TIDMATST

Alliance Trust PLC ("the Company")

LEI: 213800SZZD4E2IOZ9W55

28 July 2023

Strong performance in a volatile market

Results for six months ended 30 June 2023

Six months

to 30 June Year to 31

2023 December 2022 Change

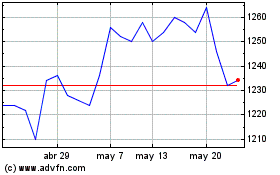

Share Price 1,008.0p 948.0p 6.3%

Net Asset Value ('NAV')

per Share(1) 1,086.5p 989.5p 9.8%

NAV Total Return(2) 11.1% -7.1%

Total Shareholder Return

('TSR')(2) 7.6% -5.8%

MSCI ACWI Total Return 7.8% -8.1%

Discount to NAV -7.2% -4.2%

Key Points

-- For the six months ended 30 June 2023, the Company's NAV Total Return2

was 11.1%, significantly outperforming its benchmark index, the MSCI All

Country World Index ('MSCI ACWI') which returned 7.8%.

-- Total Shareholder Return2 ('TSR') was 7.6%, due to a widening of the

discount, which compared favourably with peers3 (-7.2% as of 30 June 2023

vs -11.1% for the AIC Global Sector average).

-- Second interim dividend of 6.34p per share declared, up from 6.18p for

the first interim dividend. Increased dividend level is expected to be at

least maintained for the third and fourth interim dividends, giving an

expected annual dividend increase of 5% year-on-year.

-- After completing a tenure of nine years, Gregor Stewart will step down

from the Board and his role as Chairman at the year-end and will be

succeeded by Dean Buckley, who joined the Board in March 2021.

Gregor Stewart, Chairman of Alliance Trust PLC, commented:

"I am pleased to report that the Company significantly

outperformed the market and most of its peers in the first half of

2023, despite volatile market conditions. This demonstrates the

benefit of our diversified, high conviction approach. Although the

economic outlook remains highly uncertain, the Board believes the

strategy is well designed to navigate different market environments

and continue delivering attractive capital growth and a rising

dividend.

"I feel very privileged and proud to have served as a Director

and Chairman of the Company for the last nine years, steering it

through significant changes. I have no doubt Dean will serve the

Company well as Chairman."

(1) GAAP Measure

(2) Alternative Performance Measure

(3) The reference to the Company's peers is to the members of

the Association of Investment Companies Global Sector.

About Alliance Trust PLC

Alliance Trust aims to deliver long-term capital growth and

rising income from investing in global equities at a competitive

cost. We blend the top stock selections of some of the world's best

active managers, as rated by Willis Towers Watson, into a single

diversified portfolio designed to outperform the market while

carefully managing risk and volatility. Alliance Trust PLC is an

AIC Dividend Hero with 56 consecutive years of rising

dividends.

https://www.alliancetrust.co.uk

For more information, please contact:

Mark Atkinson, Senior Director -- Client Sarah Gibbons-Cook

Management, Wealth & Retail

Willis Towers Watson Quill PR

Tel: 07918 724303 Tel: 020 7466 5050 /

sarah@quillpr.com

Alliance Trust PLC Interim Report 2023

INVESTING FOR GENERATIONS

Catering for every generation, Alliance Trust aims to grow your

capital over time and provide rising income by investing in global

equities.

Investment objective

The Company's objective is to be a core investment for investors

that delivers a real return over the long term through a

combination of capital growth and a rising dividend. The Company

invests primarily in global equities across a wide range of

different sectors and industries to achieve its objective.

A CORE HOLDING FOR ALL GENERATIONS

Our portfolio's unique blend of Stock Pickers and their

customised stock selections make Alliance Trust a strong, core

holding for long-term investors seeking capital growth and rising

income. Whatever your financial goal, be it saving for university

or a first home, building a pension or leaving a legacy, we're

built to help you achieve this.

Proven resilience

Established in 1888, we've successfully navigated two world

wars, multiple economic crises, the Covid-19 pandemic and numerous

political upheavals.

Low maintenance

Our ready-made portfolio does all the hard work for you. With

thousands of funds to choose from, it can be daunting finding the

time and having the confidence to be your own wealth manager. By

using experts to select and monitor a team of top-rated Stock

Pickers, who in turn choose their most attractive stocks, we

provide a simple, high-quality way to invest in global equities at

a competitive cost.

Diversified by country, industry and style

Our approach doesn't depend on the skill of a single

high-profile individual. It's a team effort which means the

portfolio can add value through varying stock market cycles and

deliver more consistent returns.

All of our Stock Pickers have different but complementary

approaches to investing. This means our holdings are well

diversified across countries, industries and investment styles to

seek a wide range of opportunities while minimising risk.

Focused stock picking

Although well diversified, we avoid hugging the Company's

benchmark index(1) by asking the Stock Pickers to choose no more

than 20 stocks(2) in which they have the highest level of

conviction.

When combined, our portfolio's country and sector exposures

resemble the index(1) but its individual holdings are very

different. This high level of divergence is designed to maximise

potential for outperformance.

Expert manager selection

All the Stock Pickers are chosen by our Investment Manager,

Willis Towers Watson ('WTW'), a leading global investment

business.

WTW researches thousands of managers globally, before selecting

a diverse team of expert Stock Pickers for Alliance Trust.

To control risk, WTW then balances the amount of capital

allocated to each of them. Due to the modular construction of the

portfolio, if a Stock Picker needs to be replaced, this can be done

smoothly.

Responsible ownership

Our approach to investment is forward-thinking. To help protect

the returns of the next generations, we include consideration of

environmental, social and governance factors in the selection of

our Stock Pickers who in turn include these factors in their

investment processes. We place particular emphasis on engaging with

companies to drive change in harmful business practices that may

threaten long-term corporate profitability.

Rising dividend

We're proud of our 56-year track record of dividend growth,

which is one of the longest in the investment trust industry.

1. MSCI All Country World Index. 2. Apart from GQG Partners, who

also manage a dedicated emerging markets mandate with up to 60

stocks.

OUR PERFORMANCE

FINANCIAL HIGHLIGHTS AS AT 30 JUNE 2023

KEY PERFORMANCE INDICATORS

In the tables below we set out the Key Performance Indicators

('KPIs') the Board uses to measure performance. The benchmark we

use is the MSCI All Country World Index ('MSCI ACWI') in sterling

with net dividends reinvested.

Share Price

30 June 2021 993.0p

---------------- --------

30 June 2022 904.0p

---------------- --------

31 December 2022 948.0p

---------------- --------

30 June 2023 1,008.0p

---------------- --------

Net Asset Value Total Return(1)

6 months to 30 June

2021 14.8%

-------------------- ------

6 months to 30 June

2022 -10.5%

-------------------- ------

Year to 31 December

2022 -7.1%

-------------------- ------

6 months to 30 June

2023 11.1%

-------------------- ------

Total Shareholder Return(1)

6 months to 30 June

2021 11.1%

-------------------- ------

6 months to 30 June

2022 -11.3%

-------------------- ------

Year to 31 December

2022 -5.8%

-------------------- ------

6 months to 30 June

2023 7.6%

-------------------- ------

Total Dividend(2) (, 3)

First 2 Interim Dividends 7.4p

for 2021

------------------------- -----

First 2 Interim Dividends 12.0p

for 2022

------------------------- -----

Year to 31 December 2022 24.0p

------------------------- -----

First 2 Interim Dividends 12.5p

for 2023

------------------------- -----

1. Alternative Performance Measure (see page 33 of the Interim

Report 2023 for further information). 2. GAAP Measure. 3. Total

dividend rounded to one decimal place.

NET ASSET VALUE TOTAL RETURN (%)(1)

This measures the performance of our assets. It combines any

change in the Net Asset Value ('NAV') with dividends paid by the

Company.

