RNS Number:9494S

American Express Co

23 October 2000

Contact: Michael J. O'Neill

212/640-5951

mike.o'neil@aexp.com

AMERICAN EXPRESS COMPANY REPORTS

QUARTERLY NET INCOME OF $737 MILLION

(millions, except per share amounts)

Quarter Ended Percentage Nine Months Percentage

September 30 Inc/(Dec) Ended Inc/(Dec)

September 30

2000 1999 2000 1999

Net Income $737 $ 648 14 % $ 2,133 $ 1,869 14%

Net Revenues* $5,554 $4,920 13 % $16,371 $14,256 15%

Per Share

Net Income

Basic $0.56 $0.48 17 % $ 1.61 $ 1.39 16%

Diluted $0.54 $0.47 15 % $ 1.57 $ 1.36 15%

Average Common

Shares

Outstanding

Basic 1,326 1,338 (1%) 1,328 1,341 (1%)

Diluted 1,361 1,369 (1%) 1,361 1,369 (1%)

Return on

Average

Equity 25.5% 25.3% - 25.5% 25.3% -

*Net revenues are presented on a managed basis.

NEW YORK, October 23, 2000 -- American Express Company today reported quarterly

net income of $737 million, up from $648 million in the same period a year ago.

Diluted earnings per share rose 15 percent to $0.54 compared with $0.47. Net

revenues on a managed basis totaled $5.6 billion, up 13 percent from $4.9

billion. The company's return on equity was 25.5 percent. These results

reflected strong earnings growth in all business segments, and met the company's

long-term targets of 12-15 percent earnings per share growth, at least 8 percent

growth in revenues and a return on equity of 18-20 percent.

Travel Related Services (TRS) reported record quarterly net income of $507

million, up 14 percent from $446 million in the third quarter a year ago.

The TRS segment now includes earnings from Travelers Cheque (TC) operations,

which were unchanged from year-ago levels. Excluding TC, net income for the

remaining TRS business rose 15 percent from last year's third quarter. TC

results had previously been included in the American Express Bank/TC segment.

TRS net revenues increased 14 percent, reflecting higher billed business as well

as strong growth in Cardmember loans. These improvements resulted from an

increase of 5.6 million cards in force, up 13 percent from a year ago, and

higher average spending per Cardmember. The higher spending was driven by

several factors, including rewards programs and expanded merchant coverage. The

net interest yield on Cardmember loans decreased from a year ago, but increased

from second quarter levels. The year-to-year decline mainly reflects a higher

percentage of loan balances on lower-rate products. Other revenues increased,

primarily reflecting higher fee income.

The provision for losses on the charge card and lending portfolios rose from the

prior year as a result of higher volume, partly offset by improvement in credit

quality in the lending portfolio. Charge Card interest expense grew as a result

of higher volumes and an increased cost of funds. Other operating expenses rose,

reflecting in part the cost of Cardmember loyalty programs, business growth and

investment spending.

The above discussion presents TRS results "on a managed basis" as if there had

been no securitization transactions, which conforms to industry practice. The

attached financials present TRS results on both a managed and reported basis.

Net income is the same in both formats.

On a reported basis, TRS results for the third quarter of 2000 included a

securitization gain of $26 million ($17 million after-tax), compared with a

similar gain of $55 million ($36 million after-tax) a year ago. These gains were

offset by higher expenses related to card acquisition activities and therefore

had no material impact on net income or total expenses.

American Express Financial Advisors (AEFA) reported quarterly net income of $269

million, up 12 percent from $240 million a year ago.

Net revenues and earnings growth benefited from higher fee revenues due to an

increase in managed assets, which was partially offset by narrower spreads on

the investment portfolio. This increase reflected positive net sales and market

appreciation over the past 12 months. AEFA reported increases in sales of mutual

funds, annuities, and life and other insurance products. Human resources

expenses rose primarily as a result of an increase in financial advisors'

compensation, which reflected growth in sales and asset levels, the new advisor

platforms, and an increase in the total number of financial advisors.

American Express Bank (AEB) reported quarterly net income of $7 million compared

with $5 million a year ago.

Results for the current quarter reflect greater commission and fee revenues and

lower operating expenses, reflecting savings from reengineering initiatives.

These were partially offset by a decline in net interest income, mainly due to

higher funding costs.

Corporate and Other reported net expenses of $46 million, compared with $43

million a year ago.

American Express Company (http://www.americanexpress.com), founded in 1850, is a

global travel, financial and network services provider.

Note: The 2000 Third Quarter Earnings Supplement will be available on the

American Express Web site at http://ir.americanexpress.com. In addition, an

investor conference call to discuss third quarter earnings results, operating

performance and other topics that may be raised during the discussion will be

held at 5 p.m. ET today. A live webcast of the conference call will be

accessible at the American Express Web site at http://ir.americanexpress.com. A

replay of the conference call will be available from October 23 through October

30 at the same Web address.

