TIDMAWE

RNS Number : 5853G

Alphawave IP Group PLC

20 July 2023

Q2 2023 Trading and Business Update

-- Expanded customer base with 8 new design wins, including 4

new custom silicon design wins and 4 IP licence design wins

-- First 3nm custom silicon design win with our 224G SerDes IP

-- Additional 3nm IP licencing design win and 3 chiplet-based design wins

-- Strong rate of quarterly design wins reflects the scalability of our technology

-- Management remains confident in the outlook for the business

-- China business in Q2 2023 represented less than 10% of new Licence and NRE business

LONDON, United Kingdom and TORONTO, Ontario, Canada 20 July 2023

- Alphawave IP Group plc (LN: AWE, the "Company" or "Alphawave

Semi"), a global leader in high-speed connectivity for the world's

technology infrastructure, is pleased to publish its trading and

business update for the three months ended 30 June 2023.

US$m Q2 2023 Q2 2022 Change

-------- -------- -------

Licence and NRE 47.7 19.0 150%

------------------------------------------- -------- -------- -------

Royalties and Silicon Orders 36.4 9.4 290%

------------------------------------------- -------- -------- -------

New Bookings (excluding VeriSilicon

and WiseWave multi-year subscription

licences) 84.1 28.4 196%

Additional design win activity - FSA

drawdowns and China re-sale licences[1] 3.4 9.5 -64%

WiseWave multi-year subscription licences - - nm

Due to rounding, numbers presented in the table may not add up

to the totals provided and percentages may not precisely reflect

the absolute figures.

Tony Pialis, President and Chief Executive Officer of Alphawave

Semi said: "We saw continued strong sales momentum during the

quarter for our leading connectivity technology. We achieved some

exciting new wins such as our first 3nm custom silicon coherent DSP

with our 224G SerDes IP enabling 800G/1.6T connectivity in data

centers, as well as a repeat design win on an AI accelerator.

Customers' demand for our high-performance IP and products supports

our strong pipeline. We are excited about the year ahead and the

long-term continued growth potential of our business."

John Lofton Holt, Executive Chairman of Alphawave Semi said:

"Our technology leadership in the most advanced technologies is

enabling our customers to develop next-generation AI silicon. We

continue making progress on the integration of the businesses we

acquired last year, and we remain focused on strong execution and

long-term value creation."

Key Highlights

New bookings in Q2 2023 were up 196% year-on-year from US$28.4m

to US$84.1m. North American customers represented over two-thirds

of the total bookings in the quarter.

Licence and Non-recurring Engineering ("NRE") bookings in Q2

2023 were up 150% year-on-year to US$47.7m. These bookings were

primarily driven by North American customers, including a 3nm

custom silicon design win with a leading optical module company and

a 3nm IP licencing design win with a leading industrial automation

business. Chinese customers[2] represented less than 10%.

Royalties and Silicon orders were US$36.4m, up 290% over Q2

2022. The level of silicon orders was driven by pre-existing custom

silicon designs for North American and Chinese customers including

a leading North American semiconductor device company and a North

American company focused on AI accelerators.

The level of bookings in the quarter reflects the scalability of

our technology through IP licensing and custom silicon. Our

vertically integrated business model enables the business to

generate larger revenue streams and capture the full value embedded

in our custom silicon offering. In parallel, our Connectivity

Products Group made good progress toward our plan to start

generating revenue in 2024.

Expanding Technology Leadership and Strong Customer Traction

Since 2017, the Company has demonstrated connectivity technology

leadership in leading-edge technologies, including the 3nm process.

In Q2 2023 we licenced our 3nm PCIe Generation 6 and controller IP

to a leading industrial North American business. Additionally, we

secured a repeat design on an AI accelerator with a North American

customer and three chiplet-based design wins. These design wins

reflect the increased market momentum of leading-edge connectivity

and chiplet architectures. The Company expects further design wins

in 3nm and continues to work with its foundry partners in 3nm and

beyond.

With our expanded IP portfolio, we are strongly positioned to

deliver complete connectivity solutions for our IP and custom

silicon customers. In Q2 2023, we achieved our first custom silicon

design win in 3nm for a coherent DSP solution using our 224G SerDes

IP enabling next- generation 800G/1.6T connectivity for data

centers.

During the quarter Alphawave Semi expanded its ongoing

collaboration with the leading foundries in the industry. The

Company announced the launch of its first connectivity silicon

platform on TSMC's most advanced 3nm process with its ZeusCORE

Extra-Long-Reach (XLR) 1-112Gbps NRZ/PAM4 serialiser-deserialiser

("SerDes") IP. The 3nm process platform is crucial for the

development of a new generation of advanced chips needed to cope

with the exponential growth in AI generated data, and enables

higher performance, enhanced memory and I/O bandwidth, and reduced

power consumption. This flexible and customizable connectivity IP

solution together with Alphawave Semi's chiplet-enabled custom

silicon platform which includes IO, memory and compute chiplets,

allows end-users to produce high-performance silicon specifically

tailored to their applications.