Alliance Trust MSCI ACWI

------------------- -------------- ---------

6 months 11.1 7.8

------------------- -------------- ---------

1 year 15.4 11.3

------------------- -------------- ---------

3 years 37.7 32.9

------------------- -------------- ---------

5 years 50.5 53.3

------------------- -------------- ---------

Since 1 April 2017 68.9 67.6

------------------- -------------- ---------

Source: Morningstar and Refinitiv Datastream

NAV Total Return based on NAV including income with debt at fair

value and after Stock Picker and WTW investment fees.

TOTAL SHAREHOLDER RETURN (%)(1)

This demonstrates the return our shareholders receive through

dividends and capital growth of the Company.

Alliance Trust MSCI ACWI

------------------- -------------- ---------

6 months 7.6 7.8

------------------- -------------- ---------

1 year 14.3 11.3

------------------- -------------- ---------

3 years 37.1 32.9

------------------- -------------- ---------

5 years 49.0 53.3

------------------- -------------- ---------

Since 1 April 2017 66.5 67.6

------------------- -------------- ---------

Source: Morningstar and Refinitiv Datastream

COMPARISON AGAINST PEERS (%)

This shows our NAV Total Return against that of the Global AIC

Sector Average and the Morningstar universe of UK retail global

equity funds (open ended and closed ended).

AIC Global Sector

Alliance Peer Group Average NAV Total

Trust Median Return (unweighted)

------------------- -------- ---------- --------------------

6 months 11.1 5.8 9.0

------------------- -------- ---------- --------------------

1 year 15.4 10.5 11.8

------------------- -------- ---------- --------------------

3 years 37.7 26.4 19.8

------------------- -------- ---------- --------------------

5 years 50.5 43.9 40.5

------------------- -------- ---------- --------------------

Since 1 April 2017 68.9 60.3 69.3

------------------- -------- ---------- --------------------

Source: Morningstar and the Association of Investment

Companies.

NET ASSET VALUE (PENCE)(2)

This shows the value per share of the investments held by the

Company less its liabilities (including borrowings).

31 December 2019 875.9

----------------- -------

31 December 2020 933.9

----------------- -------

31 December 2021 1090.0

----------------- -------

31 December 2022 989.5

----------------- -------

30 June 2023 1,086.5

----------------- -------

Source: Morningstar and Refinitiv Datastream

NAV includes income and with debt at fair value.

1. Alternative Performance Measure (see page 33 of the Interim

Report 2023). 2.GAAP Measure.

CHAIRMAN'S STATEMENT

"In volatile market conditions, our strategy proved successful,

with our Net Asset Value Total Return for the six months ended 30

June 2023 beating our benchmark index by 3.3% and the AIC Global

Sector peer group average by 2.1%."

STRONG INVESTMENT PERFORMANCE

I am pleased to report strong investment performance for the six

months ended 30 June 2023. Our Net Asset Value ('NAV') Total Return

was well ahead of our benchmark index(1) and the majority of the

Company's peers(2) .

The Company's NAV Total Return was 11.1%, outperforming our

benchmark's return of 7.8% by 3.3%. Total Shareholder Return

('TSR') of 7.6% was slightly behind the benchmark due to a widening

of the discount. Nevertheless, our discount remained narrower than

most of our peers. During the period under review, the Company's

market capitalisation also increased by 4.2% to GBP2.89bn.

Markets have remained volatile in the first half of the year,

swinging between optimism and pessimism about the outlook for the

economy and companies' prospects with each release of data. The

ongoing ramifications from the Covid pandemic and the war in

Ukraine have compounded the battle to contain inflation and

necessitated rapid increases in interest rates by central banks. At

the same time, the potential for the use of Artificial Intelligence

('AI') to become widespread and disrupt industries has prompted a

resurgence in the valuations of technology stocks. Against that

background, it is pleasing to see that our outperformance was

principally due to strong stock selection across a variety of

sectors.

INCREASED DIVID

We have announced a second interim dividend for 2023 of 6.34p

(2022: 6.00p). The total of the first two interim dividends for

2023 is 12.52p, representing an increase of 4.3% on the same

payments for 2022. Earnings per share for the six months ended 30

June 2023 were 11.71p per share (30 June 2022: 12.46p).

Although income receipts have stabilised in 2023, having built

up significant distributable reserves, the Company expects to pay a

higher dividend in 2023 and beyond. Barring unforeseen

circumstances, the Board expects to declare third and fourth

interim dividends for 2023 of at least the same amount as the

second interim dividend. This would result in a total dividend for

2023 of at least 25.20p, an increase of 5% on the Company's 2022

dividend. Based on the Company's share price on 30 June 2023, this

level of total dividend would result in an annual dividend yield of

2.5%.

STABLE DISCOUNT

One of the Board's strategic objectives is to maintain a stable

share price discount to NAV, with our long-term aim being to

transition the Company's share price to a premium. The Company's

average discount over the period was 5.9%, this compared favourably

to the average sector discount of 9.4% over the same period.

In order to support the relative stability of the discount,

during the six months to 30 June 2023, shares equivalent to 2.0% of

the number of shares in issue at the start of the period were

bought back. The extent of buybacks in the most recent period has

been elevated across the sector. We believe share buybacks play an

important role in limiting discount volatility, adding value to

continuing shareholders and together with sustained demand for our

shares from retail investors, succeeded in keeping the discount

much narrower than the AIC Global Sector average.

BOARD SUCCESSION

As many of you will be aware, Anthony Brooke who joined the

Board in 2015, stepped down as a Director of the Company at the

conclusion of the Annual General Meeting ('AGM') on 27 April 2023.

At the same meeting, shareholders strongly supported the

appointments of Vicky Hastings and Milyae Park, who both joined the

Board in September 2022. As shareholders will know, we have been

working carefully on Board succession, as our long-standing

Directors complete their expected tenure. We are delighted with the

refreshment of the Board, as well as grateful for the skill,

commitment and passion of those who have recently left.

The next stage in this process is my own retirement. I will be

stepping down from the Board and my role as Chairman at the end of

the year. By that time I will have been a Director of the Company

for nine eventful years, which has seen the Company transform and

simplify, to focus on global equities through a multi-manager

investment approach.

Sarah Bates, our Senior Independent Director, was tasked with

leading the process to identify and appoint my successor. The

Nomination Committee carefully considered the role requirements and

sought the advice of an independent search consultant in relation

to potential external candidates. Following this review the Board,

on the recommendation of the Nomination Committee, has agreed that

Dean Buckley should succeed me as Chairman of the Company. In

accordance with best corporate governance practice, Dean's

appointment, like that of all our Directors, will continue to be

subject to annual re-election by shareholders at the AGM. As many

of you will know, Dean has a wealth of experience in fund

management and has in-depth knowledge of investment trusts. Since

he joined the Board in March 2021, Dean has brought new ideas and a

different perspective to the Board and I have no doubt will serve

the Company well as Chairman. To ensure a smooth transition to

Dean, we will work together between now and the end of the year,

prior to me stepping down from the Board with effect from 31

December 2023. Although my time at the helm is not yet up, I feel

very privileged and proud to serve as a Director and Chairman of

your Company, working with my colleagues to steer it through what

has been a volatile market in recent years.

STRENGTHENED OPERATING MODEL

Further to my statement in the Annual Report for the financial

year ended 31 December 2022, I am pleased to announce that the

final stage of the changes to the Company's operating model have

been completed, following the successful transfer of the finance,

fund accounting and administration services to Juniper Partners

Limited ('Juniper') on 1 April 2023. This should result in a more

resilient infrastructure for the Company, as most of the previous

Executive Team have now moved to Juniper and have a wider resource

surrounding them. We are also pleased that the marketing

relationship with our Investment Manager, Willis Towers Watson

('WTW') has been simplified and expanded. Following the

improvements to the operating model, the Company's ongoing charges

ratio continues to remain within our target of 0.65%.