(Preliminary)

American Express Company

Financial Summary

(Unaudited)

(Dollars in millions)

Quarters Ended

September 30 Percentage

2000 1999 Inc/(Dec)

Net Revenues (Managed Basis)(A)

Travel Related Services $ 4,400 $ 3,864 14 %

American Express Financial

Advisors 1,052 936 12

American Express Bank 146 157 (7)

5,598 4,957 13

Corporate and Other,

including adjustments and

eliminations (44) (37) (21)

CONSOLIDATED NET REVENUES

(MANAGED BASIS)(A) $ 5,554 $ 4,920 13

Pretax Income

Travel Related Services $ 721 $ 630 14

American Express Financial

Advisors 387 350 10

American Express Bank 8 6 33

1,116 986 13

Corporate and Other (87) (79) (8)

PRETAX INCOME $ 1,029 $ 907 14

Net Income

Travel Related Services $ 507 $ 446 14

American Express Financial

Advisors 269 240 12

American Express Bank 7 5 60

783 691 13

Corporate and Other (46) (43) (7)

NET INCOME $ 737 $ 648 14

Nine Months Ended

September 30 Percentage

2000 1999 Inc/(Dec)

Net Revenues (Managed Basis)(A)

Travel Related Services $ 12,898 $ 11,125 16 %

American Express Financial

Advisors 3,153 2,738 15

American Express Bank 447 474 (6)

16,498 14,337 15

Corporate and Other,

including adjustments and

eliminations (127) (81) (57)

CONSOLIDATED NET REVENUES

(MANAGED BASIS)(A) $ 16,371 $ 14,256 15

Pretax Income

Travel Related Services $ 2,073 $ 1,815 14

American Express Financial

Advisors 1,138 1,015 12

American Express Bank 26 21 23

3,237 2,851 14

Corporate and Other (242) (258) 7

PRETAX INCOME $ 2,995 $ 2,593 16

Net Income

Travel Related Services $ 1,460 $ 1,286 14

American Express Financial

Advisors 790 696 13

American Express Bank 22 18 24

2,272 2,000 14

Corporate and Other (139) (131) (6)

NET INCOME $ 2,133 $ 1,869 14

(A) Managed net reserves are reported net of interest expense, where applicable,

and American Express Financial Advisors' provision for losses and benefits, and

exclude the effect of TRS' securitization activities.

(Preliminary)

Quarters Ended

September 30 Percentage

2000 1999 Inc/(Dec)

EARNINGS PER SHARE

Basic

Earnings Per Common Share $ 0.56 $ 0.48 17 %

Average common shares

outstanding (millions) 1,326 1,338 (1)

Diluted

Earnings Per Common Share $ 0.54 $ 0.47 15

Average common shares

outstanding (millions) 1,361 1,369 (1)

Cash dividends declared

per common share $ 0.08 $ 0.075 7

Nine Months Ended

September 30 Percentage

2000 1999 Inc/(Dec)

EARNINGS PER SHARE

Basic

Earnings Per Common Share $ 1.61 $ 1.39 16 %

Average common shares

outstanding (millions) 1,328 1,341 (1)

Diluted

Earnings Per Common Share $ 1.57 $ 1.36 15

Average common shares

outstanding (millions) 1,361 1,369 (1)

Cash dividends declared

per common share $ 0.24 $ 0.225 7

Selected Statistical Information

(Unaudited)

Quarters Ended

September 30 Percentage

2000 1999 Inc/(Dec)

Return on Average Equity* 25.5% 25.3% -

Common Shares Outstanding(millions) 1,329 1,343 (1) %

Book Value per Common Share:

Actual $ 8.44 $ 7.26 16 %

Pro Forma* $ 8.68 $ 7.47 16 %

Shareholders' Equity (billions) $ 11.2 $ 9.7 15 %

Nine Months Ended

September 30 Percentage

2000 1999 Inc/(Dec)

Return on Average Equity* 25.5% 25.3% -

Common Shares Outstanding(millions) 1,329 1,343 (1) %

Book Value per Common Share:

Actual $ 8.44 $ 7.26 16 %

Pro Forma* $ 8.68 $ 7.47 16 %

Shareholders' Equity (billions) $ 11.2 $ 9.7 15 %

* Excludes the effect of SFAS No. 115

(Preliminary)

Financial Summary

(Unaudited)

(Dollars in millions)

Quarters Ended

Sept 30 June 30 March 31 Dec 31 Sept 30

2000 2000 2000 1999 1999

Net Revenues(Managed

Basis)(A)

Travel Related

Services $ 4,400 $ 4,372 $ 4,127 $ 4,109 $ 3,864

American Express

Financial Advisors 1,052 1,081 1,019 999 936

American Express

Bank 146 151 150 147 157

5,598 5,604 5,296 5,255 4,957

Corporate and Other,

including adjustments

and eliminations (44) (46) (37) (28) (37)

CONSOLIDATED NET

REVENUES (MANAGED

BASIS)(A) $ 5,554 $ 5,558 $ 5,259 $ 5,227 $ 4,920

Pretax Income

Travel Related

Services $ 721 $ 721 $ 631 $ 567 $ 630

American Express

Financial Advisors 387 397 355 347 350

American Express

Bank 8 10 8 6 6

1,116 1,128 994 920 986

Corporate and Other (87) (82) (74) (76) (79)

PRETAX INCOME $ 1,029 $ 1,046 $ 920 $ 844 $ 907

Net Income

Travel Related

Services $ 507 $ 505 $ 448 $ 406 $ 446

American Express

Financial Advisors 269 275 245 238 240

American Express Bank 7 7 7 4 5

783 787 700 648 691

Corporate and Other (46) (47) (44) (42) (43)

NET INCOME $ 737 $ 740 $ 656 $ 606 $ 648

(A) Managed net revenues are reported net of interest expense, where applicable,

and American Express Financial Advisors' provision for losses and benefits, and

exclude the effect of TRS' securitization activities.

