Atlantis Japan Growth Fund Ltd Transaction Agreement and Publication of NAVF Prospectus

01 Septiembre 2023 - 6:45AM

UK Regulatory

TIDMAJG

This announcement and the information contained in it are not for release,

publication or distribution, directly or indirectly, in whole or in part, in or

into any member state of the European Economic Area, the United States,

Australia, Canada, Japan or the Republic of South Africa or any jurisdiction for

which the same could be unlawful.

ATLANTIS JAPAN GROWTH FUND LIMITED

("AJGF" or the "Company")

(A closed-ended investment company incorporated in Guernsey with registration

number 30709)

LEI: 54930041W0LDG00PGL69

Transaction Agreement and Publication of NAVF Prospectus

01 September 2023

Further to the Company's announcement on 11 August 2023, in which the Company

announced that heads of terms had been agreed for a proposed combination of the

assets of the Company with the assets of Nippon Active Value Fund plc ("NAVF")

by way of a Section 391(1)(b) Scheme (the "Proposal"), the Board is pleased to

announce that the Company has progressed the Proposal by today entering into a

transaction agreement with NAVF agreeing to the detailed terms and mechanics of

the Proposal (the "Transaction Agreement").

The Company notes the prospectus published by NAVF today in connection with the

Proposal (the "NAVF Prospectus"). The Company will publish a shareholder

circular by 15 September 2023, which will provide details of the Proposal and

convene an extraordinary general meeting for AJGF shareholders.

Pursuant to the Transaction Agreement, the Company has undertaken to use all

reasonable endeavours to implement the Section 391(1)(b) Scheme in accordance

with, and subject to, the terms set out in Part 12 of the NAVF Prospectus.

In particular, the Company has agreed, subject only to receipt of the relevant

tax clearances, to use all reasonable endeavours to post the requisite documents

(including a shareholder circular) to AJGF shareholders by 15 September 2023 and

to use all reasonable endeavours to convene the requisite shareholder meetings

to enable the Section 391(1)(b) Scheme to become effective on or before 31

October 2023. The Company has also undertaken that, until the Section 391(1)(b)

Scheme becomes effective (or until termination of the Transaction Agreement), it

will not carry on business other than in the ordinary course or carry out

certain other activities that could frustrate the Proposal.

The obligations of the parties to implement the Section 391(1)(b) Scheme under

the Transaction Agreement are subject to the satisfaction (or waiver) of the

conditions to the scheme set out in Part 12 of the NAVF Prospectus and receipt

by the Company of the relevant tax clearances. The Transaction Agreement may be

terminated at any time prior to the effective date of the Section 391(1)(b)

Scheme by the express written consent of the parties and on the occurrence of

certain events, including any condition to the scheme that is incapable of

waiver not being satisfied or becoming incapable of satisfaction.

If the Proposal is implemented, in order to provide continuity for AJGF

shareholders, it is intended that Noel Lamb will join the NAVF board as a non

-executive director with effect from completion of the Section 391(1)(b) Scheme.

The NAVF prospectus includes further details of the Proposal, NAVF and the

proposed combination of abrdn Japan Investment Trust plc and NAVF (the "AJIT

Combination") and will be available on NAVF's website

(www.nipponactivevaluefund.com). Implementation of the Proposal is subject to

the approval, inter alia, of the Company's shareholders as well as regulatory

and tax approvals and approval by the shareholders of NAVF. The Proposal is not

conditional on implementation of the AJIT Combination.

Capitalised terms used, but not defined, in this announcement shall have the

meaning given thereto in the announcement published by the Company on 11 August

2023.

For further information please contact:

Enquiries:

Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Limited

Hannah Hayward

Email:HH61@ntrs.com

Tel: +44 (0) 1481 745 417

Corporate Broker

Singer Capital Markets

Robert Peel, Alaina Wong(Investment Banking)

James Waterlow(Sales)

Tel: +44 (0) 20 7496 3000

Important Information

This announcement contains statements about the Company that are or may be

deemed to be forward looking statements. Without limitation, any statements

preceded or followed by or that includes the words "targets", "plans",

"believes", "expects", "aims", "intends", "will", "may", "anticipates",

"estimates", "projects" or words or terms of similar substance of the negative

thereof, may be forward looking statements.

These forward looking statements are not guarantees of future performance. Such

forward looking statements involve known and unknown risks and uncertainties

that could significantly affect expected results and are based on certain key

assumptions. Many factors could cause actual results to differ materially from

those projected or implied in any forward looking statement. Due to such

uncertainties and risks, readers should not rely on such forward looking

statements, which speak only as of the date of this announcement, except as

required by applicable law.

The distribution of this announcement in jurisdictions outside the United

Kingdom may be restricted by law and therefore persons into whose possession

this announcement comes should inform themselves about, and observe, such

restrictions. Any failure to comply with the restrictions may constitute a

violation of the securities laws of such jurisdictions.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 01, 2023 07:45 ET (11:45 GMT)

Atlantis Japan Growth Fu... (LSE:AJG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

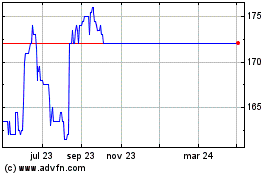

Atlantis Japan Growth Fu... (LSE:AJG)

Gráfica de Acción Histórica

De May 2023 a May 2024