CONTINUED SHAREHOLDER ENGEMENT

I am delighted to advise that we will be holding a further

investor forum in Edinburgh at the Edinburgh International

Conference Centre ('EICC') on 7 September 2023 at which

shareholders will be provided with an investment update from our

Investment Manager and one of our Stock Pickers. An Investor Forum

will also be held in London on 27 October 2023. Further details of

these events will be made available on the Company's website in due

course.

Having taken soundings from investors, the Company is also

investing in its brand and website to improve communication with

shareholders, raise the profile of the Company and attract a new

generation of investors.

If you have not yet done so, I would encourage you to subscribe

to receive the quarterly newsletter, monthly factsheet and other

Company news and events by visiting www.alliancetrust.co.uk or by

scanning the QR code on page 38 of the Interim Report 2023.

OUTLOOK

The results so far this year have been pleasing, and whilst WTW

believes that there is still a risk of economic disappointment in

the months ahead, we are confident that the portfolio is well

positioned for continued long-term growth.

Gregor Stewart

Chairman

27 July 2023

1. The Company's benchmark index is the MSCI All Country World

Index, referred to in this Interim Report as the 'MSCI ACWI', the

'benchmark' or the 'Index'.

2. The reference to the Company's peers is to the members of

Association of Investment Companies ('AIC') Global Sector.

INVESTMENT MANAGER'S REPORT

STRONG PERFORMANCE OVER A VOLATILE PERIOD

Global equity markets rose in the first half of 2023, despite

sticky inflation, rising interest rates and financial instability.

Defying widespread warnings of recession, economic growth remained

positive in all the major economies, and corporate earnings were

stronger than expected. Most developed equity markets, including

the US, UK, the eurozone and Japan, posted gains, although emerging

markets lost value, especially China which suffered from

disappointment over the pace of the country's post-pandemic

rebound.

REGIONAL SPLIT IN RETURNS

North America 10.2%

------------------ ------

Europe excluding

UK 9.0%

------------------ ------

UK 2.6%

------------------ ------

Japan 6.9%

------------------ ------

Pacific excluding

Japan -5.1%

------------------ ------

Emerging Markets -0.8%

------------------ ------

China -10.5%

------------------ ------

Source: MSCI Inc. Total returns shown in GBP as at 30 June

2023.

High quality, large-cap growth stocks were the main drivers of

market returns, especially in the technology and telecom sectors in

the US, although the consumer discretionary sector also did

well.

SECTOR SPLIT IN RETURNS

Consumer Staples -1.9%

----------------------- -----

Energy -7.6%

----------------------- -----

Financials -2.0%

----------------------- -----

Health Care -4.9%

----------------------- -----

Industrials 7.4%

----------------------- -----

Information Technology 29.5%

----------------------- -----

Real Estate -6.4%

----------------------- -----

Communication Services 18.7%

----------------------- -----

Utilities -6.1%

----------------------- -----

Consumer Discretionary 16.9%

----------------------- -----

Materials -1.2%

----------------------- -----

Source: MSCI Inc. Total returns shown in GBP as at 30 June 2023.

Real Estate return shown is as at 31 May 2023 due to data

availability.

After last year's sharp sell-off, the share prices of many

tech-related companies rebounded, due to resilient earnings. Many

were further boosted by a burst of investor enthusiasm for AI

applications such as ChatGPT, the widely publicised interactive

chatbot launched in November 2022. However, the gains among

tech-related stocks did not always extend to more speculative

opportunities, suggesting investors are being more discriminating

this time around between tech and telecom companies with current

earnings and those whose valuations rest on potential profitability

in the future.

The Company's portfolio significantly outperformed the market,

delivering a NAV Total Return of 11.1%, this compared favourably

against the Index which returned 7.8%. Total Shareholder Return was

7.6%, this was slightly lower than the Index due to a widening of

the Company's discount to 7.2% as at 30 June 2023.

STOCK SELECTION DROVE OUTPERFORMANCE

The portfolio's outperformance of the Index for the six months

ended 30 June 2023 was largely due to good stock selection by our

Stock Pickers, though they performed well at different points in

varying market conditions, highlighting the benefits of a

multi-manager approach with built-in diversification benefits.

For example, at the start of the year, when investors were

generally in a buoyant mood, eight of our nine stock pickers did

well, especially the value managers with small and mid-cap holdings

in the UK and Europe, which initially outperformed the US; only

last year's best performing Stock Picker, GQG Partners ('GQG'),

lagged the market, largely due to its relatively high exposure to a

reversal in commodity stocks following last year's bull run.

After problems in US regional banks surfaced in March 2023, the

market mood became more risk-averse, and investors crowded into the

perceived safety of mega-cap US tech-related, growth stocks. At

that point, Stock Pickers with exposure to some of these stocks,

such as Sands Capital ('Sands'), Sustainable Growth Advisers

('SGA') and Vulcan Value Partners ('Vulcan'), leapt ahead; GQG also

began to catch up, having rotated some of its exposure into

technology stocks, such as Apple and Nvidia, during the first half

of the year and away from commodities (ExxonMobil and Exelon) and

consumer staples (Walmart).

Markets rotated again in June, with our value managers once

again coming to the fore.

REDUCED HEADWIND FROM US MARKET CONCENTRATION

In the past, we have highlighted how a very concentrated market

dominated by a small number of mega-cap technology-related stocks

has been a headwind to our broadly diversified strategy. However,

while relative performance was hurt by our underweight positions in

four of the stocks that led the mega-cap rally, namely Tesla, Meta,

Apple and chip maker Nvidia, this time we had compensating

overweight positions in three of the others, that is Alphabet,

Amazon and Microsoft.

We also benefitted from a less skewed spread of regional

returns. Europe and Japan performed better than previously, albeit

losing ground and being overtaken by the US towards the end of the

period under review.

Stepping back and looking at the six-month period as a whole,

Alphabet, Microsoft, and Amazon were among the biggest contributors

to relative returns, along with Latin America's e-commerce leader

MercadoLibre. In addition, a range of non-tech related names also

added value. These included sports clothing and footwear

manufacturer Adidas, and cement and aggregate producer Heidelberg

Materials (both Germany). It also included Kuehne & Nagel, the

Swiss-based logistics group, and French jet engine maker Safran.

Petrobras, Latin America's largest energy group, was also a

significant contributor. Its share price bucked the trend in its

sector, rising over 40%, having endured wild swings at the start of

the year as investors worried that Brazil's new president would use

the government's controlling stake in the company to take a more

interventionist approach. Although the president appointed a new

chief executive, investors were reassured that their worst fears

were not realised.

AVOIDING TROUBLED US REGIONAL BANKS

Our relative returns also benefitted from our lack of exposure

to poorly performing US regional bank stocks, which suffered a

series of business failures starting with Silicon Valley Bank

('SVB'). While SVB held a large proportion of safe assets

(government bonds), it was unable to convert these into sufficient

cash to meet withdrawals because their value was depressed by

rising interest rates. The run on SVB had a domino effect on the

failure of other regional US banks and to Credit Suisse in Europe,

but swift action by policymakers to guarantee deposits in the US

and the forced merger of Credit Suisse with UBS calmed fears of

another 2008-style global banking crisis. Even so, the

vulnerability of the financial system to the pressures of sharply

rising interest rates remains a concern.

Our exposure to the financial sector is in part through payment

processing companies, such as Visa. Where we own banks, it is

mainly in emerging markets' companies like HDFC Bank and ICICI Bank

in India. Both banks are diversified by customer base, robust in

terms of balance sheets and have a less saturated market than US

regional banks, with better demographics and growth

opportunities.