(Preliminary) Financial Summary

(Unaudited)

Quarters Ended

Sept 30 June 30 March 31 Dec 31 Sept 30

2000 2000 2000 1999 1999

EARNINGS PER SHARE

Basic

Earnings Per Common $ 0.56 $ 0.56 $ 0.49 $ 0.45 $ 0.48

Share

Average common shares

outstanding (millions) 1,326 1,328 1,331 1,335 1,338

Diluted

Earnings Per Common

Share $ 0.54 $ 0.54 $ 0.48 $ 0.44 $ 0.47

Average common shares

outstanding(millions) 1,361 1,361 1,362 1,369 1,369

Cash dividends declared $ 0.08 $ 0.08 $ 0.08 $ 0.075 $ 0.075

per common share

Selected Statistical Information

(Unaudited)

Quarters Ended

September, 30 June 30, March 31, December 31, September 30,

2000 2000 2000 1999 1999

Return on Average

Equity* 25.5% 25.5% 25.4% 25.3% 25.3%

Common Shares

Outstanding

(millions) 1,329 1,333 1,334 1,341 1,343

Book Value per

Common Share:

Actual $ 8.44 $ 7.88 $ 7.69 $ 7.52 $ 7.26

Pro Forma* $ 8.68 $ 8.26 $ 7.96 $ 7.74 $ 7.47

Shareholders'

Equity

(billions) $ 11.2 $ 10.5 $ 10.3 $ 10.1 $ 9.7

* Excludes the effect of SFAS No. 115.

(Preliminary) Travel Related Services

Statements of Income

(Unaudited, Managed Basis)

(Dollars in millions)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Net Revenues:

Discount Revenue $ 1,963 $ 1,700 15.5%

Net Card Fees 420 399 5.3

Lending:

Finance Charge Revenue 1,052 747 40.8

Interest Expense 429 246 74.8

Net Finance Charge Revenue 623 501 24.2

Travel Commissions and Fees 433 448 (3.2)

TC Investment Income 103 91 12.5

Other Revenues 858 725 18.5

Total Net Revenues 4,400 3,864 13.9

Expenses:

Marketing and Promotion 358 349 2.5

Provision for Losses and Claims:

Charge Card 273 247 10.6

Lending 386 312 23.8

Other 29 17 63.9

Total 688 576 19.4

Charge Card Interest Expense 362 259 40.2

Human Resources 1,017 985 3.2

Other Operating Expenses 1,254 1,065 17.8

Total Expenses 3,679 3,234 13.8

Pretax Income 721 630 14.4

Income Tax Provision 214 184 16.7

Net Income $ 507 $ 446 13.5

These Statements of Income are provided on a Managed Basis for analytical

purposes only.

They present the income statement of TRS as if there had been no securitization

transactions.

Under Statement of Financial Accounting Standards No. 125 (SFAS No. 125), which

prescribes the accounting for securitized receivables, TRS recognized pretax

gains of $26 million ($17 million after-tax) and $55 million ($36 million

after-tax) in the third quarters of 2000 and 1999, respectively, related to the

securitization of U.S. receivables. These gains were invested in additional card

acquisition activities and had no material impact on Net Income or Total

Expenses in either quarter. For purposes of this presentation such gains and

corresponding increases in Marketing and Promotion and Other Operating Expenses

have been eliminated in each quarter.

(Preliminary) Travel Related Services

Statements of Income

(Unaudited, GAAP Reporting Basis)

(Dollars in millions)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Net Revenues:

Discount Revenue $ 1,963 $ 1,700 15.5%

Net Card Fees 418 395 5.8

Lending:

Finance Charge Revenue 504 513 (1.9)

Interest Expense 272 165 64.4

Net Finance Charge

Revenue 232 348 (33.3)

Travel Commissions and Fees 433 448 (3.2)

TC Investment Income 103 91 12.5

Other Revenues 1,190 841 41.5

Total Net Revenues 4,339 3,823 13.5

Expenses:

Marketing and Promotion 373 382 (2.3)

Provision for Losses and

Claims:

Charge Card 236 222 6.5

Lending 267 187 43.1

Other 29 17 63.9

Total 532 426 24.9

Charge Card Interest Expense 312 208 50.5

Net Discount Expense 119 105 13.3

Human Resources 1,017 985 3.2

Other Operating Expenses 1,265 1,087 16.3

Total Expenses 3,618 3,193 13.3

Pretax Income 721 630 14.4

Income Tax Provision 214 184 16.7

Net Income $ 507 $ 446 13.5

(Preliminary) Travel Related Services

Selected Statistical Information

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Total Cards in Force (millions):

United States 32.9 29.2 12.7%

Outside the United States 17.5 15.6 12.6

Total 50.4 44.8 12.6

Basic Cards in Force (millions):

