Alliance Trust PLC - Combination to form Alliance Witan PLC

THIS ANNOUNCEMENT AND THE INFORMATION

CONTAINED IN IT ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO, THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR

ANY JURISDICTION FOR WHICH THE SAME COULD BE

UNLAWFUL.

This announcement is not an offer to sell, or a

solicitation of an offer to acquire, securities in the United

States or in any other jurisdiction in which the same would be

unlawful. Neither this announcement nor any part of it shall form

the basis of or be relied on in connection with or act as an

inducement to enter into any contract or commitment whatsoever.

The information communicated in this

announcement is deemed to constitute inside information for the

purposes of Article 7 of the UK version of Regulation (EU) No.

596/2014 which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended (the Market Abuse Regulation).

The person responsible for arranging the release of this

announcement on behalf of Alliance Trust PLC is Paul Connolly of

Juniper Partners, Company Secretary and on behalf of Witan

Investment Trust plc is Andrew Ross, Chairman. Upon the publication

of this announcement, this information is considered to be in the

public domain.

26 June 2024

Alliance Trust PLC

Witan Investment Trust plc

Combination to form Alliance Witan

PLC

- Witan’s

assets to be rolled into Alliance Trust in exchange for issue of

new ordinary shares in the newly-named Alliance Witan PLC under

s.110 scheme of reconstruction.

- Alliance

Trust’s investment strategy, providing exclusive access to the best

ideas of leading active managers globally, remains

unchanged.

-

Introduction of a new, more competitive management fee

structure, coupled with the greater economies of scale on an

enlarged portfolio of approximately £5billion, is expected to

result in a lower Ongoing Charges Ratio, particularly for Witan

shareholders.

- Enhanced

third and fourth interim dividend payments for shareholders in the

enlarged Alliance Witan will extend the dividend hero status of

both companies.

- Witan

shareholders expected to benefit from an immediate uplift in market

value on completion of the transaction, and will have the option of

a partial cash exit.

- Combined

vehicle to offer improved secondary market liquidity, expected

eligibility for promotion to FTSE 100 Index in due

course.

- Assets to

be rolled over to Alliance Trust to include Witan’s listed

investment company holdings and Witan’s Secured Loan Notes will be

novated to Alliance Trust.

- Alliance

Trust’s investment manager, Willis Towers Watson, to make a

significant contribution to help absorb Transaction costs. Alliance

Trust shareholders are not expected to suffer any Net Asset Value

dilution from the direct costs of the Transaction; Witan

shareholders expected to suffer no or minimal Net Asset Value

dilution, depending upon the level of take-up of the cash exit

option.

- Deal,

expected to be completed in late Q3/early Q4 2024, preserves

distinguished heritages of both companies and represents the

largest ever conventional equity investment trust

combination.

Introduction

The boards of Alliance Trust PLC

(“Alliance Trust”) and Witan Investment Trust plc

(“Witan”) are pleased to announce that the

companies have entered into heads of terms for a combination of the

two companies to create Alliance Witan PLC (“Alliance

Witan”). This follows a comprehensive strategic review by

the board of Witan of its investment management arrangements.

The combination will build upon the distinctive

multi-manager investment model already employed by Alliance Trust -

utilising the proven management skills and deep resources of Willis

Towers Watson (“WTW”) to create an actively

managed global equity portfolio chosen by best-in-class stock

pickers - and will apply that methodology within an even more

liquid, high-profile and cost-efficient “one stop shop” investment

vehicle. With net assets of around £5 billion, significant

economies of scale, eligibility for FTSE 100 inclusion, powerful

and well-established brand recognition on both sides, and proven

marketing expertise backed by dedicated resources and budget,

Alliance Witan will aim to be the UK’s leading global equity

investment proposition, at the core of retail investors'

portfolios.

The combination will be undertaken through a

scheme of reconstruction by Witan under s110 of the Insolvency Act

1986, which will see Witan’s assets roll into Alliance Trust in

exchange for the issue of new Alliance Witan shares to the

continuing Witan shareholders (the “Transaction”).

Alliance Trust’s manager, WTW, will have overall responsibility for

managing the assets of the combined Alliance Witan, employing the

same proven approach as has been successfully utilised by Alliance

Trust since WTW’s appointment in 2017 – selecting a diverse team of

expert stock pickers, each of whom invests in a customised

selection of 10-20 of their ‘best ideas’.

Benefits of the combination

The combination is expected to result in

substantial benefits for both Alliance Trust and Witan

shareholders, as well as for future investors in Alliance

Witan:

-

Best-in-class investment management: The enlarged

portfolio will be invested in WTW’s successful multi-manager

strategy, providing access to best-in-class managers globally, many

of whom are not otherwise readily accessible by UK retail

investors. The investment proposition seeks to reduce relative risk

and volatility, meaning investors are not left vulnerable to the

underperformance risk concomitant with a single manager at the top

of its performance cycle. As at 31 May 2024, the Alliance Trust

portfolio consisted of selections by 10 stock pickers.