Aside from our underweight positions in Apple, Nvidia, Meta and

Tesla, the main detractors from our returns versus the Index

included Vale, the Brazilian mining group, and Glencore, the

Swiss-based commodities business, both of whom suffered from weaker

demand for commodities, last year's best performing asset class.

Other stocks which detracted from performance were UnitedHealth

Group and British American Tobacco, which underwent a management

reshuffle.

STOCK PICKER ALLOCATIONS: ADDING A JAPAN SPECIALIST

We did not make any major changes to portfolio positioning in

terms of Stock Picker weightings during the first half of the year,

although we did give GQG some additional capital following its

underperformance in the early part of the year. This was funded

from the strongest outperformers, namely Vulcan, Sands and Lyrical

Asset Management ('Lyrical'). Towards the end of the first half we

further trimmed the allocations to Sands, Vulcan and SGA, which all

benefited from the AI rally. These reallocations of capital helped

maintain the portfolio's balanced exposure to different market

factors. After the period under review, on 24 July we added a

specialist Japan manager, Dalton Investments ('Dalton'), to the

line-up. This was funded with capital from the other Stock Pickers,

principally Black Creek Investment Management ('Black Creek'),

Metropolis Capital ('Metropolis'), Sands, GQG and Veritas Asset

Management ('Veritas').

After years of economic malaise, corporate governance reforms

instigated in 2014 by then Prime Minister Shinzo Abe are leading to

a significant shift in how Japan's corporations are run. These

changes are making them much more shareholder-friendly and, in

turn, are helping to breathe new life into the economy.

Many of these developments stem from a decision by the Tokyo

Stock Exchange ('TSE') in January 2023 to force companies to

disclose action plans to increase their price to book ratio

(calculated by dividing the company's stock price per share by the

value of all its assets minus liabilities) to 1x. The reform should

deter companies from hoarding cash and galvanise them into action

to generate value for shareholders. Dalton says this has the

potential to be a huge boon to the Japanese market and particularly

to value managers with a focus on engagement or activism.

Mix these corporate developments in with a solid economy, a weak

currency, and low inflation and interest rates compared to much of

the developed world, and Japan represents an attractive place to

invest. Despite recent stock market gains, Japan is still trading

at a modest discount to its long-term average and a substantial

discount to other regions. We are not taking a big macro bet on

Japan but believe that hiring a skilled manager like Dalton will

enable us to better capture the most attractive stock-specific

opportunities.

ABOUT DALTON

Dalton is a value focused manager headquartered in Los Angeles

with several other offices including Tokyo. The firm is

independently owned by its senior executives and investment

professionals who invest in its strategies alongside clients,

ensuring an alignment of interests. It was established in 1999 to

pursue investment opportunities arising from the Asian financial

crisis and now offers a small range of Asia-focused and global

emerging markets equity strategies.

Dalton looks to exploit mispricing opportunities in the most

under-researched companies in Japan, which generally steers its

focus to small and mid-cap companies. The concentrated, up to

20-stock mandate that Dalton is managing for Alliance Trust is run

by the firm's Chief Investment Officer and co-founder James D.

Rosenwald, plus a team of six analysts based in Tokyo.

WTW has a positive view of this strategy largely predicated on

the experience and differentiated insights of James D. Rosenwald,

combined with the disciplined nature of the investment process and

depth of analytical support provided by his team. We believe James

is an entrepreneurial and experienced investor with good foresight,

market savviness and a large network of contacts. We also believe

the strategy is well specified and consistently executed within an

attractive opportunity set which is a relatively less efficient

part of the Japanese market.

James has a strong heritage, which includes working for George

Soros as an investor in the Korean market. He has been investing in

Japan since his teens when he began working with his grandfather,

who had previously worked with Benjamin Graham, the British-born

American economist who is widely known as the father of value

investing.

The firm's investment philosophy is based on four

principles:

-- Buy good businesses with strong cash flows and balance sheets who have a

"moat" against competition

-- Seek shares that trade at a material discount to intrinsic value, looking

to double money over 3-5 years

-- Identify companies with an alignment of interest between the business

owner/management and minority shareholders

-- Identify a demonstrable track record of managing capital effectively and

rewarding minority shareholders.

A STOCK PICKER'S MARKET

Moving into the second half of the year, we are excited by the

long-term potential of our holdings, with many performing much

better operationally than is currently recognised in their share

prices. However, the US has once again become very concentrated in

a small number of very large-cap US tech-related stocks, and we are

cautious about how such a concentrated market at large will evolve

in the near term.

The economic backdrop is deteriorating. Despite rapid increases

in interest rates, it is still possible that inflation will fall

without a recession, particularly in the US where the rate of price

rises has peaked, and growth remains robust. Moreover, the use of

AI has the potential to boost productivity and increase corporate

earnings, with a knock-on effect on share prices. Goldman Sachs

estimate that AI could increase US productivity by 1.5 percentage

points per year over a 10-year period, which would imply that the

S&P 500's fair value would be about 9% higher than it is today.

In that scenario, the rest of the US market could catch up with big

tech.

Equally, the sector could be enjoying a bout of euphoria which

is divorced from economic reality. The long-predicted recession may

not have materialised, but high interest rates may be needed for

longer than expected to squeeze inflation out of the system,

especially in Europe and the UK. And many forward-looking

indicators are already flashing red. These include an inverted US

Treasury yield curve -- with shorter-term bond yields higher than

longer-term bond yields -- which has historically preceded a

downturn.

WARY OF HYPE

Although it has huge potential, we are wary of much of the hype

surrounding AI. As with the internet bubble 20 years ago, it could

take several years before the clear AI winners emerge. In the

meantime, some of today's front runners may fall by the wayside.

So, while we do have exposure to AI, through Microsoft, for

example, our Stock Pickers are playing it company by company rather

than as a portfolio theme.

It is important to remember that the economic impact of interest

rate hikes by the US Federal Reserve, the European Central bank and

the Bank of England have yet to be fully felt, among consumers and

businesses. Typically, interest rate changes take 18 months to

filter through to the real economy, even longer perhaps in the UK

where mortgage borrowers face large increases in repayments as

their fixed-rate deals come to an end. It would therefore be

complacent to believe the risk of recession has disappeared

altogether; history's most anticipated recession could still be on

track, albeit slightly delayed.

On balance, we believe equity markets are not sufficiently

pricing in potential future near-term weakness in the economy and

corporate earnings. As a precaution, we are keeping gearing low to

minimise the impact of potential short-term equity market declines.

At the end of June, gross gearing was 7.2%. This was just below the

typical 7.5%-12.5% range, driven by market appreciation and us

keeping gearing unchanged since reducing it to the low end of the

range at the end of 2022. While we keep gearing under review, we

are wary of increasing it when the outlook for equity markets

generally remains challenging, despite being positive on the

portfolio from a fundamental, bottom-up perspective. We remain

diversified across countries, sectors and investment styles to

reduce risk, and have faith in our Stock Pickers selecting the best

stocks to continue adding value to portfolio returns relative to

peers and the Index.

COMBINED STOCK PICKER ALLOCATIONS

There have been no major changes to the portfolio structure in

the first half of the year, with capital allocations kept in

balance by fluctuating market movements. These movements ensured

that the portfolio retained a balanced exposure to styles, sectors

and regions, thereby avoiding taking any significant macro or

factor bets and relying on stock selection to drive portfolio

returns.

REGION

North America 57.9%

------------------------ -----

Asia & Emerging Markets 15.7%

------------------------ -----

Europe 14.9%

------------------------ -----

UK 9.5%

------------------------ -----

Stock Picker Cash 2.0%

------------------------ -----

Source: Juniper Partners Limited.