United States 25.8 22.9 12.7

Outside the United States 13.4 12.0 11.6

Total 39.2 34.9 12.3

Card Billed Business:

United States $ 56.2 $ 47.1 19.4

Outside the United States 18.6 17.0 9.7

Total $ 74.8 $ 64.1 16.8

Average Discount Rate (A) 2.70% 2.73% -

Average Basic Cardmember

Spending (dollars) (A) $ 2,041 $ 1,935 5.5

Average Fee per Card-Managed

(dollars) (A) $ 36 $ 38 (5.3)

Non-Amex Brand (B):

Cards in Force (millions) 0.6 0.2 +

Billed Business $ 0.8 $ 0.2 +

Travel Sales $ 5.4 $ 5.5 (1.6)

Travel Commissions and Fees/

Sales (C) 8.0% 8.1% -

Travelers Cheque:

Sales $ 7.7 $ 7.3 5.0

Average Outstanding $ 6.9 $ 6.5 6.3

Average Investments $ 6.7 $ 6.2 6.5

Tax Equivalent Yield 8.8% 8.8% -

Total Debt $ 35.2 $ 30.8 14.2

Shareholder's Equity $ 6.3 $ 5.7 10.5

Return on Average Equity (D) 32.6% 30.5% -

Return on Average Assets (D) 3.0% 3.1% -

(A) Computed from proprietary card activities only.

(B) This data relates to Visa and Eurocards issued in connection with joint

venture activities.

(C) Computed from information provided herein.

(D) Excluding the effect of SFAS NO. 115.

+ Denotes variance of more than 100%.

(Preliminary) Travel Related Services

Selected Statistical Information (continued)

(Unaudited, Managed Basis)

(Amounts in billions, except percentages and where indicated)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Charge Card Receivables:

Total Receivables $ 28.1 $ 25.3 11.0%

90 Days Past Due as a % of Total 2.3% 2.5% -

Loss Reserves (millions) $ 987 $ 907 8.8

% of Receivables 3.5% 3.6% -

% of 90 Days Past Due 152% 144% -

Net Loss Ratio 0.37% 0.41% -

U.S. Cardmember Lending:

Total Loans $ 27.1 $ 20.6% 31.7

Past Due Loans as a % of Total:

30-89 Days 1.8% 2.0% -

90+ Days 0.8% 0.8% -

Loss Reserves (millions):

Beginning Balance $ 686 $ 602 13.9

Provision 328 264 24.2

Net Charge-Offs/Other (283) (230) 22.8

Ending Balance $ 731 $ 636 15.0

% of Loans 2.7% 3.1% -

% of Past Due 103% 111% -

Average Loans $ 26.6 $ 19.8 34.8

Net Write-Off Rate 4.3% 4.7% -

Net Interest Yield 7.8% 8.5% -

(Preliminary) Travel Related Services

Statements of Income

(Unaudited, Managed Basis)

(Dollars in millions)

Quarters Ended

September June March December September

30, 2000 30, 2000 31, 2000 31, 1999 30, 1999

Net Revenues:

Discount Revenue $ 1,963 $ 1,949 $ 1,805 $ 1,865 $ 1,700

Net Card Fees 420 411 405 408 399

Lending:

Finance Charge

Revenue 1,052 948 887 802 747

Interest Expense 429 385 332 302 246

Net Finance Charge

Revenue 623 563 555 500 501

Travel Commissions

and Fees 433 507 438 459 448

TC Investment Income 103 98 91 88 91

Other Revenues 858 844 833 789 725

Total Net Revenues 4,400 4,372 4,127 4,109 3,864

Expenses:

Marketing and Promotion 358 345 331 344 349

Provision for Losses

and Claims:

Charge Card 273 344 278 227 247

Lending 386 332 335 332 312

Other 29 28 29 24 17

Total 688 704 642 583 576

Charge Card Interest

Expense 362 350 314 300 259

Human Resources 1,017 1,048 1,016 1,033 985

Other Operating

Expenses 1,254 1,204 1,193 1,282 1,065

Total Expenses 3,679 3,651 3,496 3,542 3,234

Pretax Income 721 721 631 567 630

Income Tax Provision 214 216 183 161 184

Net Income $ 507 $ 505 $ 448 $ 406 $ 446

These Statements of Income are provided on a Managed Basis for analytical

purposes only. They present the income statements of TRS as if there had been no

securitization transactions. Under Statement of Financial Accounting Standards

No. 125 (SFAS No. 125), which prescribes the accounting for securitized

receivables, TRS recognized pretax gains of $26 million ($17 million after-tax)

in the third quarter of 2000, $80 million ($52 million after-tax) in the second

quarter of 2000, $36 million ($23 million after-tax) in the first quarter of

2000 and $55 million ($36 million after-tax) in the third quarter of 1999,

related to the securitization of U.S. receivables. These gains were invested in

additional card acquisition activities and had no material impact on Net Income

or Total Expenses in any quarter. For purposes of this presentation such gains

and corresponding increases in Marketing and Promotion and Other Operating

Expenses have been eliminated in each quarter.

