note 11, the determination of

what constitutes 'observable' requires significant judgement by

the Company. The Company considers observable data to be that market

data that is readily available, regularly distributed or updated,

reliable and verifiable, not proprietary and provided by independent

sources that are actively involved in the relevant market.

Adoption of new and revised standards. At the date of approval

of these condensed financial statements, there were no new or revised

standards or interpretations relevant to the Company which came

into effect.

3. Investments

As the Company's business is investing in financial assets with

a view to profiting from their total return in the form of increases

in fair value, financial assets are designated as fair value through

profit or loss on initial recognition. These investments are recognised

on the trade date of their acquisition at which the Company becomes

a party to the contractual provisions of the instrument. At this

time, the best evidence of the fair value of the financial assets

is the transaction price. Transaction costs that are directly attributable

to the acquisition or issue of the financial assets are charged

to profit or loss in the Statement of Comprehensive Income as a

capital item. Subsequent to initial recognition, investments designated

as fair value through profit or loss are measured at fair value

with changes in their fair value recognised in profit or loss in

the Statement of Comprehensive Income and determined by reference

to:

(i) investments quoted or dealt on recognised stock exchanges in

an active market are valued by reference to their market bid

prices;

(ii) investments other than those in (i) above which are dealt on

a trading facility in an active market are valued by reference

to broker bid price quotations, if available, for those investments;

(iii) investments in underlying funds, which are not quoted or dealt

on a recognised stock exchange or other trading facility or in

an active market, are valued at the net asset values provided

by such entities or their administrators. These values may be

unaudited or may themselves be estimates and may not be produced

in a timely manner. If such information is not provided, or is

insufficiently timely, the Investment Manager uses appropriate

valuation techniques to estimate the value of investments. In

determining fair value of such investments, the Investment Manager

takes into consideration relevant issues, which may include the

impact of suspension, redemptions, liquidation proceedings and

other significant factors. Any such valuations are assessed and

approved by the Directors. The estimates may differ from actual

realisable values;

(iv) investments which are in liquidation are valued at the estimate

of their remaining realisable value; and

(v) any other investments are valued at Directors' best estimate

of fair value.

Transfers between levels of the fair value hierarchy are recognised

as at the end of the reporting period during which the change has

occurred.

Investments are derecognised on the trade date of their disposal,

which is the point where the Company transfers substantially all

the risks and rewards of the ownership of the financial asset.

Gains or losses are recognised within profit or loss in the 'Capital'

column of the Condensed Statement of Comprehensive Income. The

Company uses the weighted average cost method to determine realised

gains and losses on disposal of investments.

4. Operating segments

IFRS 8, 'Operating segments' requires a 'management approach',

under which segment information is presented on the same basis

as that used for internal reporting purposes. The Board, as a whole,

has been determined as constituting the chief operating decision

maker of the Company. The Board has considered the requirements

of the standard and is of the view that the Company is engaged

in a single segment of business, which is investing predominantly

in Chinese equities. The key measure of performance used by the

Board is the Net Asset Value of the Company (which is calculated

under IFRS). Therefore, no reconciliation is required between the

measure of profit or loss used by the Board and that contained

in the financial statements.

The Board of Directors is responsible for ensuring that the Company's