As at 30 June 2023

SECTOR

Information Technology 20.7%

----------------------- -----

Financials 18.9%

----------------------- -----

Industrials 14.2%

----------------------- -----

Communication Services 10.8%

----------------------- -----

Health Care 10.7%

----------------------- -----

Consumer Discretionary 9.5%

----------------------- -----

Consumer Staples 4.7%

----------------------- -----

Materials 3.6%

----------------------- -----

Energy 3.3%

----------------------- -----

Stock Picker Cash 2.0%

----------------------- -----

Real Estate 0.9%

----------------------- -----

Utilities 0.7%

----------------------- -----

Source: Juniper Partners Limited.

As at 30 June 2023

Note: On 24 July 2023, the Company added a new specialist Japan

manager, Dalton Investments, to the Stock Picker line up. This

resulted in a small overweight to Japan relative to the

benchmark.

INVESTMENT PORTFOLIO

OUR LARGEST 30 INVESTMENTS AT 30 JUNE 2023

Value of

Country of Holding % of

Name Listing Sector GBPm Total Assets

------------------ ---------------- ------------------ -------- -------------

Communication

1 Alphabet United States Services 154.9 4.7

------------------ ---------------- ------------------ -------- -------------

Alphabet is a holding company that engages

in the acquisition and operations of different

firms. It is best known as a parent company

for Google but holds other subsidiaries as

well. The company, through its subsidiaries,

provides web based search, advertisements,

maps, software applications, mobile operating

systems, consumer content, enterprise solutions,

commerce and hardware product. Alphabet dominates

the online search market with Google's global

share above 80%, via which it generates strong

revenue growth and cash flow.

-------------------------------------------------------- -------- -------------

Information

2 Microsoft United States Technology 153.4 4.6

------------------ ---------------- ------------------ -------- -------------

Microsoft develops, manufactures, licenses,

sells and supports software products including

operating systems, server applications, business

& consumer applications and software/development

tools for the Internet and intranets. In addition,

it develops video game consoles and digital

music entertainment devices. Microsoft is an

established player in the tech sector and continues

to evolve and innovate to maintain this position.

We see the potential for solid growth driven

by a still significant opportunity for its

Azure cloud-computing business and within its

suite of office and productivity solutions.

-------------------------------------------------------- -------- -------------

Consumer

3 Amazon.com United States Discretionary 124.3 3.7

------------------ ---------------- ------------------ -------- -------------

Amazon.com is an American multinational technology

company that focuses on e-commerce, online

advertising, cloud computing, digital streaming,

and artificial intelligence. Amazon offers

personalised shopping services, web-based credit

card payments, and direct shipping to customers.

In addition, it operates a cloud platform that

offers services globally. Amazon's revenue

growth does not only benefit from increases

in online shopping. The opportunity for growth

is also driven by the strength and execution

in AWS, its cloud computing business.

-------------------------------------------------------- -------- -------------

Information

4 Visa United States Technology 100.3 3.0

------------------ ---------------- ------------------ -------- -------------

Visa is an American multinational financial

services corporation. It describes itself as

a global payments technology company that works

to enable consumers, businesses, banks, and

governments to use digital currency. It facilitates

electronic funds transfers throughout the world,

most commonly through Visa branded credit cards,

debit cards and prepaid cards across a broad

clientele from retail to corporate. The company

is a dominant player within payment solutions

and with cross-border travel volumes increasing,

this could help sustain double-digit revenue

growth for years to come.

-------------------------------------------------------- -------- -------------

5 UnitedHealth Group United States Health Care 70.4 2.1

------------------ ---------------- ------------------ -------- -------------

UnitedHealth Group describes itself as a health

and well-being company, offering health care

coverage and benefits through UnitedHealthcare,

and technology and data-enabled care delivery

through Optum. It also manages organised health

systems across the United States and provides

employers products and resources to plan and

administer employee benefit programs. UnitedHealth

Group is the largest health insurer in the

world. Due to its size, stability, dividends,

and positioning, it holds a dominant position

in the largest healthcare industry in the world.

-------------------------------------------------------- -------- -------------

Information

6 Mastercard United States Technology 64.6 1.9

------------------ ---------------- ------------------ -------- -------------

Mastercard is an American technology company

in the global payments business. It works with

a wide range of consumers across individuals

to corporations to governments to enable and

facilitate electronic forms of payment. It

provides technological solutions and enablement

of electronic payment solutions. Mastercard

is a firm that has shown good stability and

quality with its earnings, holding one of the

dominant positions amongst payment solutions.

-------------------------------------------------------- -------- -------------

Information

7 Nvidia United States Technology 55.6 1.7

------------------ ---------------- ------------------ -------- -------------

Nvidia is a world-leading supplier of artificial

intelligence hardware and software, based in

California. Example products which the company

designs include graphics processing units ('GPUs')

and systems on a chip ('SoCs') for the mobile

computing and automotive markets.

-------------------------------------------------------- -------- -------------

8 Petrobras Brazil Energy 47.5 1.4

------------------ ---------------- ------------------ -------- -------------

Petrobras, based in Brazil, where it is 54%

state-owned, is Latin America's largest oil

and gas company. It refines, markets, trades,

transports and supplies oil products. The company

also operates oil tankers, distribution pipelines,

marine, river and lake terminals, thermal power

plants, fertiliser plants, and petrochemical

units.

-------------------------------------------------------- -------- -------------

Information

9 ASML Netherlands Technology 38.3 1.2

------------------ ---------------- ------------------ -------- -------------

ASML is a Dutch technology corporation headquartered

in Veldhoven, Netherlands. The firm develops

and manufactures photolithography machines

which are subsequently used in the production

of computer chips.

-------------------------------------------------------- -------- -------------

Information

10 Meta United States Technology 37.2 1.1

------------------ ---------------- ------------------ -------- -------------

Meta is an American multinational technology

conglomerate headquartered in California. The

firm owns and operates Facebook, Instagram,

Threads, and WhatsApp, among others. It is

one of the 'Big Five' information technology

companies in the United States.

-------------------------------------------------------- -------- -------------

11 AstraZeneca United Kingdom Health Care 36.0 1.1

------------------ ---------------- ------------------ -------- -------------

12 Airbus France Industrials 34.7 1.0

------------------ ---------------- ------------------ -------- -------------

13 TotalEnergies France Energy 34.5 1.0

------------------ ---------------- ------------------ -------- -------------

14 Bureau Veritas France Industrials 33.1 1.0

------------------ ---------------- ------------------ -------- -------------

Consumer

15 MercadoLibre Uruguay Discretionary 30.7 0.9

------------------ ---------------- ------------------ -------- -------------

16 VINCI France Industrials 30.3 0.9

------------------ ---------------- ------------------ -------- -------------

17 Canadian Pacific Canada Industrials 29.8 0.9

------------------ ---------------- ------------------ -------- -------------

18 DBS Bank Singapore Financials 29.8 0.9

------------------ ---------------- ------------------ -------- -------------

19 Glencore United Kingdom Materials 29.8 0.9

------------------ ---------------- ------------------ -------- -------------

20 HDFC Bank India Financials 29.1 0.9

------------------ ---------------- ------------------ -------- -------------

21 Safran France Industrials 28.4 0.9

------------------ ---------------- ------------------ -------- -------------

The Cooper

22 Companies United States Health Care 28.2 0.9

------------------ ---------------- ------------------ -------- -------------

23 Novo Nordisk Denmark Health Care 27.7 0.8

------------------ ---------------- ------------------ -------- -------------

Murata Information

24 Manufacturing Japan Technology 27.4 0.8

------------------ ---------------- ------------------ -------- -------------

25 Fiserv United States Financials 27.2 0.8

------------------ ---------------- ------------------ -------- -------------

Information

26 Apple United States Technology 26.8 0.8

------------------ ---------------- ------------------ -------- -------------

Information

27 Texas Instruments United States Technology 26.6 0.8

------------------ ---------------- ------------------ -------- -------------

28 ICON Ireland Health Care 26.5 0.8

------------------ ---------------- ------------------ -------- -------------

Communication

29 Interpublic Group United States Services 25.9 0.8

------------------ ---------------- ------------------ -------- -------------

Information

30 salesforce.com United States Technology 25.8 0.8

------------------ ---------------- ------------------ -------- -------------

Top 30 Investments 1,434.8 43.1

------------------ ---------------- ------------------ -------- -------------

A full list of investments held in the portfolio is available on

the Company's website at www.alliance trust.co.uk

Note: All figures are subject to rounding differences.