(Preliminary) Travel Related Services

Statements of Income

(Unaudited, GAAP Reporting Basis)

(Dollars in millions)

Quarters Ended

September June March December September

30, 2000 30, 2000 31, 2000 31, 1999 30, 1999

Net Revenues:

Discount Revenue $ 1,963 $ 1,949 $ 1,805 $ 1,865 $ 1,700

Net Card Fees 418 411 405 408 395

Lending:

Finance Charge

Revenue 504 500 524 526 513

Interest Expense 272 258 231 197 165

Net Finance

Charge Revenue 232 242 293 329 348

Travel Commissions

and Fees 433 507 438 459 448

TC Investment Income 103 98 91 88 91

Other Revenues 1,190 1,117 1,006 902 841

Total Net Revenues 4,339 4,324 4,038 4,051 3,823

Expenses:

Marketing and

Promotion 373 393 352 344 382

Provision for Losses

and Claims:

Charge Card 236 302 241 213 222

Lending 267 170 175 241 187

Other 29 28 29 24 17

Total 532 500 445 478 426

Charge Card Interest

Expense 312 295 260 246 208

Net Discount Expense 119 131 126 101 105

Human Resources 1,017 1,048 1,016 1,033 985

Other Operating

Expenses 1,265 1,236 1,208 1,282 1,087

Total Expenses 3,618 3,603 3,407 3,484 3,193

Pretax Income 721 721 631 567 630

Income Tax Provision 214 216 183 161 184

Net Income $ 507 $ 505 $ 448 $ 406 $ 446

(Preliminary) Travel Related Services

Selected Statistical Information

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarters Ended

September June March December September

30, 2000 30, 2000 31, 2000 31, 1999 30, 1999

Total Cards in

Force (millions):

United States 32.9 32.5 31.4 29.9 29.2

Outside the

United States 17.5 16.9 16.5 16.1 15.6

Total 50.4 49.4 47.9 46.0 44.8

Basic Cards in

Force (millions):

United States 25.8 25.3 24.5 23.4 22.9

Outside the

United States 13.4 12.9 12.6 12.3 12.0

Total 39.2 38.2 37.1 35.7 34.9

Card Billed Business:

United States $ 56.2 $ 55.8 $ 50.6 $ 51.7 $ 47.1

Outside the

United States 18.6 18.7 17.7 19.1 17.0

Total $ 74.8 $ 74.5 $ 68.3 $ 70.8 $ 64.1

Average Discount

Rate (A) 2.70% 2.69% 2.72% 2.71% 2.73%

Average Basic

Cardmember

Spending

(dollars) (A) $ 2,041 $ 2,085 $ 1,980 $ 2,102 $ 1,935

Average Fee per

Card - Managed

(dollars) (A) $ 36 $ 36 $ 37 $ 38 $ 38

Non-Amex Brand (B):

Cards in Force

(millions) 0.6 0.6 0.6 0.3 0.2

Billed Business $ 0.8 $ 0.7 $ 0.5 $ 0.2 $ 0.2

Travel Sales $ 5.4 $ 6.2 $ 5.5 $ 5.6 $ 5.5

Travel Commissions

and Fees/Sales (C) 8.0% 8.2% 8.0% 8.2% 8.1%

Travelers Cheque:

Sales $ 7.7 $ 6.7 $ 5.1 $ 5.4 $ 7.3

Average Outstanding $ 6.9 $ 6.5 $ 6.1 $ 6.1 $ 6.5

Average Investments $ 6.7 $ 6.2 $ 6.0 $ 5.9 $ 6.2

Tax Equivalent Yield 8.8% 8.9% 8.9% 8.8% 8.8%

Total Debt $ 35.2 $ 31.1 $ 33.9 $ 35.7 $ 30.8

Shareholder's Equity $ 6.3 $ 6.0 $ 5.8 $ 5.5 $ 5.7

Return on Average

Equity (D) 32.6% 32.2% 31.6% 31.2% 30.5%

Return on Average

Assets (D) 3.0% 3.0% 3.0% 3.1% 3.1%

(A) Computed from proprietary card activities only.

(B) This data relates to Visa and Eurocards issued in connection with joint

venture activities.

(C) Computed from information provided herein.

(D) Excluding the effect of SFAS No. 115.

(Preliminary) Travel Related Services

Selected Statistical Information (continued)

(Unaudited, Managed Basis)

(Amounts in billions, except percentages and where indicated)

Quarters Ended

September June March December September

30, 2000 30, 2000 31, 2000 31, 1999 30, 1999

Charge Card

Receivables:

Total

Receivables: $ 28.1 $ 27.4 $ 26.8 $ 27.0 $ 25.3

90 Days Past

Due as a %

of Total 2.3% 2.4% 2.6% 2.5% 2.5%

Loss Reserves

(millions) $ 987 $ 986 $ 894 $ 857 $ 907

% of Receivables 3.5% 3.6% 3.3% 3.2% 3.6%

% of 90 Days

Past Due 152% 153% 129% 126% 144%

Net Loss Ratio 0.37% 0.36% 0.34% 0.40% 0.41%

U.S. Cardmember

Lending:

Total Loans $ 27.1 $ 25.9 $ 24.2 $ 23.4 $ 20.6

Past Due Loans

as a % of Total:

