Atlantis Japan Growth Fund Ltd Proposal for the Reconstruction and Voluntary Winding-up of Company

11 Agosto 2023 - 1:00AM

UK Regulatory

TIDMAJG

This announcement and the information contained in it are not for release,

publication or distribution, directly or indirectly, in whole or in part, in or

into any member state of the European Economic Area, the United States,

Australia, Canada, Japan or the Republic of South Africa or any jurisdiction for

which the same could be unlawful.

This announcement contains inside information for the purposes of Article 7 of

Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 and as amended ("MAR"), and

is disclosed in accordance with the Company's obligations under Article 17 of

MAR.

ATLANTIS JAPAN GROWTH FUND LIMITED

("AJGF" or the "Company")

(A closed-ended investment company incorporated in Guernsey with registration

number 30709)

LEI: 54930041W0LDG00PGL69

Proposal for the Reconstruction and Voluntary Winding-up of the Company

11 August 2023

The Board of Atlantis Japan Growth Fund Limited is pleased to announce that

heads of terms have been agreed for a proposed combination of the assets of the

Company with the assets of Nippon Active Value Fund plc ("NAVF") (the

"Proposal").

The Board has been actively reviewing options to address the relative small size

of the Company, which has been driven in part by the market rotation away from

the growth investment style and recent disappointing relative performance. These

issues have made it difficult to attract significant demand for the Company's

shares and, absent any action, the discount at which the shares trade to net

asset value is likely to persist.

NAVF is a UK investment trust which targets attractive capital growth for its

shareholders through the active management of a focused portfolio of quoted

companies which have the majority of their operations in, or revenue derived

from, Japan, and that have been identified by NAVF's investment adviser, Rising

Sun Management Limited ("Rising Sun"), as being undervalued.

The Proposal provides the Company's shareholders ("Shareholders") with access to

a focused and differentiated investment opportunity with a strong track record,

a partial cash exit option and a larger continuing investment trust with the

prospect of improved liquidity. The combination, if approved by each company's

shareholders, will be implemented through a scheme of reconstruction pursuant to

section 391(1)(b) of the Companies (Guernsey) Law, 2008 ("Section 391(1)(b)

Scheme"), resulting in the reconstruction and members' voluntary liquidation of

the Company.

Key benefits of the Proposal:

· NAVF's active management approach, which differentiates it from many of its

peers, focuses on unlocking value in cash-rich smaller Japanese companies, an

approach which is aligned with recent developments in Japanese corporate

governance and with NAVF's structure as a listed UK investment trust. The

highly selective portfolio of NAVF offers investors a high-conviction,

uncorrelated opportunity.

· Since the date of its IPO (21 February 2020), NAVF has been the top

performing Japanese investment trust over the period to 9 August 2023, having

delivered a NAV Total Return of 45.6 per cent. in sterling terms.

· Although NAVF has only been in existence for a little over three years,

members of its investment adviser's team have a track record of over 30 years of

investing in Japan, pursuing an activist strategy in recent years.

· NAVF has access to the Tokyo based research team of its investment adviser's

affiliate, Dalton Investments LLC, and corporate legal expertise based in Japan.

NAVF also benefits from the potential to have other clients of Dalton

Investments LLC invest alongside it, which provides the opportunity to take more

meaningful stakes in companies and have more effective conversations with

investee company management.

· As announced on 18 May 2023 in connection with the proposed combination of

abrdn Japan Investment Trust plc and NAVF (the "AJIT Combination"), NAVF has

undertaken to move to a premium listing on the Main Market of the London Stock

Exchange, which is expected to complete prior to completion of the Proposal and

the AJIT Combination and improve the access of retail investors to the enlarged

NAVF and therefore its share rating and liquidity. The Proposal is not

conditional upon the AJIT Combination.

· NAVF also intends to implement the Proposal under the same prospectus to be

issued by NAVF in connection with the AJIT Combination, which is expected to

reduce the costs of the proposed combination.

· Rising Sun has offered to underwrite the Company's costs of the proposed

merger up to £800,000 including advisory and termination fees and associated

VAT.

· The Proposal will result in an inflow of capital into the NAVF portfolio

which can be deployed at an advantageous time in the cycle, when recent

government reforms support, more than ever in NAVF's view, the strategy of

finding undervalued Japanese listed companies and actively engaging with them to

deliver returns for shareholders.