RESPONSIBLE INVESTMENT

In the six months to 30 June 2023, EOS at Federated Hermes

engaged with 85 companies held in the portfolio on a range of over

390 issues and objectives. Key areas of engagement included climate

change, human and labour rights, human capital and board

effectiveness. Over the same period, the Company's Stock Pickers

cast 2,877 votes at 166 company meetings. They voted on all the

proposals that could be voted on in the period. The Company's Stock

Pickers voted against management on 301 proposals and abstained on

52 proposals. Of the votes exercised against company management,

the most frequently recurring themes were compensation and director

election.

HOW OUR STOCK PICKERS VOTED

Votes exercised with management 87.7%

----------------------------------- -----

Votes exercised against management 10.5%

----------------------------------- -----

Votes abstained 1.8%

----------------------------------- -----

Source: EOS at Federated Hermes, WTW, ISS. Data to 30 June

2023.

REASONS FOR VOTING AGAINST MANAGEMENT

Audit Related 0.3%

----------------------- -----

Capitalisation 6.3%

----------------------- -----

Company Articles 0.3%

----------------------- -----

Compensation 23.6%

----------------------- -----

Corporate Governance 1.7%

----------------------- -----

Director Election 35.2%

----------------------- -----

Director Related 6.3%

----------------------- -----

E&S Blended 0.7%

----------------------- -----

Environmental 10.3%

----------------------- -----

Miscellaneous 0.3%

----------------------- -----

Non-Routine Business 1.0%

----------------------- -----

Routine Business 1.3%

----------------------- -----

Social 11.6%

----------------------- -----

Strategic Transactions 0.7%

----------------------- -----

Takeover Related 0.3%

----------------------- -----

Percentage figures above are of eligible votes exercised that

were against management.

Source: EOS at Federated Hermes, WTW, ISS. Data to 30 June

2023.

Percentages may not cast to 100 due to rounding differences.

OTHER INFORMATION

PRINCIPAL AND EMERGING RISKS

In common with other financial services organisations, the

Company's business model results in inherent risks.

The Directors have carried out a robust assessment of the

principal and emerging risks facing the Company and how these are

continuously monitored and managed.

In pursuit of its strategic objectives the Company faces the

following principal and emerging risks:

-- Investment, Counterparty and Financial Risks -- Market, Investment

Performance, Credit and Counterparty, Capital Structure and Financial

-- Operational -- Cyber Attack and Outsourcing

-- Environmental, Social and Governance ('ESG') factors including Climate

Change

-- Legal and Regulatory Non-Compliance

These risks, and the way in which they are managed, are

described in more detail within the How We Manage Our Risks section

on pages 35 to 40 of the Annual Report for the year ended 31

December 2022, which is available on the Company's website at

www.alliancetrust. co.uk. The Board believes these principal risks

and uncertainties are applicable to the remaining six months of the

financial year, as they were to the six months ended 30 June

2023.

Emerging risks facing the Company have largely remained

unchanged since those detailed in the Annual Report for the year

ended 31 December 2022, namely geopolitical tension, inflation, and

economic recession. During the first half of 2023, market and

investor confidence in the banking sector was also severely

impacted as a result of the collapse of three US banks -- Silicon

Valley Bank, Signature Bank and First Republic Bank.

In addition, we witnessed the collapse of one of Switzerland's

leading financial institutions -- Credit Suisse, which resulted in

its takeover by UBS. The ongoing war in Ukraine and tensions

between China and the West with regards to Taiwan also continue to

impact market and investor confidence. These emerging risks are

considered by the Board alongside its principal risks. The Board

remains of the view that active management of the concentrated

'best ideas' approach employed by the Company will be able to take

advantage of any volatility as it creates opportunities. The Board

believes that the Company's globally diversified multi-manager

portfolio will be less volatile and, hopefully, a more rewarding

investment.

RELATED PARTY TRANSACTIONS

There were no transactions with related parties during the six

months ended 30 June 2023 which have a material effect on the

results or the financial position of the Company.

GOING CONCERN STATEMENT

As at 30 June 2023, while there have been market changes over

the period the Board does not consider that in relation to its

ability to continue as a going concern that there have been any

significant changes to these factors. The Directors, who have

reviewed budgets, forecasts and sensitivities, consider that the

Company has adequate financial resources to enable it to continue

in operational existence for the foreseeable future. Accordingly,

the Directors believe it is appropriate to continue to adopt the

going concern basis.

The factors impacting on going concern are set out in detail in

the Company's Viability Statement on pages 62 and 63 of the Annual

Report for the year ended 31 December 2022. Factors considered

included Financial Strength, Investment, Liquidity, Dividends,

Reserves, Discount, Significant Risks, Borrowings, Reserves,

Security and Operations.

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

-- The condensed set of financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting" as adopted by the UK,

and give a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company;

-- The interim management report includes a fair review of the information

required by:

a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of important events that have occurred during the first six months of the financial year and their impact on the condensed set of financial statements, and a description of the principal risks and uncertainties for the remaining six months of the year; and

b) DTR 4.2.8R of the Disclosure and Transparency Rules, being related party transactions that have taken place in the first six months of the current financial year and that have materially affected the financial position or performance of the entity during that period, and any changes in the related party transactions described in the last annual report that could do so.

Signed on behalf of the Board

Gregor Stewart

Chairman

27 July 2023

FINANCIAL STATEMENTS

CONDENSED INCOME STATEMENT (UNAUDITED) FOR THE PERIODED 30 JUNE

2023

Year to

6 months to 30 6 months to 30 31 December 2022

June 2023 June 2022 (audited)

GBP000 Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

--------------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

Income 3 42,102 - 42,102 46,907 - 46,907 95,521 - 95,521

Gain/(loss) on investments

held at fair value

through profit or

loss - 289,726 289,726 - (422,539) (422,539) - (358,675) (358,675)

Profit on fair value

of debt - 2,765 2,765 - 38,274 38,274 - 54,682 54,682

Total 42,102 292,491 334,593 46,907 (384,265) (337,358) 95,521 (303,993) (208,472)

Investment management

fees 4 (2,451) (5,438) (7,889) (1,671) (5,010) (6,681) (3,197) (9,586) (12.783)

Administrative expenses (1,239) (200) (1,439) (2,921) (452) (3,373) (5,562) (912) (6,474)

Finance costs 5 (1,063) (3,190) (4,253) (1,018) (3,050) (4.068) (2,156) (6,469) (8,625)

Foreign exchange

(losses)/gains - (3,284) (3,284) - 3,291 3,291 - 486 486

Profit/(loss) before

tax 37,349 280,379 317,728 41,297 (389,486) (348,189) 84,606 (320,474) (235,868)

Taxation 6 (3,323) (185) (3,508) (3,565) (233) (3,798) (6,435) (342) (6,777)

Profit/(loss) for

the period/year 8 34,026 280,194 314,220 37,732 (389,719) (351,987) 78,171 (320,816) (242,645)

--------------------------- ---- ------- ------- ------- ------- --------- --------- ------- --------- ---------

All profit/(loss) for the period/year is attributable to equity holders.