- Strong

investment performance track record: Over the seven-year

period since the appointment of WTW as manager of Alliance Trust at

the beginning of April 2017 to 31 March 2024, Alliance Trust’s NAV

total return was 104.2% against 95.7% for the MSCI All Country

World Index (Alliance Trust’s benchmark). Over the past three years

to the same date, its NAV total return was 39.7%, against 33.6% for

the MSCI All Country World Index.1

-

Attractive dividend yield and progressive dividend

policy: Alliance Witan will increase its third and fourth

interim dividends for the financial year ending 31 December 2024 so

that they are commensurate with the interim dividend payments

currently being paid to Witan shareholders. This is currently

estimated to represent an increase of 2.6% on the first Alliance

Trust interim dividend of the current financial year and a 7.1%

increase on the fourth Alliance Trust interim dividend for the year

ended 31 December 2023. Furthermore, it is anticipated that

Alliance Witan’s dividend for the financial year ending 31 December

2025 will be increased compared to the prior financial year such

that a Witan shareholder will continue to see a progression in

their income. This progressive dividend increase will represent a

fiftieth consecutive year of dividend increases for Witan

shareholders as the combination takes effect, and will extend

Alliance Trust’s unsurpassed record of increasing dividends for 57

years in a row.

- Large

scale and FTSE 100 inclusion: Alliance Witan is expected

to have net assets of more than £5 billion on completion of the

Transaction (based on the last published net asset values of the

two companies as at the date of this announcement). It is also

expected that Alliance Witan will be eligible for inclusion in the

FTSE 100 Index and will benefit from improved secondary market

liquidity.

- Lower

management fees: WTW has agreed a new management fee

structure for Alliance Witan (see further below) which will result

in an even more competitive blended fee rate for the combined

entity and its shareholders than is currently enjoyed by Alliance

Trust’s and Witan's respective shareholders.

- Lower

ongoing charges: The new management fee structure and the

economies of scale which the combination will bring will allow

Alliance Witan to target an ongoing charges basis points ratio in

the high 50s in future financial years2, an improvement

to both Witan’s and Alliance Trust's current ongoing charge ratios,

which are 76bps and 62bps, respectively.

-

Significant contribution to costs from WTW: WTW

has agreed to make a significant contribution to the costs of the

Transaction. The value of the contribution will be applied

initially to meet Alliance Trust’s direct transactional costs,

meaning that the Transaction is expected to be undertaken at zero

cost to existing Alliance Trust shareholders, with any excess

applied firstly to offset any remaining direct transactional costs

incurred by Witan, and then accruing for the benefit of

shareholders in the combined Alliance Witan.

- Tangible

economic upside for Witan’s shareholders: In addition to

the benefits detailed above, legacy Witan shareholders who roll

over into Alliance Witan will benefit from an immediate uplift in

the value of their shareholding to the extent that Alliance Trust

shares are trading at a tighter discount to net asset value. Witan

shareholders will also be given the opportunity to elect for a cash

exit at a price close to NAV, for some or all of their holding, as

part of Witan’s scheme of reconstruction. The benefit of the

discount on the cash exit will be applied first to Witan’s direct

transactional costs; and any amount remaining thereafter will be

for the benefit of all ongoing shareholders in Alliance Witan.

Continuing Witan shareholders are therefore expected to suffer

minimal or no dilution, depending upon the level of take-up of the

cash exit and any residual benefit flowing from the WTW cost

contribution.

The Transaction

The combination will be implemented through a

scheme of reconstruction pursuant to section 110 of the Insolvency

Act 1986, resulting in the voluntary liquidation of Witan and the

rollover of its assets (consisting of investments which are in

accordance with Alliance Trust's investment policy, investment

company holdings as well as futures, cash, cash equivalents and

other appropriate securities) and certain of its liabilities into

Alliance Witan in exchange for the issue of new shares in Alliance

Witan to the Witan shareholders who elect (or are deemed to have

elected) to roll over into Alliance Witan (the "Rollover

Option", which is the default option for the

Transaction).

Shareholders in Witan will have the option of

receiving cash in respect of some or all of their shares in Witan

at a price equal to 97.5% of the net asset value per Witan share,

less related asset realisation costs (the “Cash

Option”). The Cash Option will be limited to, in

aggregate, 17.5% of the Witan shares in issue (excluding treasury

shares) (the "Overall Limit"). Each Witan

shareholder may elect for the Cash Option in respect of more than

17.5% of their respective holding of Witan shares. However, if

aggregate elections for the Cash Option exceed the Overall Limit,

elections by Witan shareholders who have elected for the Cash

Option in excess of 17.5% of their respective shareholding will be

scaled back on a pro rata basis among Witan shareholders

who have made excess applications. Such shareholders will be deemed

to have elected for the Rollover Option in respect of the portion

of their application which is scaled back.