· The combination with NAVF is expected to improve the enlarged fund's

liquidity for all shareholders as well as spreading the fixed costs of NAVF, as

the continuing entity, over a larger pool of assets. The ongoing costs ratio of

NAVF, as enlarged by implementation of the Proposal and the AJIT Combination,

are anticipated to be significantly less than that of AJGF as currently

constituted.

· The Proposal includes a cash exit opportunity of up to 25 per cent. of the

Company's shares in issue, providing Shareholders with the ability to realise

part (or potentially all) of their investment at a 2 per cent. discount to

formula asset value ("FAV") per ordinary share.

Background to the Proposal

While the Board believes that the Company's strategy remains attractive in the

longer term, it is aware that the Company's small size and recent poor

performance, both relative and absolute, make it difficult to attract

significant demand for its shares, and that the discount at which the shares

trade to net asset value is likely to persist. The Board is also conscious that

the continuation vote at the forthcoming annual general meeting is a significant

hurdle to the Company continuing unchanged.

Accordingly, the Board has been reviewing alternative options for the Company's

future, including combinations with other closed-ended funds, a change of

manager and a solvent liquidation with no rollover option. In conducting its

review, the Board took account of the attractive opportunities in Japanese

equities and the fact that many of the Company's investors are long term

supporters of the listed investment fund structure and concluded that a rollover

into an investment trust or similar vehicle was appropriate. Furthermore, the

Board wished to see an appropriate cash exit opportunity being available to

shareholders as well as ongoing liquidity in, and demand for, the rollover

vehicle's shares. The Board has maintained dialogue with major shareholders on

the future of the Company over the last twelve months.

The Board considers that taking advantage of the ongoing reforms and

improvements in corporate governance to invest in undervalued Japanese listed

companies and actively engage with them to deliver returns for shareholders is

an attractive strategy. The strategy has delivered strong returns in recent

years, and in the Board's view can be expected to continue to do so.

The combination with NAVF, as contemplated in the Proposal, therefore provides

an opportunity for shareholders to continue with an attractive ongoing exposure

to Japanese equities in an investment trust structure alongside an option to

elect for a cash exit at a modest discount to NAV in respect of at least 25 per

cent. of their holdings.

The Board wishes to place on record its appreciation of the long-standing

dedication and service to the Company of the investment adviser, Atlantis

Investment Research Corporation. For many years this was led Mr Ed Merner,

regarded as one of the leading Japanese fund managers by his peers until his

death in 2022. Taeko Setaishi and her team at AIRC have advised the fund since

2016 and deserve our thanks.

Combination with NAVF

The Board has in principle agreed the terms for a combination of the Company

with NAVF. NAVF is a UK investment trust, with Rising Sun as its investment

adviser. Total net assets were £165.8 million at 30 June 2023. It aims to

provide its shareholders with attractive capital growth through active

management of a focused portfolio of quoted companies which have the majority of

their operations in, or revenue derived from, Japan and that are considered by

Rising Sun to be undervalued.

The combination, if approved by each company's shareholders at the requisite

general meetings, will be implemented through a Section 391(1)(b) Scheme,

resulting in the voluntary liquidation of the Company and the rollover of its

assets into NAVF in exchange for the issue of new NAVF shares to Shareholders

who roll their investment into the enlarged fund.

New NAVF shares issued to the Company's Shareholders will be issued on a FAV-to

-FAV basis. FAVs will be calculated using the respective net asset values of

each company, adjusted for (i) the costs payable by the relevant company in

relation to the Proposal, (ii) any dividends and distributions declared by each

company which have a record date prior to the effective date of the combination,

and (iii) in the case of AJGF, less the amount reserved by the liquidator to

provide for known and unknown liabilities. The AJGF FAV per share in respect of

the rollover pool shall be increased by the amount equivalent to the 2 per cent.

discount applied to the AJGF FAV per share in respect of the cash option.

The Board believes it is appropriate to offer Shareholders the opportunity to

realise part, or potentially all, of their investment in the Company via a cash

exit for up to 25 per cent. of the Company's shares in issue, at a 2 per cent.

discount to FAV per share of the Company. The discount applied to the cash exit

FAV will benefit the FAV of AJGF shares electing, or deemed to have elected, to

rollover.