Earnings per share

attributable to

equity holders

Basic (pence per

share) 8 11.71 96.41 108.12 12.46 (128.65) (116.19) 26.14 (107.28) (81.14)

Diluted (pence per

share) 8 11.71 96.41 108.12 12.46 (128.65) (116.19) 26.14 (107.28) (81.14)

The Company does not have any other comprehensive income and

hence profit/(loss) for the period/year, as disclosed above, is the

same as the Company's total comprehensive income.

CONDENSED STATEMENT OF CHANGES IN EQUITY (UNAUDITED) FOR THE

PERIODED 30 JUNE 2023

Distributable reserves

--------------------------------- ---------------------

Capital Realised Unrealised

Share redemption capital capital Revenue Total distributable

GBP000 Note capital reserve reserve reserve reserve reserves Total

------------- ----------- ---------- -------- --------------------- -----------

At 1 January

2022 7,703 11,295 2,763,783 481,177 95,222 3,340,182 3,359,180

Total Comprehensive

Income:

Profit/(loss)

for the

year - - 56,607 (377,423) 78,171 (242,645) (242,645)

Transactions

with owners,

recorded

directly

to equity:

Ordinary

dividend

paid 7 - - - - (71,086) (71,086) (71,086)

Unclaimed

dividends

returned - - - - 27 27 27

Own shares

purchased (389) 389 (150,457) - - (150,457) (150,457)

At 31 December

2022 (audited) 7,314 11,684 2,669,933 103,754 102,334 2,876,021 2,895,019

--------------------- ---- -------- ------------- ----------- ---------- -------- --------------------- -----------

At 1 January

2022 7,703 11,295 2,763,783 481,177 95,222 3,340,182 3,359,180

Total Comprehensive

income

Profit/(loss)

for the

period - - 73,334 (463,053) 37,732 (351,987) (351,987)

Transactions

with owners,

recorded

directly

to equity:

Ordinary

dividend

paid 7 - - - - (35,673) (35,673) (35,673)

Unclaimed

dividends

returned - - - - 18 18 18

Own shares

purchased (259) 259 (100,322) - - (100,322) (100,322)

At 30 June

2022 7,444 11,554 2,736,795 18,124 97,299 2,852,218 2,871,216

--------------------- ---- -------- ------------- ----------- ---------- -------- --------------------- -----------

At 1 January

2023 7,314 11,684 2,669,933 103,754 102,334 2,876,021 2,895,019

Total Comprehensive

income

Profit for

the period - - 42,673 237,521 34,026 314,220 314,220

Transactions

with owners,

recorded

directly

to equity:

Ordinary

dividend

paid 7 - - - - (35,347) (35,347) (35,347)

Own shares

purchased (143) 143 (57,287) - - (57,287) (57,287)

------------- ----------- --------------------- -----------

At 30 June

2023 7,171 11,827 2,655,319 341,275 101,013 3,097,607 3,116,605

--------------------- ---- -------- ------------- ----------- ---------- -------- --------------------- -----------

The GBP341.3 million of Unrealised Capital reserve (GBP18.1

million at 30 June 2022 and GBP103.8 million at 31 December 2022)

arising on the revaluation of investments is subject to fair value

movements and may not be readily realisable at short notice. As

such it may not be entirely distributable. The capital reserve

includes movements on the unsecured fixed rate loans of GBP2.8

million (GBP38.3 million as at 30 June 2022 and GBP54.7 million at

31 December 2022) which are not distributable.

CONDENSED BALANCE SHEET (UNAUDITED) AS AT 30 JUNE 2023

30 June 31 December

GBP000 Note 2023 30 June 2022 2022 (audited)

----------- --------------- -----------------

Non-current assets

Investments held at fair value

through profit or loss 10 3,254,091 3,042,835 3,012,492

Right of use asset - 403 54

------------------------------------- ----------- --------------- -----------------

3,254,091 3,043,238 3,012,546

Current assets

Outstanding settlements and other

receivables 11,721 29,166 9,648

Cash and cash equivalents 63,702 73,547 88,864

------------------------------------- ----------- --------------- -----------------

75,423 102,713 98,512

Total assets 3,329,514 3,145,951 3,111,058

Current liabilities

Outstanding settlements and other

payables (9,033) (23,189) (9,344)

Bank loans 11 (63,500) (91,500) (63,500)

Lease liability - (250) (38)

------------------------------------- ----------- --------------- -----------------

(72,533) (114,939) (72,882)

Total assets less current

liabilities 3,256,981 3,031,012 3,038,176

Non-current liabilities

Unsecured fixed rate loan notes

held at fair value 11 (140,376) (159,549) (143,141)

Lease liability - (247) (16)

------------------------------------- ----------- --------------- -----------------

(140,376) (159,796) (143,157)

------------------------------------- ---- ----------- --------------- -----------------

Net assets 3,116,605 2,871,216 2,895,019

------------------------------------- ---- ----------- --------------- -----------------

Equity

Share capital 12 7,171 7,444 7,314

Capital redemption reserve 11,827 11,554 11,684

Capital reserve 2,996,594 2,754,919 2,773,687

Revenue reserve 101,013 97,299 102,334

------------------------------------- ----------- --------------- -----------------

Total equity 3,116,605 2,871,216 2,895,019

------------------------------------- ---- ----------- --------------- -----------------

All net assets are attributable

to the equity holders.

Net asset value per ordinary share

attributable to equity holders

Basic and diluted (GBP) 9 10.87 9.64 9.89

----------- --------------- -----------------

CONDENSED CASH FLOW STATEMENT (UNAUDITED) FOR THE PERIODED 30

JUNE 2023

Year to

6 months 6 months 31 December

to to 2022

GBP000 30 June 2023 30 June 2022 (audited)

--------------- --------------- --------------

Cash flows from operating activities

Profit/(loss) before tax 317,728 (348,189) (235,868)

Adjustments for:

(Gains)/losses on investments (289,726) 422,539 358,675

Gains on fair value of debt (2,765) (38,274) (54,682)

Foreign exchange losses/(gains) 3,284 (3,291) (486)

Depreciation - 101 174

Finance costs 4,253 4,068 8,625

Scrip dividends - (344) (503)

Operating cash flows before movements

in working capital 32,774 36,610 75,935

Increase in receivables (913) (5,010) (3,189)

Decrease in payables (1,303) (178) (1,153)

--------------------------------------------- --------------- --------------- --------------

Net cash inflow from operating activities

before income tax 30,558 31,422 71,593

Taxes paid (3,713) (4,280) (7,302)

--------------------------------------------- --------------- --------------- --------------

Net cash inflow from operating activities 26,845 27,142 64,291

Cash flows from investing activities

Proceeds on disposal at fair value of

investments through profit and loss 791,489 1,687,322 2,202,258

Purchases of fair value through profit

and loss investments (743,307) (1,504,000) (1,920,913)

Net cash inflow from investing activities 48,182 183,322 281,345

Cash flows from financing activities

Dividends paid -- equity (35,347) (35,673) (71,086)

Unclaimed dividends returned - 18 27

Purchase of own shares (56,654) (100,064) (149,033)

Repayment of bank debt - (89,000) (117,000)

Principal paid on lease liabilities - (126) (293)

Interest paid on lease liabilities - (11) (17)

Finance costs paid (4,904) (3,931) (8,435)

Net cash outflow from financing activities (96,905) (228,787) (345,837)

Net decrease in cash and cash equivalents (21,878) (18,323) (201)

Cash and cash equivalents at beginning

of period/year 88,864 88,579 88,579

Effect of foreign exchange rate changes (3,284) 3,291 486

--------------------------------------------- --------------- --------------- --------------

Cash and cash equivalents at the end

of period/year 63,702 73,547 88,864

--------------------------------------------- --------------- --------------- --------------

Notes to the financial statements

1 GENERAL INFORMATION

The information contained in this report for the period ended 30

June 2023 does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. A copy of the statutory

accounts for the year ended 31 December 2022 has been delivered to

the Registrar of Companies. The auditor's report on those financial

statements was prepared under s495 and s496 of the Companies Act

2006. The report was not qualified, did not contain an emphasis of

matter paragraph and did not contain statements under section

498(2) or (3) of the Companies Act.