Conditional upon completion of the Transaction,

Alliance Witan will increase its third and fourth interim dividends

for the financial year ending 31 December 2024 so that they are

commensurate with the first interim dividend of 1.51p per share

paid to Witan shareholders earlier this month. In addition to this

first interim dividend, Witan shareholders will, in lieu of a

normal second interim dividend, receive an interim pre-liquidation

dividend, expected to be not less than 1.75 pence per share. This

is expected to be paid ahead of the scheme effective date and those

opting to roll over will then be entitled to all Alliance Witan

dividends declared post the scheme effective date. With the scheme

anticipated to become effective in late September/early October, it

is therefore envisaged that Alliance Witan’s third interim dividend

for the year ending 31 December 2024, to be paid in December 2024

to shareholders on the register in November 2024, will be the first

dividend to which former Witan shareholders will be entitled.

For illustrative purposes, on the basis of the

last published net asset values of Alliance Trust and Witan as at

the date of this announcement, each of Alliance Witan’s third and

fourth interim dividends would be approximately 6.79 pence per

share. For Witan shareholders, each of those dividends would be

equivalent to an estimated 1.51 pence per share prior to the

combination of the two companies; and would mean that the estimated

full year dividend (pre and post combination) for 2024 for current

Witan / future Alliance Witan shareholders would be equivalent to

approximately 6.28 pence per share (assuming a pre-liquidation

dividend by Witan of 1.75p per share), an increase of 4% over the

6.04 pence per share paid by Witan in respect of 2023. The

illustrative increase in Alliance Witan’s third and fourth

dividends per share would result in an aggregate dividend paid to a

current Alliance Trust / future Alliance Witan shareholder in

respect of the financial year ending 31 December 2024 amounting to

26.82 pence per share (a 6.4% increase over Alliance Trust’s

financial year ending 31 December 2023). This progressive dividend

increase will represent a fiftieth consecutive year of dividend

increases for Witan shareholders as the combination takes effect;

and will extend Alliance Trust’s unsurpassed record of increasing

dividends for 57 years in a row. It is anticipated that Alliance

Witan’s dividend for the financial year ending 31 December 2025

will be increased compared to 2024 such that Alliance Witan

shareholders from both backgrounds see a further rise in

income.

WTW, the investment manager of Alliance Trust,

has agreed to make a contribution (the “Manager

Contribution”) to the costs of the Transaction of an

amount equal to 52.375bps on the assets that roll into Alliance

Witan, amounting to approximately £7.4m (based on Witan’s last

published net asset value as at today’s date, and assuming the Cash

Option is fully exercised).

Each side will bear its own costs in relation to

the Transaction. The benefit of the Manager Contribution will be

first applied to Alliance Trust’s direct transactional costs, with

any excess applied to offset any remaining direct transactional

costs incurred by Witan. Any amount remaining thereafter will be

for the benefit of all shareholders in Alliance Witan, through an

offset against management fees incurred following the Transaction.

The benefit of the discount on the Cash Option will be first

applied to Witan’s direct transactional costs, with any excess

remaining thereafter again being for the benefit of all

shareholders in Alliance Witan.

New shares in Alliance Witan will be issued to

Witan shareholders on a Formula Asset Value

(“FAV”)-to-FAV basis. FAVs will be calculated

using the respective net asset values of each company as at the

relevant calculation date, adjusted for the costs of the

Transaction, the allocation of the benefit of both the Manager

Contribution and the discount on the Cash Option, any dividends and

distributions declared by either company but unpaid as at the date

of the FAV calculation, and taking account of the liquidator’s

retention (for Witan).

The agreed objective of the two companies is to

create a broadly balanced ongoing Board of Directors with strong

representation from both sides. Acknowledging the significant work

to be done in bringing the two companies together, the Alliance

Witan Board will initially comprise ten directors, with four

directors joining from the Witan Board. Dean Buckley, current Chair

of Alliance Trust, will be Chair and Andrew Ross, current Chair of

Witan, will be Deputy Chair. It is envisaged that the Board will

then reduce in size to a maximum of eight directors following the

next Annual General Meeting of Alliance Witan in April/May

2025.

New Management Fee

Structure

As part of the Transaction, and conditional upon

the Transaction being implemented, WTW has agreed a new management

fee structure pursuant to which WTW will be paid an annual fee for

its management services to Alliance Witan, calculated on a monthly

basis, as follows:

- 0.52% on the

first £2.5 billion of Alliance Witan’s market capitalisation;

- 0.49% on market

capitalisation between £2.5 billion and £5.0 billion; and

- 0.46% on market

capitalisation in excess of £5.0 billion.