30-89 Days 1.8% 1.6% 1.8% 1.8% 2.0%

90+ Days 0.8% 0.8% 0.8% 0.8% 0.8%

Loss Reserves

(millions):

Beginning

Balance $ 686 $ 689 $ 672 $ 636 $ 602

Provision 328 268 285 277 264

Net Charge-

Offs/Other (283) (271) (268) (241) (230)

Ending Balance $ 731 $ 686 $ 689 $ 672 $ 636

% of Loans 2.7% 2.6% 2.8% 2.9% 3.1%

% of Past Due 103% 109% 109% 110% 111%

Average Loans $ 26.6 $ 25.2 $ 23.6 $ 21.7 $ 19.8

Net Write-Off Rate 4.3% 4.4% 4.6% 4.5% 4.7%

Net Interest Yield 7.8% 7.4% 7.8% 7.7% 8.5%

(Preliminary) American Express Financial Advisors

Statements of Income

(Unaudited)

(Dollars in millions)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Net Revenues:

Investment Income $ 582 $ 566 2.8%

Management and Distribution

Fees 700 578 21.0

Other Revenues 259 224 15.6

Total Revenues 1,541 1,368 12.6

Provisions for Losses and

Benefits:

Annuities 254 251 1.0

Insurance 146 135 8.2

Investment Certificates 89 46 94.4

Total 489 432 13.1

Net Revenues 1,052 936 12.4

Expenses:

Human Resources 527 456 15.5

Other Operating Expenses 138 130 6.8

Total Expenses 665 586 13.6

Pretax Income 387 350 10.3

Income Tax Provision 118 110 6.8

Net Income $ 269 $ 240 12.0

(Preliminary American Express Financial Advisors

Selected Statistical Information

(Unaudited)

(Dollars in millions, except where indicated)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Investments (billions) $ 30.0 $ 30.7 (2.5)%

Client Contract Reserves

(billions) $ 31.0 $ 31.0 0.1

Shareholder's Equity

(billions) $ 4.2 $ 3.9 8.1

Return on Average Equity* 23.1% 22.8% -

Life Insurance in Force

(billions) $ 95.8 $ 86.3 11.0

Assets Owned, Managed or

Administered(billions):

Assets Managed for

Institutions $ 55.9 $ 48.2 15.9

Assets Owned,Managed or

Administered for Individuals:

Owned Assets:

Separate Account Assets 36.6 28.9 26.8

Other Owned Assets 40.6 38.1 6.4

Total Owned Assets 77.2 67.0 15.2

Managed Assets 122.0 99.5 22.7

Administered Assets 38.0 21.1 80.3

Total $ 293.1 $ 235.8 24.3

Market Appreciation

(Depreciation) During

the period:

Owned Assets:

Separate Account Assets $ (203) $ (986) 79.4

Other Owned Assets $ 163 $ (273) -

Total Managed Assets $ (76) $ (5,318) 98.6

Cash Sales:

Mutual Funds $ 11,698 $ 8,304 40.9

Annuities 1,465 1,190 23.2

Investment Certificates 868 1,061 (18.2)

Life and Other Insurance

Products 220 196 12.1

Institutional 1,169 909 28.6

Other 815 953 (14.6)

Total Cash Sales $ 16,235 $ 12,613 28.7

Number of Financial Advisors 12,137 10,631 14.2

Fees from Financial Plans &

Advice Services $ 26.1 $ 22.3 16.9

Percentage of Total Sales

from Financial Plans and

Advice Services 69.2% 67.7% -

*Excluding the effect of SFAS No. 115.

Note: In the first quarter of 2000, reporting of data related to cash sales

and assets owned, managed and administered was revised to better reflect

AEFA's multiple sales channel strategy and broadening of its product

portfolio through additional non-proprietary offerings.

(Preliminary) American Express Financial Advisors

Statements of Income

(Dollars in millions) (Unaudited)

Quarters Ended

September June March December September

30, 30, 31, 31, 30,

2000 2000 2000 1999 1999

Net Revenues:

Investment Income $ 582 $ 592 $ 572 $ 668 $ 566

Management&

Distribution Fees 700 701 688 616 578

Other Revenues 259 248 246 245 224

Total Revenues 1,541 1,541 1,506 1,529 1,368

Provision for Losses

& Benefits:

Annuities 254 254 259 276 251

Insurance 146 138 139 130 135

Investment Certificates 89 68 89 124 46

Total 489 460 487 530 432

Net Revenues 1,052 1,081 1,019 999 936

Expenses:

Human Resources 527 528 498 443 456

Other Operating Expenses 138 156 166 209 130

Total Expenses 665 684 664 652 586

Pretax Income 387 397 355 347 350

Income Tax Provision 118 122 110 109 110

Net Income $ 269 $ 275 $ 245 $ 238 $ 240

(Preliminary) American Express Financial Advisors

Selected Statistical Information

(Unaudited)

(Dollars in millions, except where indicated)