The interim results are unaudited and have not been reviewed by

the Company's auditors. They should not be taken as a guide to the

full year.

2 ACCOUNTING POLICIES

Basis of preparation

These condensed interim financial statements for the six months

to 30 June 2023 have been prepared in accordance with IAS 34

'Interim financial reporting' and also in accordance with the

measurement and recognition principles of UK adopted international

accounting standards ('IASs') but are not the Company's statutory

accounts. They include comparators extracted from the Company's

statutory accounts but do not include all of the information

required for full annual financial statements and should be read in

conjunction with the 2022 Annual Report and Accounts, which were

prepared in accordance with the requirements of the Companies Act

2006 and in accordance with UK-adopted international accounting

standards. Those accounts have been reported on by the Company's

auditors and delivered to the Registrar of Companies. The report of

the auditor was (i) unqualified, (ii) did not include a reference

to any matters to which the auditor drew attention by way of

emphasis without qualifying their report and (iii) did not contain

a statement under section 498(2) or (3) of the Companies Act

2006.

The Association of Investment Companies ('AIC') issued a

Statement of Recommended Practice: Financial Statements of

Investment Companies ('SORP') in July 2022. The Directors have

sought to prepare the financial statements in accordance with the

AIC SORP where the recommendations are consistent with IFRS. The

Company qualifies as an investment entity.

Going concern

The Directors having assessed the principal and emerging risks

of the Company have, at the time of approving the financial

statements, a reasonable expectation that the Company has adequate

resources to continue in operational existence for at least 12

months from date of approval. The Company's assets, the majority of

which are investments in quoted equity securities and are readily

realisable, significantly exceed its liabilities. The Company's

bank loan facilities are due to expire on 16 December 2023, but

this does not impact the Company's ability to continue in

operational existence. They therefore continue to adopt the going

concern basis of accounting in preparing the financial statements.

The Company's business activities, together with the factors likely

to affect its future development and performance are set out in the

Strategic Report of the Annual Report for the financial year ended

31 December 2022.

Segmental reporting

The Company has identified a single operating segment, the

investment trust, which aims to maximise shareholders returns. As

such no segmental information has been included in these financial

statements.

Application of accounting policies

The same accounting policies, presentations and methods of

computation are followed in these financial statements as were

applied in the Company's annual audited financial statements for

the financial year ended 31 December 2022.

3 INCOME

Year to

6 months to 6 months to 31 December

GBP000 30 June 2023 30 June 2022 2022

Income from investments

Listed dividends -- UK 6,527 7,061 14,795

Listed dividends -- Overseas 35,059 39,666 80,135

41,586 46,727 94.930

----------------------------- ------------- ------------- ------------

Other income

Property rental income - 165 257

Other interest 515 12 323

Other income 1 3 11

516 180 591

----------------------------- ------------- ------------- ------------

Total income 42,102 46,907 95,521

----------------------------- ------------- ------------- ------------

4 INVESTMENT MANAGEMENT FEES

The fees paid to WTW include GBP7,251,000 for investment

management services, which is allocated 25% to revenue and 75% to

capital. A further fee of GBP638,000 for support services is

recorded directly to revenue.

5 FINANCE COSTS

6 months to 30 June 6 months to 30 June

2023 2022 Year to 31 December 2022

------------------------ ------------------------

GBP000 Revenue Capital Total Revenue Capital Total Revenue Capital Total

----------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Bank loans

interest and

associated

costs 385 1,155 1,540 237 712 949 583 1,750 2,333

4.28% unsecured

fixed rate

notes 528 1,585 2,113 535 1,605 2,140 1,070 3,210 4,280

2.657% unsecured

fixed rate

notes 66 198 264 66 198 264 133 399 532

2.936% unsecured

fixed rate

notes 73 219 292 73 219 292 147 440 587

2.897% unsecured

fixed rate

notes 72 216 288 72 216 288 145 435 580

Interest on lease

liabilities - - - 4 7 11 4 13 17

Other finance

costs (61) (183) (244) 31 93 124 74 222 296

Total 1,063 3,190 4,253 1,018 3,050 4,068 2,156 6,469 8,625

----------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

The Company attributes finance costs, 25% to revenue and 75% to

capital profits.

6 TAXATION

In the six months to 30 June 2023 the Company incurred a tax

charge of GBP3.5 million relating to withholding tax on dividends

received.

7 DIVIDS PAID

6 months to 6 months to Year to 31

GBP000 30 June 2023 30 June 2022 December 2022

2021 fourth interim dividend of

5.825p per share - 17,752 17,752

2022 first interim dividend of

6.000p per share - 17,921 17,921

2022 second interim dividend of

6.000p per share - - 17,791

2022 third interim dividend of

6.000p per share - - 17,622

2022 fourth interim dividend of

6.000p per share 17,498 - -

2023 first interim dividend of

6.180p per share 17,849 - -

35,347 35,673 71,086

-------------------------------- ------------- ------------- --------------

8 EARNINGS PER SHARE

6 months to 30 June 2023 6 months to 30 June 2022 Year to 31 December 2022

--------------------------------------------------------- -------------------------- ----------------------------- -----------------------------

GBP000 Revenue Capital Total Revenue Capital Total Revenue Capital Total

--------------------------------------------------------- ------- ------- -------- ------- --------- --------- ------- --------- ---------

Ordinary shares

Earnings for the purposes of basic earnings per share

being net profit attributable to equity holders 34,026 280,194 314,220 37,732 (389,719) (351,987) 78,171 (320,816) (242,645)

--------------------------------------------------------- ------- ------- -------- ------- --------- --------- ------- --------- ---------

Number of shares

Weighted average number of ordinary shares for the

purposes of:

---------------------------------------------------------------------------------------------------------------------------------------------------

Basic earnings per share 290,635,815 302,936,193 299,027,659

--------------------------------------------------------- -------------------------- ----------------------------- -----------------------------

Diluted earnings per share 290,635,815 302,936,655 299,027,937

--------------------------------------------------------- -------------------------- ----------------------------- -----------------------------

9 NET ASSET VALUE PER ORDINARY SHARE

The calculation of the net asset value per ordinary share is

based on the following:

30 June 30 June 31 December

GBP000 2023 2022 2022

Equity shareholder funds 3,116,605 2,871,216 2,895,019

Number of shares at period end -- Basic

and diluted 286,844,600 297,760,600 292,579,600

10 HIERARCHICAL VALUATION OF FINANCIAL INSTRUMENTS

Accounting Standards recognise a hierarchy of fair value

measurements, for financial instruments measured at fair value in

the Balance Sheet, which gives the highest priority to unadjusted

quoted prices in active markets for identical assets or liabilities

(Level 1) and the lowest priority to unobservable inputs (Level 3).

The classification of financial instruments depends on the lowest

significant applicable input.

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

Level 1 Unadjusted, fully accessible and current quoted prices

in active markets for identical assets or liabilities.

Included within this category are investments listed

on any recognised stock exchange.

Level 2 Quoted prices for similar assets or liabilities or

other directly or indirectly observable inputs which

exist for the period of investment. Examples of such

instruments would be forward exchange contracts and

certain other derivative instruments.