Ashtead Group Pretax Profit Rises on Strong Revenue Growth

05 Diciembre 2023 - 2:08AM

Noticias Dow Jones

By Najat Kantouar

Ashtead Group reported higher pretax profit for the second

quarter of fiscal 2024 on the back of stronger rental revenue

growth mainly in the U.S., despite an inflationary environment.

The U.K. equipment rental company said Tuesday that pretax

profit for the second quarter ended Oct. 31 was $666 million

compared with $658 million for the same period a year earlier.

Adjusted pretax profit--which strips out exceptional and other

one-off items--was $688 million, compared with $697 million due to

increased financing costs amid higher interest rate environment,

the company said.

For the year as a whole Ashtead expects to book a depreciation

charge of $2.12 billion and net interest cost of $540 million and

therefore miss full-year forecasts, as previously guided.

The group's revenue rose 13% to $2.88 billion from $2.54 billion

while rental revenue for the quarter was $2.58 billion, compared

with $2.31 billion.

For the year ahead the company expects revenue to grow between

11% and 13% as guided for in November. On Nov. 20 the company also

said that it expects Ebitda to be 2% to 3% below current market

expectations. It didn't update this guidance metric.

Ebitda for the second quarter was $1.35 billion, compared with

$1.21 billion.

The board has declared an interim dividend of 15.75 cents, up

from 15 cents.

"We are in a position of strength, with the operational

flexibility and financial capacity to capitalize on the

opportunities arising from these market conditions and ongoing

structural change," Chief Executive Brendan Horgan said.

Write to Najat Kantouar at najat.kantouar@wsj.com

(END) Dow Jones Newswires

December 05, 2023 02:53 ET (07:53 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

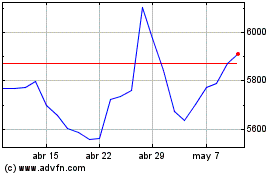

Ashtead (LSE:AHT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ashtead (LSE:AHT)

Gráfica de Acción Histórica

De May 2023 a May 2024