Alphawave Semi also announced the expansion of its ongoing

collaboration with Samsung to include the 3nm process node. Samsung

Foundry platform customers now benefit from Alphawave Semi's most

advanced high-performance connectivity IP and chiplet technologies,

including 112 Gigabits-per-second (Gbps) Ethernet and PCI Express

Gen6/CXL 3.0, interfaces to build the complex systems-on-a-chip

(SoCs) needed to keep pace with the rapidly growing demands of

data-intensive applications such as generative AI and the

associated infrastructure required by global data centers.

In Q2 2023, there were no Flexible Spending Accounts ([3])

("FSA") drawdowns (Q2 2022: US$5.6m) and US$3.4m of China

(VeriSilicon) reseller deals ([4]) (Q2 2022: US$3.9m). Both FSA and

reseller deals represent the conversion of customer commitments to

design wins.

Overall, design win activity in the quarter was strong with 8

new design wins, 6 from new end-customers and 2 from existing

end-customers.

Alphawave Semi has more than half of the top twenty

semiconductor device companies as customers[5], a reflection of its

continued strength in the data infrastructure markets that require

the world's most advanced connectivity technology.

Outlook

The outlook for 2023 remains unchanged. Alphawave Semi expects

2023 revenue of US$340m to US$360m and adjusted EBITDA of

approximately US$87m (or approximately 25% of revenue), which is at

the mid-point of the revenue guidance range.

Despite the uncertain macroeconomic environment, our growing

pipeline reflects positive secular growth trends in data

infrastructure markets and the continued investment in

next-generation AI- centric connectivity solutions. This, combined

with our talented team and strong balance sheet, give us confidence

in our future.

About Alphawave Semi

Alphawave Semi is a global leader in high-speed connectivity for

the world's technology infrastructure. Faced with the exponential

growth of data, Alphawave Semi's technology services a critical

need: enabling data to travel faster, more reliably and with higher

performance at lower power. We are a vertically integrated

semiconductor company, and our IP, custom silicon, and connectivity

products are deployed by global tier-one customers in data centers,

compute, networking, AI, 5G, autonomous vehicles, and storage.

Founded in 2017 by an expert technical team with a proven track

record in licensing semiconductor IP, our mission is to accelerate

the critical data infrastructure at the heart of our digital world.

To find out more about Alphawave Semi, visit: awavesemi.com

Related Party Disclosures

There are no new related parties disclosed in this press

release.

###

Trademarks

Alphawave Semi and the Alphawave Semi logo are trademarks of

Alphawave IP Group plc. All rights reserved. All registered

trademarks and other trademarks belong to their respective

owners.

Contact Information:

Alphawave Semi John Lofton Holt, Executive ir@awaveip.com

plc Chairman +44 (0) 20 7717 5877

Jose Cano, Head of IR

------------------ ---------------------------- -----------------------------

Brunswick Group Simone Selzer alphawave@brunswickgroup.com

Sarah West +44 (0) 20 7404 5959

---------------- ------------------------------ -----------------------------

Gravitate PR Lisette Paras alphawave@gravitatepr.com

Siddarth Nigam +1 415 420 8420

================== ============================ =============================

LEI: 213800ZXTO21EU4VMH37

[1] Both FSA (Flexible Spending Account) drawdowns and China

re-sale licences convert previously announced contractual

commitments included within bookings reported in prior periods to

new product design wins which will be recognised as revenue over

time.

[2] These Chinese customers are out of scope from the WiseWave

and VeriSilicon agreements.

[3] FSAs or Flexible Spending Accounts represent contracts with

customers who have committed to regular periodic payments. These

payments are not in respect of specific licences but can be used as

credit against future deliverables. FSA drawdowns represent the

design win value of transactions signed during the period, against

which FSA payments will be credited and will convert to revenue

over time.

[4] In February 2021, Alphawave IP signed a three-year exclusive

subscription reseller agreement with VeriSilicon with a minimum

value of US$54 million. Reseller deals represent the subsequent

licensing of IP by VeriSilicon to third parties in China and do not

constitute additional bookings for the Company as they are part of

the US$54 million minimum commitment.

([5]) Semiconductor device companies ranked on market

capitalisation as of 11.07.23.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFFFVLDRIALIV

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

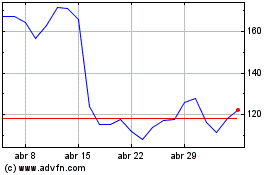

Alphawave Ip (LSE:AWE)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Alphawave Ip (LSE:AWE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024