Quarters Ended

September June March December September

30, 30, 31 31, 30,

2000 2000 2000 1999 1999

Investments (billions) $ 30.0 $ 30.0 $ 30.3 $ 30.3 $ 30.7

Client Contract Reserves

(billions) $ 31.0 $ 31.0 $ 31.0 $ 31.0 $ 31.0

Shareholder's Equity

(billions) $ 4.2 $ 4.0 $ 3.9 $ 3.9 $ 3.9

Return on Average

Equity* 23.1% 23.1% 23.0% 22.9% 22.8%

Life Insurance in

Force (billions) $ 95.8 $ 93.8 $ 91.7 $ 89.2 $ 86.3

Assets Owned, Managed or

Administered(billions):

Assets Managed for

Institutions $ 55.9 $ 56.1 $ 57.4 $ 55.5 $ 48.2

Assets Owned,Managed or

Administered for Individuals:

Owned Assets:

Separate Account Assets 36.6 36.5 38.4 35.9 28.9

Other Owned Assets 40.6 39.9 39.8 38.7 38.1

Total Owned Assets 77.2 76.4 78.2 74.6 67.0

Managed Assets 122.0 119.6 122.7 115.1 99.5

Administered Assets 38.0 34.1 31.2 24.8 21.1

Total $ 293.1 $ 286.2 $ 289.5 $ 270.0 $ 235.8

Market Appreciation

(Depreciation) During

the period:

Owned Assets:

Separate Account

Assets $ (203) $ (2,301) $ 2,332 $ 6,726 $ (986)

Other Owned Assets $ 163 $ (90) $ (120) $ (254) $ (273)

Total Managed Assets $ (76) $ (6,488) $ 7,020 $ 20,745 $ (5,318)

Cash Sales:

Mutual Funds $ 11,698 $ 10,376 $ 12,104 $ 8,611 $ 8,304

Annuities 1,465 1,566 1,362 939 1,190

Investment

Certificates 868 871 835 993 1,061

Life and Other Insurance

Products 220 219 237 224 196

Institutional 1,169 1,557 1,551 1,928 909

Other 815 661 573 870 953

Total Cash Sales $ 16,235 $ 15,250 $ 16,662 $ 13,565 $ 12,613

Number of Financial

Advisors 12,137 11,486 11,094 11,366 10,631

Fees from Financial Plans

& Advice Services $ 26.1 $ 23.9 $ 26.3 $ 22.1 $ 22.3

Percentage of Total Sales

from Financial Plans and

Advice Services 69.2% 66.1% 66.9% 67.4% 67.7%

*Excluding the effect of SFAS No. 115.

Note: In the first quarter of 2000, reporting of data related to cash sales

and assets owned, managed and administered was revised to better reflect

AEFA's multiple sales channel strategy and broadening of its product

portfolio through additional non-proprietary offerings.

(Preliminary) American Express Bank

Statements of Income

(Unaudited)

(Dollars in millions)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Net Revenues:

Interest Income $ 188 $ 181 3.9%

Interest Expense 125 106 17.3

Net Interest Income 63 75 (15.2)

Commissions & Fees 54 46 17.7

Foreign Exchange Income

& Other Revenue 29 36 (20.8)

Total Net Revenues 146 157 (7.0)

Expenses:

Human Resources 65 68 (4.2)

Other Operating Expenses 67 78 (14.7)

Provision for Losses 6 5 26.9

Total Expenses 138 151 (8.7)

Pretax Income 8 6 33.5

Income Tax Provision 1 1 (40.2)

Net Income $ 7 $ 5 60.0

(Preliminary) American Express Bank

Selected Statistical Information

(Unaudited)

(Dollars in billions, except where indicated)

Quarters Ended

September 30, Percentage

2000 1999 Inc/(Dec)

Total Shareholder's

Equity (millions) $ 729 $ 702 3.8%

Return on Average

Common Equity (A) 4.1% 3.7% -

Return on Average

Assets (A) 0.24% 0.20% -

Total Loans $ 5.1 $ 5.1 0.8

Total Non-performing

Loans(millions) $ 156 $ 181 (14.2)

Other Non-performing

Assets (millions) $ 37 $ 40 (6.6)

Reserve for Credit

Losses(millions)(B) $ 179 $ 204 (12.1)

Loan Loss Reserves as

a % of Total Loans 3.1% 3.5% -

Deposits $ 8.0 $ 8.1 (1.7)

Assets Managed (C)/

Administered $ 10.2 $ 7.7 33.5

Assets of Non-

Consolidated Joint

Ventures $ 2.3 $ 2.4 (1.6)

Risk-Based Capital Ratios:

Tier 1 10.4% 9.9% -

Total 11.9% 12.1% -

Leverage Ratio 5.8% 5.5% -

(A) Excludes the effect of SFAS No.115 for all periods presented.

(B) Allocation:

Loans $ 158 $ 179

Other Assets,

primarily derivatives 16 23

Other Liabilities 5 2

Total Credit Loss

Reserves = $ 179 $ 204

(C) Includes assets managed by American Express Financial Advisors.