Shareholders may elect for more or less than their pro rata entitlement to the

cash option however, excess applications for the cash option over 25 per cent.

of the Company's issued share capital will be scaled back pro rata to such

excess applications.

The combination with NAVF is expected to improve the enlarged fund's liquidity

for all shareholders as well as spreading the fixed costs of NAVF, as the

continuing entity, over a larger pool of assets.

Following completion of the Proposal, it is expected that a director from the

Board of the Company will join the Board of NAVF.

Management cost contribution

Rising Sun, the investment adviser to NAVF, has demonstrated its conviction in

the combined fund by offering to pay for the Company's costs of implementing the

Proposal up to £800,000. The Board welcomes this contribution and notes the

strong indication it gives of Rising Sun's commitment to the Proposal and the

enlarged NAVF.

Annual report and accounts and AGM

The Board expects that the Company will publish its annual report and accounts

for the year to 30 April 2023 and the notice of the AGM to be held in December

as usual in the coming weeks. The Company intends that the extraordinary general

meeting required to implement the Proposal will be held before planned the AGM,

such that (assuming the Proposal is approved) the Company will be in liquidation

by the date of the AGM, and the AGM may therefore be adjourned sine die. If the

Proposal is not approved, the AGM will be held as planned and the scheduled

continuation vote will be put to shareholders.

City Code

In accordance with customary practice for schemes of reconstruction schemes, The

Panel on Takeover and Mergers has confirmed that the City Code on Takeovers and

Mergers is not expected to apply to the combination of the Company and NAVF.

Approvals

Implementation of the Proposal is subject to the approval, inter alia, of the

Company's Shareholders as well as regulatory and tax approvals and approval by

the shareholders of NAVF. It is anticipated that the Company will publish a

circular setting out details of the Proposal in early September 2023. The

Proposal is not conditional on implementation of the AJIT Combination.

The Company has consulted with a number of its major Shareholders who have

indicated support for the Proposal. These comprise approximately 51 per cent. of

the Company's share register.

Noel Lamb, Chairman of the Company, commented:

"Style rotation, recent poor performance and reduced liquidity have led the

Board to review alternative options and take market soundings. The investment

adviser, Atlantis Investment Research Corporation has given the fund great

service over many years. Looking ahead, this proposal to rollover into Nippon

Active Value Fund with an option for a 25 per cent. cash exit, will provide

investors with increased liquidity and access to a manager with a proven record.

I commend it to our shareholders."

For further information please contact:

Enquiries:

Company Secretary

Hannah Hayward

Northern Trust International Fund Administration Services (Guernsey) Limited

Email:HH61@ntrs.com

Tel: +44 (0) 1481 745 417

Corporate Broker

Singer Capital Markets

Robert Peel,

Robert.Peel@singercm.com(Investment Banking)

James Waterlow,

James.Waterlow@singercm.com(Sales)

Tel: +44 (0) 20 7496 3000

Important Information

This announcement contains statements about the Company that are or may be

deemed to be forward looking statements. Without limitation, any statements

preceded or followed by or that includes the words "targets", "plans",

"believes", "expects", "aims", "intends", "will", "may", "anticipates",

"estimates", "projects" or words or terms of similar substance of the negative

thereof, may be forward looking statements.

These forward looking statements are not guarantees of future performance. Such

forward looking statements involve known and unknown risks and uncertainties

that could significantly affect expected results and are based on certain key

assumptions. Many factors could cause actual results to differ materially from

those projected or implied in any forward looking statement. Due to such

uncertainties and risks, readers should not rely on such forward looking

statements, which speak only as of the date of this announcement, except as

required by applicable law.

The distribution of this announcement in jurisdictions outside the United

Kingdom may be restricted by law and therefore persons into whose possession

this announcement comes should inform themselves about, and observe, such

restrictions. Any failure to comply with the restrictions may constitute a

violation of the securities laws of such jurisdictions.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

August 11, 2023 02:00 ET (06:00 GMT)

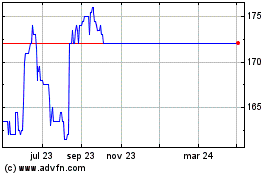

Atlantis Japan Growth Fu... (LSE:AJG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Atlantis Japan Growth Fu... (LSE:AJG)

Gráfica de Acción Histórica

De May 2023 a May 2024