The new management fee structure will apply on

completion of the Transaction. As part of the reformulation of the

structure, some allowances for external distribution services

including marketing and promotional activities not directly

undertaken by WTW, which were previously included within the

investment management fee paid to WTW, will no longer be

incorporated; and Alliance Witan will instead pay such costs

directly, giving the Board more flexibility in this area. This will

not result in any changes to the services offered to the Company by

WTW.

Expected Timetable

It is anticipated that documentation in

connection with the proposals will be posted to shareholders by the

end of August 2024, with a view to convening general meetings in

September 2024 and the Transaction being completed by late

September/early October. Completion of the Transaction will be

conditional upon, inter alia, approval from the

shareholders of both companies, Financial Conduct Authority

approval in relation to the publication by Alliance Trust of a

prospectus, the novation of the relevant Note Purchase Agreements

from Witan to Alliance Witan.

Dean Buckley, Chair of Alliance Trust,

commented:

“The formation of Alliance Witan brings

together the two leading open-architecture multi-manager investment

company propositions in the UK to form a FTSE 100 equity investment

vehicle with the quality, cost efficiency and profile to play a

leading role in the UK investment market. Shareholders will benefit

from access to the proven investment process implemented by our

investment manager, Willis Towers Watson, and access to the world’s

leading stock pickers. This is also a significant moment for our

industry in broader terms – Alliance Witan represents a key

milestone in the history of the investment trust structure which

has demonstrated its capabilities very effectively over many

decades.

Witan was an early adopter of the

multi-manager solution and, on behalf of my Board, we congratulate

Andrew Bell and his team on all that they have achieved during

their tenures. Combining our two historic companies, established in

1888 and 1909 respectively, recognises the attractive opportunity

to deploy the investment strategy, which has proved to be robust

through the investment cycle, at significantly greater

scale.”

Andrew Ross, Chairman of Witan, commented:

"Since Andrew Bell announced his intention

to retire, we have been through an extensive process to identify

the best candidate to take on the management of our shareholders’

assets. The Board assessed a number of very strong proposals,

including single-manager candidates with impressive track records.

However, the Board was unanimous in recommending the combination

with Alliance Trust, which allows the continuation of our multi

manager approach at lower fees and in a larger, more liquid

vehicle. The companies share similar cultures and a mutual desire

to provide a “one stop shop” for retail investors in global

equities. I am delighted to announce this transaction, the largest

ever investment trust combination, in Witan’s 100th year as a

quoted company on the London Stock Exchange. The deal will result

in one of the leading investment companies listed in London and

will stand our shareholders in good stead for many years to

come."

Enquiries

Alliance Trust PLC

Dean Buckley

|

|

Via Willis Towers

Watson or Juniper Partners |

Witan Investment Trust plc

Andrew Ross

|

|

Via J.P. Morgan

Cazenove

|

Willis Towers Watson

(Manager, Alliance Trust)

Mark Atkinson

|

|

+44 (0)7918

724303

|

Juniper Partners Limited

(Company Secretary, Alliance Trust)

|

|

+44 (0)131 378

0500

|

Investec Bank plc (Lead Financial Adviser, Sole Sponsor and

Corporate Broker to Alliance Trust)

David Yovichic, Tom Skinner, Lucy Lewis and Denis Flanagan

|

|

+44 (0)20 7597

4000

|

Dickson Minto Advisers LLP

(Joint Financial Adviser to Alliance Trust)

Douglas Armstrong

|

|

+44 (0)20 7649

6823

|

J.P. Morgan Cazenove (Financial Adviser and Corporate

Broker to Witan)

William Simmonds and Rupert Budge

|

|

+44 (0)20 3493

8000

|

Important Information

This announcement is not for publication or distribution, directly

or indirectly, in or into the United States of America. This

announcement is not an offer of securities for sale into the United

States. The securities referred to herein have not been and will

not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

1 Source: Willis Towers Watson. NAV total returns

calculated with debt valued at fair value. Total return

calculations assume dividend reinvestment as at the ex-dividend

date. Past performance is not a reliable indicator of future

results.

2 Based upon the last published net asset values of

Alliance Trust and Witan as at the date of this announcement. The

ongoing charges ratio for the financial year ending 31 December

2025 is expected to be materially below 60bps, reflecting the

management fee waiver to be provided by WTW to represent costs

contribution to the Transaction; without any management fee waiver,

the ongoing charges ratio for the next financial year is still

anticipated to be less than 60 bps.

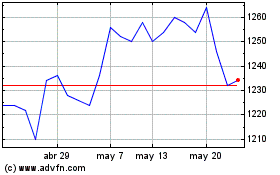

Alliance (LSE:ATST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alliance (LSE:ATST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024