(Preliminary) American Express Bank

Statements of Income

(Unaudited)

(Dollars in millions) Quarters Ended

September June March December September

30, 30, 31, 31, 30,

2000 2000 2000 1999 1999

Net Revenues:

Interest Income $ 188 $ 183 $ 183 $ 180 $ 181

Interest Expense 125 120 118 112 106

Net Interest Income 63 63 65 68 75

Commissions & Fees 54 56 52 48 46

Foreign Exchange Income

& Other Revenue 29 32 33 31 36

Total Net Revenues 146 151 150 147 157

Expenses:

Human Resources 65 65 66 69 68

Other Operating Expenses 67 69 68 68 78

Provision for Losses 6 7 8 4 5

Total Expenses 138 141 142 141 151

Pretax Income 8 10 8 6 6

Income Tax Provision 1 3 1 2 1

Net Income $ 7 $ 7 $ 7 $ 4 $ 5

(Preliminary) American Express Bank

Selected Statistical Information

(Unaudited)

(Dollars in billions, except where indicated)

Quarters Ended

September June March December September

30, 30, 31, 31, 30,

2000 2000 2000 1999 1999

Total Shareholder's

Equity (millions) $ 729 $ 707 $ 697 $ 691 $ 702

Return on Average

Common Equity (A) 4.1% 3.7% 3.5% 3.5% 3.7%

Return on Average

Assets (A) 0.24% 0.21% 0.19% 0.20% 0.20%

Total Loans $ 5.1 $ 5.1 $ 5.0 $ 5.1 $ 5.1

Total Non-performing

Loans(millions) $ 156 $ 174 $ 174 $ 168 $ 181

Other Non-performing

Assets (millions) $ 37 $ 36 $ 31 $ 37 $ 40

Reserve for Credit

Losses(millions)(B) $ 179 $ 187 $ 189 $ 189 $ 204

Loan Loss Reserves as

a % of Total Loans 3.1% 3.3% 3.4% 3.3% 3.5%

Deposits $ 8.0 $ 8.2 $ 8.4 $ 8.3 $ 8.1

Assets Managed (C)/

Administered $10.2 $ 9.8(D) $ 9.4 $ 8.6 $ 7.7

Assets of Non-

Consolidated Joint

Ventures $ 2.3 $ 2.3 $ 2.4 $ 2.2 $ 2.4

Risk-Based Capital Ratios:

Tier 1 10.4% 10.3% 10.1% 9.9% 9.9%

Total 11.9% 11.9% 11.6% 12.0% 12.1%

Leverage Ratio 5.8% 5.8% 5.6% 5.6% 5.5%

(A) Excludes the effect of SFAS No.115 for all periods presented.

(B) Allocation:

Loans $ 158 $ 166 $ 170 $ 169 $ 179

Other Assets,

primarily derivatives 16 16 15 16 23

Other Liabilities 5 5 4 4 2

Total Credit Loss

Reserves $ 179 $ 187 $ 189 $ 189 204

(C) Includes assets managed by American Express Financial Advisors.

(D) Revised from previous disclosure

(Preliminary) American Express Bank

Exposures by Country and Region

(Unaudited)

($ in billions) Net

Guarantees 9/30/00 6/30/00

FX & and Total Total

Country Loans Deriv- Contin- Other* Exposure** Exposure**

atives gents

Hong Kong $ 0.5 - $ 0.1 $ 0.1 $ 0.7 $ 0.6

Indonesia 0.2 - - 0.1 0.3 0.3

Singapore 0.5 - 0.1 0.1 0.7 0.6

Korea 0.2 - - 0.2 0.5 0.5

Taiwan 0.2 - - 0.1 0.4 0.4

China - - - - - -

Japan - - - - 0.1 0.1

Thailand - - - - - -

Other 0.1 - - 0.1 0.2 0.2

Total Asia/Pacific

Region** 1.7 - 0.4 0.7 2.8 2.7

Chile 0.2 - - 0.1 0.3 0.4

Brazil 0.2 - - 0.1 0.3 0.3

Mexico - - - - 0.1 0.1

Peru - - - - - -

Argentina 0.1 - - - 0.1 0.1

Other 0.2 0.2 0.1 0.5 0.5

Total Latin

America** 0.8 - 0.2 0.3 1.3 1.4

India 0.3 - 0.1 0.3 0.7 0.7

Pakistan 0.1 - - 0.2 0.3 0.3

Other 0.1 - 0.1 0.1 0.2 0.2

Total

Subcontinent** 0.4 - 0.2 0.6 1.2 1.2

Egypt 0.3 - - 0.2 0.6 0.5

Other 0.1 - - - 0.2 0.2

Total Middle East

& Africa** 0.4 - 0.1 0.2 0.7 0.7

Total Europe*** 1.4 $ 0.1 0.5 2.3 4.4 4.4

Total

North America** 0.3 0.1 0.2 1.3 1.9 1.8

Total

Worldwide** = $ 5.1 $ 0.3 $ 1.6 $ 5.3 $ 12.3 $ 12.3

* Includes cash, placements and securities

** Individual items may not add to totals due to rounding

*** Total exposures at 9/30/00 and 6/30/00 include $4 million and $5 million of

exposures to Russia, respectively.

Note: Includes cross-border and local exposure and does not net local funding

or liabilities against any local exposure.

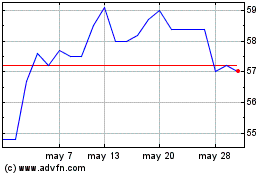

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024